Solution Manual for Interpreting and Analyzing Financial Statements 6th Edition by Schoenebeck

Solution Manual for Interpreting and Analyzing Financial Statements 6th Edition by Schoenebeck

Solution Manual for Interpreting and Analyzing Financial Statements 6th Edition by Schoenebeck

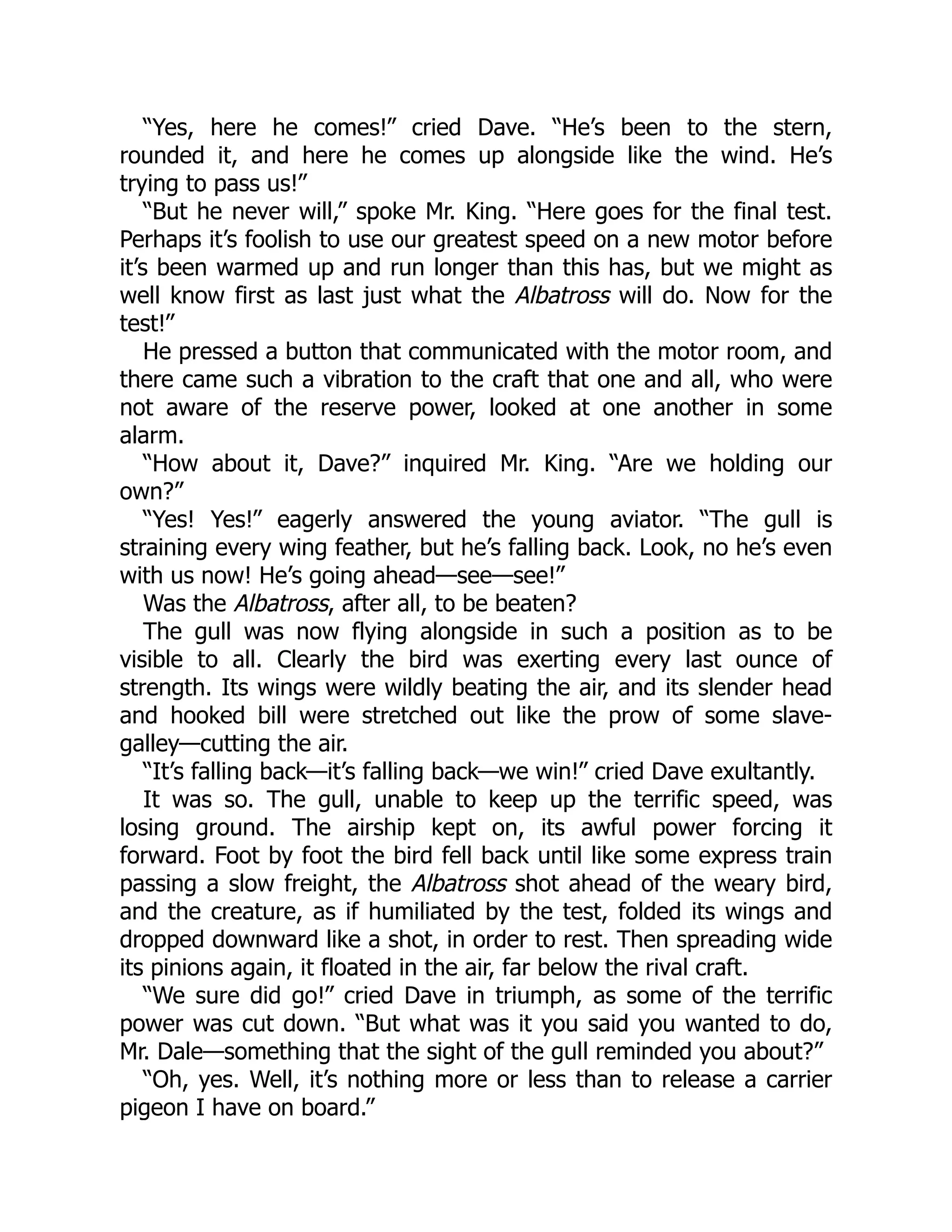

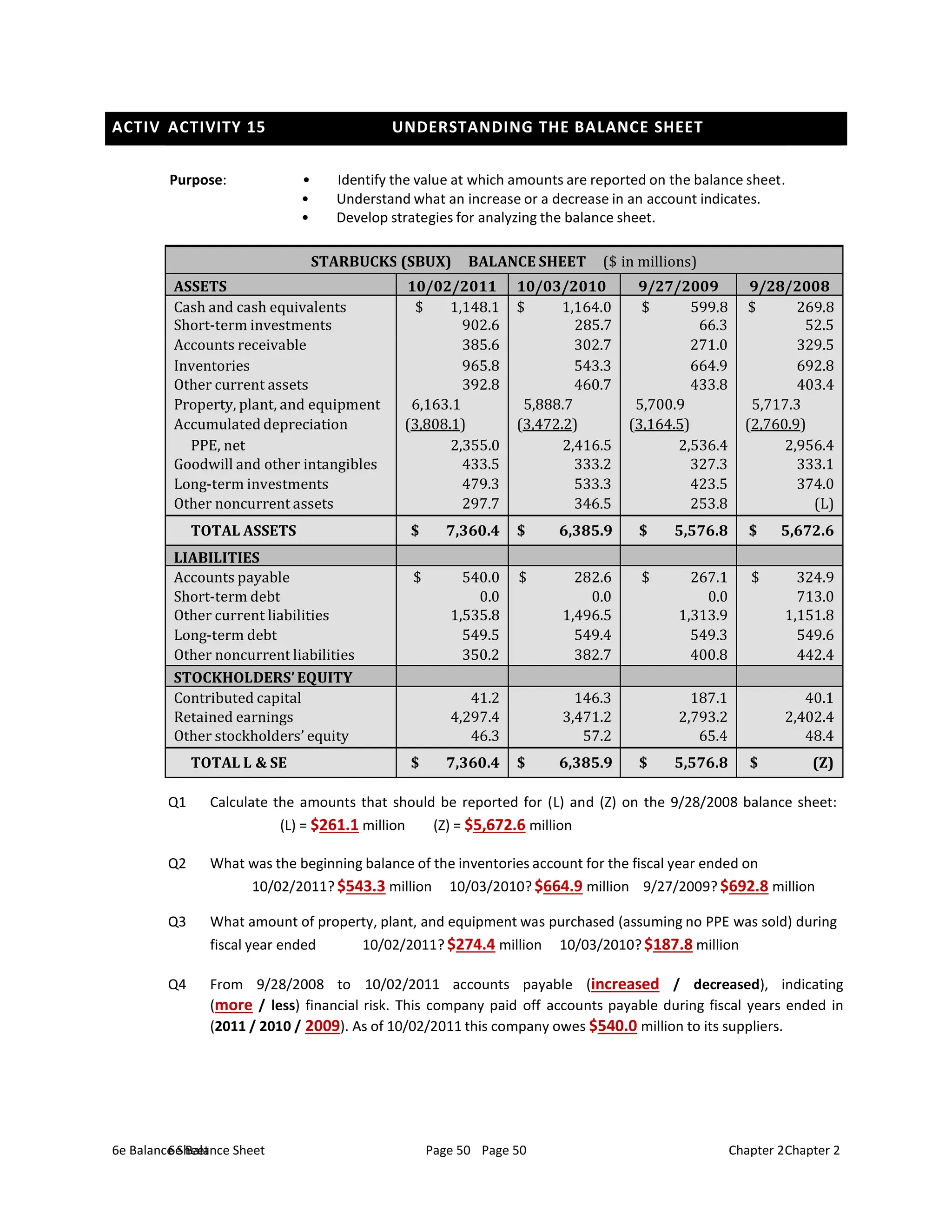

