More Related Content Similar to Valuation Of ASHOK LEYLAND (20) More from Aakash Singh (8) 1. Valuation Of ASHOK LEYLAND

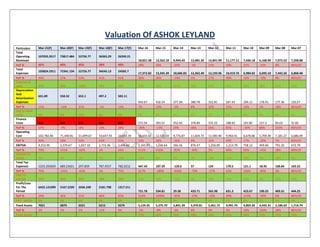

Particulars Mar-21(F) Mar-20(F) Mar-19(F) Mar-18(F) Mar-17(F) Mar-16 Mar-15 Mar-14 Mar-13 Mar-12 Mar-11 Mar-10 Mar-09 Mar-08 Mar-07

Total

Operating

Revenues

107035.3517 73817.484 52726.77 36363.29 26350.21

18,821.58 13,562.18 9,943.43 12,481.20 12,841.99 11,177.11 7,436.18 6,168.99 7,972.52 7,358.88

YoY % 45% 40% 45% 38% 40% 39% 36% -20% -3% 15% 50% 21% -23% 8% #DIV/0!

Total

Expenses

103824.2911 72341.134 52726.77 34545.13 24505.7

17,372.82 13,345.39 10,606.83 12,362.40 12,193.96 10,419.76 6,984.02 6,045.10 7,442.26 6,868.48

YoY % 44% 37% 53% 41% 41% 30% 26% -14% 1% 17% 49% 16% -19% 8% #DIV/0!

Expense to

sales 97% 98% 100% 95% 93% 92% 98% 107% 99% 95% 93% 94% 98% 93% 93%

Depreciation

And

Amortisation

Expenses

631.89 550.32 652.1 497.2 502.11

443.67 416.34 377.04 380.78 352.81 267.43 204.11 178.41 177.36 150.57

YoY % 15% -16% 31% -1% 13% 7% 10% -1% 8% 32% 31% 14% 1% 18% #DIV/0!

Dep to fixed

asset 9% 8% 10% 8% 9% 9% 8% 6% 6% 6% 5% 4% 4% 8% 9%

Finance

Costs 410 350 375 400 350 273.54 393.51 452.92 376.89 255.25 188.92 101.85 157.3 83.63 31.82

YoY % 17% -7% -6% 14% 28% -30% -13% 20% 48% 35% 85% -35% 88% 163% #DIV/0!

Operating

Cost 102,782.40 71,440.81 51,699.67 33,647.93 23,653.59 16,655.61 12,535.54 9,776.87 11,604.73 11,585.90 9,963.41 6,678.06 5,709.39 7,181.27 6,686.09

YoY % 44% 38% 54% 42% 42% 33% 28% -16% 0% 16% 49% 17% -20% 7% #DIV/0!

EBITDA 4,252.95 2,376.67 1,027.10 2,715.36 2,696.62 2,165.97 1,026.64 166.56 876.47 1,256.09 1,213.70 758.12 459.60 791.25 672.79

YoY % 79% 131% -62% 1% 24% 111% 516% -81% -30% 3% 60% 65% -42% 18% #DIV/0!

EBITDA TO

SALES 4% 3% 2% 7% 10% 12% 8% 2% 7% 10% 11% 10% 7% 10% 9%

Total Tax

Expenses 1233.355659 689.23421 297.859 787.4557 782.0212 447.43 107.39 -120.6 37 124 170.5 121.1 18.45 168.84 163.22

YoY % 79% 131% -62% 1% 75% 317% -189% -426% -70% -27% 41% 556% -89% 3% #DIV/0!

TAX TO

EBITDA 29% 29% 29% 29% 29% 21% 10% -72% 4% 10% 14% 16% 4% 21% 24%

Profit/Loss

For The

Period

6422.121099 5167.2239 2636.339 2181.798 1317.511

721.78 334.81 29.38 433.71 565.98 631.3 423.67 190.25 469.31 444.25

YoY % 24% 96% 21% 66% 83% 116% 1040% -93% -23% -10% 49% 123% -59% 6% #DIV/0!

