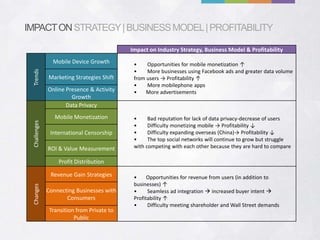

The document analyzes the evolution of the social media industry, highlighting key phases from the discovery of 6 degrees of separation to the rise of social media giants like Facebook, Twitter, and Google+. It discusses the competitive landscape using the five forces model, emphasizing the challenges of data privacy, monetization, and international censorship. Future strategies for major platforms focus on mobile ad revenue and integrating services to enhance profitability and user engagement.