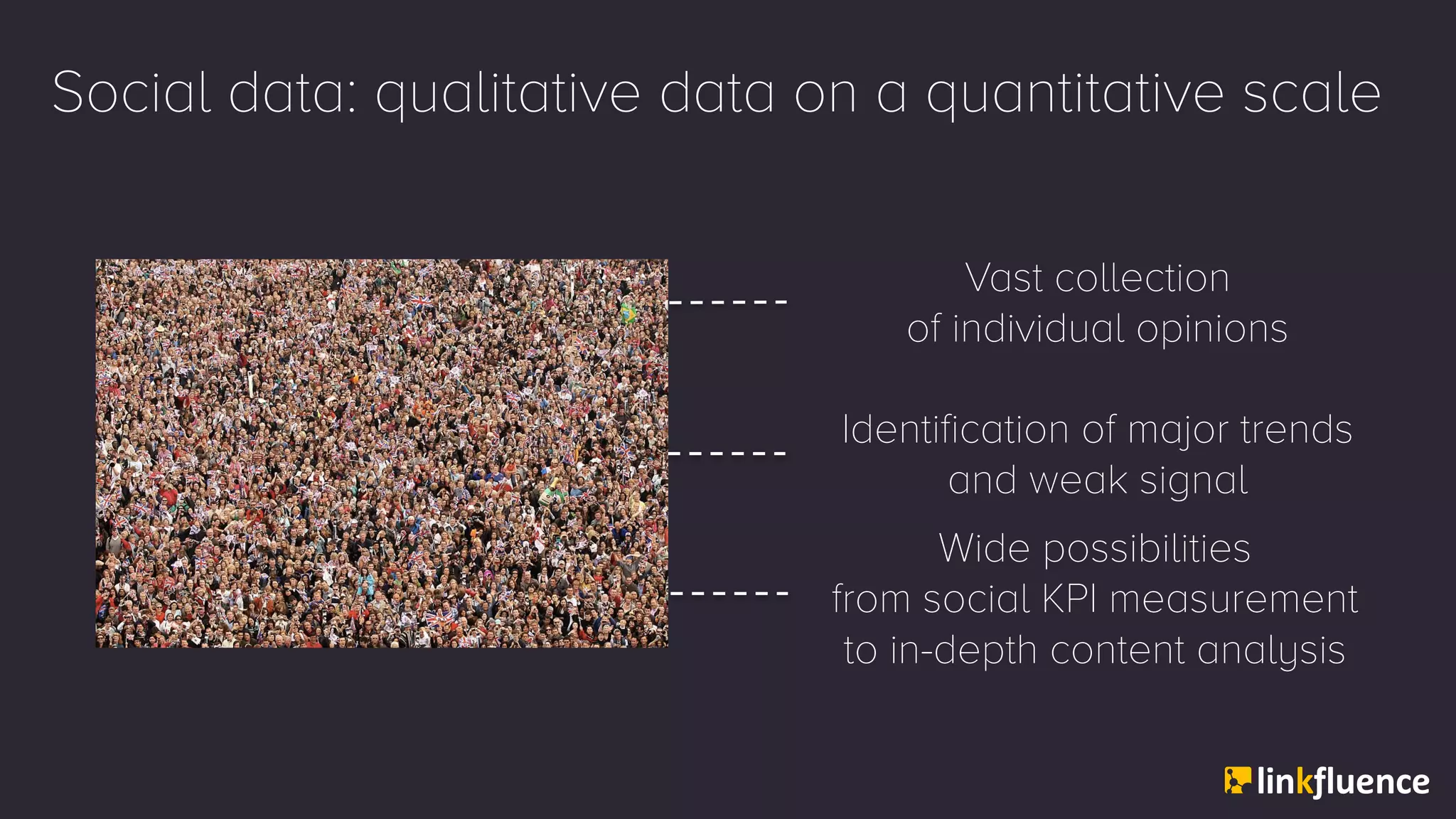

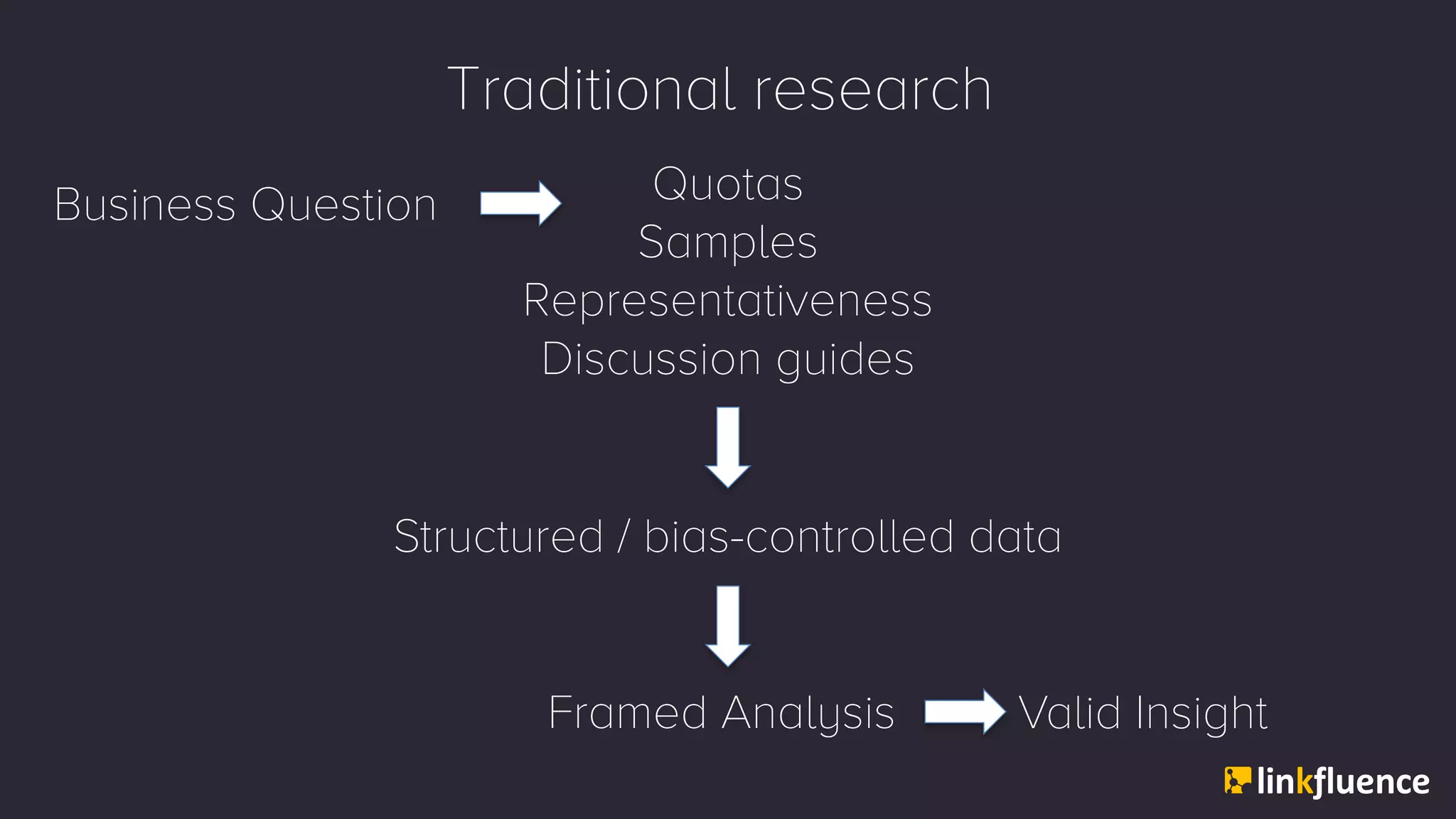

