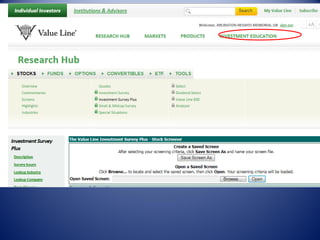

This document discusses three stock analysis services: Morningstar, Standard & Poor's NetAdvantage, and Value Line. Morningstar rates over 2,000 stocks on a 1-5 star scale based on analysts' fair value estimates and uncertainty. Standard & Poor's provides stock reports and company profiles for over 1,100 and 6,000 companies respectively, including consensus opinions and financial projections. Value Line covers 1,700 stocks, providing financial forecasts, consensus estimates, and timeliness rankings from 1 (highest) to 5 (lowest) based on expected price performance.