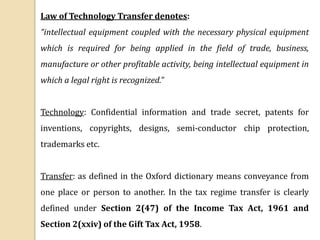

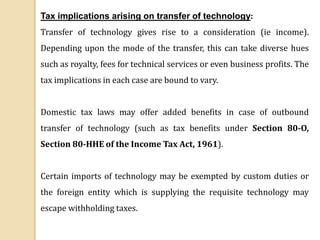

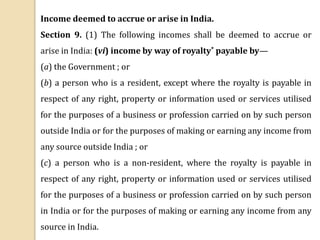

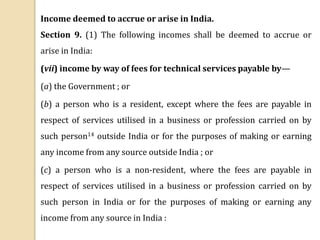

This document discusses the taxation implications of technology transfer in India. It defines technology transfer and outlines the various types of intellectual property that can be transferred such as patents, copyrights, and trademarks. It also discusses how transfer of technology results in income that is taxed differently depending on whether it is classified as royalty, fees for technical services, or business profits. The document provides details on relevant sections of India's Income Tax Act regarding taxation of income from technology transfer and examines how double taxation avoidance agreements may impact taxation.