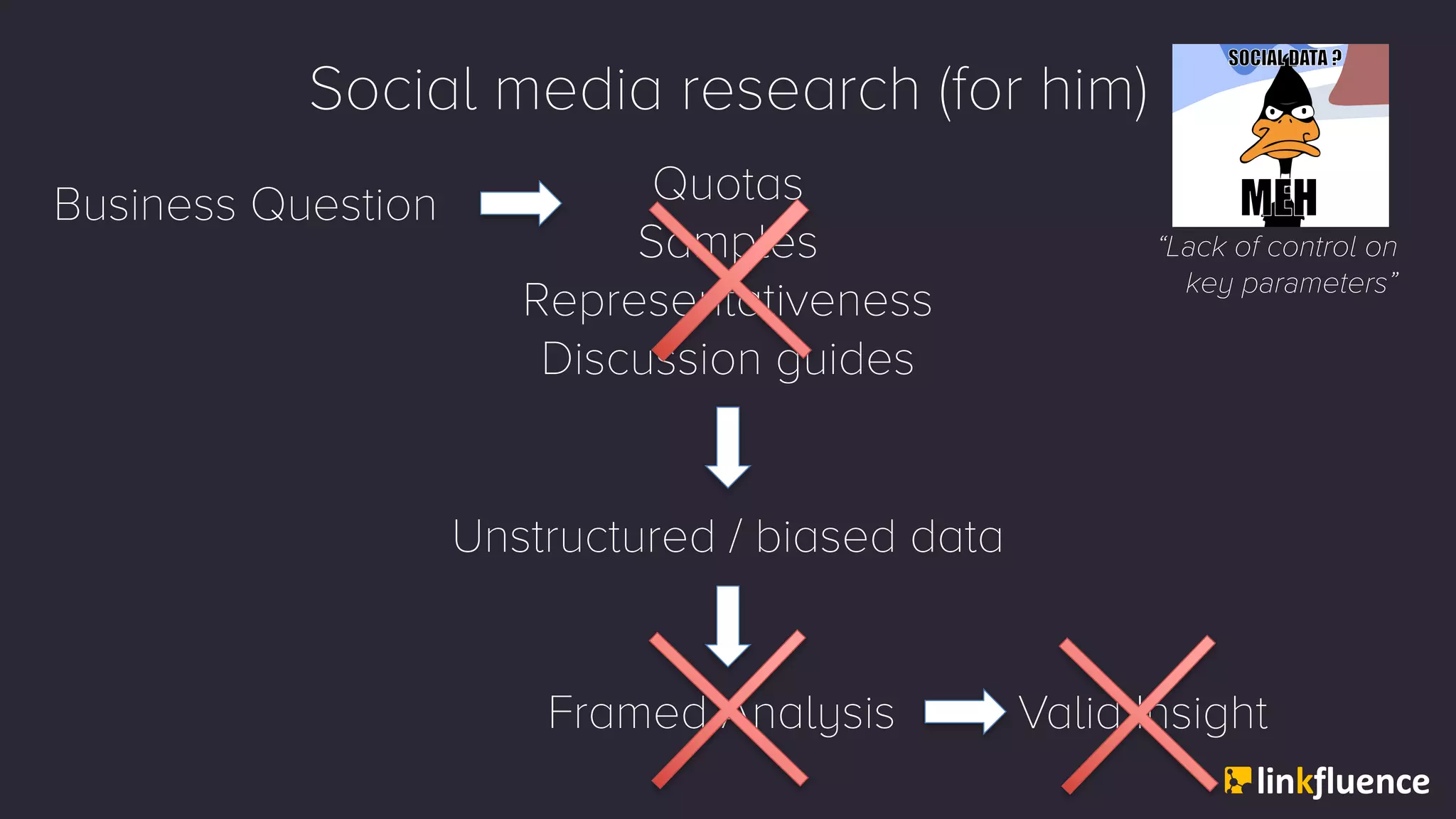

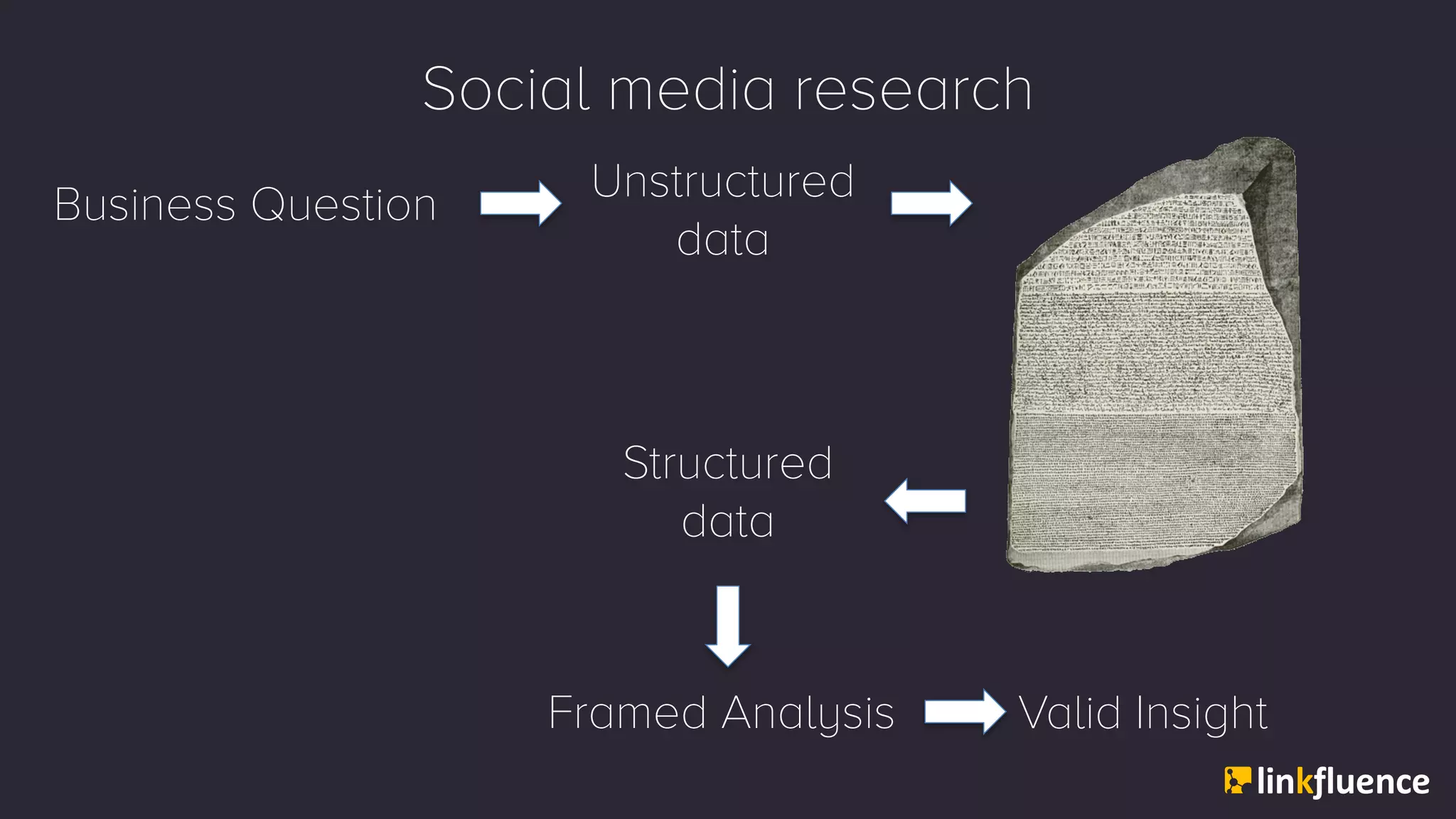

