Steelbis newsletter 27 10-2021

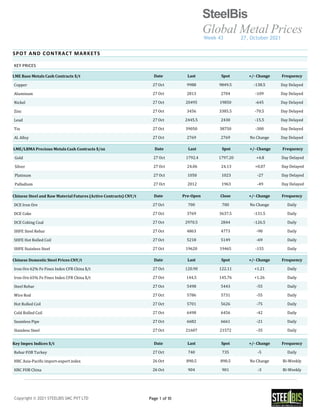

- 1. SteelBis Global Metal Prices Week 43 27, October 2021 Copyright © 2021 STEELBIS SMC PVT LTD Page 1 of 10 LME Base Metals Cash Contracts $/t Date Last Spot +/- Change Frequency Copper 27 Oct 9988 9849.5 -138.5 Day Delayed Aluminum 27 Oct 2813 2704 -109 Day Delayed Nickel 27 Oct 20495 19850 -645 Day Delayed Zinc 27 Oct 3456 3385.5 -70.5 Day Delayed Lead 27 Oct 2445.5 2430 -15.5 Day Delayed Tin 27 Oct 39050 38750 -300 Day Delayed Al. Alloy 27 Oct 2769 2769 No Change Day Delayed SPOT AND CONTRACT MARKETS KEY PRICES LME/LBMA Precious Metals Cash Contracts $/oz Date Last Spot +/- Change Frequency Gold 27 Oct 1792.4 1797.20 +4.8 Day Delayed Silver 27 Oct 24.06 24.13 +0.07 Day Delayed Platinum 27 Oct 1050 1023 -27 Day Delayed Palladium 27 Oct 2012 1963 -49 Day Delayed Chinese Steel and Raw Material Futures (Active Contracts) CNY/t Date Pre-Open Close +/- Change Frequency DCE Iron Ore 27 Oct 700 700 No Change Daily DCE Coke 27 Oct 3769 3637.5 -131.5 Daily DCE Coking Coal 27 Oct 2970.5 2844 -126.5 Daily SHFE Steel Rebar 27 Oct 4863 4773 -90 Daily SHFE Hot Rolled Coil 27 Oct 5218 5149 -69 Daily SHFE Stainless Steel 27 Oct 19620 19465 -155 Daily Chinese Domestic Steel Prices CNY/t Date Last Spot +/- Change Frequency Iron Ore 62% Fe Fines Index CFR China $/t 27 Oct 120.90 122.11 +1.21 Daily Iron Ore 65% Fe Fines Index CFR China $/t 27 Oct 144.5 145.76 +1.26 Daily Steel Rebar 27 Oct 5498 5443 -55 Daily Wire Rod 27 Oct 5786 5731 -55 Daily Hot Rolled Coil 27 Oct 5701 5626 -75 Daily Cold Rolled Coil 27 Oct 6498 6456 -42 Daily Seamless Pipe 27 Oct 6682 6661 -21 Daily Stainless Steel 27 Oct 21607 21572 -35 Daily Key Impex Indices $/t Date Last Spot +/- Change Frequency Rebar FOB Turkey 27 Oct 740 735 -5 Daily HRC Asia-Pacific import-export index 26 Oct 890.5 890.5 No Change Bi-Weekly HRC FOB China 26 Oct 904 901 -3 Bi-Weekly

- 2. SteelBis Global Metal Prices Week 43 27, October 2021 Copyright © 2021 STEELBIS SMC PVT LTD Page 2 of 10 Ferrous Scrap $/t Date Low High +/- Change Frequency Bulk HMS 1&2 (80:20) CFR Turkey 25 Oct 508 510 +5 Weekly Bulk Shredded 211 CFR Turkey 25 Oct 527 530 +5 Weekly HMS Bundle CFR Port Qasim Ex-UAE 25 Oct 550 555 +5 Weekly Containerized Shredded CFR Chittagong 25 Oct 590 600 +10 Weekly Bullk HMS 1&2 (80:20) CFR Chittagong 25 Oct 575 585 +10 Weekly Containerized Shredded 211 CFR Port Qasim 25 Oct 560 565 +5 Weekly Containerized Shredded CFR Nava Shiva 25 Oct 553 558 +3 Weekly Containerized HMS 1&2 (80:20) CFR Taiwan 25 Oct 488 490 +3 Weekly SPOT AND CONTRACT MARKETS KEY PRICES Ferrous Scrap PKR/t Date Low High +/- Change Frequency Qainchi Tok 27 Oct 121100 121350 +1500 Daily Arat Tok 27 Oct 116250 116500 +1500 Daily Shershah 26 Oct 120000 121500 - Weekly Gadani 26 Oct 126000 128000 - Weekly Semi Finished PKR/t Date Low High +/- Change Frequency