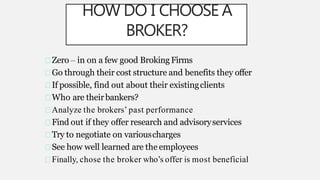

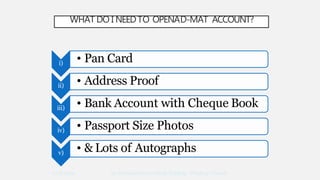

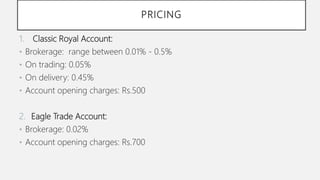

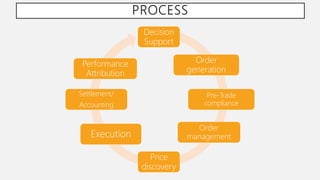

Eagles Ford is a stock brokerage firm based in Udaipur, India that was established in 2018. It offers various trading and investment services through different account types. The Classic Royal Account has brokerage fees ranging from 0.01-0.5% and account opening charges of Rs. 500, while the Eagle Trade Account has brokerage of 0.02% and opening charges of Rs. 700. Eagles Ford leverages both online and offline channels to reach customers. While it has a strong process for order execution and research capabilities, online listings have increased competition from individual home sellers and part-time agents.