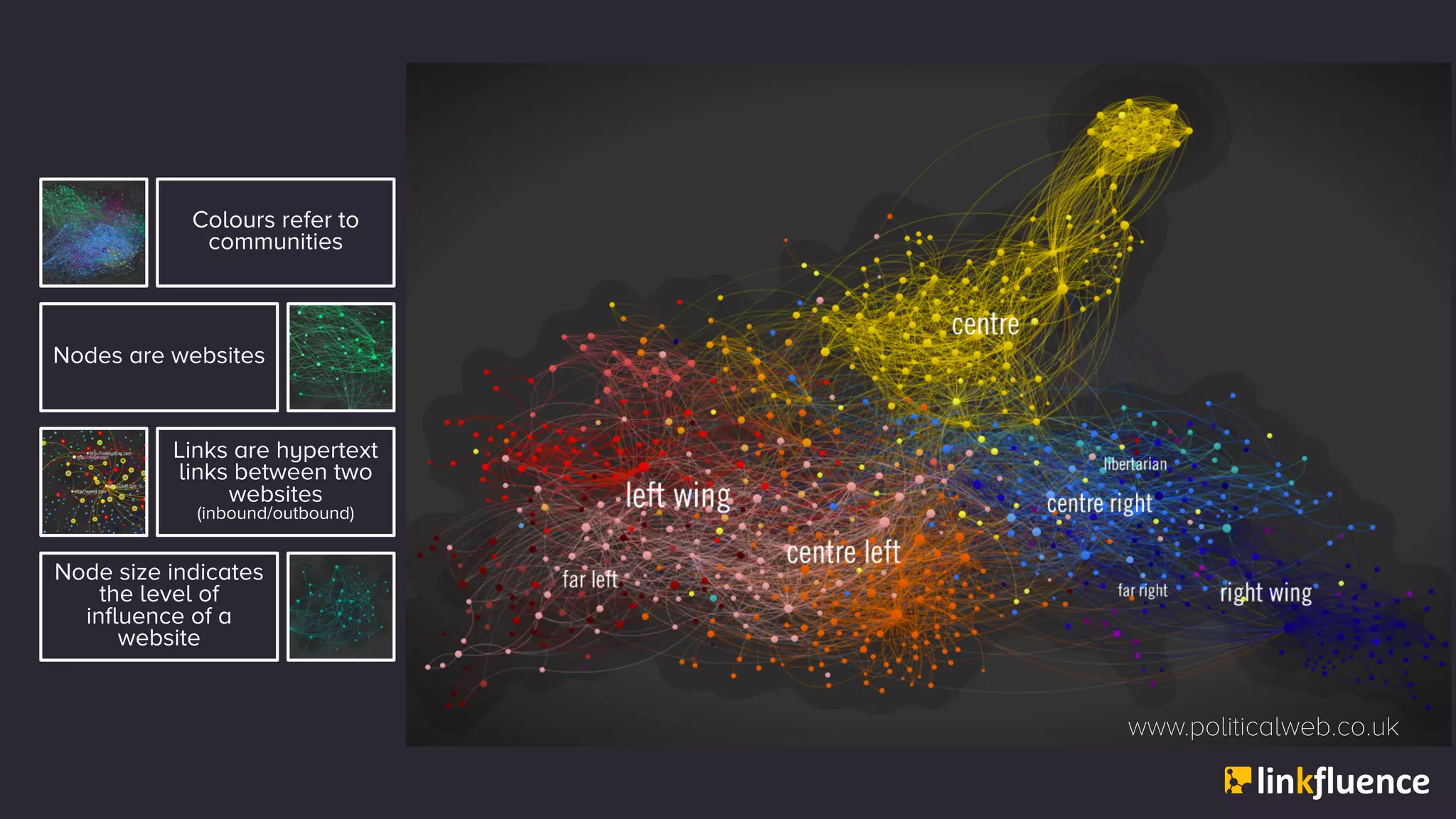