Bala 27 Oct 152000 153000 +1000 Daily Bari 27 Oct 153000 154000 +1000 Daily G60 CC Billet 25 Oct 161000 164000 - Weekly Gadani PKR/t Date Low High +/- Change Frequency Ship Plate 3-4up 26 Oct 140000 142000 +4000 Weekly Ship Plate 5up 26 Oct 144000 146000 +4000 Weekly Structure 26 Oct 140000 142000 +4000 Weekly Finished Long PKR/t (Note:G60 prices are updated as per mill revisions) Date Low High +/- Change Frequency G60 Rebar 10 mm Ex-KHI 21 Oct 186000 187000 +4000 NA G 60 Rebar 12 mm Ex-KHI 21 Oct 183000 184000 +4000 NA G 60 Rebar 10 mm Ex-LHR 21 Oct 184000 185000 +5000 NA Local Deformed 12 mm Ex-LHR 27 Oct 168000 170000 +2000 Weekly Ship Plate Rebar 8 mm 25 Oct 168000 169000 +1000 Weekly Ship Plate Rebar 10-16 mm 25 Oct 170000 171000 +1000 Weekly Ship Plate rebar 18-25 mm 25 Oct 171000 172000 +1000 Weekly Angle 27 Oct 171000 173000 +4000 Weekly T Iron 27 Oct 170000 174000 No Change Weekly Girder (I/H Beam) 27 Oct 180000 185000 +1000 Weekly

- 3. SteelBis Global Metal Prices Week 43 27, October 2021 Copyright © 2021 STEELBIS SMC PVT LTD Page 3 of 10 Flat Steel (Note: prices are updated as per mill revisions) Date Last Spot +/- Change Frequency Primary Grade Cold Rolled Coil 0.25mm 20 Oct 250439 253949 +3510 NA Primary Grade Cold Rolled Coil 1mm 20 Oct 239324 242834 +3510 NA Primary Grade Galvanized Coil 0.25mm SGCH 20 Oct 269744 273254 +3510 NA Primary Grade Galvanized Coil 1mm SGCC 20 Oct 247923 251433 +3510 NA Pre-painted Galvanized Coil 1mm SGCC/SGCH 20 Oct 261495 265005 +3510 NA SPOT AND CONTRACT MARKETS KEY PRICES Demolition Offers (Pakistan) $/LDT Date Low High +/- Change Frequency Container 25 Oct 610 615 +5 Weekly Tanker 25 Oct 600 610 +5 Weekly Bulker 25 Oct 595 600 +5 Weekly European Steel Market Assessments €/t Date Last Spot +/- Change Frequency Hot Rolled Coil Ex-Southern Europe 22 Oct 940 900 -40 Weekly Hot Rolled Coil Ex-Northern Europe 22 Oct 1030 990 -40 Weekly US Steel Market Monthly Averages $/t Date Open Close +/- Change Frequency Hot Rolled Coil Ex-Midwest 11 Oct 2105 2143 +38 Bi-Monthly Cold Rolled Coil Ex-Midwest 11 Oct 2298 2315 +17 Bi-Monthly No. 1 Heavy Melting Scrap 11 Oct 419 422 +3 Bi-Monthly Shredded Scrap 11 Oct 466 463 -3 Bi-Monthly No1 Busheling Scrap 11 Oct 585 586 +1 Bi-Monthly

- 4. SteelBis Bulletin Page 4 of 10 . FEATURE: Markets have never been better, great time to be in steel business Copyright © 2021 STEELBIS SMC PVT LTD Week 43 27, October 2021 The 85th meeting of IREPAS (the International Rebar Exporters and Producers Association) was held as a virtual event and was attended by 223 producer representatives among the 918 registered delegates from a total of 70 different countries. There were also 69 registrations representing 31 different raw material suppliers. At the opening of the conference, Murat Cebecioglu, chairman of IREPAS, emphasized that the supply was no longer an issue