This document provides a guide to payroll and payroll tax information for 2009-2010. It includes charts with tax rates, wage limits, and taxability of compensation. It also offers tips to save on payroll such as using independent contractors, direct deposit, retirement planning, and available tax credits. Contact information is provided for Juanita Aubel, the tax advisor, along with tables of contents listing the guide's parts on processing and reporting, startup information for new employers, and specific payroll forms.

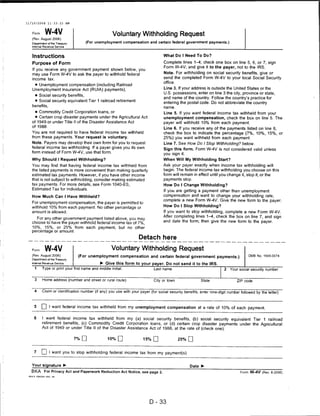

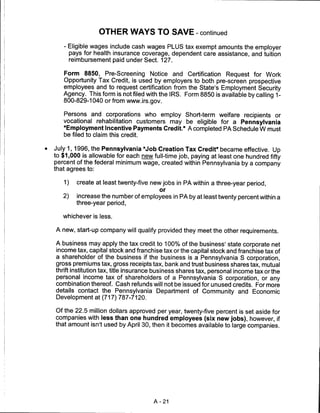

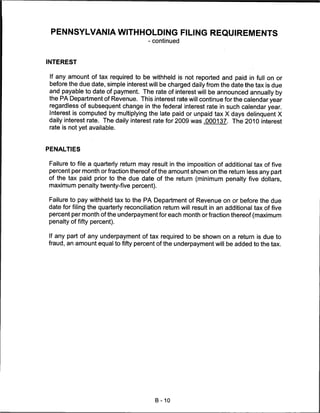

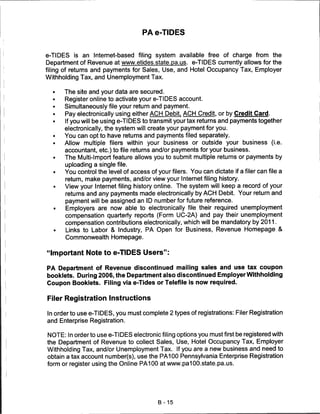

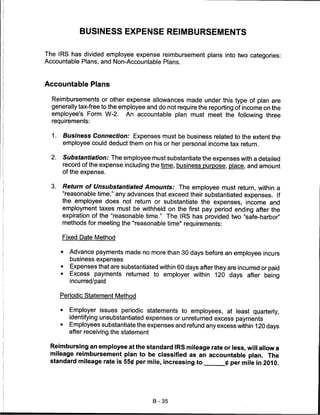

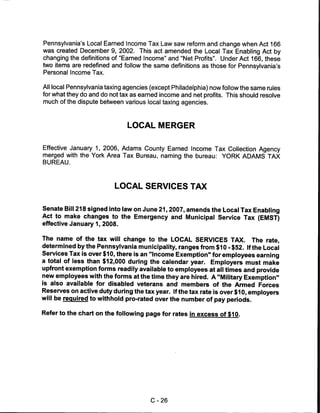

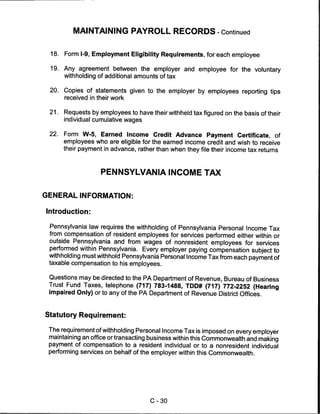

![Check the appropriate block(s) to indicate the tax(es) you will be paying by EFT. Enter the account number for each tax type. If you

select the ACH Debit option, the tax typefc) checked should fall under the bank account listed in Section 8 from which the

payments') will be drawn.

1 r~ Capital Stock/Franchise Tax File Box) Number

Loans Tax (AH 3 taxes reported on RCT-101)

Corporate Net Income Tax

File Box) Number

2. □ Utilities Gross Receipts Tax —

File Box) Number

3. Q Gross Receipts Telecommunication Taxes for

Intra-State, Inter-State, Mobile

—

File (Box) Number

4. □ Public Utility Realty Tax

File (Box) Number

5. □ Bank Shares Tax

Title Insurance & Trust Company Shares Tax

Bank Loans Tax

hie Box) Number

6. □ Mutual Thrift Institutions Tax —

File | Box) Number

7. Q Insurance Premiums Tax —

File (Box) Number

8. [] Marine Insurance Premiums Tax

EIN

9. n Liquid Fuels and Fuels Tax

Account Number

10. □ Motor Carriers Road Tax

Account Number

11. LJ IFTA - Motor Carriers

Account Number

12. □ Malt Beverage Tax

Account Number

13. C] Cigarette Stamp Agents

Account Number

14. □ Pari-Mutuel

Authorized Signature Information:

I certify the information provided on this form is true and correct and hereby authorize the PA Department of Revenue to use the

information herein in direct conjunction with the EFT program.

Print Name : Last First M.I. Title Date

Signature Telephone Mumber

Make a copy of this completed Authorization Agreement for your records. You may fax your completed Authorization Agreement to

(717) 787-0145, or mail it to the PA DEPARTMENT OF REVENUE, PO BOX 280908, HARRISBURG, PA 17128-0908.

For additional information visit www.revenue.state.pa.us or call (717) 783-6277 (electronic filing calls only). Services for taxpayers with

special hearing and/or speaking needs: 1-800-447-3020 (TT only).