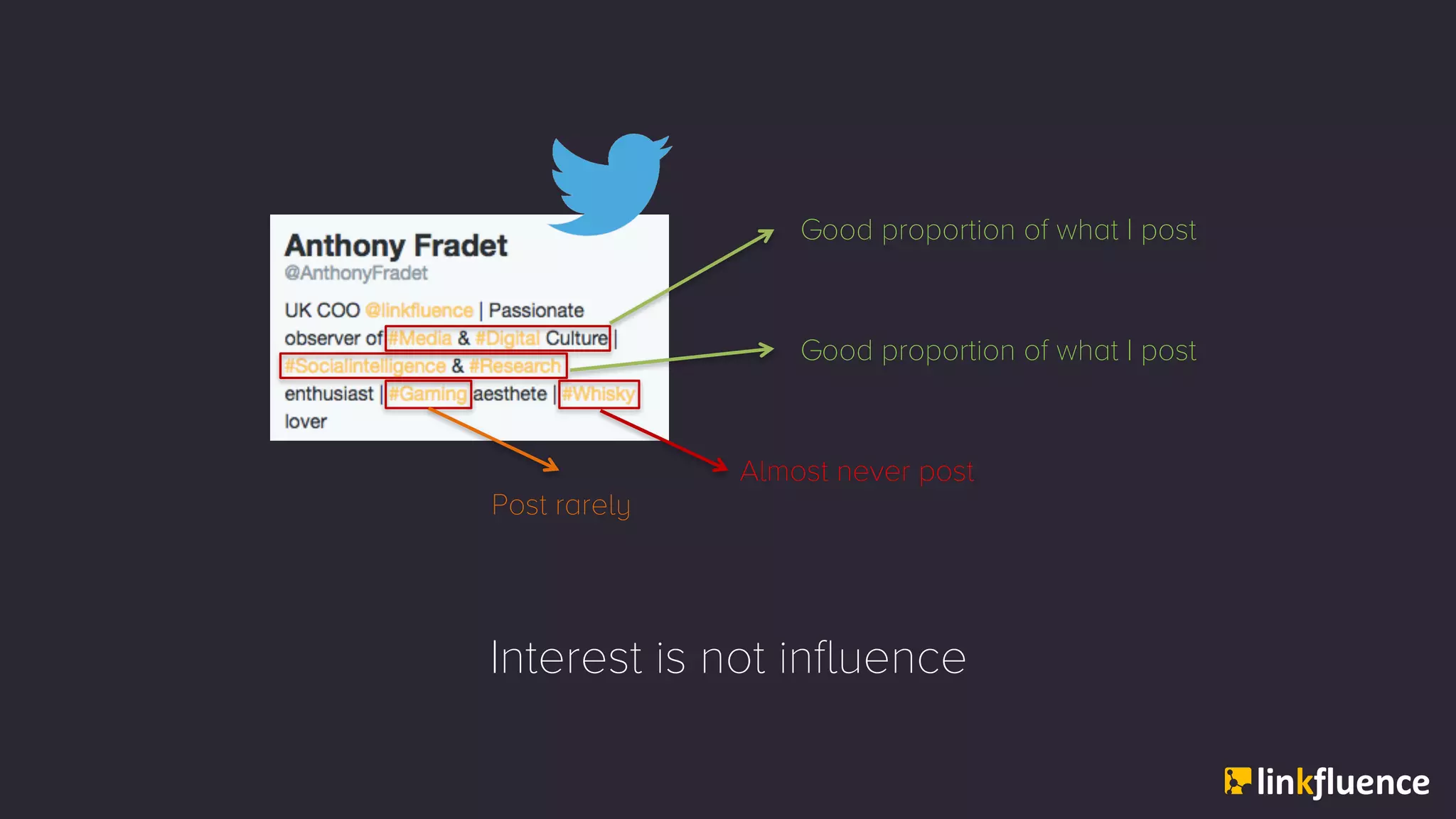

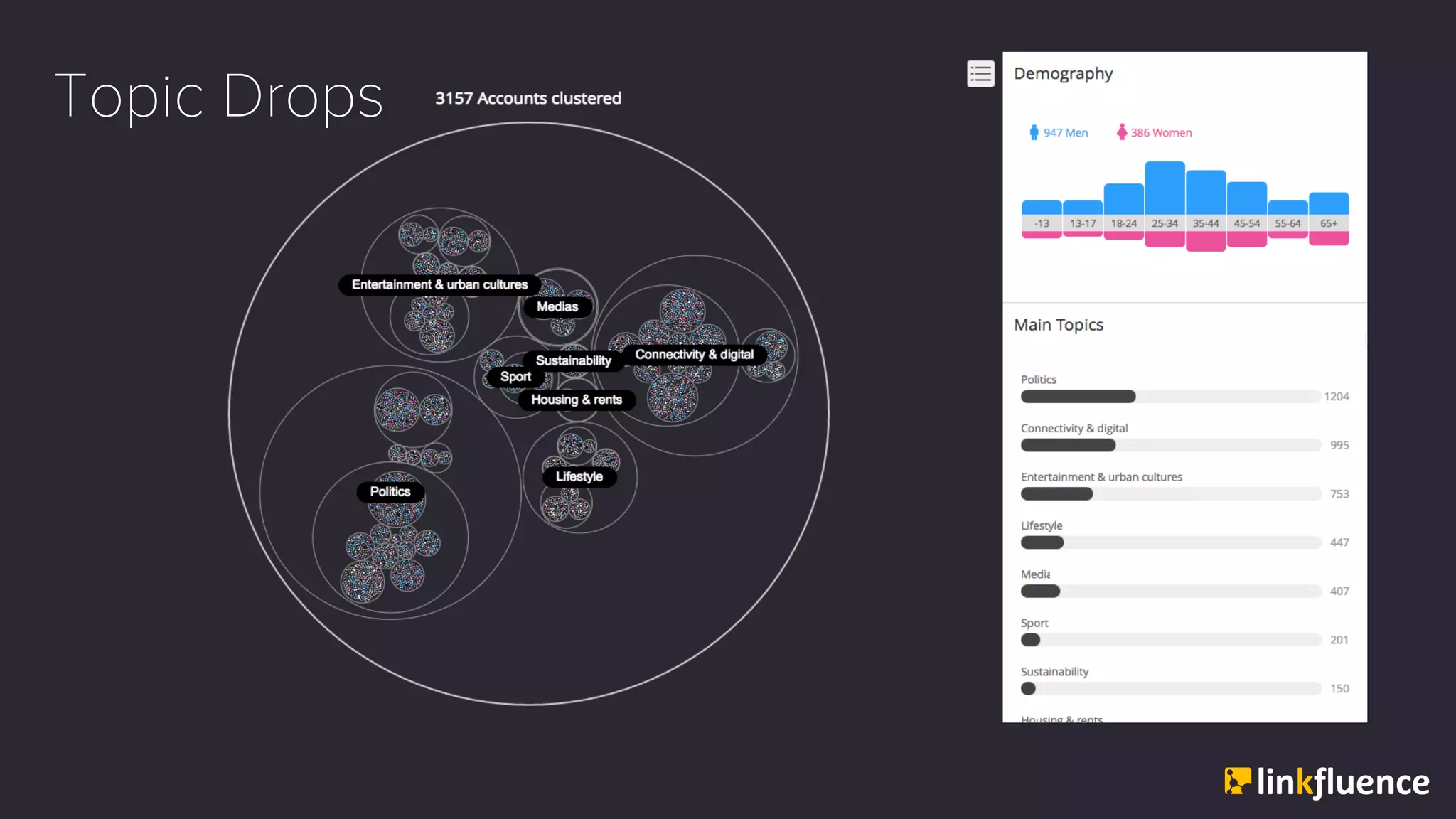