in the global long steel products market, and demand would be the driving factor from now on, though it would probably be rather slow for a while because prices are normalizing and delivery periods are becoming shorter. He also added that the cost of producing steel is increasing, especially on the energy side. IREPAS chairman also said the logistics situation is getting worse in terms of constituting a bottleneck. Furthermore, the strong surge in electricity costs, which have tripled or quadrupled since August this year, has tightened the pressure on many mills, meaning they have to seek to pass on cost increases to their customers, he added. Mr. Cebecioglu also said that the outlook for the market in the next quarter is much more positive than it has been seen for some time despite several uncertainties. Raw Material Suppliers at IREPAS: Scrap demand level is very supportive of the market Jens Björkman from Stena Metal International, the chairman of the raw material suppliers committee, commented on the performance of the steel market and stated that general conditions are expected to improve amid quite substantial support from governments for a rebound after lockdowns. “We will continue to see markets resuming to more normal circumstances next year. We expect the markets to perform well,” Mr. Björkman noted. The raw material committee chairman pointed out that China is planning to cap its steel production in the first quarter at lower levels, meaning that demand for raw materials will also remain limited. As a result, demand in China will be slightly lower during the first quarter next year. Commenting on the scrap market, especially in Turkey, Mr. Björkman said that seasonally the October- November period is normally a very strong production period, with strong prices also. He added that, with continued strong production, the demand level is very supportive of the market. Regarding threats of scrap bans from certain countries and regions, the Stena official commented, “The risks of that happening are pretty mild, as it is such an important trade”. Answering a question about financing of the raw materials trade, the raw material committee chairman underlined that, in terms of trade finance, such as letters of credit, there is no shortage of financing, while, on the other hand, there are some issues regarding credit insurance when selling material to the EU market or the domestic market. “Credit insurance, i.e., the ability to cover credit with insurance, has been very difficult during the pandemic and also the post-pandemic period. We are seeing some signs that it might get a little bit better as raw material buyers are performing better and are actually delivering very strong quarterly and annual results, which alleviates the situation for insurance. However, in general it has been a slow rebound so far,” Björkman said.