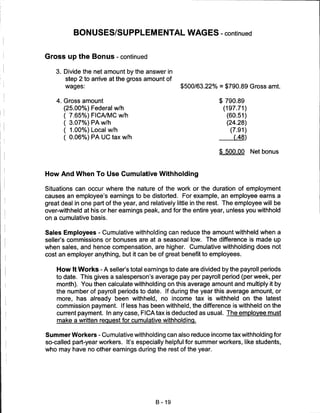

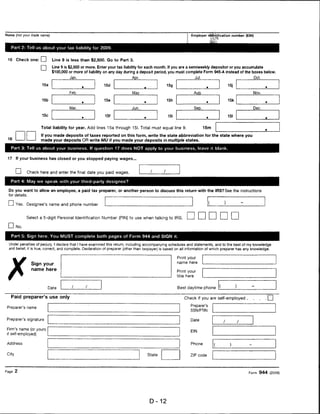

B-14](https://image.slidesharecdn.com/stambaughnesspayrollmanual20092010-12629627631222-phpapp01/85/Stambaugh-Ness-Payroll-Manual-2009-2010-43-320.jpg)

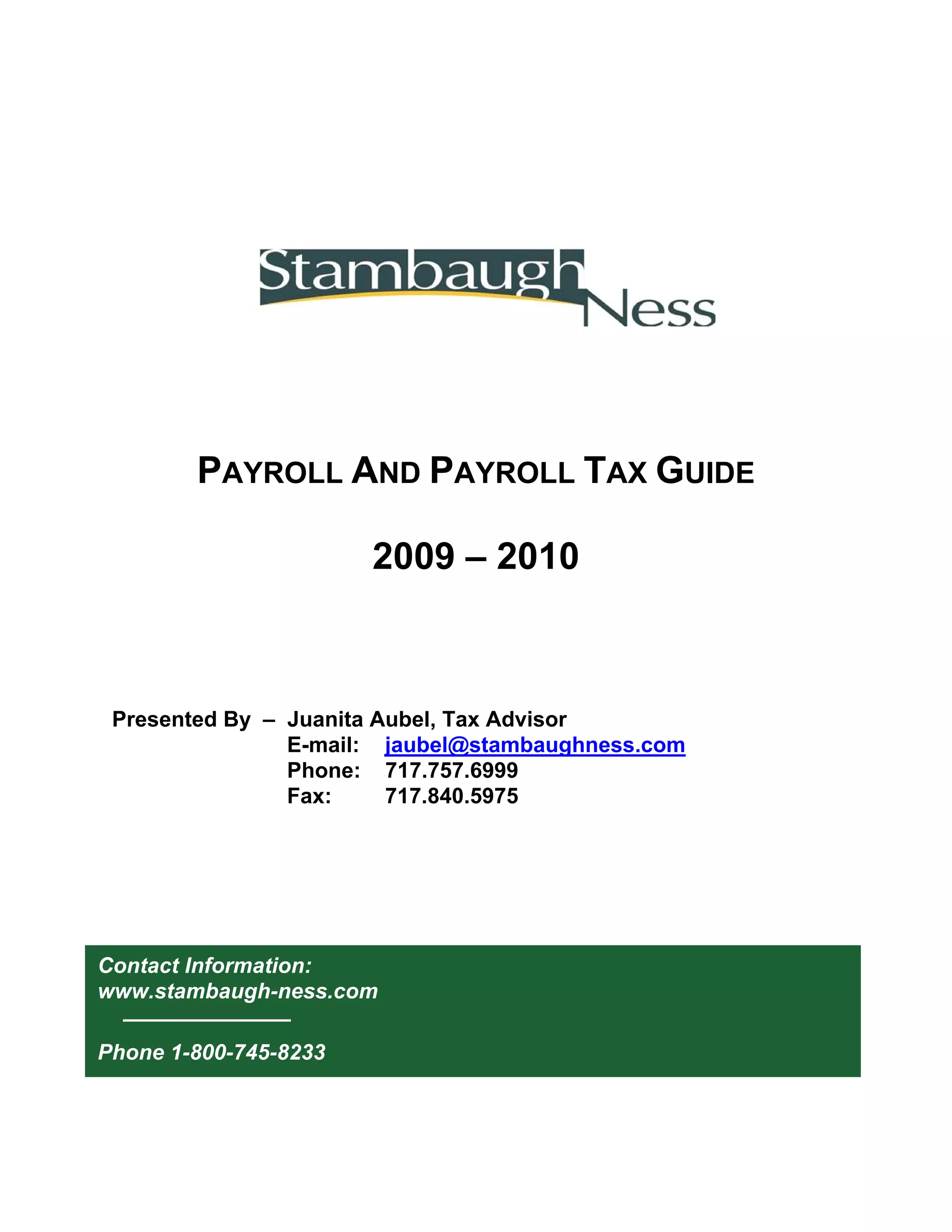

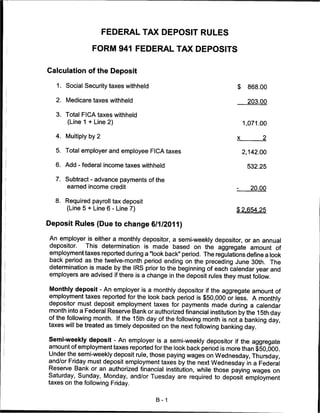

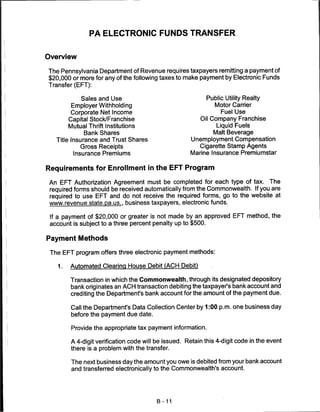

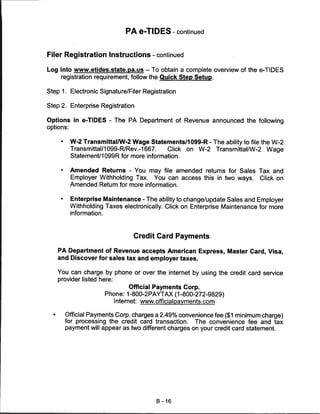

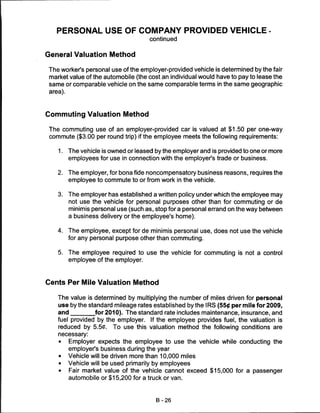

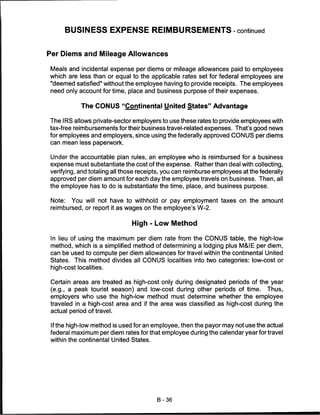

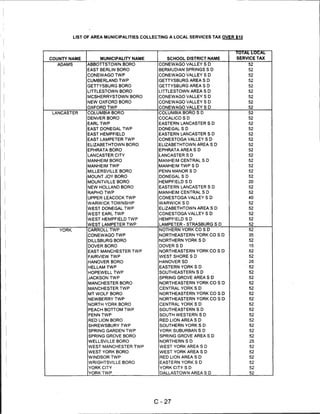

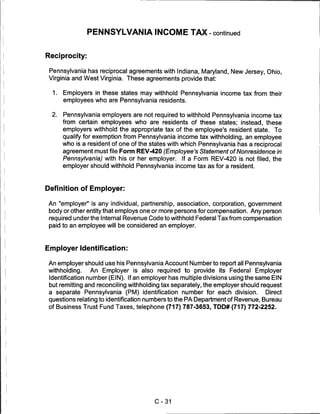

![FORM 1099-MISC

CORRECTED (if checked)

PAYER'S name, street address, city, state, ZIP code, and telephone no. 1 Rents | OMB No. 1545-0115

Miscellaneous

2 Royalties I(Q)09 Income

Form 1099-MISC

3 Other income 4 Federal income lax withheld Copy B

For Recipient

$ £

PAYER'S federal identification RECIPIENT'S identification 5 Fishing boat proceeds 6 Medical and health care payments

number number

$ $

RECIPIENT'S name 7 Nonemployee compensation 8 Substitute payments in lieu of

dividends or interest This is important tax

information and is

being furnished to

the Internal Revenue

$ $ Service. If you are

Street address (including apt. no.) 9 Payer made direct sales of 10 Crop insurance proceeds required to file a