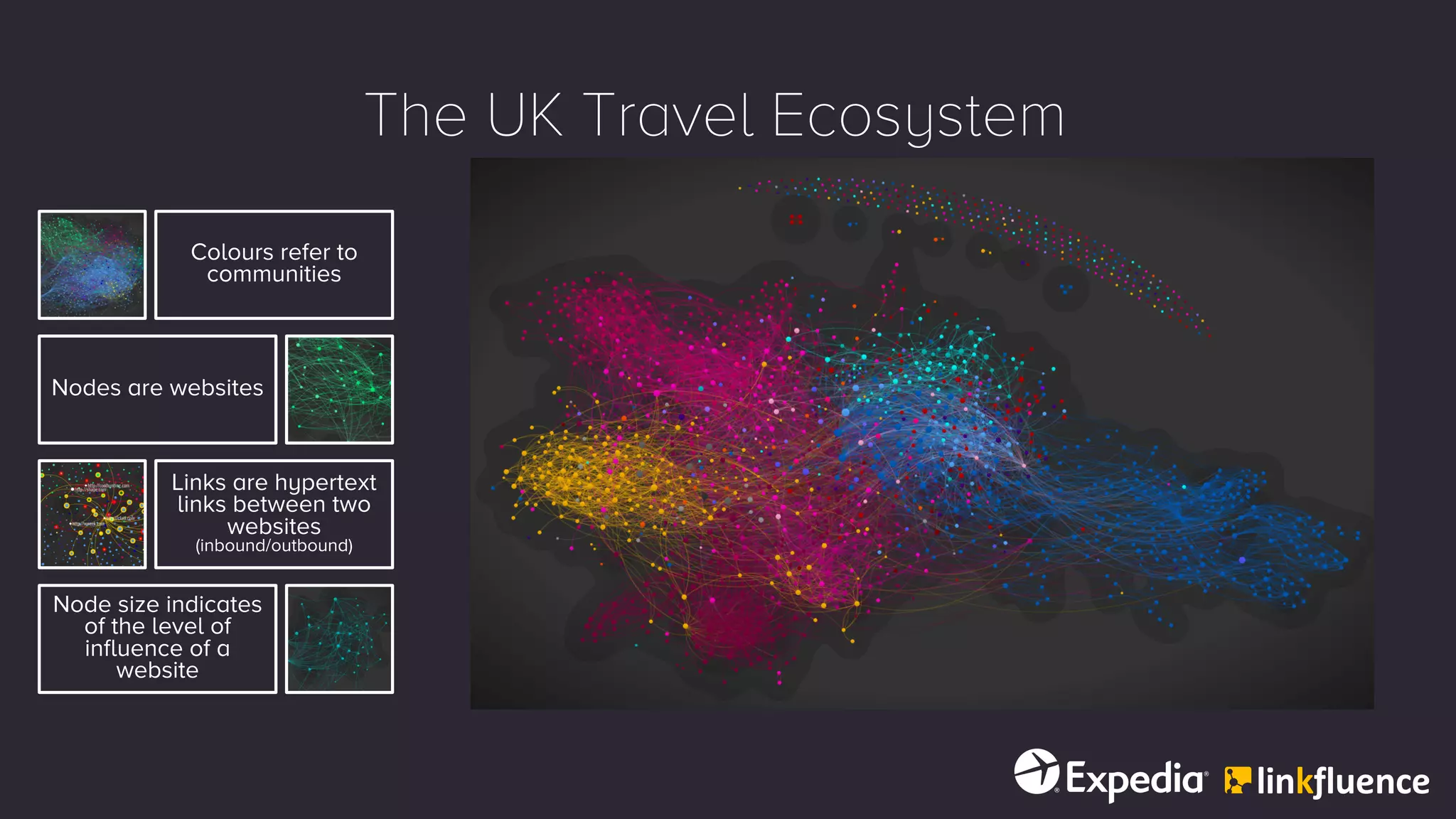

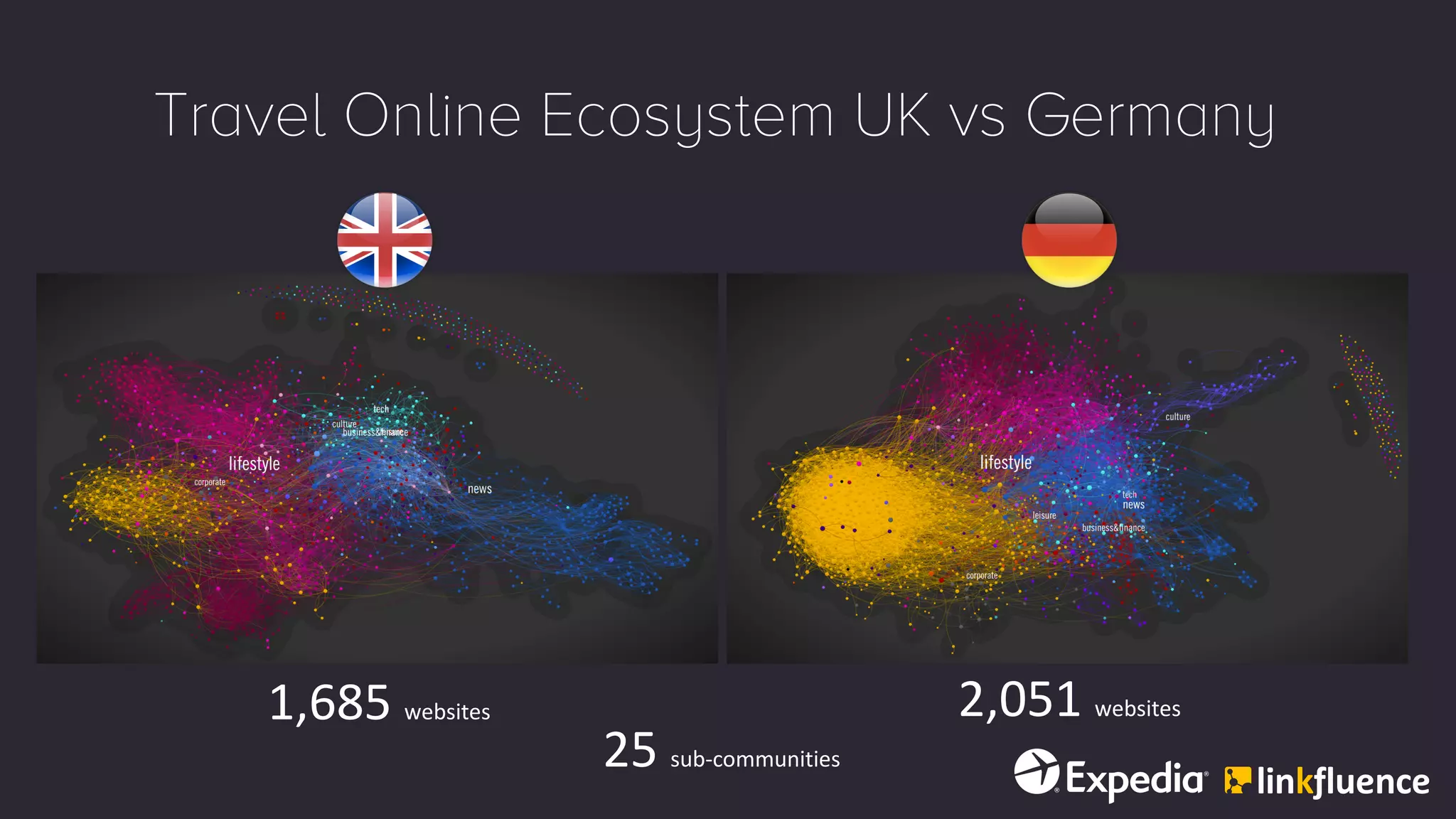

