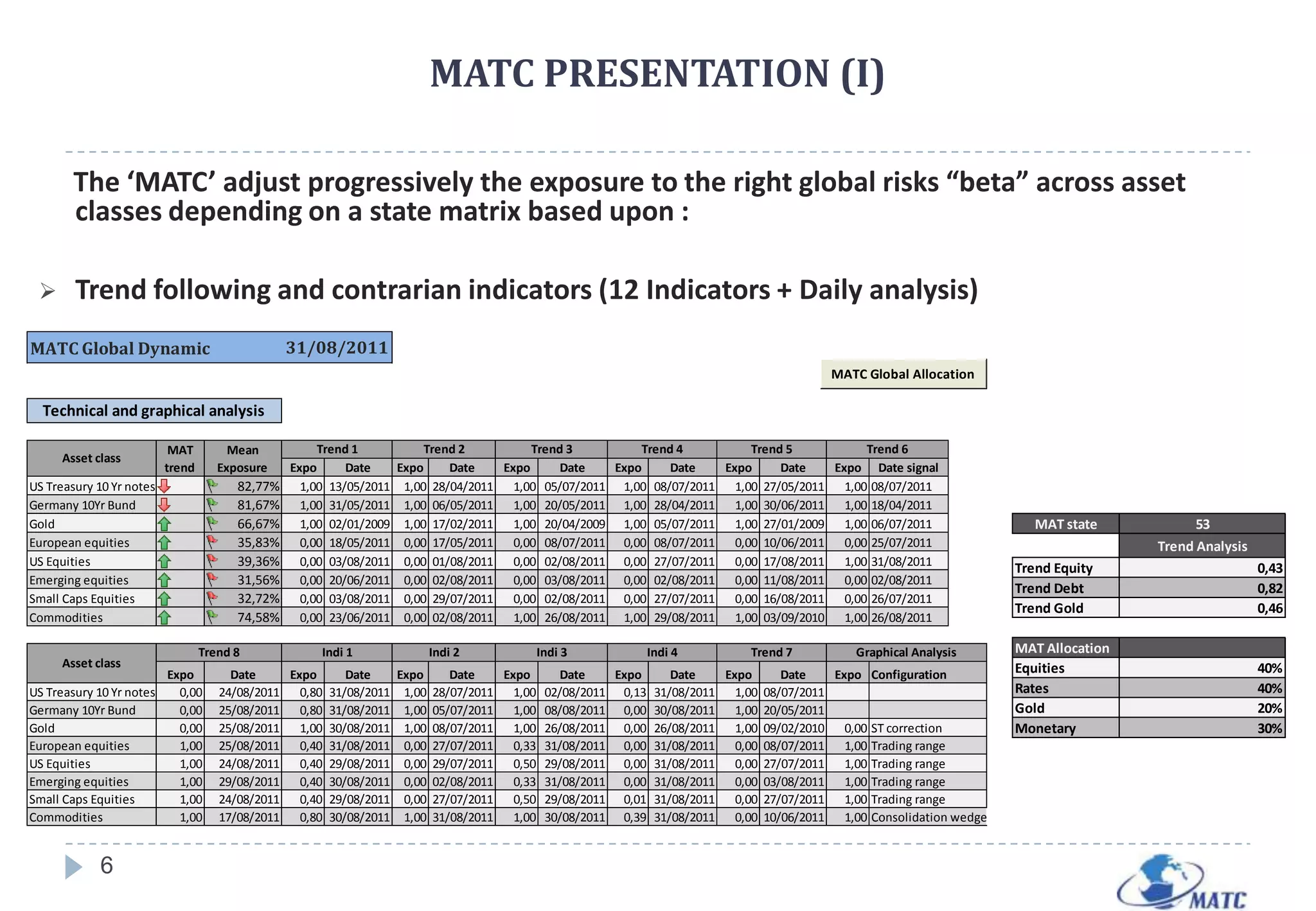

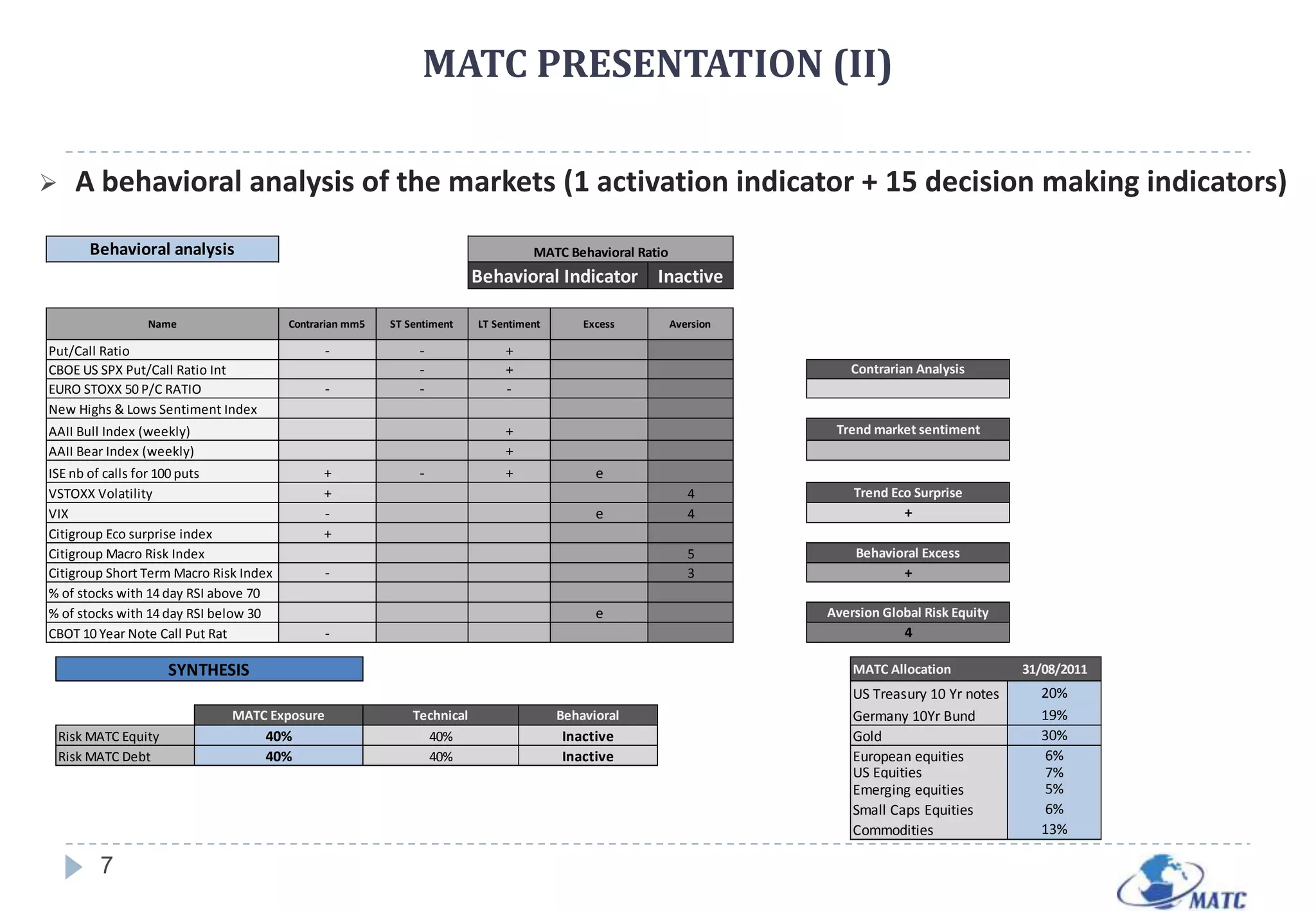

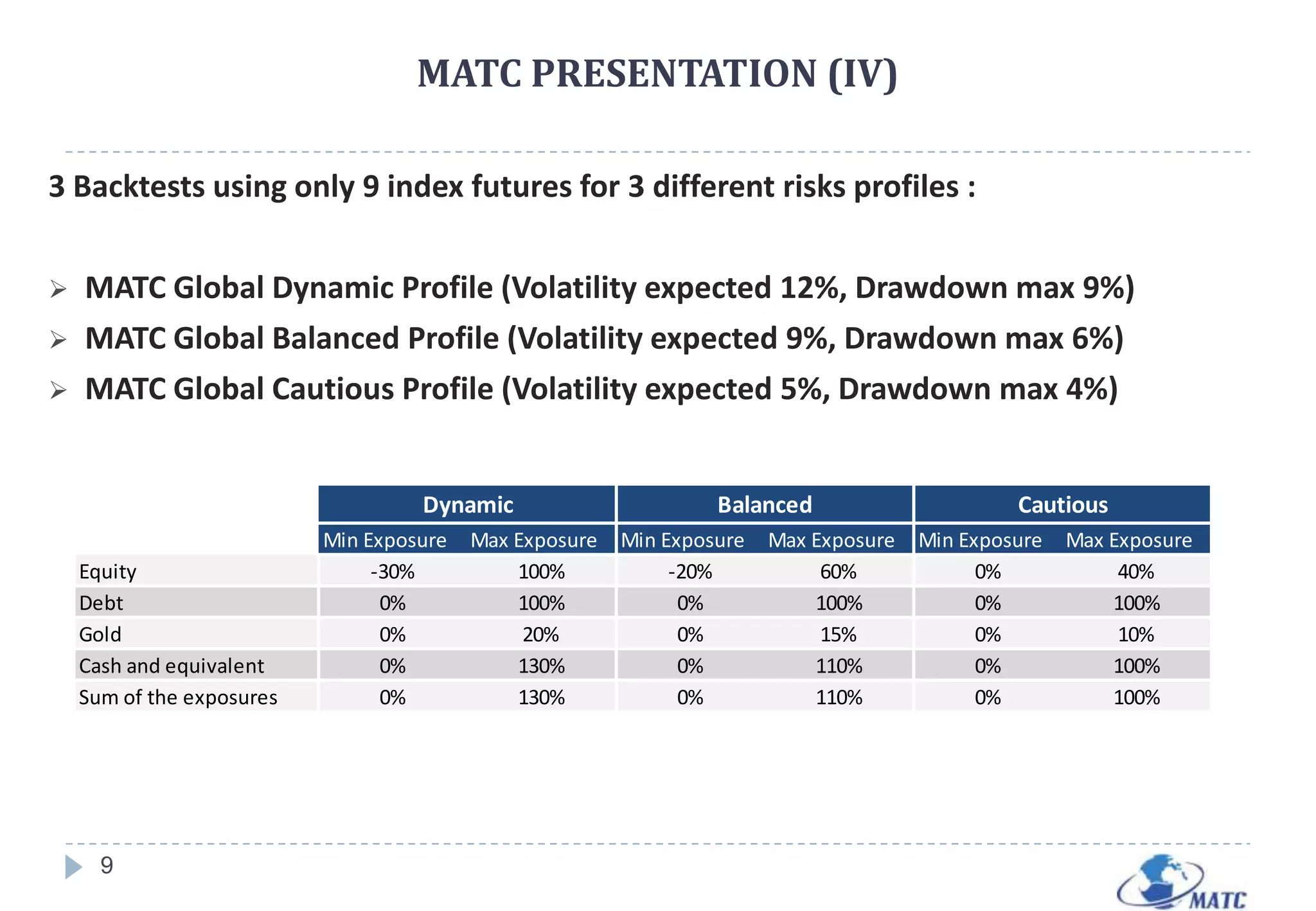