- 5. SteelBis Bulletin He also commented on the situation regarding freight rates and said that the current levels are not a new normal, but they will not go down in the next few months either. Addressing the issue of the trade talks between the EU and the US, Mr. Baysal said he believed that nothing has changed regarding US trade policy, but things are rather getting worse or staying the same, instead of getting better. During a discussion on whether China would return to the export markets or otherwise, the traders committee chairman shared with the conference participants a rumored report that the Chinese government is mulling an export tax on steel starting from January 1 next year. Finally, Baysal commented on current steel price levels and on whether they are here to stay: “Yes, prices will not decrease any time soon, at least not until the second quarter of 2022. Scrap prices decreased a little last month, but shipping prices continued to double or even triple, keeping steel prices at the same levels. High energy costs will continue to negatively affect steel prices. If China continues to decrease production and stay away from the export market, high steel prices may continue for a long while yet. However, in the long run, I think neither shipping prices nor raw material prices will stay this high.” Producers at IREPAS: Markets have never been better, great time to be in steel business Michael Setterdahl, from GFG Alliance – Liberty Steel Mills, member of the producers committee, said that it is a great time to be in the steel business. Page 5 of 10 Copyright © 2021 STEELBIS SMC PVT LTD Week 43 27, October 2021 Traders at IREPAS: Prices will not decrease at least until Q2 2022 F. D. Baysal from Seba International, co-chairman of the traders committee, answered questions during a panel discussion. Mr. Baysal said he believed that there is definitely a genuine recovery. He pointed out that steel production slowed down just to adjust to demand, not because the mills were not able to maintain production, but because most mills are run in an automated manner and are capable of working with minimum staff. Commenting on the outlook for EU imports, the traders committee chairman said that demand for imports in the EU has been strong for some time and will continue, though imports face other limitations: for example, specifically for rebar, homologation and quotas are the limiting factors. “The Turkish rebar quota opening on October 1 got consumed in a single day, with many importers still holding back significant volumes to clear customs as of January 1. Also, significant imports from other developing countries are not realistic, as it takes time to qualify due to homologation procedures which can take up to 15 months,” Mr. Baysal said. Regarding the recent surges in energy costs worldwide, he pointed out that energy price increases may be permanent, but that the surge seen recently is definitely temporary. He said that in 2008 and 2014 energy prices were even higher than today, but in subsequent years they moved down and even collapsed during the pandemic, resulting in many postponed drillings, production halts, and shutdowns of coal plants. “Going forward, all it takes is for Russia, Saudi Arabia and the US to increase production, and pricing will go back to normal levels again. Obviously, the nations who are importing their energy will be affected the most,” he suggested.

- 6. He went on to say that the markets have never been better and that the first quarter of 2022 will be excellent, as long as China does not start increasing exports, while pointing out that steel consumption is growing at a higher rate in the rest of the world than in China. Considering that the extra increases in steel production costs amount to €120/mt, Mr. Setterdahl indicated that, in the medium term, there will be CO2 charges or taxes and that there will be surcharges on all products. He said that right now, steel has surcharges on ferroalloys, but there has been very little reference to natural gas or electricity in the pricing of steel. Commenting on energy costs on the other hand, the Liberty official underlined that the EU and emerging markets will be affected the most because they are importing energy. He also noted that increases in electricity from wind power and solar power are expected, but these will be incremental increases, not immediate as in the case of coal energy. According to Mr. Setterdahl, demand in China is slowing down, with the Chinese demand growth forecast dropping from 6.5 percent to 4.9 percent. “As inventory levels are going up and as Chinese regulators are concerned about the increase in prices for residential buildings amid expensive rebar and cement, I think there is a political push in China to reduce demand,” Setterdahl noted. In response to a question on whether China would resume exports, he said that Chinese mills may want to turn to the export markets to maintain their volumes with domestic consumption slowing down, but Beijing will not allow mass exports, he noted, explaining that 20 million mt of steel exports out of China may be tolerated but, if the figure goes up to the maximum amount of 65 million mt registered a few year ago, Beijing will take action. Page 6 of 10 SteelBis Bulletin Week 43 27, October 2021 Copyright © 2021 STEELBIS SMC PVT LTD Base metals down under as US dollar emerges stronger 3M LME aluminium fell as much as 3.8% to $2,723 a tonne on Wednesday, sliding to an eight-week low as declining coal prices alleviated trader concerns about a supply deficit. Shanghai Futures Exchange December aluminium contract sank 5% to its lowest level in over ten weeks, to RMB 20,065 a tonne. Aluminium smelting is a high-energy operation that rose by 50% this year and reached 13-year highs, owing to robust demand and production cuts in China due to power shortages which led to the surge in coal prices earlier. However, aluminum has recently fallen as China's state planner stated it had instructed key coal- producing provinces to examine and regulate illicit storage facilities and tighten down on stockpiling, since then thermal coal hit its 10% lower trading limit on Wednesday. Similarly, 3M copper slid 1.3% at $9,663 per tonne. While ShFE copper dropped 2% to reach 70,560 a tonne. Copper hit a new high of $10,747.50 a tonne but has fallen by about 10% since May, pulled down by weak Chinese factory output, debt issues in the housing market, and an energy shortage. Further, Copper prices are set to fall next year from record highs reached in 2021 as mine supply increases and China's economic development slows. 3M LME nickel declined 0.6% at $19,970 a tonne. While Nickel at Shanghai Futures Exchange dropped 2.6% to RMB 148,340/tonne. Zinc shed 1.5% to $3,373 a tonne, Similarly, SHFE zinc down by 2.7% to RMB 23,895 a tonne. 3M tin on LME lost 1.1% to $37,000/tonne.

