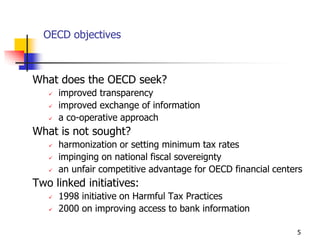

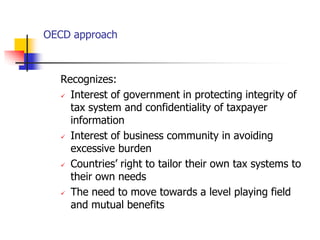

This document defines a tax haven as a country that levies low or no taxes while maintaining good governance. It lists various countries and territories considered tax havens in Europe, the Caribbean, Africa, and the Pacific Rim. It then discusses the OECD (Organisation for Economic Co-operation and Development) model, which seeks improved transparency and exchange of information between countries through cooperation rather than tax rate harmonization or impinging on national sovereignty. The OECD has initiated approaches to address harmful tax practices and improve access to bank information.