$5,000 or more of consumer return, a negligence

product to a biyer penalty or other

(recip ent) for re ale ► [ ] $ sanction may be

City, state, and ZIP code 11 imposed on you if

this income is

taxable and the IRS

Account number (see instructions) 13 Exce golde i parachute 14 Gro proceeds paid to determines that it

payments an attorney has not been

reported.

$

15a Section 409A deferrals 15b Section 409A income 16 State tax withheld 17 State/Payer's state no. 18 State income

$ $

Form 1099-MISC (keep for your records) Department of the Treasury - Internal Revenue Service

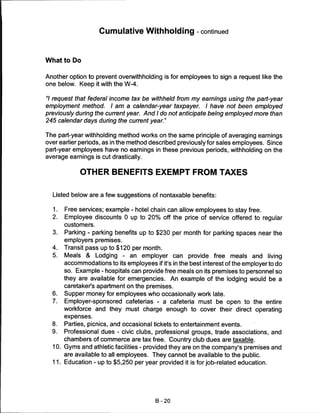

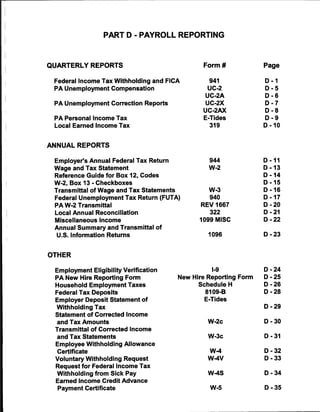

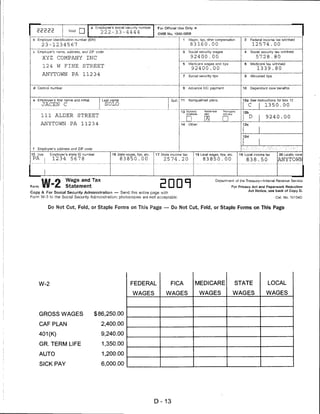

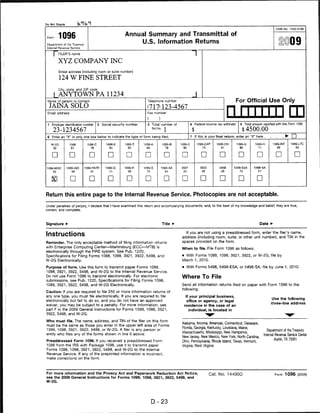

Form 1099-MISC is due to the recipient on February 1 and to the IRS on March 1.

When Forms 1099 are transmitted to the IRS, they must be summarized on Form 1096,

Annual Summary and Transmittal of U. S. Information Returns. A separate Form 1096

should be used for each type of information return submitted to the IRS. Boxes are

provided on the form to indicate the types of information return being submitted.

B-34](https://image.slidesharecdn.com/stambaughnesspayrollmanual20092010-12629627631222-phpapp01/85/Stambaugh-Ness-Payroll-Manual-2009-2010-63-320.jpg)

