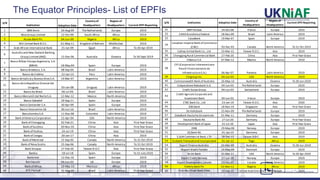

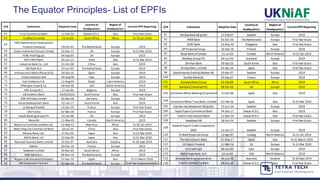

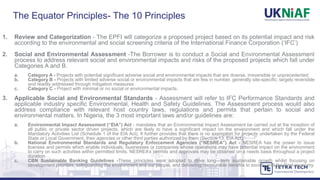

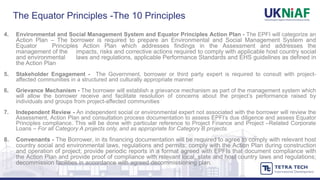

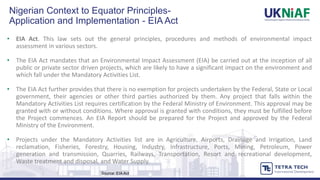

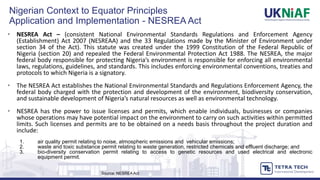

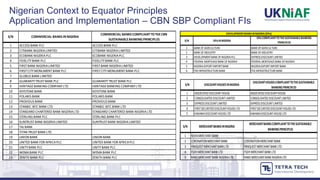

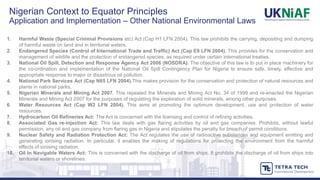

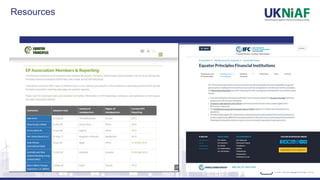

The document discusses the Equator Principles, which are a set of voluntary guidelines for managing social and environmental risk in project financing adopted by many financial institutions. It outlines the basic concepts and 10 principles of the Equator Principles, which guide compliance procedures for projects and institutions. It also lists the 116 financial institutions across 37 countries that have adopted the Equator Principles, including 7 banks in Nigeria. Finally, it briefly describes the project review and categorization process required by Equator Principle Financial Institutions.