- 7. Page 7 of 10 Copyright © 2021 STEELBIS SMC PVT LTD SteelBis Bulletin Week 43 27, October 2021 FOCUS: China’s steel production dips to 73.9 mnt in Sept’2021.. Global crude steel production dropped by 8.9% in September 2021 on year to reach 144.4 million tonnes, of which the world’s top producer and consumer of the metal, China produced 73.9 million tonnes maintaining its position at the top of the list among other countries. However, China’s September 2021 crude steel output was far lower on a year or year basis, with production down by 21.2% compared to September 2020, and also down 11.2% on month from August where the country produced 83.2 million tonnes of crude steel. The world's largest steel producer and exporter has been overhauling its steel sector to reduce waste, promote renewables and unconventional fuel, and reform its electricity network as part of its plan to bring carbon emissions to a peak before 2030, through the introduction of production controls and the retention of domestically needed supplies in the country. Earlier last week China's government in a document published on the website of the National Development and Reform Commission (NDRC), announced that energy-intensive industries like steel, aluminium, cement and oil refining should ensure that more than 30% of their production capacity meets tighter energy efficiency standards by 2025. An annex to the document outlined that Blast furnaces must cut 17% of their energy consumption for a single unit of production by 2025. September, marked the fourth consecutive month where China’s crude steel production has dropped. It is the highest recorded decline after ferrous metal’s output declined 8.4% in July and 13.2% in August. Meanwhile, since the beginning of the October, steel mills in Jiangsu, Guangdong, and Guangxi have progressively resumed production. As of Octover 13, mills in Jiangsu province had increased crude steel production by at least 25,000 mt/day since the end of September, as power shortage in some areas eased significantly in October, while steel output cuts in H2 September have put most regions back on track to fulfill 2021 energy consumption targets. Most steelmakers, however, are not likely to run at full capacity, according to sources in these regions, because they will need to curtail output to some extent in 2021 to keep crude steel output near 2020 levels. China has been requesting steel mills reduce production since July to stay on track to meet its pledge to peak carbon emissions by 2030 and become carbon neutral by 2060. Outlook: During the first 3 quarters, Beijing's attempts to keep steel output below last year's high were met with minimal success, with China’s production up by 2% on annual basis to stand at 805.89 million tonnes in the first nine months of the year, however, the government ramping up its efforts to keep its promises became evident in September when daily crude steel output lowered to 2.46 million tonnes since December 2018, down 8.6% from August's average, as power shortages in parts of the country and environmental restrictions impeded plant activity. Moreover, since late August, capacity utilisation rates at 71 electric arc furnaces in China have been declining, falling to 49.22% in the last week of September, down 21.09% from the same period a year ago. Electricity rationing driven by coal shortages.