PAT - SALES 6% 7% 5% 6% 5% 4% 2% 0% 3% 4% 6% 6% 3% 6% 6%

Fixed Assets 7021 6879 6521 6215 5579 5,129.35 5,375.70 5,841.39 5,970.81 5,461.72 4,991.76 4,869.26 4,442.31 2,186.63 1,714.74

YoY % 2% 5% 5% 11% 9% -5% -8% -2% 9% 9% 3% 10% 103% 28% #DIV/0!

Fixed Assets 27% 40% 59% 48% 43% 45% 65% 72% 27% 23%

2. - SALES

Margin

Total Current

Liabilities

37462.37308 28050.644 18454.37 13454.42 8695.57

5,209.86 5,035.52 4,586.60 5,296.10 4,843.70 3,759.87 2,960.76 2,136.95 2,275.95 1,922.61

YoY % 34% 52% 37% 55% 67% 3% 10% -13% 9% 29% 27% 39% -6% 18% #DIV/0!

CL to Sales 35% 38% 35% 37% 33% 28% 37% 46% 42% 38% 34% 40% 35% 29% 26%

Total Current

Assets

40673.43363 29526.994 18981.64 14545.32 9222.574

5,290.61 4,693.00 3,855.44 4,296.53 4,303.89 3,983.77 4,081.45 3,120.71 2,743.42 2,527.50

YoY % 38% 56% 31% 58% 74% 13% 22% -10% 0% 8% -2% 31% 14% 9% #DIV/0!

CA to Sales 38% 40% 36% 40% 35% 28% 35% 39% 34% 34% 36% 55% 51% 34% 34%

Working

Capital 3,211.06 1,476.35 527.27 1,090.90 527.00 80.75 -342.52 -731.16 -999.57 -539.81 223.90 1,120.69 983.76 467.47 604.89

change in WC 1,734.71 949.08 -563.63 563.89 446.25 423.27 388.64 268.41 -459.76 -763.71 -896.79 136.93 516.29 -137.42 604.89

CAPEX -489.89 -192.32 -346.10 138.80 -52.46 -690.02 -882.03 -506.46 128.31 117.15 -144.93 222.84 2,077.27 294.53 1,564.17

FCFF(revenue

model) 1,774.77 930.67 1,638.97 1,225.21 1,520.81 1,985.29 1,412.64 525.21 1,170.92 1,778.65 2,084.92 277.25

-

2,152.41 465.30 ########

Total Assets 23,166.77 20,870.96 18,634.79 16,490.96 14,991.78 13,385.52 13,311.49 12,808.00 13,096.70 11,915.75 10,593.31 9,308.12 7,911.26 5,578.20 4,505.17

YoY % 11% 12% 13% 10% 12% 1% 4% -2% 10% 12% 14% 18% 42% 24% #DIV/0!

Cost Of

Materials

Consumed

73,694.46 52,638.90 35,566.82 24,871.91 17,765.65

12,252.17 8,626.64 5,909.69 7,539.42 9,121.48 8,064.50 5,333.83 4,390.59 5,834.61 5,491.44

YoY % 40% 48% 43% 40% 45% 42% 46% -22% -17% 13% 51% 21% -25% 6% #DIV/0!

Purchase Of

Stock-In

Trade

3,595.57 2,663.38 2,315.99 1,852.79 1,684.35

1,531.23 1,391.19 1,269.03 1,311.74 507.37 273.37 244.88 202.19 163.53 124.18

YoY % 35% 15% 25% 10% 10% 10% 10% -3% 159% 86% 12% 21% 24% 32% #DIV/0!

Operating

And Direct

Expenses

0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0 0 45.51 50.3 57.48 41.7

YoY % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! -100% -10% -12% 38% #DIV/0!

