SW

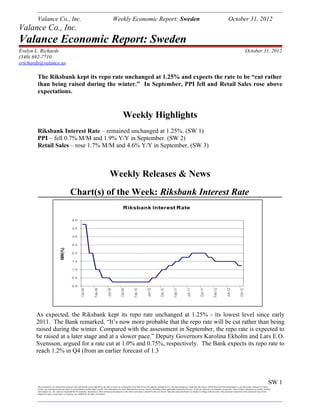

- 1. Valance Co., Inc. Weekly Economic Report: Sweden October 31, 2012 Valance Co., Inc. Valance Economic Report: Sweden Evelyn L. Richards October 31, 2012 (340) 692-7710 erichards@valance.us The Riksbank kept its repo rate unchanged at 1.25% and expects the rate to be “cut rather than being raised during the winter.” In September, PPI fell and Retail Sales rose above expectations. Weekly Highlights Riksbank Interest Rate – remained unchanged at 1.25%. (SW 1) PPI – fell 0.7% M/M and 1.9% Y/Y in September. (SW 2) Retail Sales – rose 1.7% M/M and 4.6% Y/Y in September. (SW 3) Weekly Releases & News Chart(s) of the Week: Riksbank Interest Rate This document is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy the products mentioned in it. No representation is made that any returns will be achieved. Past performance is not necessarily indicative of future results; any information derived herein is not intended to predict future results. This information has been obtained from various sources, including where applicable, entered by the user; we do not represent it as complete or accurate. Users of these calculators are hereby advised that Valance Co., Inc. takes no responsibility for improper, inaccurate or other erroneous assumptions to the extent such data is entered by the user hereof. Opinions expressed herein are subject to change without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor suitable for all types of investors SW 1 As expected, the Riksbank kept its repo rate unchanged at 1.25% - its lowest level since early 2011. The Bank remarked, “It’s now more probable that the repo rate will be cut rather than being raised during the winter. Compared with the assessment in September, the repo rate is expected to be raised at a later stage and at a slower pace.” Deputy Governors Karolina Ekholm and Lars E.O. Svensson, argued for a rate cut at 1.0% and 0.75%, respectively. The Bank expects its repo rate to reach 1.2% in Q4 (from an earlier forecast of 1.3

- 2. Valance Co., Inc. Weekly Economic Report: Sweden October 31, 2012 Trade Data & PPI Trade Data PPI This document is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy the products mentioned in it. No representation is made that any returns will be achieved. Past performance is not necessarily indicative of future results; any information derived herein is not intended to predict future results. This information has been obtained from various sources, including where applicable, entered by the user; we do not represent it as complete or accurate. Users of these calculators are hereby advised that Valance Co., Inc. takes no responsibility for improper, inaccurate or other erroneous assumptions to the extent such data is entered by the user hereof. Opinions expressed herein are subject to change without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor suitable for all types of investors SW 2 As expected, Sweden’s trade surplus widened from SEK 5.0 bln in August to SEK 7.5 bln in September; down from a surplus of SEK 9.5 bln a year earlier. On a 3-mth. mov. avg. basis, the trade surplus narrowed from a surplus of SEK 6.0 bln to SEK 5.4 bln. Exports decreased by 13.2% Y/Y, following a -2.6% Y/Y loss the previous month. Imports fell 11.9% Y/Y, compared with a 2.5% Y/Y loss the month before. September’s Producer Price Index decreased 0.7% M/M and 1.9% Y/Y, compared with -0.5% M/M and -1.9% Y/Y posted the previous month.

- 3. Valance Co., Inc. Weekly Economic Report: Sweden October 31, 2012 Retail Sales, Trade Weighted Exchange Rate & Data Retail Sales Trade Weighted Exchange Rate Data October 25th - Household Borrowing Growth – fell 4.5% Y/Y in September, following 4.6% Y/Y growth the previous month. This document is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy the products mentioned in it. No representation is made that any returns will be achieved. Past performance is not necessarily indicative of future results; any information derived herein is not intended to predict future results. This information has been obtained from various sources, including where applicable, entered by the user; we do not represent it as complete or accurate. Users of these calculators are hereby advised that Valance Co., Inc. takes no responsibility for improper, inaccurate or other erroneous assumptions to the extent such data is entered by the user hereof. Opinions expressed herein are subject to change without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor suitable for all types of investors SW 3 Retail Sales rose 1.7% M/M and 4.6% Y/Y in September, compared with -0.4% M/M and 1.6% Y/Y the previous month. Sales were forecast to gain 0.4% M/M and 2.5% Y/Y. Additionally, Retail Sales for consumables increased 1.4% Y/Y, while sales for durables rose 7.0% Y/Y.

- 4. Valance Co., Inc. Weekly Economic Report: Sweden October 31, 2012 News & Upcoming Dates News October 25th (Bloomberg) - Sweden Needs Measures to Tame Consumer Debt – Riksbank Governor Stefan Ingves remarked: We have seen no changes to regulator frameworks at all, so it’s very important. They should have been in place a long time ago. We of course think that’s good, so indebtedness plays a role, but it’s very, very hard, so to speak, to put any numbers on it. From a pure technical point of view, when it comes to model-building and things like that, we have a long way to go. Since we are six people, we still need to have an orderly process in which to conduct our conversations and then this is a well-functioning technique. It’s not an issue that’s on the agenda, but as far as I can judge everyone at the board is happy with the way things work. Key Dates This Week This document is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy the products mentioned in it. No representation is made that any returns will be achieved. Past performance is not necessarily indicative of future results; any information derived herein is not intended to predict future results. This information has been obtained from various sources, including where applicable, entered by the user; we do not represent it as complete or accurate. Users of these calculators are hereby advised that Valance Co., Inc. takes no responsibility for improper, inaccurate or other erroneous assumptions to the extent such data is entered by the user hereof. Opinions expressed herein are subject to change without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor suitable for all types of investors Date Indicator Month Expectation Previous 11/01 Swedbank PMI Survey OCT 45.0 44.7 11/05 PMI Services OCT -- -- 11/06 Service Production SEP -- 0.3% / 1.2% 11/07 Riksbank Minutes from Rate Meeting Released 11/07 Budget Balance OCT -- 2.8B SW 4