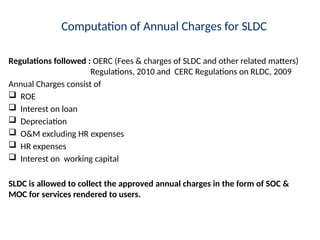

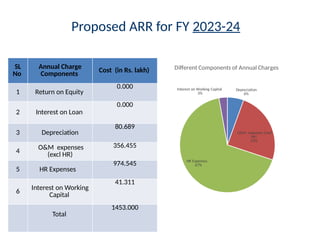

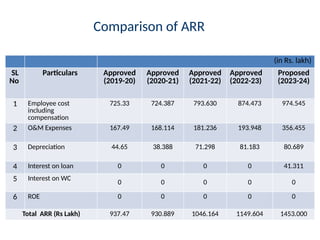

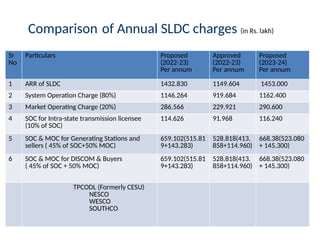

The document outlines the analysis of the annual revenue requirement (ARR) and associated fees for the State Load Dispatch Center (SLDC) for the fiscal year 2023-24, including components such as return on equity, interest on loans, and operational expenses. Proposed charges amount to ₹1453 lakh, with significant scrutiny on projected expenses, particularly regarding human resources and operational costs which are deemed excessively high compared to previous years. Observations also highlight the need for careful review of asset depreciation and working capital requirements, with recommendations for adjustments based on regulatory guidelines.

![Working capital

Observation

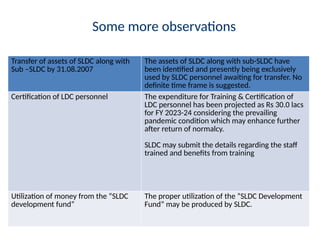

• SLDC has claimed Working capital requirement of Rs 353.083 lakh [O&M

excluding HR for one month at Rs. 29.705 lakh, HR expenses for one month at

Rs. 81.212 lakh & Receivables (two months of SOC & MOC) at Rs. 242.167

lakh]

• SLDC in their ARR application has admitted that they have not taken loans to

meet working expenses.

• The Commission did not approve any amount under working capital head for

the previous two years on the ground that the same may be incurred out of

the fund in the SLDC Development Fund.

Submission

Proposed working capital of Rs. 353.083 lakh may not be approved separately

and the same may be allowed to be incurred from SLDC Development Fund.](https://image.slidesharecdn.com/sldcarranalysis-241006183012-1cad6e80/85/STATE-LOAD-DESPATCH-CENTRE-ARR-ANALYSIS-pptx-11-320.jpg)