Changes In

Inventories

Of FG,WIP

And Stock-In

Trade

200 -350 200 400 -300

-521.44 -52.61 423.87 271.98 -167.01 -165.22 -251.85 -1.05 -97.48 -48.98

YoY % 891% -112% 56% -263% 1% -34% 23886% -99% 99% #DIV/0!

COGS 77,490.03 54,952.28 38,082.81 27,124.69 19,150.00 13,261.96 9,965.22 7,602.59 9,123.14 9,461.84 8,172.65 5,326.86 4,591.73 5,900.66 5,566.64

Total

Shareholders

Funds

7,805.46 7,227.28 6,691.93 6,254.14 5,844.99

5,514.14 5,118.69 4,447.88 4,455.10 4,208.17 3,962.96 3,656.31 3,473.90 2,148.98 1,894.57

YoY % 8% 8% 7% 7% 6% 8% 15% 0% 6% 6% 8% 5% 62% 13% #DIV/0!

Total Capital

And

Liabilities

23,166.77 20,870.96 18,634.79 16,490.96 14,991.78

13,385.52 13,311.49 12,808.00 13,096.70 11,915.75 10,593.31 9,308.12 7,911.26 5,578.20 4,505.17

3. YoY % 11% 12% 13% 10% 12% 1% 4% -2% 10% 12% 14% 18% 42% 24% #DIV/0!

Inventories 7,119.45 5,234.89 3,766.11 2,789.71 2,249.77 1,730.59 1,398.53 1,188.70 1,896.02 2,230.63 2,208.90 1,638.24 1,330.01 1,223.91 1,070.32

YoY % 36% 39% 35% 24% 30% 24% 18% -37% -15% 1% 35% 23% 9% 14% #DIV/0!

Cash And

Cash

Equivalents

65,905.32 33,797.60 16,094.09 7,450.97 3,371.48

1,568.13 751.29 11.69 13.94 32.56 179.53 518.92 88.08 451.37 434.94

YoY % 95% 110% 116% 121% 115% 109% 6327% -16% -57% -82% -65% 489% -80% 4% #DIV/0!

Current

Investments

0.00 0.00 0.00 0.00 0.00

0 408.45 384.37 0 0

YoY % #DIV/0! #DIV/0!

Trade

Receivables

1,414.06 1,400.06 1,372.60 1,307.24 1,188.40

1,250.95 1,257.69 1,299.01 1,419.41 1,230.25 1,164.50 1,022.06 957.97 375.84 522.88

YoY % 1% 2% 5% 10% -5% -1% -3% -8% 15% 6% 14% 7% 155% -28% #DIV/0!

Trade

Payables

4,065.22 3,534.97 3,213.61 3,382.75 3,075.23

2,562.69 2,828.32 2,214.15 2,485.37 2,772.46 2,308.51 2,331.68 1,771.29 1,735.11 1,433.69

YoY % 15% 10% -5% 10% 20% -9% 28% -11% -10% 20% -1% 32% 2% 21% #DIV/0!

EBIT 3,621.06 1,826.35 375.00 2,218.16 2,194.51 1,722.30 610.30 -210.48 495.69 903.28 946.27 554.01 281.19 613.89 522.22

Basic EPS

(Rs.) 22.57 18.16 9.26 7.67 4.63 2.54 1.18 0.11 1.63 2.13 4.75 3.18 1.43 3.53 3.36

CURRENT

MARKET

PRICE AS ON

31 MAR

2016 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55 108.55

Equity Share

Capital 284.59 284.59 284.59 284.59 284.59 284.59 284.59 266.07 266.07 266.07 133.03 133.03 133.03 133.03 132.39

Profit/Loss

Before Tax 7,655.48 5,856.46 2,934.20 2,969.25 2,099.53 1,169.21 442.20 -91.22 470.71 689.98 801.80 544.77 208.70 638.15 607.47

YoY % 31% 100% -1% 41% 80% 164% -585% -119% -32% -14% 47% 161% -67% 5% #DIV/0!

