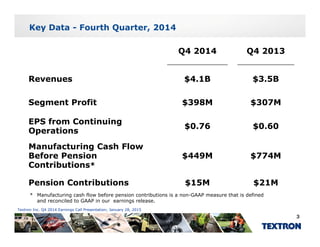

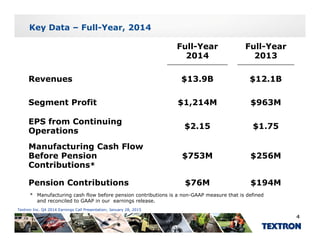

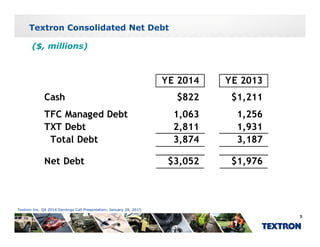

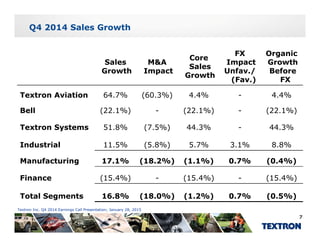

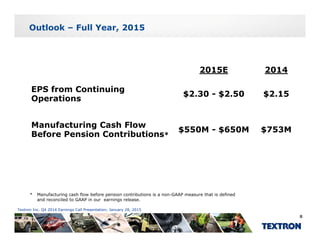

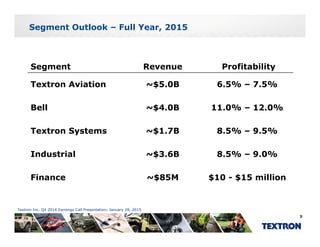

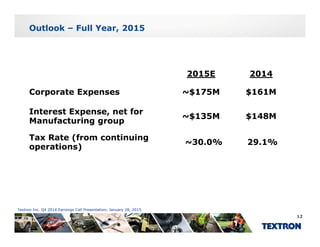

This document summarizes Textron's Q4 2014 earnings call presentation. Key points include: Revenues for Q4 2014 were $4.1 billion compared to $3.5 billion for Q4 2013. Full year 2014 revenues were $13.9 billion compared to $12.1 billion for full year 2013. The outlook for 2015 estimates EPS from continuing operations of $2.30 to $2.50 compared to $2.15 for 2014, and manufacturing cash flow before pension contributions of $550 million to $650 million compared to $753 million for 2014. Segment revenue and profitability expectations for 2015 are provided for Textron Aviation, Bell, Textron Systems, Industrial, and Finance.