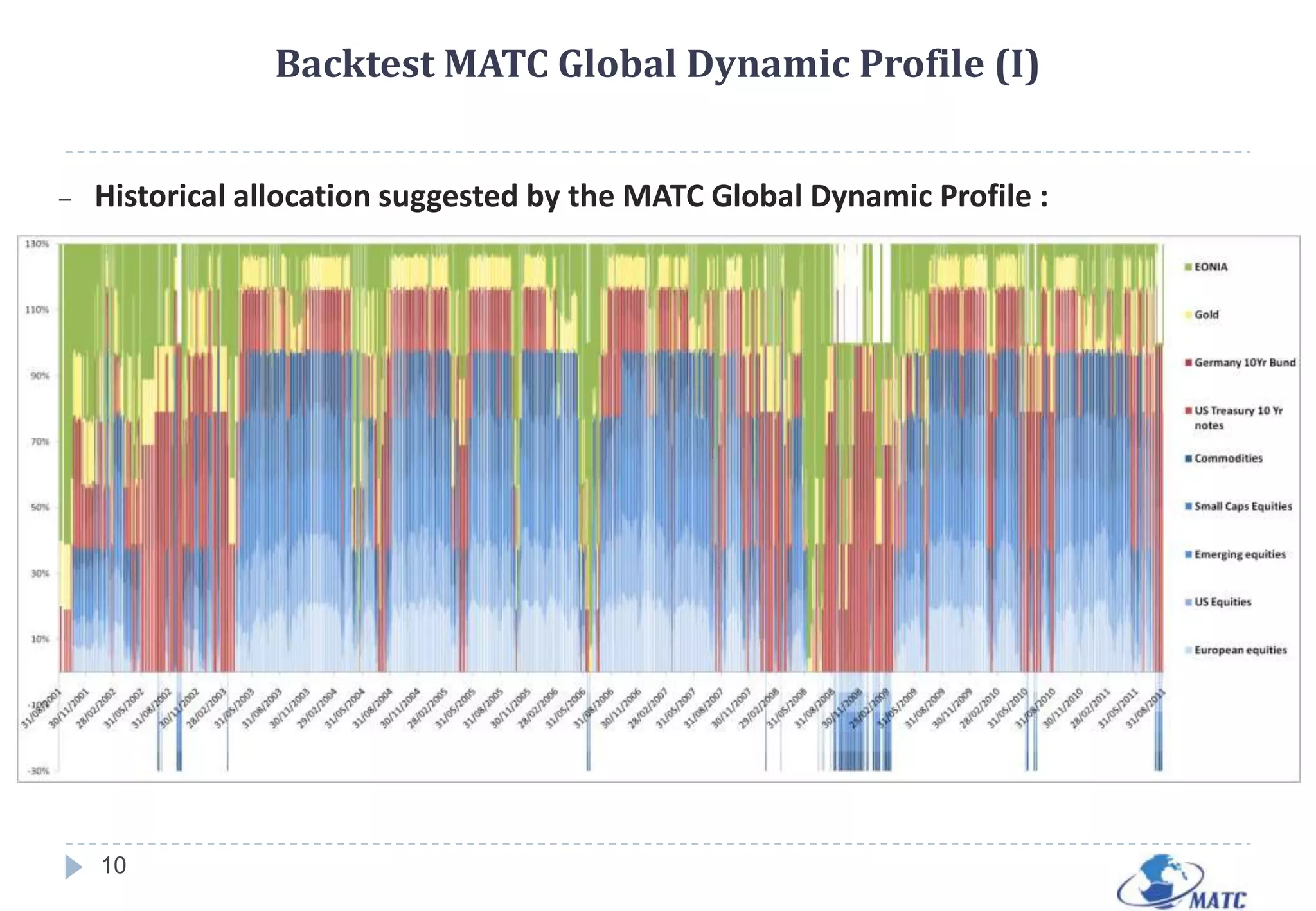

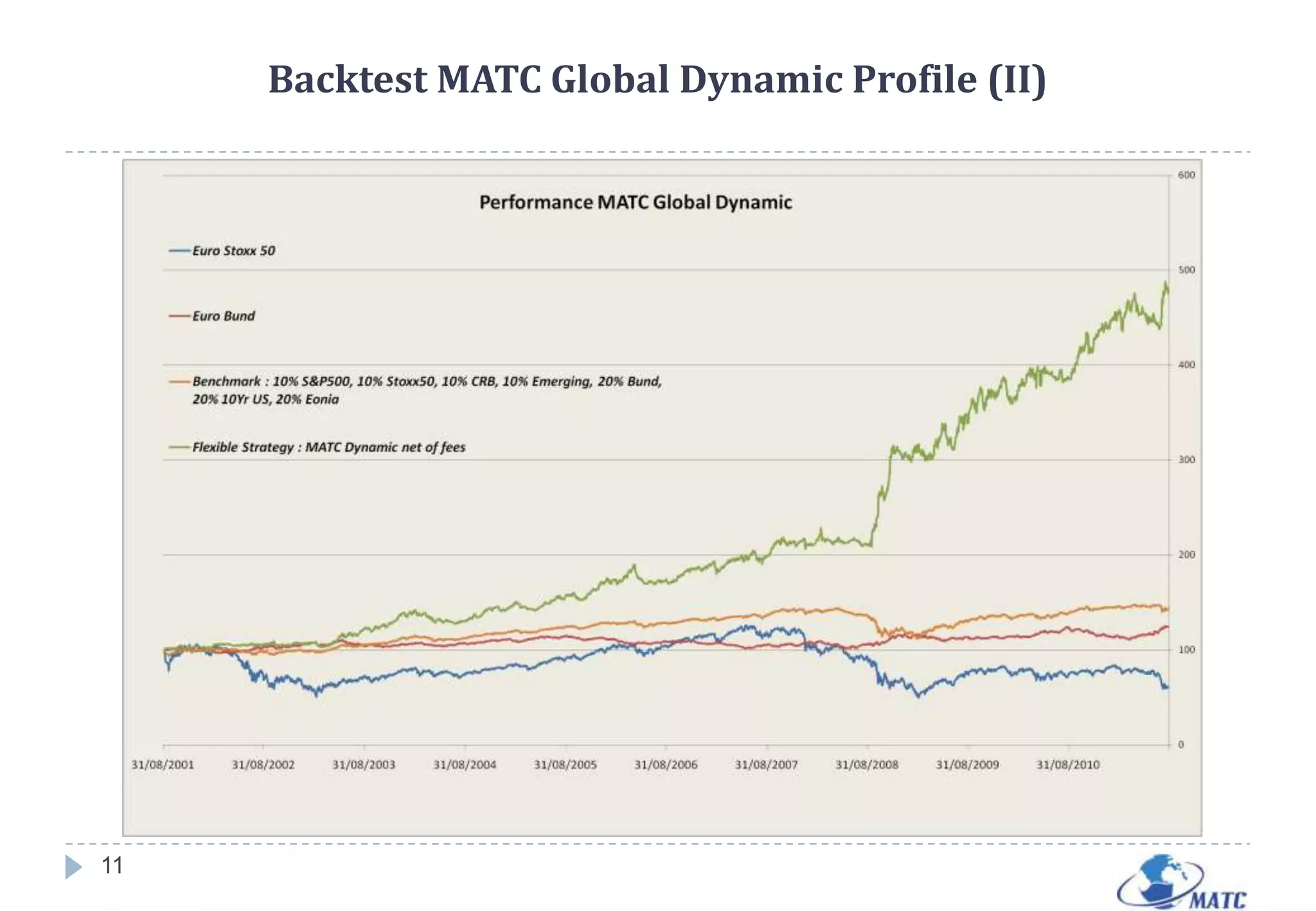

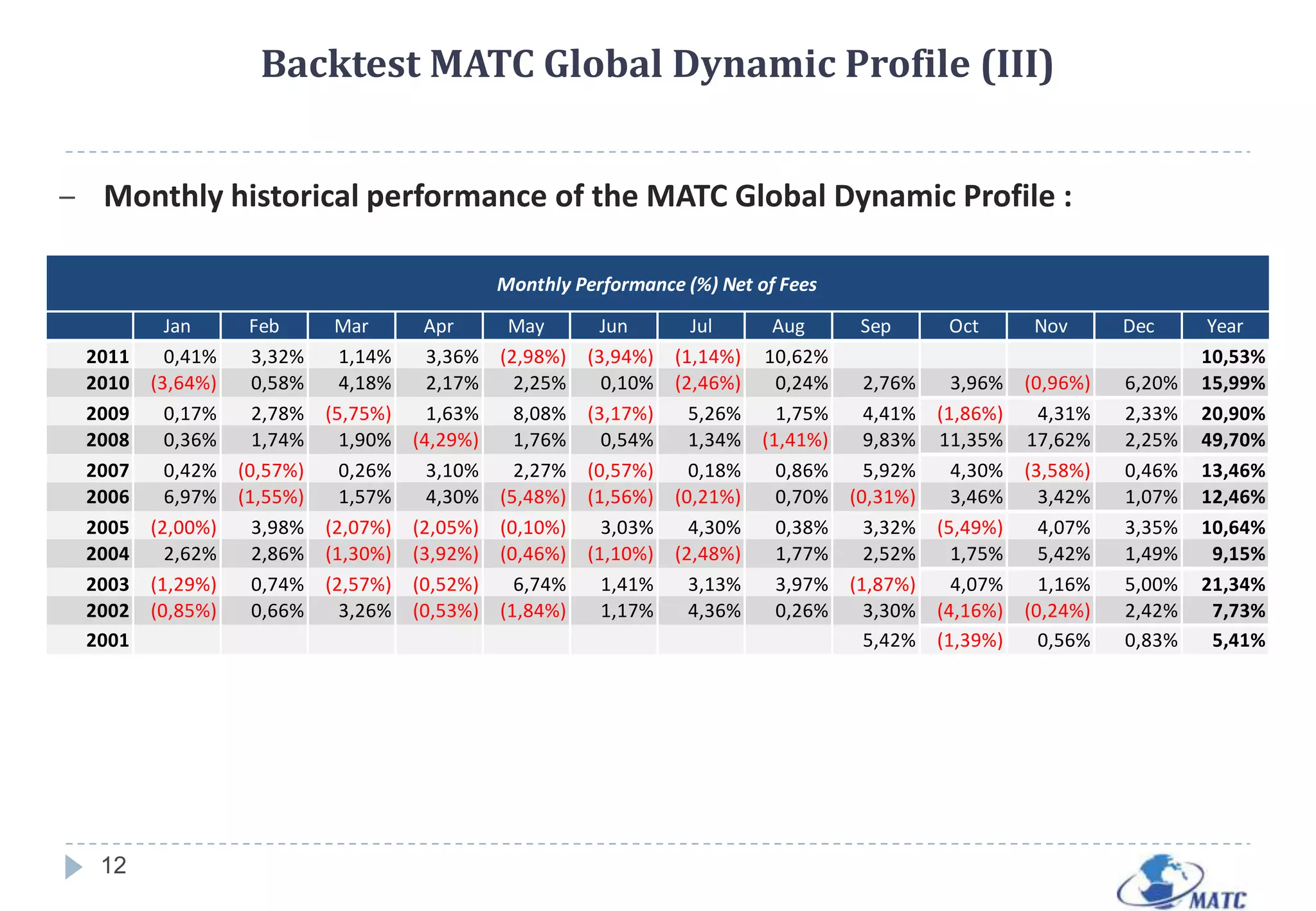