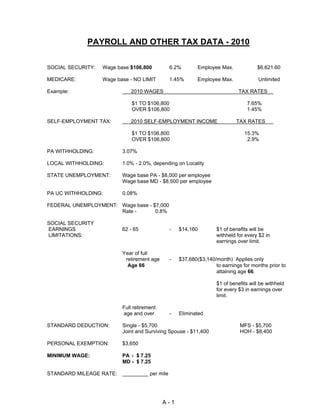

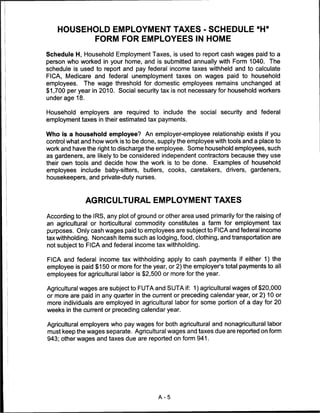

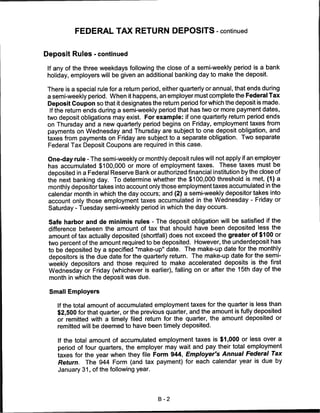

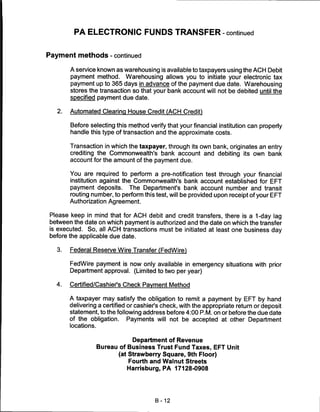

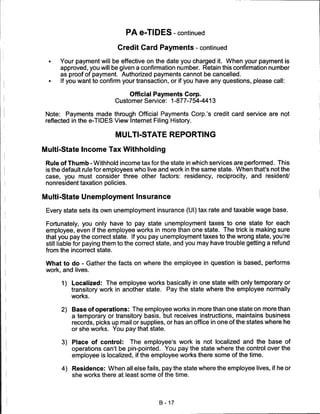

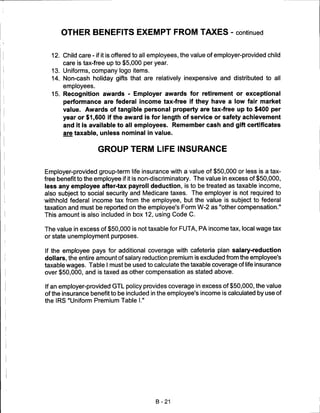

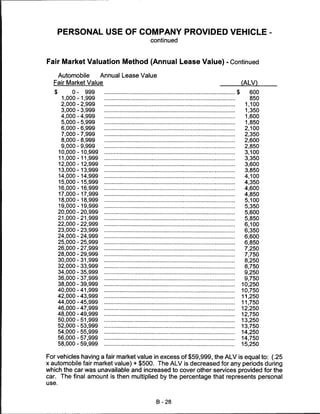

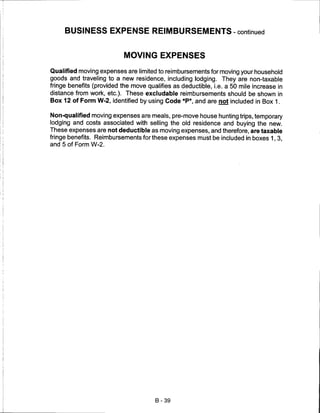

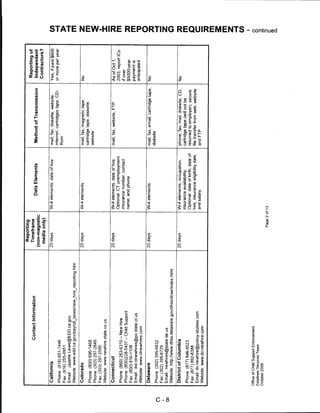

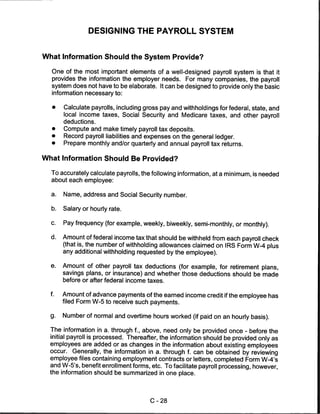

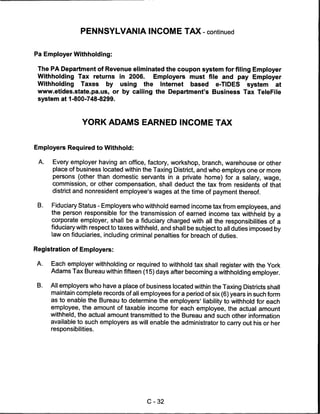

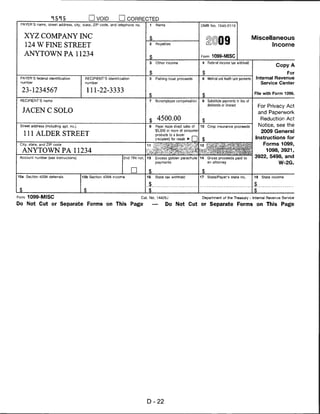

![Reporting

Reporting of

Contact Information Timeframe

Data Elements Method of Transmission Independent

(non-magnetic

Contractors?

media only)

Illinois 20 days W-4 elements; mail, fax, magnetic cartridge & No

Optional: date of hire, address diskette, website and email

Shedrick C. Woods, Manager

for income withholding orders

Phone: (800) 327-HIRE [4473] - Customer Service

Phone: (312) 793-0322 - New Hire

Phone: (312) 793-6298 - Magnetic Media Technical Support

3

m

Fax: (217)557-1947

z

Email: DES.NHire@illinois.gov

Website: wwwides.state.il.us/employer/new-hire.asp

m

Indiana 20 days W-4 elements, date of hire; mail, fax, magnetic tape, No

Optional: date of birth, State of cartridge tape, diskette,

Phone:(866)879-0198

hire; medical insurance website, email, FTP, EFT

Phone:(317)612-3028

Phone: (866) 879-0198, ext. 111 - Technical Support

Fax:(800)408-1388 m

Fax: (317)612-3036

Email: rredmond@policy-studies.com

7)

Website: www.in.gov or www.in-newhire.com

m

"0

Iowa 15 days W-4 elements, date of birth, mail, fax, CD, diskette, Yes*

date of hire, employer's phone, cartridge tape, website

O

Phone: (877) 274-2580 7)

medical insurance availability,

o Fax: (800) 759-5881

I

date of med insurance

Email: csrue@dhs.state.ia.us

qualification, address z

Website: www.iowachildsupport.gov

for income withholding

o

Kansas 20 days W-4 Elements, Fax, mail, CD-Rom, diskette, No

date of hire, FEIN and address website 7)

