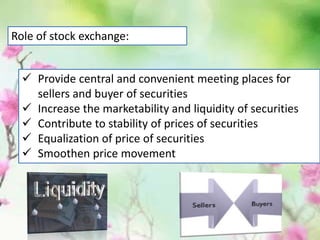

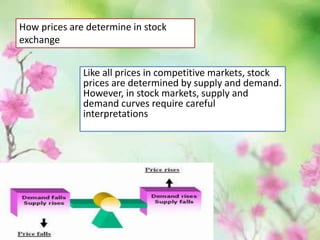

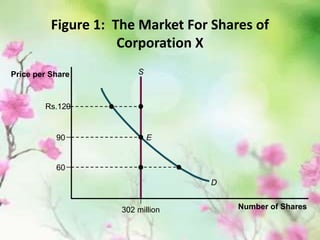

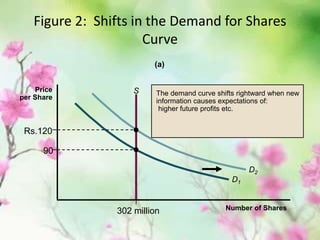

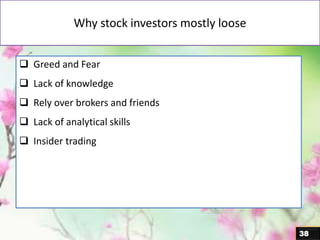

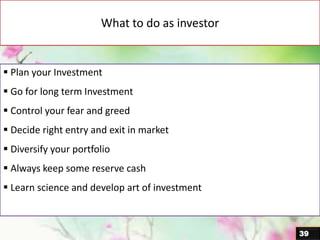

Markets, including stock markets, bring together buyers and sellers to exchange commodities and securities. A stock market functions as a place for trading shares of publicly held companies, either on exchanges or over-the-counter. Stock prices are determined by supply and demand and can fluctuate based on factors such as company performance, economic conditions, world events, demand and supply of shares, and market sentiment. Successful long-term stock investing requires understanding these market influences and having a diversified portfolio.