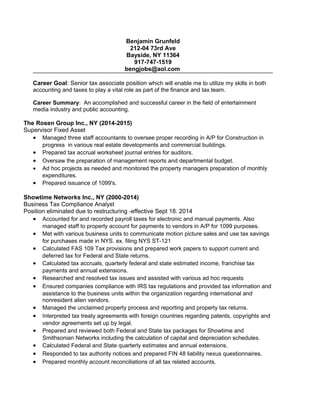

Benjamin Grunfeld is seeking a senior tax associate position, leveraging his extensive experience in public accounting and the entertainment media industry. His work history includes supervisory roles in taxation and financial compliance at organizations like Showtime Networks and KPMG, where he managed tax filings and compliance for various entities. He holds a bachelor's degree in accounting and has experience with numerous accounting software applications.