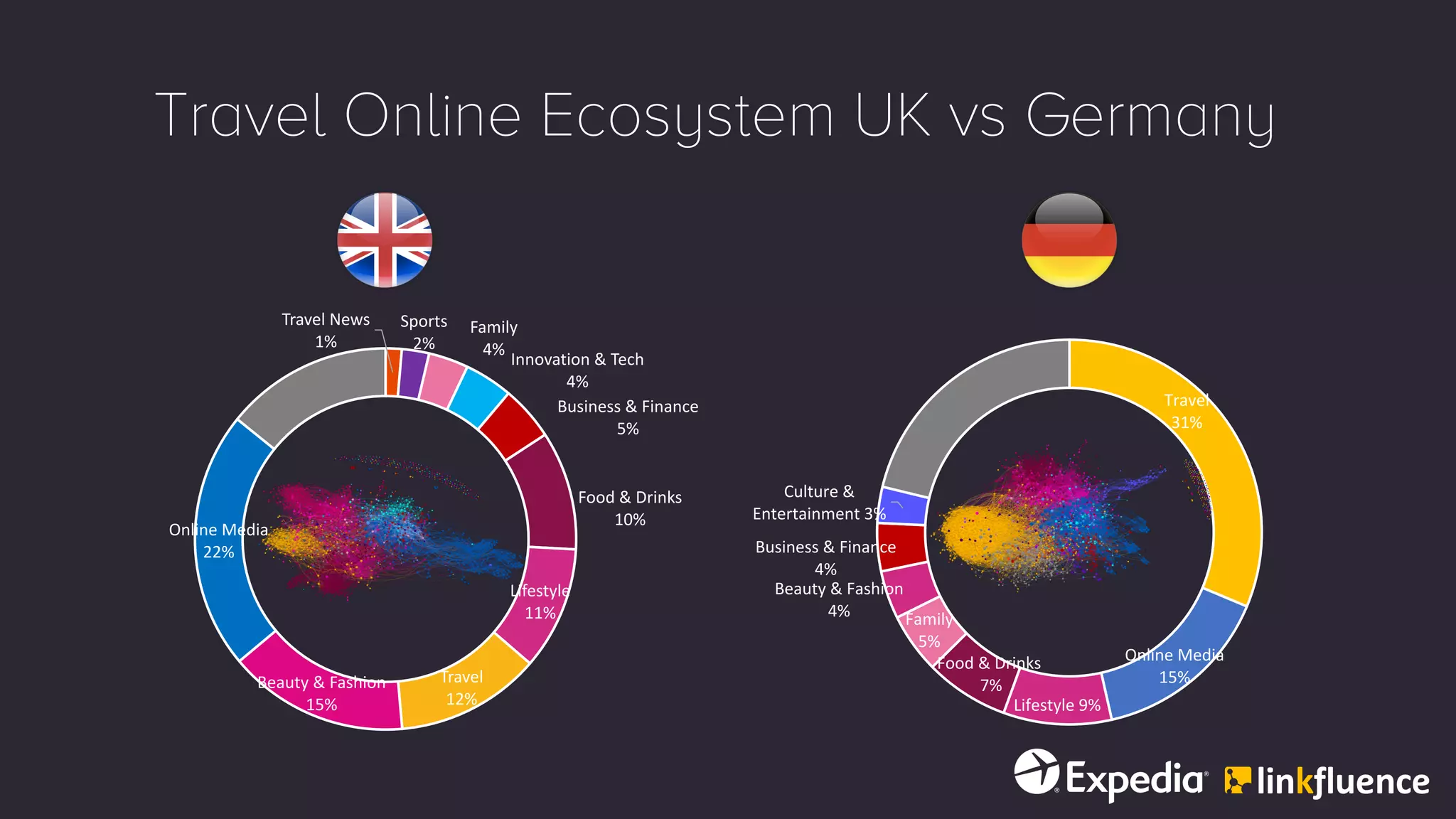

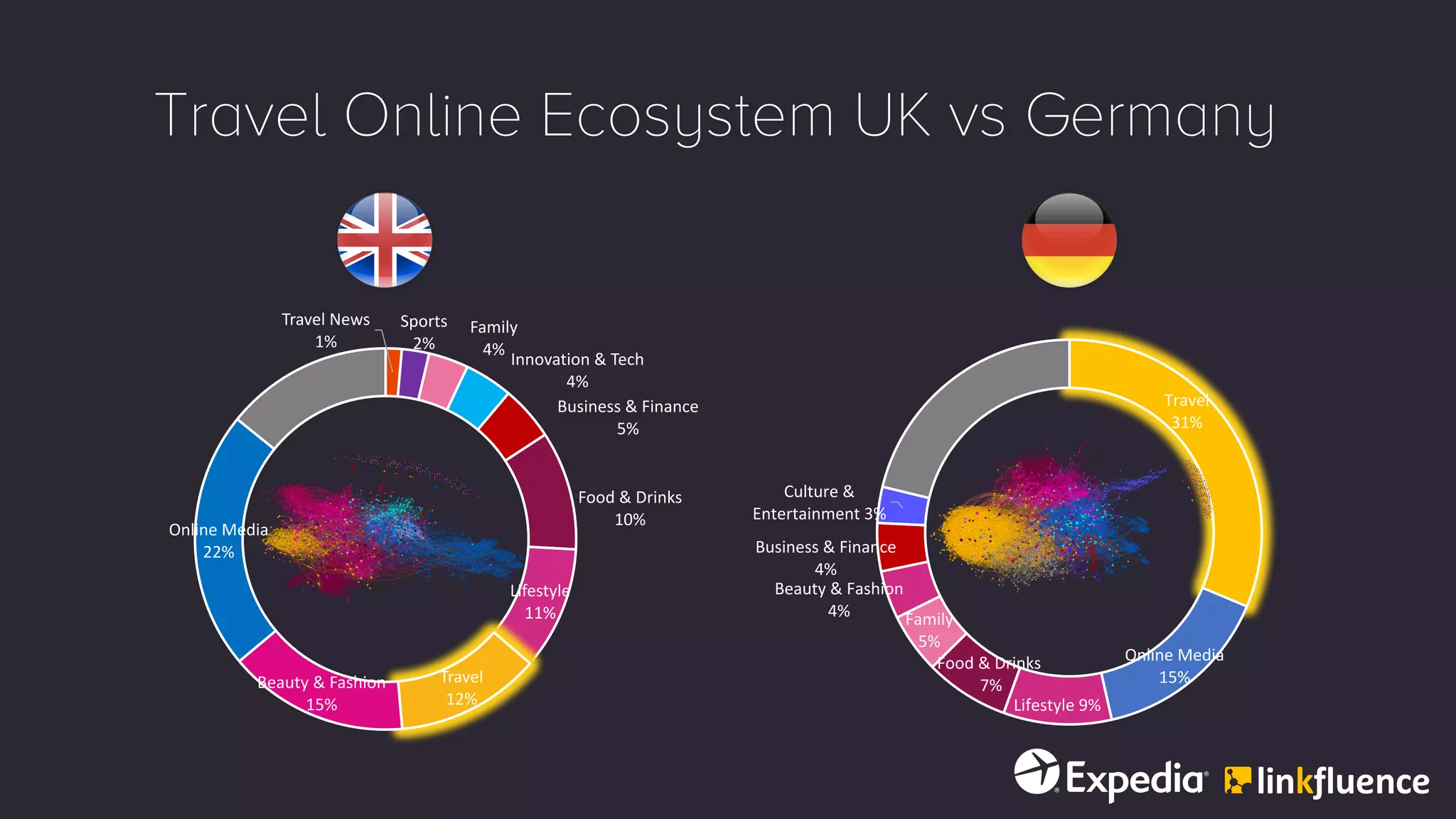