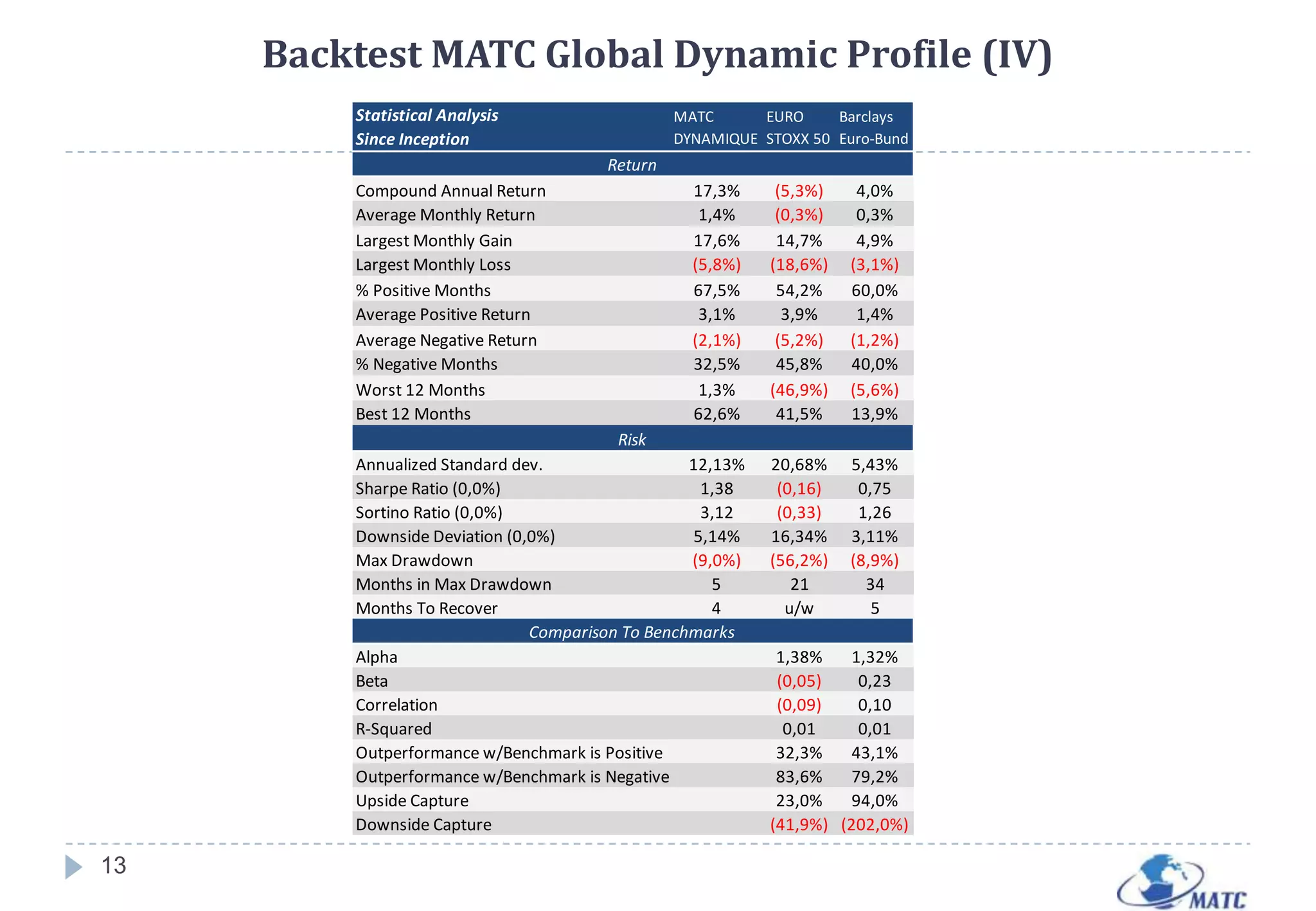

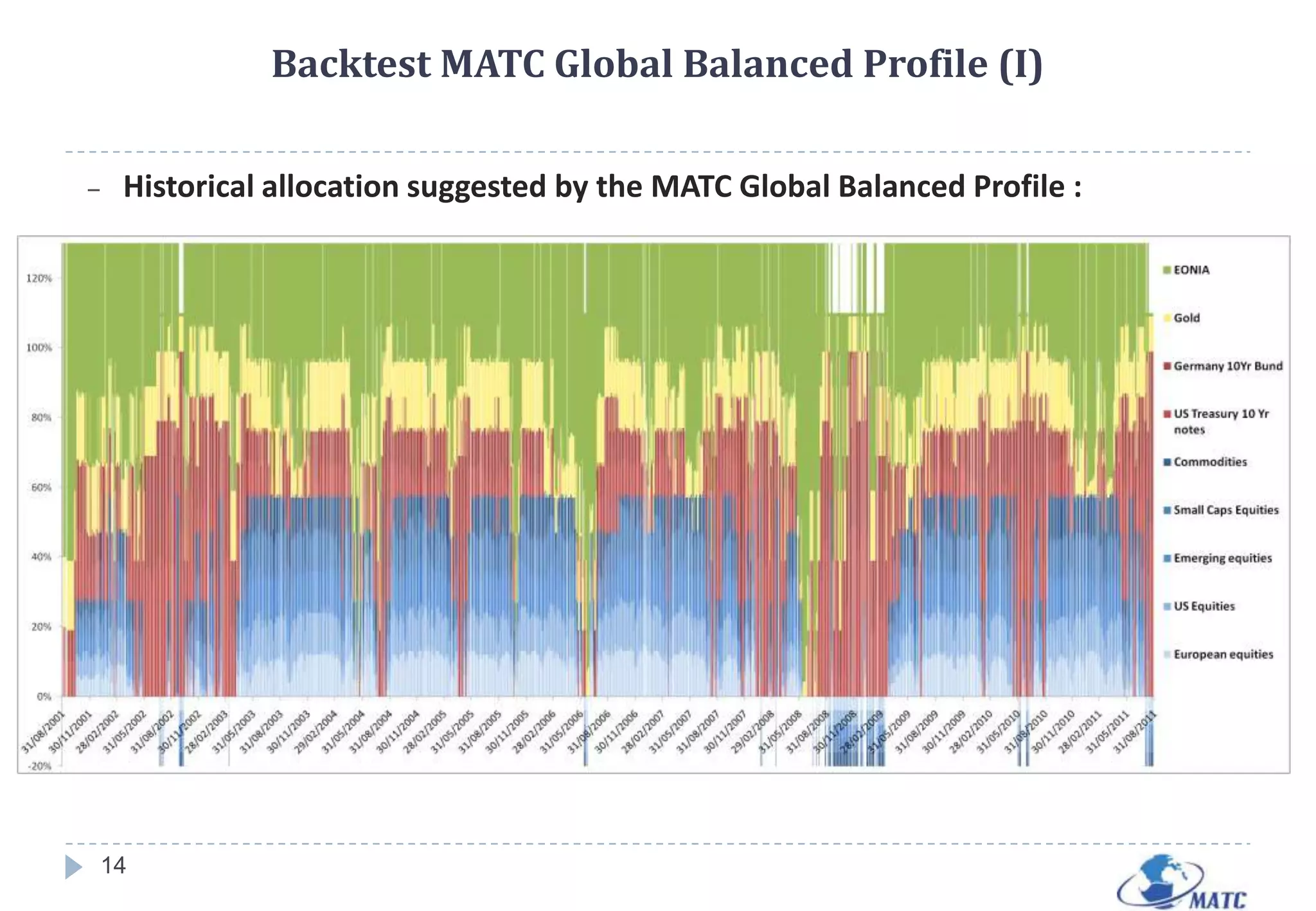

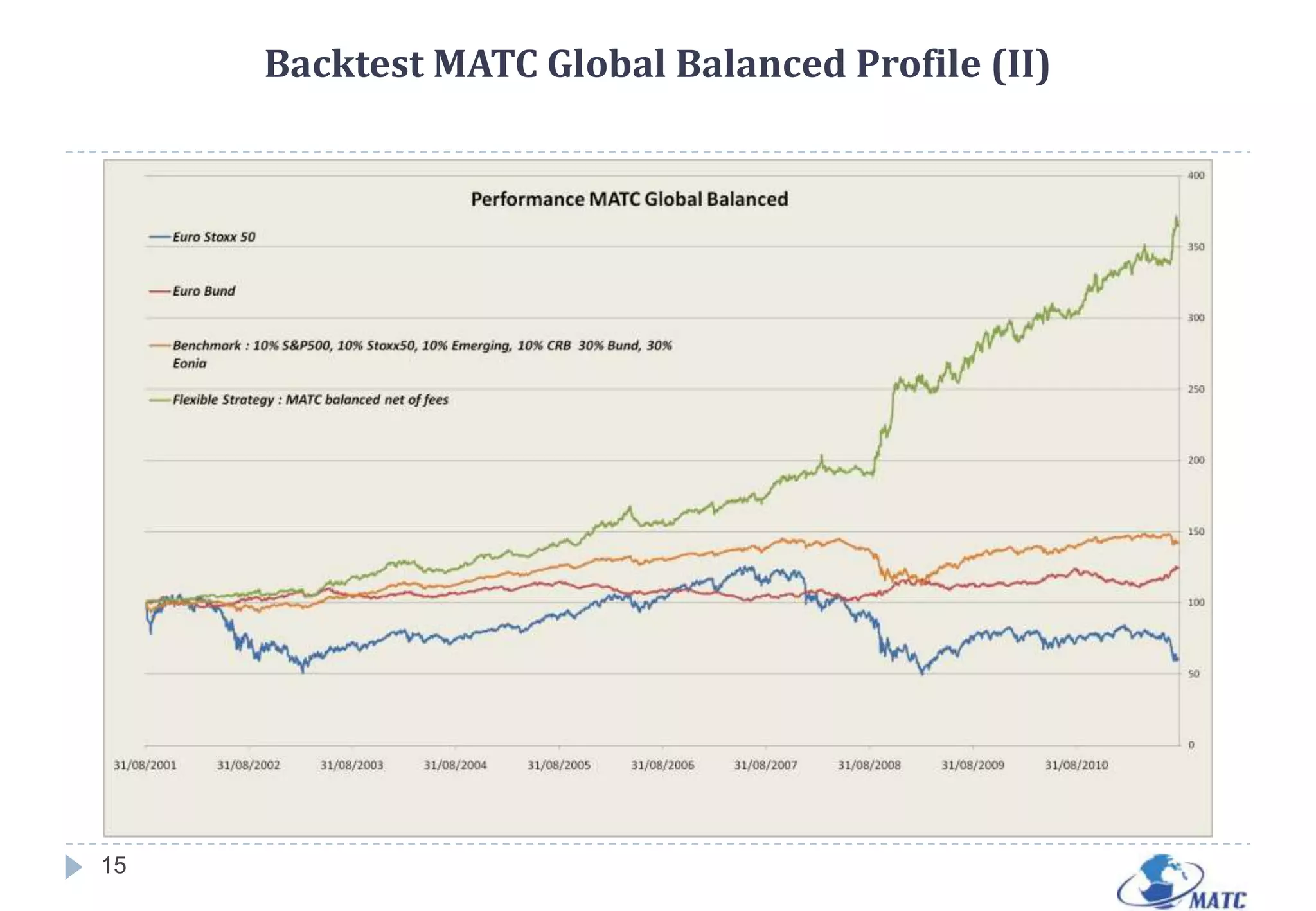