- 8. Page 8 of 10 Copyright © 2021 STEELBIS SMC PVT LTD SteelBis Bulletin Week 43 27, October 2021 Chinese HRC futures down 3.56% d.o.d and 11.59% w.o.w In terms of end user segments, construction steel demand in September and October was weaker than a year ago, according to several dealers in Beijing, Shanghai, and Guangzhou, and any further increase in demand in Q4 is projected to be capped by a slowdown in the property sector. Analysts therefore expect, if the country continues a similar output in the fourth quarter, total annual production will drop by around 30 million tonnes to slightly over 1 billion tonnes and with this case, the industry will be able to achieve the government's goal of reducing yearly output. Chinese HRC exports offers declined this week with recent quotes coming along levels of $940-950/t CFR Pakistan, after earlier hovering around $960/t CFR as of last weekend. Offers earlier were heard at levels as high as $970-990/t CFR however, domestic market volatility ensued after the country's top economic planner, the National Development & Reform Commission said it would investigate the spread of "fabricated" price information, and a slew of government measures followed in order to control raw material prices, which saw prices in the Chinese ferrous complex falter significantly. Uncertainty in the local market has been preventing traders from actively making new offers, moreover, demand for Chinese hot rolled products continues to remain low due to competitive offers from Russia and other regions. The Chinese Hot rolled coil export index fell to $896/t FOB last weekend down $14/t on day, with some traders heard lowering their offers for the SS400 HRC to $885-890/t FOB on Friday, October 22nd 2021. Spot prices for hot-rolled coils in China also fell sharply triggered by the Chinese government's move to contain a surge in coal prices. The downtrend continued with the domestic hot rolled coil index assessed at 5625 yuan a tonne today, down 2.71% on week. Meanwhile, spot HRC trading liquidity in Shanghai and Tangshan remained weak as the market continued to panic amidst price volatility. Sentiment was further dented as hot rolled coil futures at the Shanghai Futures Exchange plunged on a near daily basis from Thursday October 21st, with the most actively traded contract for January 2022 delivery closing at 5032 yuan in today’s session, plummeting over 12% on week from 5720 yuan at its open last Wednesday. In view of market participants, "Chinese HRC prices are unlikely to drop to a level where they can be price competitive again unless supplies from other origins are significantly reduced, on the other hand, if the export volume increases, it is likely that export duties [on steel products] will be imposed.” FOCUS: China’s steel production dips to 73.9 mnt in Sept’2021.… continues

- 9. Page 9 of 10 Copyright © 2021 STEELBIS SMC PVT LTD SteelBis Bulletin Week 43 27, October 2021 Coke Futures fall as Beijing probe into illegal storage sites China imported 4.35 million tonnes of coking coal in September, down by 35.3% year on year and 7.2% lower month on month, according to the latest Chinese customs data reports. Imports fell as rising covid cases in Mongolia led to delivery delays; Mongolian imports declined by 39% to 659,094 tonnes in September on the month, after more than doubling in August. On the contrary, US imports rose by 21% in September on the month to hit a record high of 1.47mn tonnes. Canadian imports in September more than tripled to 967,973 tonnes from a year earlier; while imports from Russia nearly doubled year on year, reaching about 927,000 tonnes. The country’s January-September 2021 imports fell by 41% to 35.08mn tonnes after China banned coal imports from Australia a year earlier with no Australian imports since December 2020. Tight supply in China, the world's biggest steel producer, propelled coking coal and coke prices to record peaks earlier this month. Offers for premium low- volatile hard coking coal delivered on a CFR China basis rose by 50% on month to a record $597.65/t over the period between September 1st to September 30th 2021; similarly, premium low-volatile hard coking coal price of ex-Australian coal surged 61% to $401/t FOB over the same period. The present market volatility has more to do with Beijing's resolve to ensure supply and price stability measures than market fundamentals. In the spot and contract markets, Chinese coal futures continued to fall on Wednesday after the government earlier announced intervention to cool commodity prices, while demand for industrial metals stayed subdued on output controls. The most-active coking coal and coke futures for January 2022 delivery on the Dalian Commodity Exchange opened down 9% at 2,704 yuan and 3,430 yuan, respectively, hitting their daily trading limits. The plunge came as thermal coal hit its 10% lower trading limit after the state planner said it had asked major coal producing provinces to probe and regulate illegal storage sites, and to crack down on hoarding behaviors. In a note, analysts at Sinosteel Futures shared, "The collective price of coal-related futures has turned from strong to weak, and the market would witness further panic as Beijing will implement intervention measures on coal prices in accordance with the law".