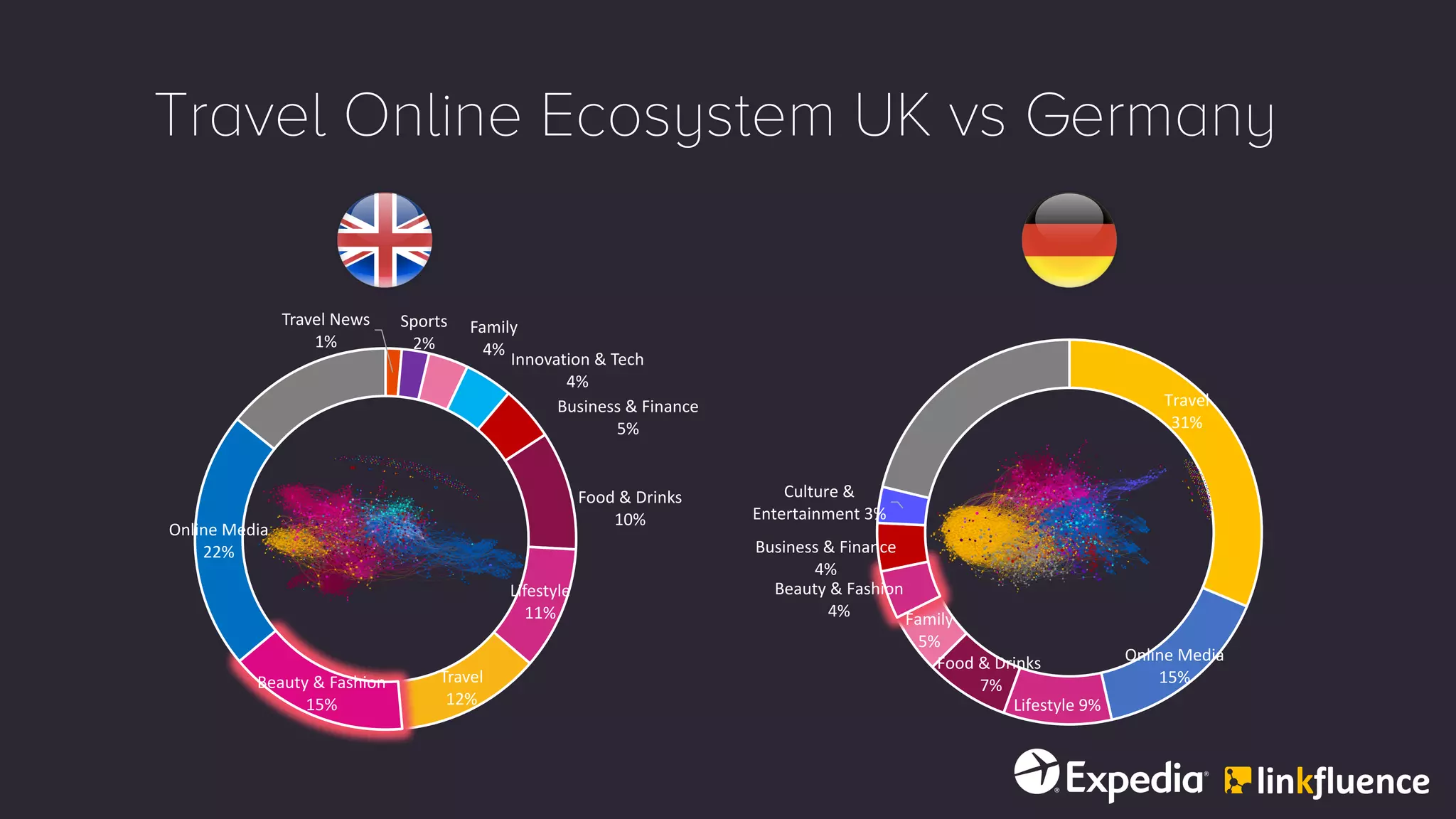