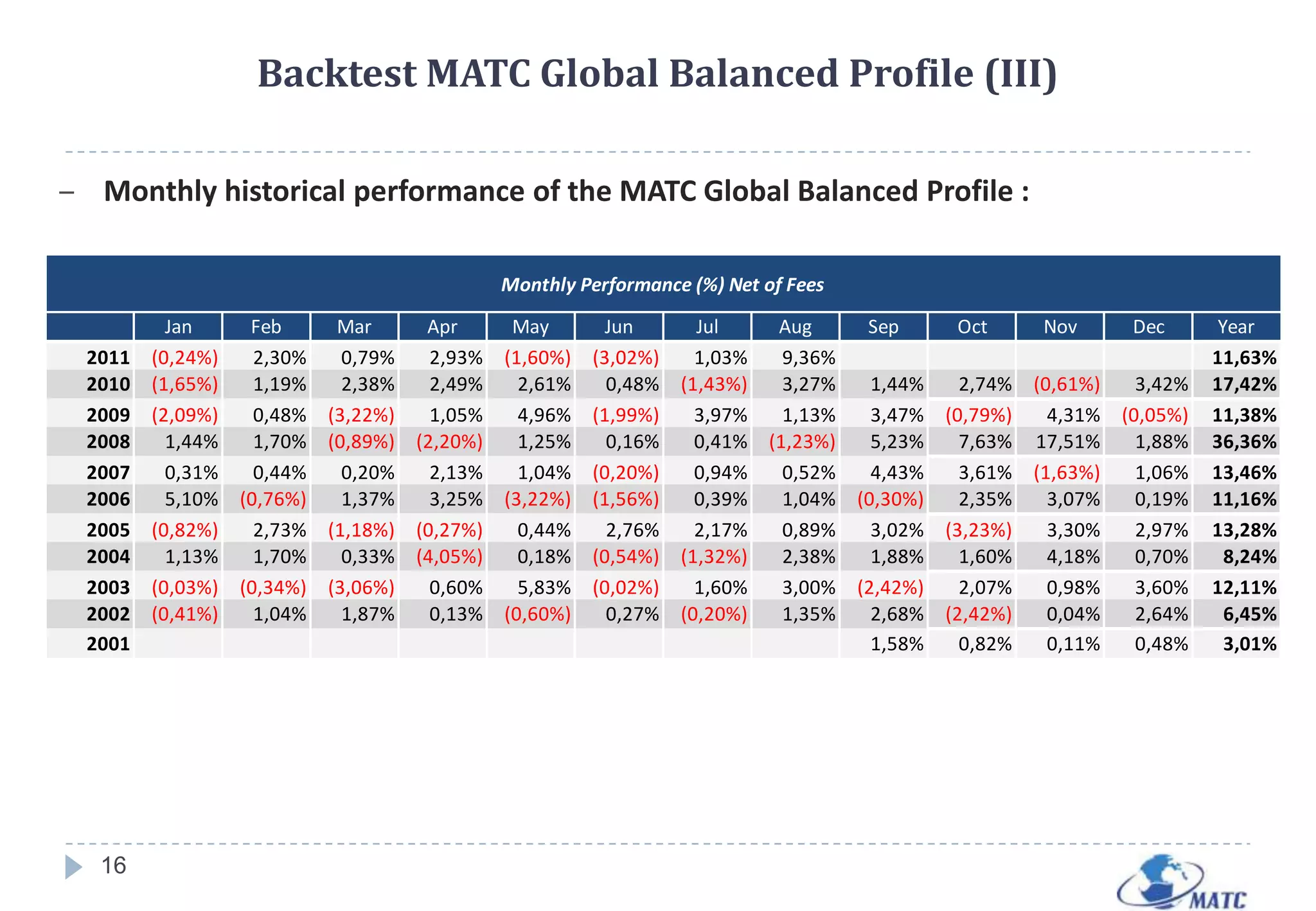

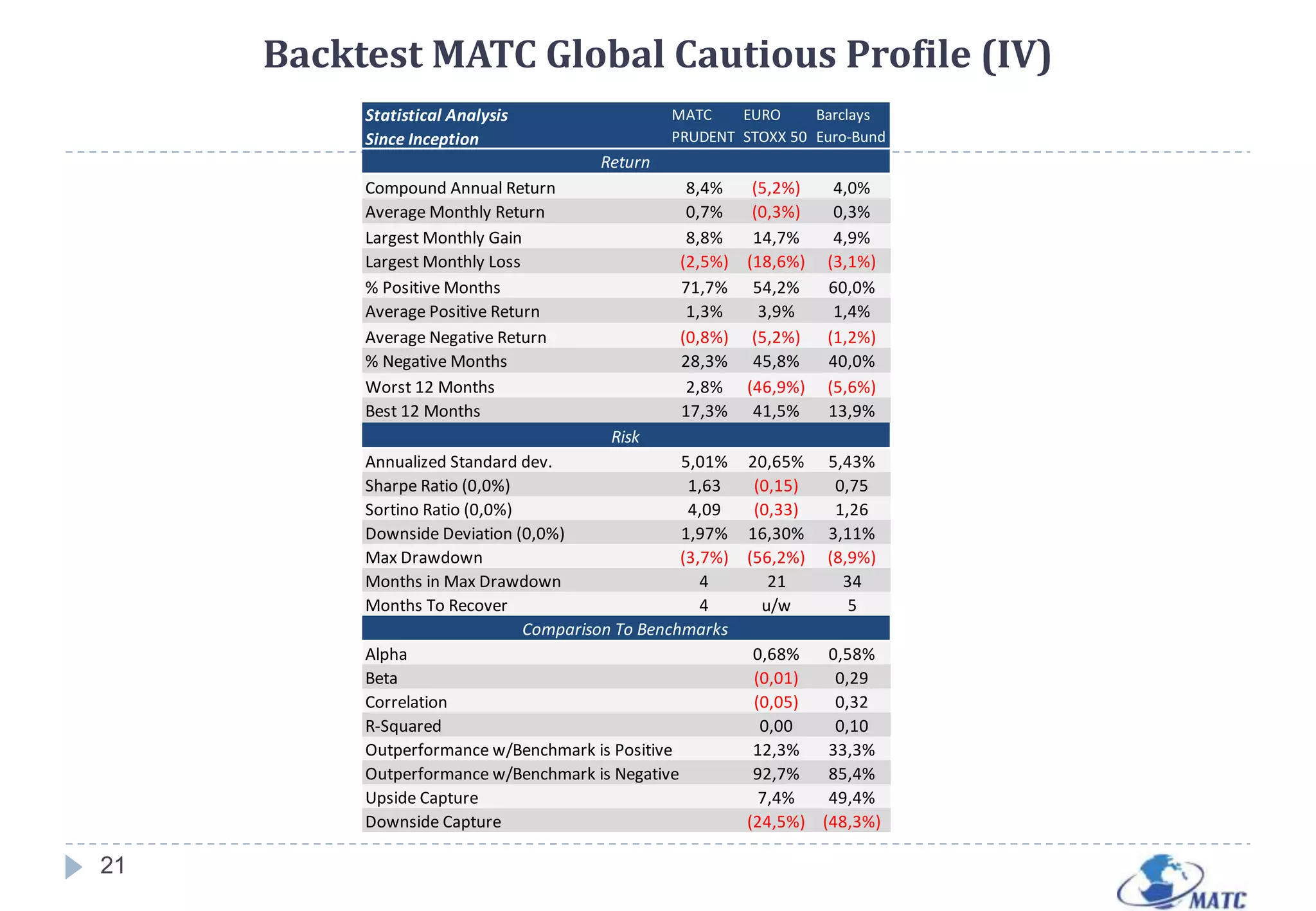

The MATC model is a specialized asset allocation framework designed for diverse global multi-asset funds, focusing on capital appreciation and preservation through systematic and trend-following strategies. It employs daily dynamic adjustments based on behavioral indicators and market sentiment, optimizing asset exposure to mitigate risks and seize opportunities. The model incorporates both technical and behavioral analysis, making it adaptable to various risk profiles and market conditions.