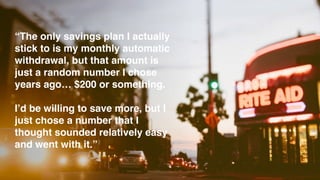

This case study describes the development process of Squirrel, a smart savings account app. The researchers conducted interviews which found users want automatic savings but lack understanding of spending habits. Personas like Megan were created, with goals of tracking spending and saving for specific purposes. Competitive tools were analyzed but found lacking for goal-focused savings. An iterative design process refined the onboarding, goals, insights, and account settings features to help users save money by sorting transactions into essential and nonessential categories and setting savings goals. The key learning was to continually return the focus to understanding and addressing the actual needs of the target users.