This chapter establishes the context for topics covered in the text by highlighting key issues affecting healthcare organizations. It is organized into three sections that address: (1) changing methods of healthcare financing and delivery; (2) addressing the high cost of care; and (3) establishing value-based payment mechanisms. The document discusses the Affordable Care Act and its provisions for expanding insurance coverage and Medicaid. It also covers trends in healthcare such as the rise of uninsured individuals, accountable care organizations, and value-based purchasing systems.

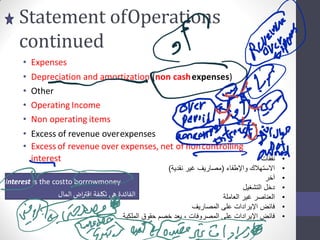

![Various stakeholders,including:

Patients

Providers-includingphysicians,institutionalproviders,and ancillaryproviders(e.g.,

physicaltherapists,laboratories,hospices,and home care providers)

Employers

Payors-includingvariouslevelsof governmentalagencies and managed care organizations

Regulators-includinggovernmental (e.g., Medicare and Medicaid) and private agencies

(e.g., the JointCommission on Accreditationof HealthcareOrganizations[JCAHO]and the

NationalCommitteefor QualityAssurance [NCQA])](https://image.slidesharecdn.com/testbank213hcm-230619142528-ed606f2a/85/Testbank-213-hcm-293-320.jpg)