![6e Balance Sheet Page 53 Chapter 2

6e Balance Sheet Page 53 Chapter 2

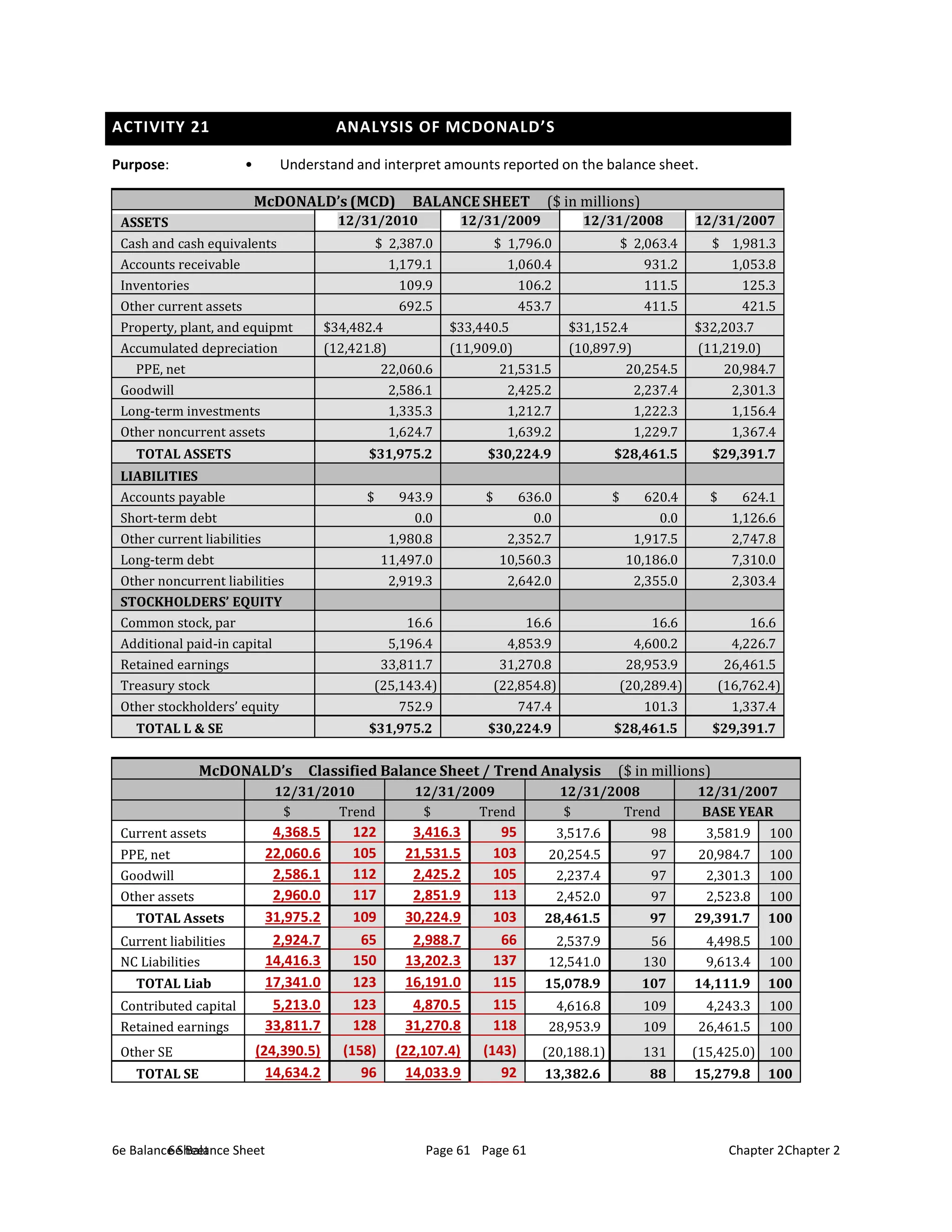

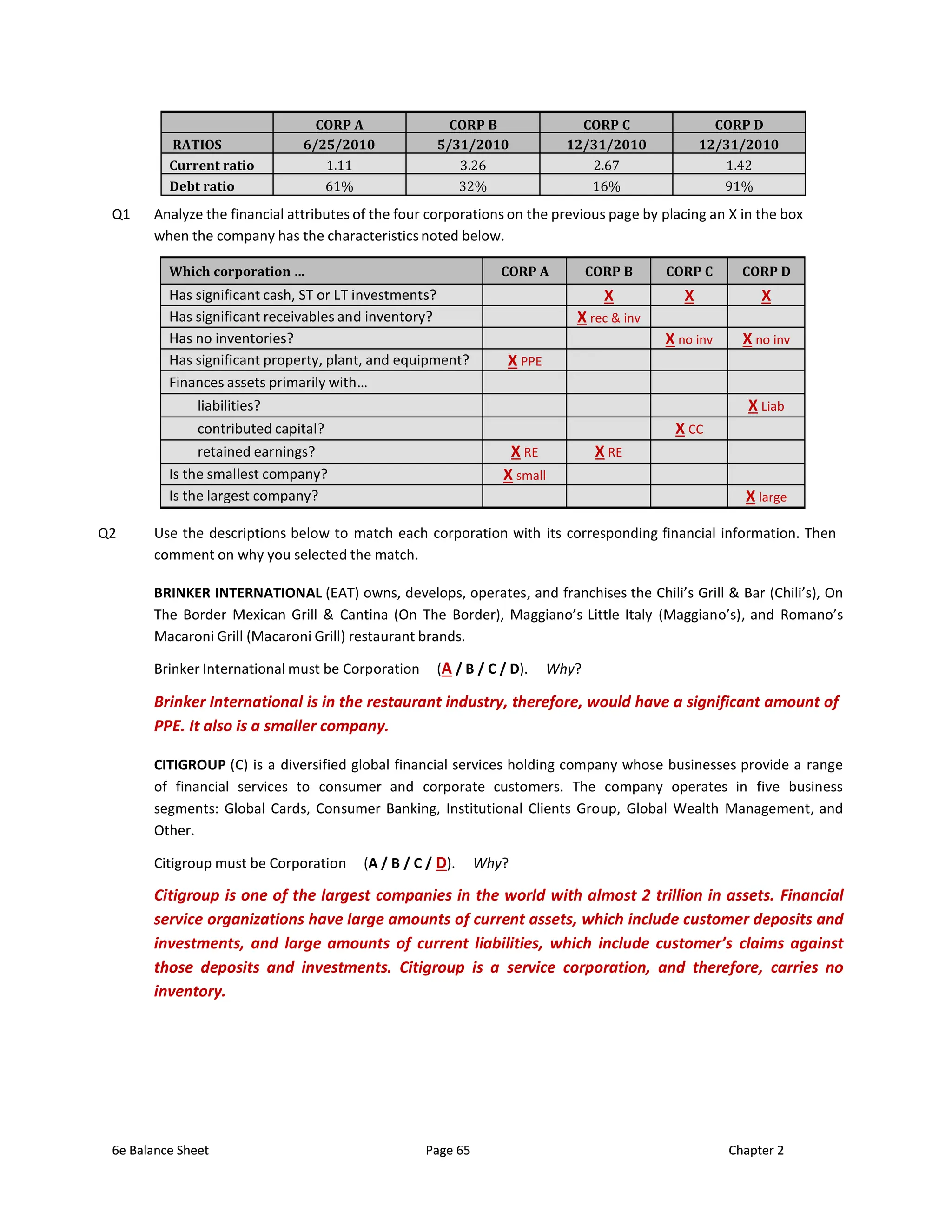

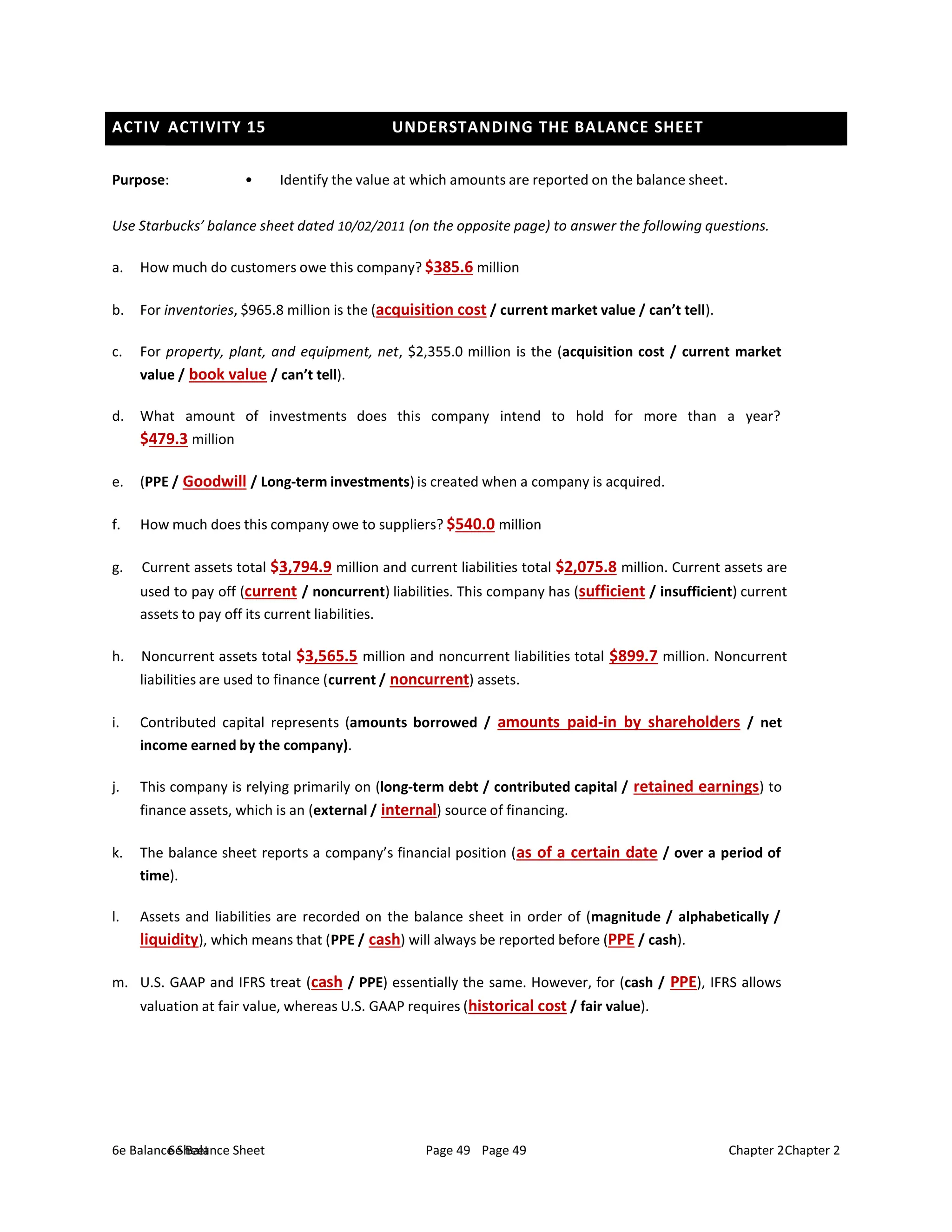

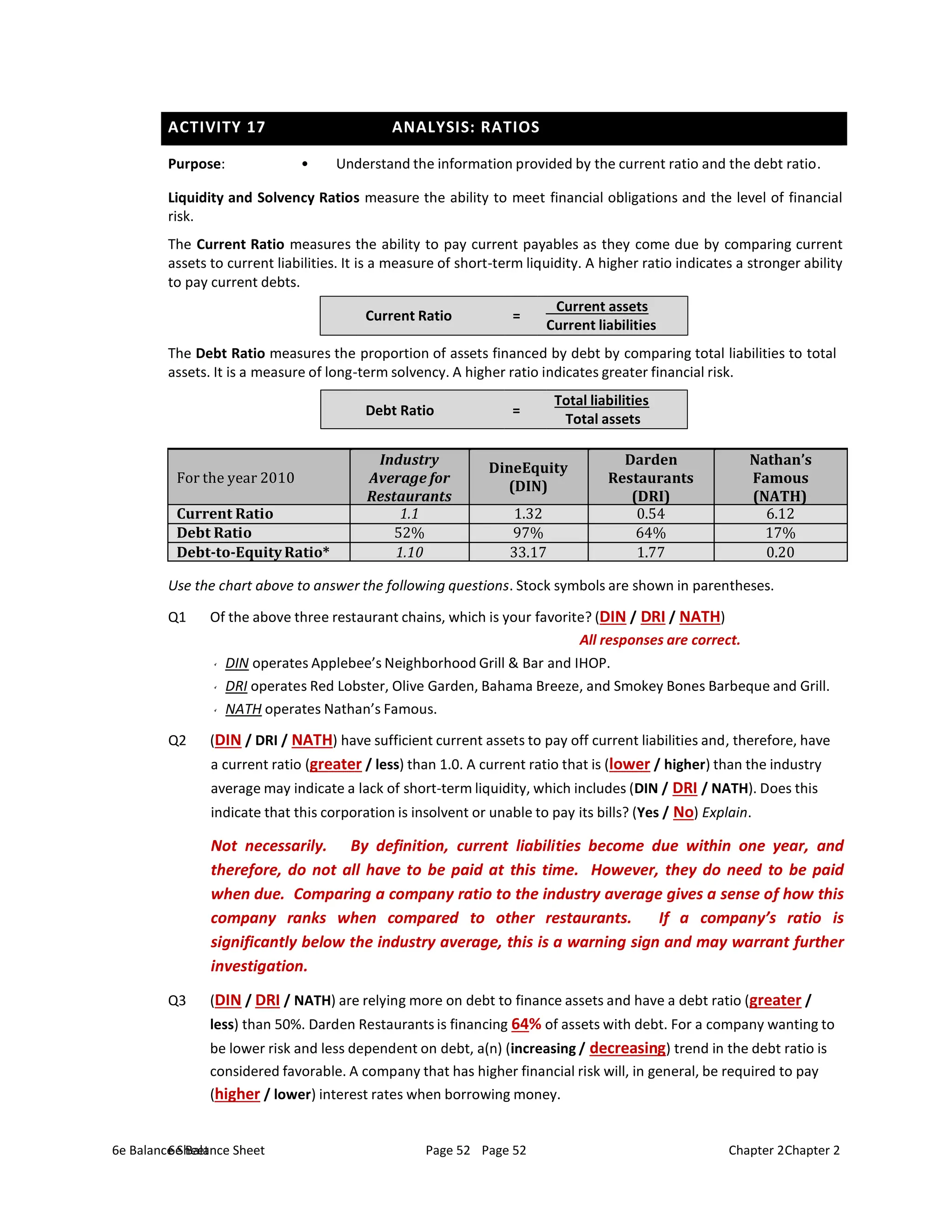

Q4 Why does a company with a higher debt ratio tend to have greater financial risk?