4. DCF ANALYSIS

Particulars Mar-21 Mar-20 Mar-19

Mar-

18 Mar-17

Mar-

16 Mar-15

Mar-

14 Mar-13

Mar-

12 Mar-11 Mar-10 Mar-09

Dec-

07

Dec-

06

FCFF (EBITDA Formula) 1958.0221 1090.27 1828.08 1369.4 1666.42 2076.9 1456.19 252.21 1186.995 1813.5 2122.49 309.854

-

2145.25 503.15

WACC 9% 9% 9% 9% 9%

Years (t) 5 4 3 2 1

Discounted FCFF 1273 772 1412 1153 1529

Sum of Discounted FCFF 6138

Terminal Value (Growth

5%) 51398

Dicsounted Terminal Value

(t=5) 33405

Value of company (Sum of

Discounted

FCFF+Discounted Terminal

Value)

39543

Shares Outstanding 284.59

FCFF per share 138.94802

Current Market Price (As on

12 Aug 2016) 89

Upside 56%

BUY CALL

5. Forecasting Financial Ratios

Profitability

Ratios Profitability Ratios Mar-21 Mar-20 Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Mar-14 Mar-13 Mar-12 Mar-11 Mar-10 Mar-09 Dec-07 Dec-06

Gross Profit

Ratio

((Total Operating

Revenues-

COGS)/Total

Operating Revenues) 28% 26% 28% 25% 27% 30% 27% 24% 27% 26% 27% 28% 26% 26% 24%

Return on

Sales

[PAT/Total Operating

Revenues) 6% 7% 5% 6% 5% 4% 2% 0% 3% 4% 6% 6% 3% 6% 6%

Return on

Assets

[PAT/ Average Total

Assets] 28% 25% 14% 13% 9% 5% 3% 0% 3% 5% 6% 5% 2% 8% 10%

Return on

Equity

[PAT / Average

Stockholders' Equity] 82% 71% 39% 35% 23% 13% 7% 1% 10% 13% 16% 12% 5% 22% 23%

Net Profit

Ratio

[PAT/Total Operating

Revenue] 6% 7% 5% 6% 5% 4% 2% 0% 3% 4% 6% 6% 3% 6% 6%

Liquidity

Ratios Liquidity Ratios

Current Ratio

[Current Assets /

Current Liabilities] 1.085714 1.0526316 1.0285714 1.0810811 1.060606 1.015499 0.931979 0.840588 0.811263 0.888554 1.05955 1.378514 1.4603571 1.205396 1.314619

Quick Ratio

[(Current Assets-

Inventory) / Current

Liabilities] 0.895671 0.8660087 0.8244946 0.8737357 0.80188 0.683324 0.654246 0.58142 0.45326 0.428032 0.47206 0.825197 0.83797 0.667638 0.757918

Cash Ratio

[(Cash and cash equi.

+ current investment)

/ Current Liabilities] 1.75924 1.2048778 0.872102 0.5537935 0.387724 0.300993 0.230312 0.086352 0.002632 0.006722 0.04775 0.175266 0.0412176 0.198322 0.226224

Net Working

Capital

[Current Assets -

Current Liabilities] 3211.061 1476.3497 527.26774 1090.8988 527.0042 80.75 -342.52 -731.16 -999.57 -539.81 223.9 1120.69 983.76 467.47 604.89

Management

Efficiency

Ratios

Management

Efficiency Ratios

Receivable

Turnover

[Sales / Accounts

Receivable] 75.69377 52.724628 38.413658 27.816787 22.1728 15.04583 10.7834 7.654622 8.793231 10.43852 9.59821 7.275679 6.4396484 21.21254 14.07375

