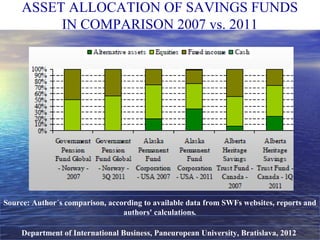

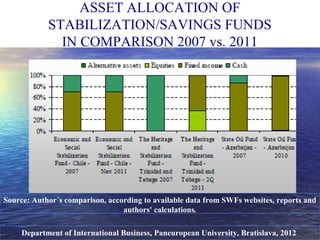

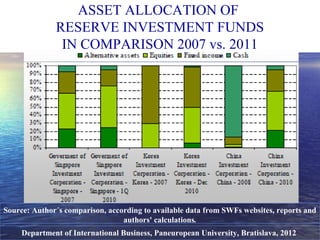

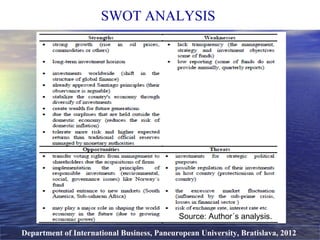

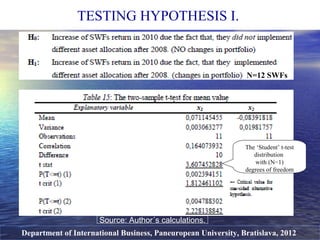

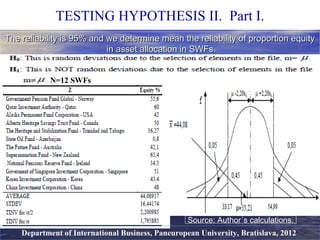

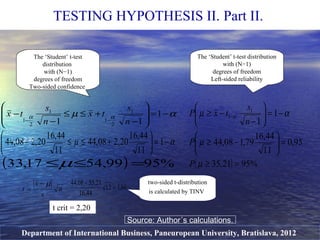

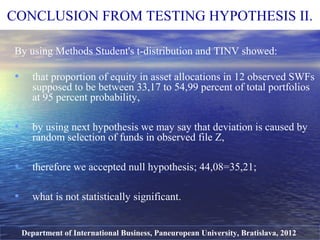

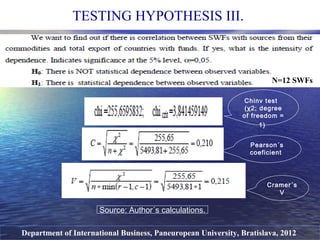

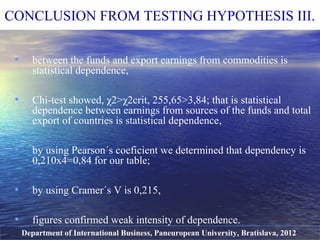

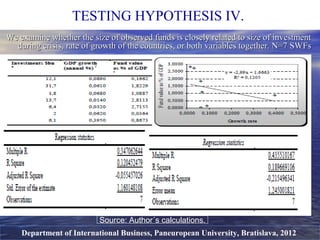

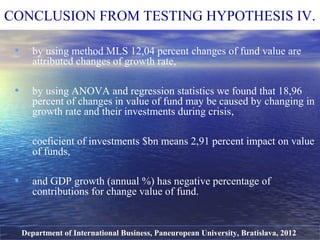

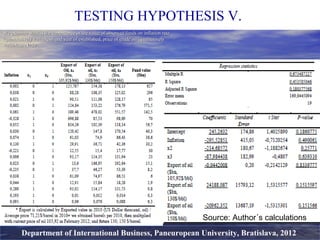

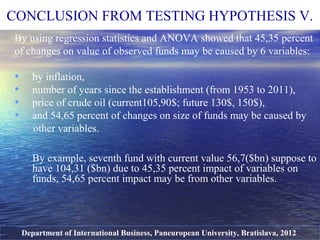

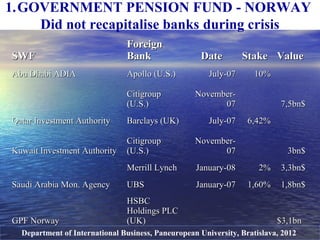

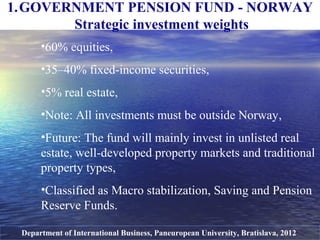

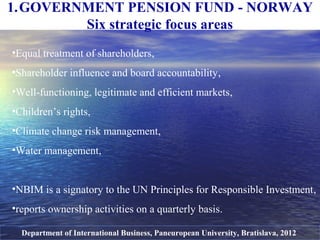

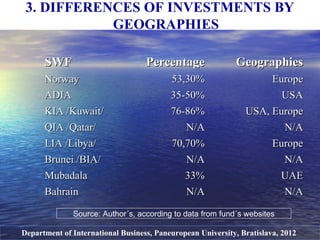

The document summarizes a student research paper on sovereign wealth funds and their impact on international finance. It includes an outline, research objectives to analyze how sovereign wealth funds impact financial markets and national economies. It also reviews literature on how countries establish sovereign wealth funds. The paper presents asset allocation comparisons for different types of sovereign wealth funds from 2007 to 2011. It includes a SWOT analysis and tests four hypotheses using statistical analysis methods to analyze relationships between sovereign wealth fund performance, investments, and economic indicators. The conclusions drawn found some relationships were statistically significant while others showed little dependence.