A higher debt ratio indicates greater debt. Debt is a legal liability that must be repaid

plus interest. If the principal or interest cannot be repaid, then a company can be forced

into bankruptcy and creditors may not get fully repaid. Therefore, creditors are at

financial risk of not receiving the full amount due to them. As the amount of company

debt increases, so does the financial risk of not being able to pay back that debt plus

interest when due.

Q5 Does a high debt ratio indicate a weak corporation? (Yes / No) Explain your answer.

The answer is no, not necessarily. Even though DineEquity has a higher debt ratio, it

may not be considered a weak corporation. Companies use different strategies to

finance assets. Companies within a stable industry have the ability to use more debt

than companies within a volatile industry. Companies with a large investment in PPE

can use that PPE as collateral for debt financing. Also, some corporations make the

decision to accept higher financial risk.

* Instead of reporting the Debt Ratio, some financial sources report the Debt-to-Equity ratio, computed as liabilities

divided by stockholders’ equity. To convert:

Debt ratio = [Debt-to-equity ratio/ (1 + Debt-to-equity ratio)]

For DineEquity 0.97 = 33.17 / 34.17](https://image.slidesharecdn.com/7243-250322003151-8991782a/75/Solution-Manual-for-Interpreting-and-Analyzing-Financial-Statements-6th-Edition-by-Schoenebeck-14-2048.jpg)