- 10. Page 10 of 10 Copyright © 2021 STEELBIS SMC PVT LTD SteelBis Bulletin Week 43 27, October 2021 CISA vows to ramp up efforts to ensure iron ore supplies As stated in a press release issued on Monday, October 25th 2021, China Iron and Steel Association (CISA), vowed to double efforts to ensure iron ore supplies as Chinese steel mills reported better profitability during the first three quarters of 2021, despite being faced with growing costs, stringent environmental protection measures and energy conservation requirements. Chinese steel makers optimized their businesses and realized profit totaling 319.3 billion yuan ($49.97 billion), up 123 percent year-on-year. On average, their profit margin rose 2.18 percentage points to 6.03 percent. During the same period, the average price of iron ore rose to $171.67 per ton, up 72.64 percent year-on-year, while the price for coking coal rose by 57.07 percent and that for scrap steel shot up by 36.48 percent. In the press release the association stressed that upstream resources supply has become increasingly monopolistic, while the downstream industry in China is highly fragmented. The association plans to speed up the process of tackling iron ore supplies through more communication and exchanges. It will also develop resource supplies, improve the pricing mechanism for iron ore, and refine futures trading rules to ensure stable industry and supply chains. CISA also noted that, for the first nine months, crude steel output increased 2 percent to 80,589 tons. The growth rate was 2.5 percentage points lower than in 2020. Nonetheless, nationwide restrictions have had a clear impact on crude steel production, with September output down 21.2 percent year-on-year -- the lowest growth rate in three years, according to CISA. China's crude steel output accounted for a slightly lesser share of the global total, at 55.45 percent, down 2.81 percentage points from the same period in 2020. Data from the World Steel Association also showed that Chinese crude steel production grew at a slower pace than the rest of the world in the first eight months of the year, with China growing at 10.6 percent year- on-year in contrast to 18.1 percent for the rest of the world. CISA had earlier rallied with government ministries to accelerate the development of domestic iron ore sources and the construction of overseas iron mines invested in by Chinese companies in order to secure the country's iron and steel supplies during the 14th Five-Year Plan 2021-25. Over January-September, China's run-of-mine (RoM) iron ore output managed to grow 13.4% on year to 743.4 million tonnes, though the growth eased from the 14.2% on year for the first eight months mainly because of the ongoing power rationing the stringent safety scrutiny, according to the data released by the Metallurgical Mines' Association of China (MMAC) on October 21. For September alone, the country's output grew 9.6% on year or up 0.9% on month to 84.7 million tonnes, among which 71.9 million tonnes or 84.9% were from the top seven mining bases including Hebei, Liaoning, Sichuan, Shanxi, Inner Mongolia, Xinjiang and Anhui.

- 11. Disclaimer: This report is developed by the research team of SteelBis ltd. And hence is the sole copyright of the Company. No party or individual is allowed to reproduce such material or replicate its work upon other forums. The intent of this report is to share the latest trends in terms of pricing and news for the products under concern. This research does not in any way, intend to recommend the users about any products or Company, and hence, SteelBis ltd or any of its employee are neither in any way liable for damages or misinterpretations caused by their research nor are they to be held responsible for any errors or omissions made during the development of their reports. https://steelbis.com https://www.linkedin.com/company/steelbisglobal/ https://twitter.com/SteelBisGlobal https://www.facebook.com/steelbis.global