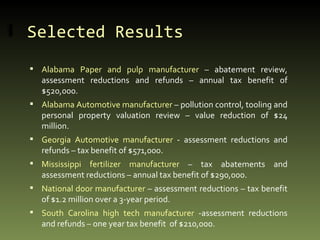

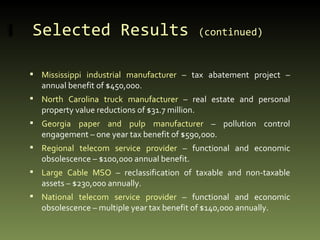

Silver Oak Advisors is a property tax consulting firm comprised of experienced professionals from Big Four accounting firms. They provide personal property and real estate tax services for industrial, manufacturing, telecom and other complex property clients. Their team has over 40 years of experience and they focus on achieving significant tax savings and refunds for clients through assessment reductions, exemptions, abatements and other strategies.

![Contact Information Glenn Williams ,CMI Brian Scully, CMI Managing Director Director, Telecom Practice Direct Dial 678.403.2977 Direct Dial 678.403.2084 [email_address] [email_address] Jeff Talton Director, Industrial Properties Direct Dial 678.848.2571 [email_address] SILVER OAK ADVISORS, LLC 400 Galleria Parkway SE SUITE 1500 [email_address] ATLANTA, GEORGIA 30339 (877) 352-8616](https://image.slidesharecdn.com/statementofqualifications-updated05-1-09nosalestax-090508155240-phpapp02/85/Statement-Of-Qualifications-19-320.jpg)