Phone: (888) 219-7801

for withholding orders m

Phone:(785)296-1716

Fax:(888)219-7798 0

Fax: (785)291-3423 c

Email: newhires@dol.ks.gov

Website, www.dol.ks.gov

m

Kentucky 20 days W-4 elements; Optional: date US mail, fax, magnetic tape, No

of birth, State of hire, date of diskette, website, file upload

Phone:(800)817-2262 m

hire, KY employer ID number, via Internet

Fax: (800)817-0099 z

medical insurance availability,

Email: ky-newhire@policy-studies.com

contact phone

Website: www.kynewhire.com

c

Office of Child Support Enforcement

Employer Services Team

October 2009

Page 4 of 13

CO

Q.](https://image.slidesharecdn.com/stambaughnesspayrollmanual20092010-12629627631222-phpapp01/85/Stambaugh-Ness-Payroll-Manual-2009-2010-80-320.jpg)

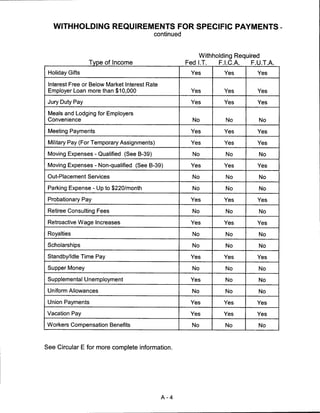

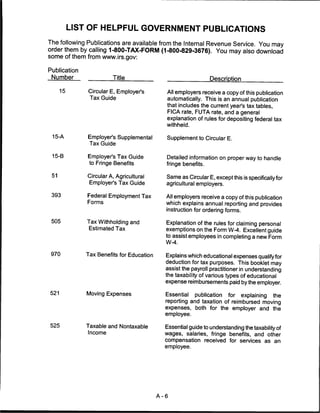

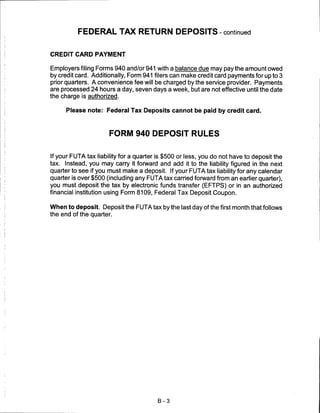

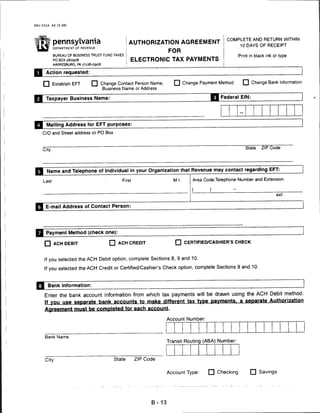

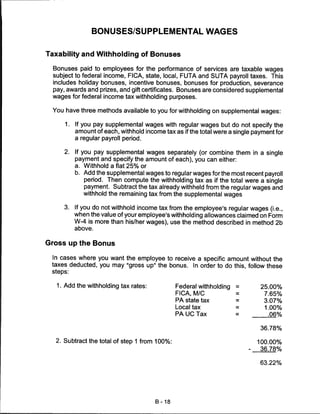

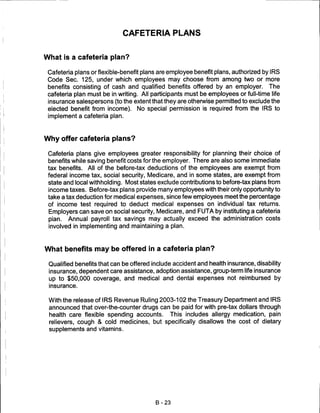

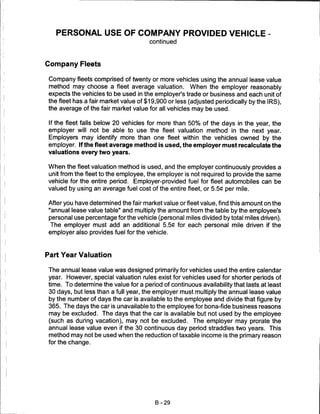

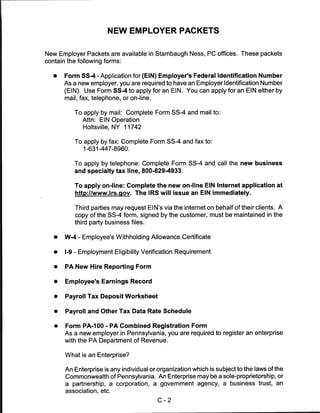

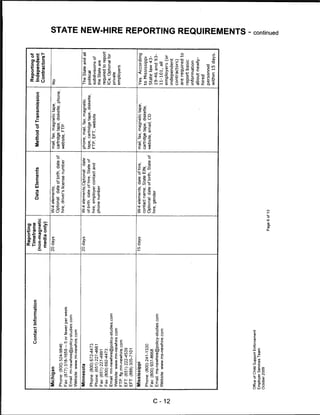

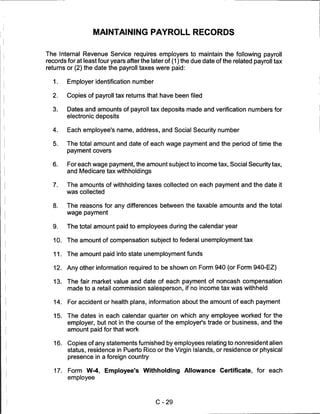

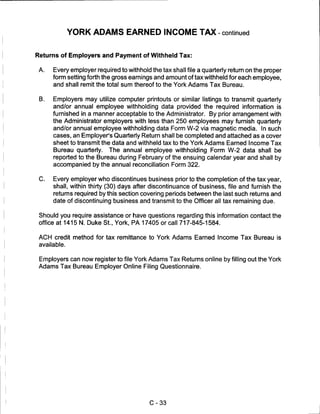

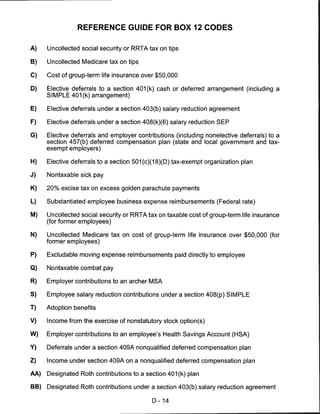

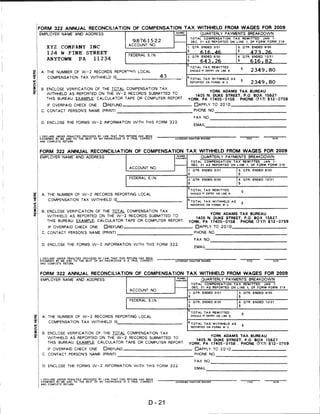

![Reporting

Reporting of

Contact Information Timeframe

Data Elements Method of Transmission Independent

(non-magnetic

Contractors?

media only)

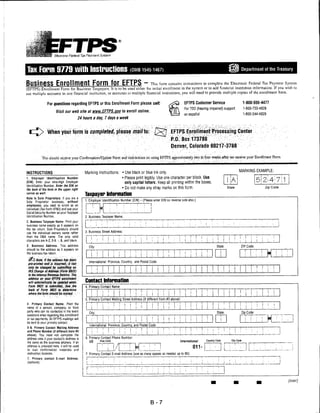

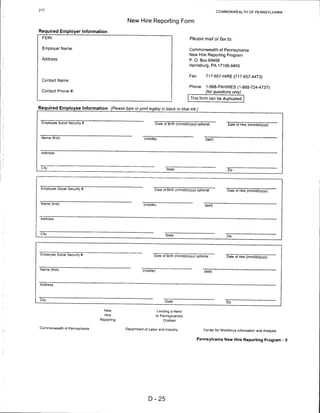

Pennsylvania 20 business days W-4 elements, date of hire, mail, fax, magnetic tape, No CO

employer contact name and diskette, website, email, FTP

Phone: (888) PAHIRES [724-4737]

phone,

Fax: (717) 657-HIRE (4473)

Optional: date of birth

Email: reporting@panewhires.com 3

Website: www.panewhires.com m

ftp:24.104.35.55

z

Puerto Rico 20 days W-4 elements, employer's mail, fax No m

State ID number, date of birth,

Administration for Child Support Enforcement

date of hire, State of hire,

State New Hire Registry

salary

P.O. Box 70376

San Juan, PR 009368376

Phone: (787)767-1500

7)

Fax: (787) 767-3882; 765-1313

