The document discusses concerns about valuations and liquidity in GCC stock markets. It argues that current valuations cannot be justified by economic fundamentals and rely too heavily on liquidity from local investors. When domestic investors decide to sell, it is unclear who will replace them as buyers. The document also discusses how increased competition from globalization and WTO membership could reduce profitability in Saudi industries like banking and petrochemicals that currently benefit from protection. Finally, it notes that Dubai's economy is heavily exposed to lower asset prices through its real estate and stock markets.

![P.O. Box 26893

Manama, Bahrain

Telephone: +973 17 533570

tarek.fadlallah@bh.nomura.com

6

Sunday 16th

October, 2005

Emaar

Notwithstanding the global outlook there is undoubtedly an element of froth in the Dubai property market

with the prospect of a deteriorating demand/supply balance over the next two years.

But it is an open debate as to whether the property market will crash or whether the downside risks might

be alleviated by the controlled and regulated nature of the properties designated for foreign buyers.

On balance it may be possible to argue for a relatively benign scenario for property deflation in Dubai with

prices drifting downward gently if rental yields remain competitive with stock yields and the risk free rate.

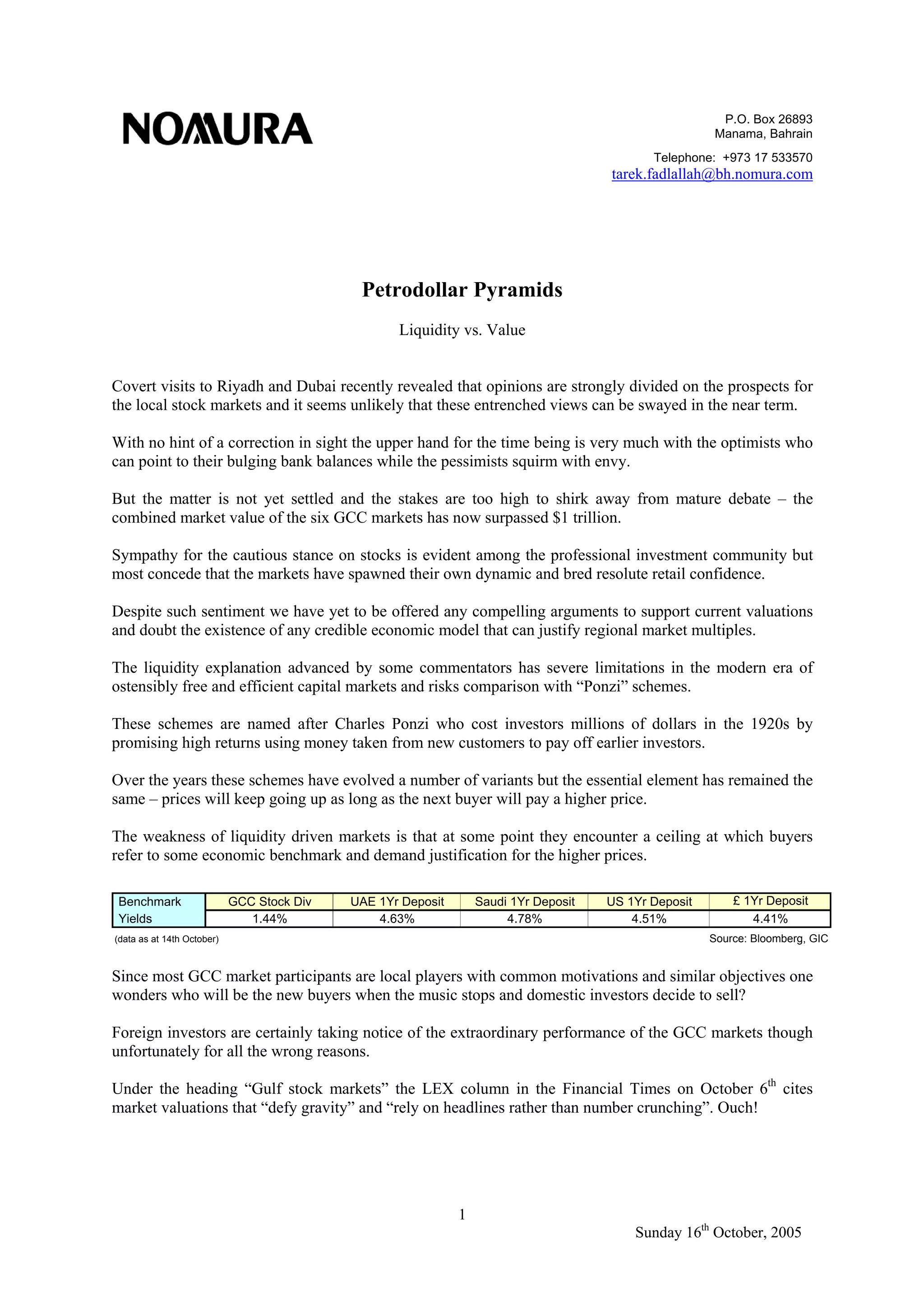

Nomura has no corporate view on Dubai’s largest listed property company but Emaar’s valuations appear

high compared to its global peers which have proven records through several economic cycles.

UAE Hong Kong Singapore United Kingdom

Emaar Cheung Kong Capital Land Land Securities

Market Cap ($million) 44,016 23,876 5,383 11,434

PER (forecast) 31.5 13.4 12.1 20.9

PBR (x) 5.8 1.0 1.6 1.0

Dividend Yield (%) 0.75 2.24 1.20 3.08

(as at 14th October)

Source: Bloomberg, IBES, Shuaa Capital

Earlier this month a respected regional investment company published a report in which it estimated

Emaar’s Discounted Cash Flow valuation at AED 20.53 per share.

The estimate was couched in a politically diplomatic but economically bizarre [Neutral] rating given that

the assigned valuation was 21% below the prevailing share price.

The logic that Emaar deserves a premium appears flawed as (i) economically sensitive firms usually trade

at a market discount at this stage in the cycle in anticipation of higher interest rates and lower asset values;

(ii) the reference market benchmark index is itself overvalued.

Emaar has announced ambitious plans to spend $15 billion on building shopping malls in the Middle East,

developing Cairo Heights, constructing Damascus Hills and buying stakes in European realtors.

Notwithstanding the company’s excellent credentials it seems unlikely that it can replicate its domestic

success and maintain its profit margins in new markets in which it lacks experience and local knowledge.

Spending money is easy but making it is more difficult and even with fairly hopeful assumptions it may

take several years for Emaar’s valuations to fall into line with international averages.

PRICE 26.5 2004 2005e 2006e 2007e 2008e 2009e

EPS (AED) 0.28 0.84 1.18 1.45 1.71 1.73

PER (X) 94.64 31.55 22.46 18.28 15.50 15.32

Source: Shuaa Capital, Bloomberg

Given a straight choice between buying physical property in Dubai and shares in Emaar the former should

provide a better running yield and more reliable prospects for capital preservation. But both are risky.](https://image.slidesharecdn.com/gcc4-200803154022/85/Petrodollar-Pyramids-October-2005-6-320.jpg)