Day Sales

Outstanding

[365*( Trade

Receivables/Sales)] 4.822061 6.922761 9.5018288 13.121573 16.46161 24.25921 33.84831 47.68361 41.5092 34.96664 38.0279 50.16714 56.680113 17.20681 25.93482

Inventory

Turnover (COGS/Avg. Inventory) 10.88427 10.497308 10.111975 9.7231192 8.511992 7.663259 7.125496 6.395718 4.811732 4.241779 3.69987 3.251575 3.4524026 4.821155 5.200912

Days Inventory

Outstanding

[365*( Inventory/

COGS)] 33.53465 34.770819 36.095817 37.539394 42.88068 47.62986 51.2245 57.06943 75.85626 86.0488 98.652 112.2533 105.72347 75.708 70.18

6. Accounts

Payable

Turnover

(COGS / Accounts

Payable) 19.0617 15.545312 11.850464 8.0185314 6.22718 5.175015 3.523371 3.433638 3.670737 3.412796 3.54023 2.284559 2.5923084 3.400741 3.882736

Days Payable

Outstanding

[365*(Accounts

Payable/COGS)] 19.14834 23.479747 30.800481 45.519558 58.61401 70.53119 103.594 106.3012 99.43507 106.9504 103.101 159.7683 140.80115 107.3295 94.00587

Operating

Cycle

[Days Inventory+Days

Sales] 38.35671 41.69358 45.597646 50.660967 59.34229 71.88908 85.07281 104.753 117.3655 121.0154 136.68 162.4204 162.40359 92.9148 96.11482

Cash

Conversion

Cycle

[Day Sales O/S+Days

Inventory O/S-Days

Payable O/S] 19.20837 18.213833 14.797165 5.1414093 0.72828 1.357886

-

18.52117 -1.5482 17.9304 14.065 33.5792 2.652171 21.602441

-

14.41474 2.108945

Total Asset

Turnover [Sales/ Total Assets] 4.620211 3.5368514 2.8294811 2.2050439 1.757644 1.406115 1.018833 0.776345 0.953003 1.077732 1.05511 0.798892 0.7797734 1.429228 1.63343

Leverage

Ratios Leverage Ratios

Debt Ratio

[Total Liabilities/Total

Assets] 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

Equity Ratio

[Total Equity / Total

Assets] 0.336925 0.3462841 0.3591094 0.3792464 0.389879 0.411948 0.384532 0.347274 0.34017 0.35316 0.3741 0.392809 0.4391083 0.385246 0.420532

Debt-Equity

Ratio

[Total Liabilities /

Total Equity] 2.968019 2.8878023 2.7846665 2.6368081 2.564895 2.42749 2.600566 2.879574 2.93971 2.831575 2.67308 2.545769 2.2773425 2.595743 2.377938

Times Interest

Earned

[(PBT+Finance Cost) /

Finance Cost] 19.67189 17.732737 8.8245272 8.4231332 6.998662 5.274366 2.123733 0.798596 2.248932 3.703154 5.24412 6.348748 2.3267641 8.630635 20.09082

Valuation

Growth Ratios

EPS [PAT/NO. Of Share] 22.56622 18.15673 9.2636379 7.666459 4.629504 2.53621 1.176464 0.110422 1.63006 2.127185 4.74555 3.18477 1.4301285 3.527851 3.355616

Price-Earnings

Ratio

[Current Market

Price/EPS] 4.810287 5.9784993 11.717859 14.159079 23.44744 42.80008 92.26799 983.0462 66.59265 51.02989 22.8741 34.08409 75.902268 30.76944 32.34876

Book Value per

Share

[Shareholder's

Funds/No Of Share] 27.42705 25.395416 23.514274 21.975957 20.53828 19.37573 17.98619 16.71695 16.74409 15.81603 29.79 27.48485 26.113659 16.1541 14.31052

PB Ratio

[Current Market

Price/BV] 3.957772 4.2743935 4.616345 4.9394891 5.285253 5.602369 6.035186 6.493408 6.482884 6.863292 3.64384 3.949448 4.1568285 6.719656 7.585328