m

Rhode Island 14 days W-4 elements, medical phone, mail, fax, magnetic No

insurance availability, date of tape, cartridge tape, diskette, m

Phone: (888) 870-6461 - New Hire

availability; website, Internet upload, FTP

Phone: (401) 222-2847 - Child Support

Optional: date of birth, date of

Phone: (888) 870-6461 - Reporting O

hire, State of hire, payroll

Fax: (888) 430-6907

address

Email: contact@rinewhire.com (info only)

Website: www.Rinewhire.com

FTP: FTP.Rlnewhire.com

South Carolina 20 days W-4 elements;

o

mail, fax, internet upload, No

Optional: date of birth, date of website, FTP 7)

Phone: (888) 454-5294 - New Hire

hire, employer's phone number m

Phone: (803) 898-9235 - New Hire

Phone: (800) 768-5858 - Child Support 0

Fax: (803)898-9100

Website: www.scnewhire.com

73

South Dakota 20 days W-4 elements; phone, mail, fax, cartridge No

m

Optional: date of birth, date of tape, diskette, website

Phone: (888) 827-6078

hire, State of hire

Phone: (605) 626-2942

m

Fax: (888) 835-8659

Fax: (605) 626-2842

z

Website: www.sdjobs.org

CO

Office of Child Support Enforcement

Employer Services Team

§

October 2009

Page 10 of 13 C

CD

Q.](https://image.slidesharecdn.com/stambaughnesspayrollmanual20092010-12629627631222-phpapp01/85/Stambaugh-Ness-Payroll-Manual-2009-2010-86-320.jpg)

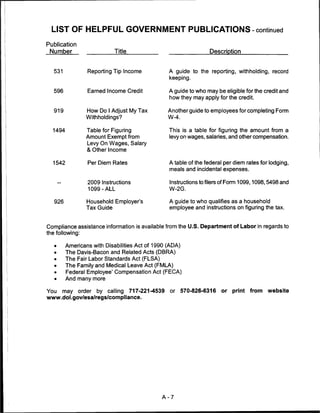

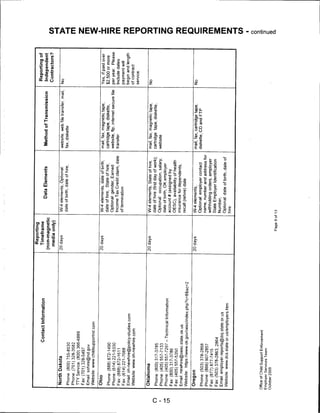

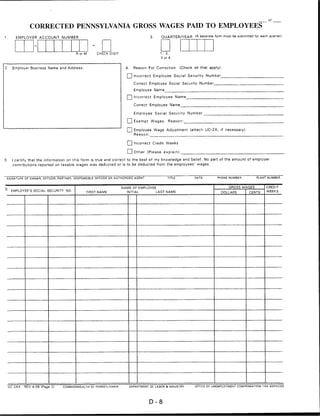

![TRANSMITTAL #

Of

PENNSYLVANIA UNEMPLOYMENT COMPENSATION CORRECTION REPORT

(To Amend Quarterly UC-2/2ATax Reports) (A separate form must be submitted for each quarter)

1. EMPLOYER ACCOUNT NUMBER 3. QUARTER/YEAR

R or M CHECK DIGIT 1, 2,

3 or 4

4. Reason For Adjustment (Check all that apply):

2. Employer Name and Address: Q Incorrect Gross Wages. 'Please explain. Q Exempt Wages Reported in Error.* Please explain:

I I Incorrect Employee Withholding Rate Used LJ Calculation Error. Please explain:

List Rate Used

I I Incorrect Taxable Wages. Please explain: I I Other Error, Please i

□ Incorrect Employer Contribution Rate Used *PR0VIDE 'DIVIDUAL EMPLOYEE CORRECTION

FORM (UC-2AX), IF NECESSARY.

