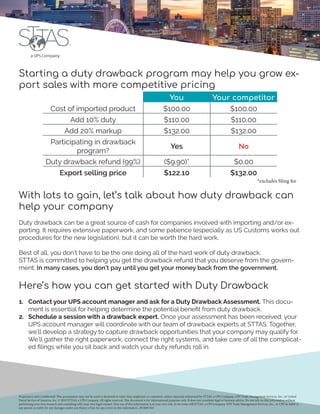

Duty drawback allows companies to claim a refund on import duties, fees, and taxes paid on goods brought into the U.S. if those goods are later exported. There are two main types of duty drawback: manufacturing drawback applies when an imported item is manufactured into a different exported item, and unused merchandise drawback applies when an imported item is exported without changes. Recent legislation expanded eligibility for duty drawback claims by allowing for broader substitutions of goods and increasing the claims filing timeline to five years. Working with a duty drawback specialist can help companies navigate the paperwork required to claim refunds on eligible exports.