7. Valuation Ratios

DATA Required 2016

CMP ON 31 MARCH 2016 108.55 P/E 42.80008382

EPS ON 31 MARCH 2016 2.536209986 P/B 5.602368547

REVENUE ON 31 MARCH 2016 18,821.58 P/SALES RATIO 1.641320468

NO . O/S SHARE 285 PRICE TO CASH FLOW 18.43641689

NET WORTH 5,514.14 PRICE TO EARNING GROWTH RATIO 5.887803507

ANNUAL DIVIDEND 45.00 DIVIDEND YIELD 0.414555504

CASH FLOW FROM OPERATION 1675.61 MARKET CAP 30892.2445

EPS GROWTH 116% ENTERPRISE VALUE 30475.9945

SHORT TERM BORROWING 0 NET DEBT 416.25

LONG TERM BORROWING 1,984.38 EV/EBITDA 14.07036778

CASH & CASH EQUIVALENT 1,568.13 EV/SALES 1.619204897

EBITDA 2,165.97 EV/EBIT 17.69493962

Net Debt= SHORT TERM BORROWING+LONG TERM BORROWING-CASH & CASH EQUIVALENT

8. Analysis

Company Profiles:

Company : Ashok Leyland: Ashok Leyland is an Indian automobile manufacturing company based in Chennai, India. Founded in 1948, it is the 2nd largest

commercial vehicle manufacturer in India, 4th largest manufacturer of buses in the world and 16th largest manufacturer of trucks globally. Operating six

plants, Ashok Leyland also makes spare parts and engines for industrial and marine applications. With a joint venture with Nissan Motors of Japan the company

made its presence in the Light Commercial Vehicle (LCV) segment (<7.5 tons).

Discounted Cash Flow Valuation

1. Revenue Growth: The revenue growth of the companies has been assumed as follows:

Company : Ashok Leyland: Ashok Leyland is an 2nd largest commercial vehicle manufacturer in India Ashok Leyland has an potential to grow with an average

growth of 40-45% and on this basis the future operating revenue forecasting has been done with an growth rate of 40-45%. Fall in fuel prices has substantially

improved interest serviceability of the fleet operators leading to higher demand. The company expects to earn over one-fourth of its revenues from exports in

the next 3-5 years by expanding presence in Africa, South East and Latin American market.

2. The other financials are based on the revenue and the average/estimated of the last three –five years.

3. WACC (Weighted Average Cost of Capital) for all the three companies are calculated as follows:

WACC Calculation Ashok Leyland

WACC 9%

Weight of Debt 38.0%

Weight of Equity 62.0%

After-tax Cost of Debt 2.1%

Corporate tax rate 29.0%

Cost of Debt 3.0%

Cost of Equity 13.2%

9. Adjusted Risk free Rate 5.0%

Annual inflation rate 9.0%

Country Risk Premium 1.5%

Risk free Rate 8.0%

Unlevered Beta 1.82

Market Premium 4.0%

4. Terminal Growth Rate Assumption: T growth rate is taken 5 % assumption for all the three companies.

5. After calculating the value of the company the following recommendation can be given for each of the companies:

Name of the Company FCFF/ Share

(Rs)

Current Market Price (Rs) Upside

(%)

Recommendation

Ashok Leyland 138.9480213 89 (As on 12 Aug 2016) 56% BUY

This report has been prepared by Aakash Singh, MBA Finance Student (SIBM HYD) only for the learning purpose. It includes research analysis, projections, forecasts and other

predictive statements providing a basis for investment decisions. The views expressed therein are based solely on information available publicly/internal data/other reliable

sources believed to be true. The information is provided merely as a complementary service and do not constitute an offer, solicitation for the purchase or sale of any financial

instruments or neither me nor anyone responsible for the risk held by the investor.