List Rate Used

d Wages Reported to Wrong State • □ PLEASE CHECK IF EMPLOYEE WAGE DETAIL WAS

CORRECTED ON ELECTRONIC MEDIA.

5. Was the employee withholding correctly withheld? Q Yes Q No [J Not applicable (Please see instructions on reverse side.)

AMOUNT PREVIOUSLY

TAX RATE :.'.'■■■:-:' -Vv ■■- ' .-. ^■-":':-, REPORTED CORRECT AMOUNT DIFFERENCE (OVER) UNDER

GROSS WAGES

7. EMPLOYEE WITHHOLDING

B

w *

'■-■'■--■ ' ■■■■.■•:"■ ;-■■.■■: ■•■ . ■;

-..;■.

■■-- ' .

■. ,■ ■{ TAXABLE WAGES

9. EMPLOYER CONTRIBUTION

10.TOTAL (REFUND/CREDIT) OR TAX DUE (ADD LINES 7 AND 9) IN THE DIFFERENCE COLUMN refunos/credits should

BE IN PARENTHESES 1 )

11. Please check one: £~J Refund [~] Credit Q] Not Applicable (Please see instructions on reverse side.)

12. Employer Certification: I certify that the information on this form is true and correct to the best of my knowledge and belief. No part of the

amount of employer contributions reported on taxable wages was deducted or is to be deducted from the employees' wages.

SIGNATURE OF OWNER, OFFICER, PARTNER, RESPONSIBLE OFFICER OR AUTHORIZED AGENT PHONE NUMBER

department use only (do not write below this line) —■

correction report □ journal voucher

SY MO YR QTR YR BASIC CONTRIBUTION INTEREST PENALTY A

(X) WAGES

RATE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 4

_J

J

u

u

u

Totals

COMMENTS TOTAL REMITTANCE

Rate Verification Certification: Date Contribution Received Date Report Received

B.I. Audit Needed □ Yes □ No □ N/A Benefit Charges □ Yes □ No □ N/A FSD CERTIFICATION/DATE

TAX TECHNICIAN DATE OTHER REQUIRED SIGNATURE

Vear I ] No Change Rate Revised From Year Q No Change Rate Revised From

UC-2X REV 4-06 (Page 1) COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF LABOR & INDUSTRY OFFICE OF UC TAX SERVICES

D-7](https://image.slidesharecdn.com/stambaughnesspayrollmanual20092010-12629627631222-phpapp01/85/Stambaugh-Ness-Payroll-Manual-2009-2010-113-320.jpg)

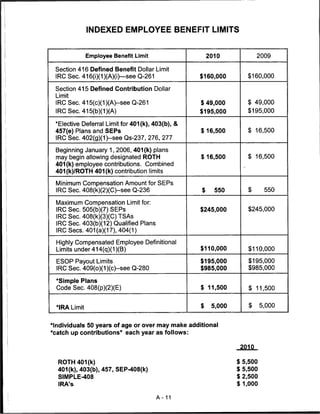

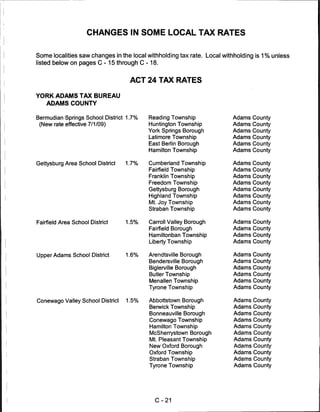

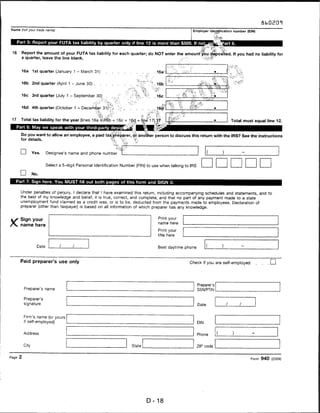

![Form 940 for 2009: Employer's Annual Federal Unemployment (FUTA) Tax Return

Department of the Treasury — Internal Revenue Service OMB No. 1545-0028

(EIN)

f Return

Employer identification number

'" that apply.)

^ame (not your trade name) _

"I 4 a. Amended

Trarte namp (ii any) I I b. SuccessOrtemployer

. ■ ■..r;' ,■:; ■■ -T-.

I I • ;c. Np.payments to employees

Address

Number Street ... Suite or room number v^.:;- y:-..'i -.V,~

, d;.;EinaJ|:Business closed or

vfc ped paying wages

City .•■■•State ZIP code

Read the separate instructions before youifjiKout this form. Please type or priqtjwittiiri tfie boMsyii'*

1 If you were required to pay your state unpfrtployrnent tax iti ..-."> .'•^ *"h v

1a One state only, write the state abbreviation . "■?."". 4. 1a1

- OR - ;C: %v %.

1 b More than one state (You are a multi-statejsempjbyer)>l.-ti 1b CD Check here. Fill out Schedule A.

2 If you paid wages in a state that is subject to CREDIT REDUCTION 2 I I Check here. Fill out Schedule A

(Form 940), Part 2.

Part 2: Determine your FUTA tax before adjustments for 2009. If any line does NOT apply, leave it blank.

3 Total payments to all employees

4 Payments exempt from FUTA tax 4

Check all that apply: 4a LJ Fringe benefits 4c I I Retirement/Pension 4e I I Other

4b I ] Group-term life insurance 4d I I Dependent care

5 Total of payments made to each employee in excess of

$7,000 5

6 Subtotal (line 4 + line 5 = line 6) 6

7 Total taxable FUTA wages (line 3 - line 6 = line 7) 7

8 FUTA tax before adjustments (line 7 x .008 = line 8) 8

Part 3: Determine your adjustments. If any line does NOT apply, leave it blank.

9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax,

multiply line 7 by .054 (line 7 X .054 = line 9). Then go to line 12 9

10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax,

OR you paid ANY state unemployment tax late (after the due date for filing Form 940), fill out

the worksheet in the instructions. Enter the amount from line 7 of the worksheet 10

11 If credit reduction applies, enter the amount from line 3 of Schedule A (Form 940) . . 11

Part 4: Determine your FUTA tax and balance due or overpayment for 2009. If any line does NOT apply, leave it blank.

12 Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12) . . 12

13 FUTA tax deposited for the year, including any overpayment applied from a prior year . .13

14 Balance due (If line 12 is more than line 13, enter the difference on line 14.)

• If line 14 is more than $500, you must deposit your tax.

• If line 14 is $500 or less, you may pay with this return. For more information on how to pay, see

the separate instructions 14

15 Overpayment (If line 13 is more than line 12, enter the difference on line 15 and check a box

below.) . 15

Check one: Lj Apply to next return.

► You MUST fill out both pages of this form and SIGN it. I I Send a refund.

For Privacy Act and Paperwork Reduction Act Notice, see the back of Form 940-V, Payment Voucher. Cat. No. 11234O Form 940 (2009)

D-17](https://image.slidesharecdn.com/stambaughnesspayrollmanual20092010-12629627631222-phpapp01/85/Stambaugh-Ness-Payroll-Manual-2009-2010-123-320.jpg)

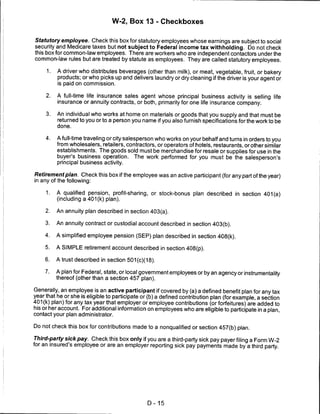

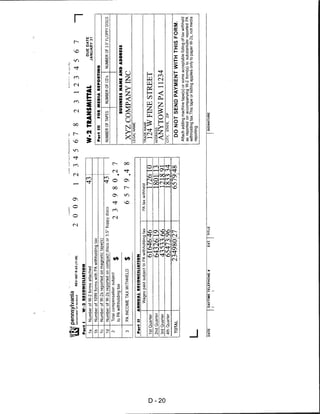

![DO NOT CUT, FOLD, OR STAPLE THIS FORM

For Official Use Only ►

M "4 4 M M

OMB No, 1545-0008

a Employer's ne me. address, and ZIP code c Tax year/r-orm corrected d Employees correct SSN

XYZ COMPANY INC 222-33-7777

2 0 0 9 / W-2

124 W FINE STREET

e Corrected SSN and/oi name (Check this box and complete boxes f and/or

ANYT OWN PA 112 34 g if incorrect on form previously filed.) r~i

Complete boxes f and/or g only it incorrect on form previously filed ►

f Employee's previously reported SSN

b Employer's Federal EIN g Employee's previously reported name

23-1234567

h Emplo yee's first name and initial Last name Sufi

JA]:na SOLO

777 SKY LANE

Note: Only complete money fields that are being corrected

(exception: for corrections involving MQGE, see the Instructions ANY TOWN PA 11234

for Forms W-2c and W-3c, boxes 5 and 6). i Emplo yee's address and ZIP code

Previously reported Correct information Previously reported Correct information

1 Wages, tips, other compensation 1 Wages, tips, other compensation 2 Federal income tax withheld 2 Federal income tax withheld

92400.00 95000.00 12574 .00 23750.00 .

3 Social security wages 3 Social security wages 4 Social security tax withheld 4 Social security tax withheld

92400.00 95000.00 5728.80 5890.00

5 Medicare wages and tips 5 Medicare wages and tips 6 Medicare tax withheld 6 Medicare tax withheld

92400. 00 95000.00 _j 1339.80 1377.50

7 Social security tips 7 Social security tips 8 Allocated tips 8 Allocated tips

9 Advance EIC payment 9 Advance EIC payment 10 Dependent care benefits 10 Dependent care benefits

11 Nonqualified plans 11 Nonqualified plans 12a See I istructions for box 12 12a See instructions for box 12

o

d

13 Statutory Kellrpineiu Tlrint-partv 13 Statutory Retirement 1 hint-party

prnploveii plan sitt. nav ampUiyee plan skk nay

12b 12b

c

□ □ n □ n it 3

14 Other (see inst ructions) 14 Other (sse instructions) 12c 12c

t:

? ,., .

12d 12d

Stale Correction Information

Previously reported Correct information . Previously reported Correct information

15 State 15 State 15 State 15 State

PA PA

Employer s state ID number Employer's state ID number Employer's state ID number Employer's state ID number

1234 5678 1234 5678

16 State wages, tips, etc. 16 State wages, tips. etc. 16 State wages, tips, etc. 16 State wages, tips. etc.

92400.00 95000.00

17 State income tax 17 State income tax 17 State income lax 17 State income lax

2574.20 2916.50

Locality Correction information

Previously reported Correct information Previously reported Correct information

18 Local wages, tips, etc. 18 Local wages, tips, etc. ^ - Vaf* to6aVwages, tips, etc. 18 Local wages, tips, etc.

92400.00 95000.00

19 Local income tax 19 Local income tax 19 Local income tax 19 Local income tax

838.50 950.00

20 Locality name 20 Locality name 20 Locality name 20 Locality name

ANYTOWN ANYTOWN

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Copy A—For Social Security Administration

Form W-2C (Rev. 2-2009) Corrected Wage and Tax Statement Department of the Treasury

Cat. No. 61437D Internal Revenue Service

D-30](https://image.slidesharecdn.com/stambaughnesspayrollmanual20092010-12629627631222-phpapp01/85/Stambaugh-Ness-Payroll-Manual-2009-2010-136-320.jpg)