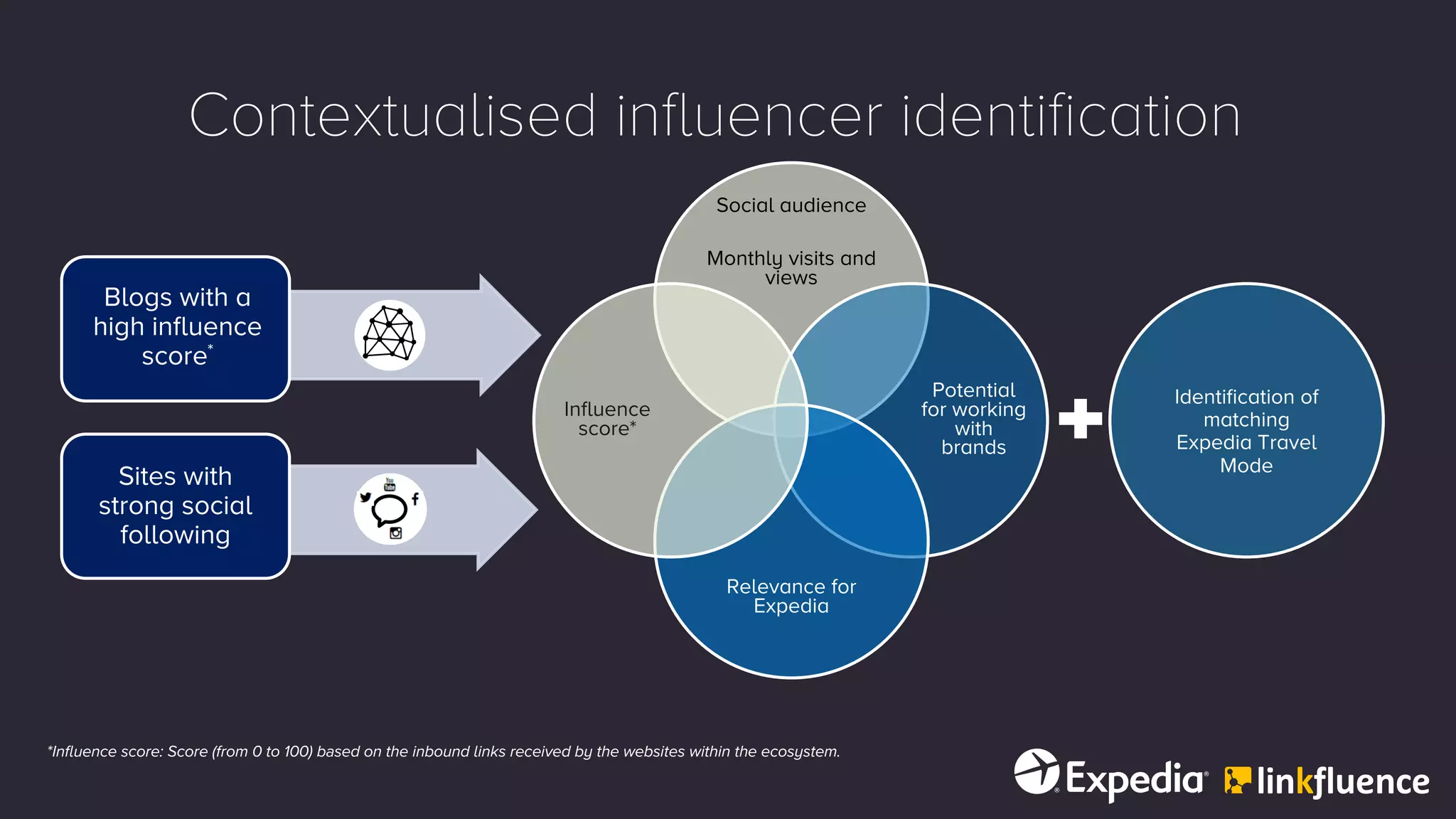

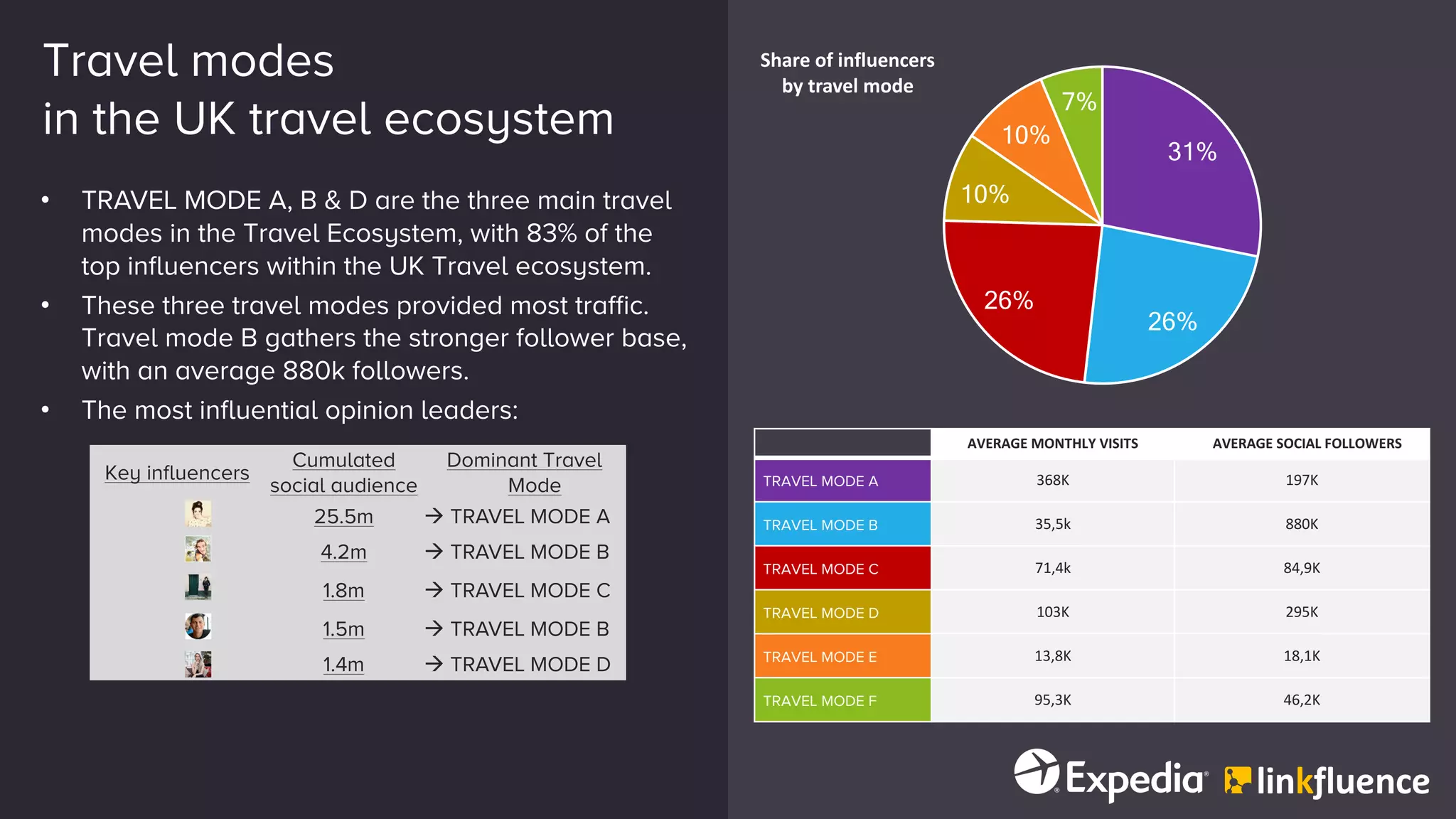

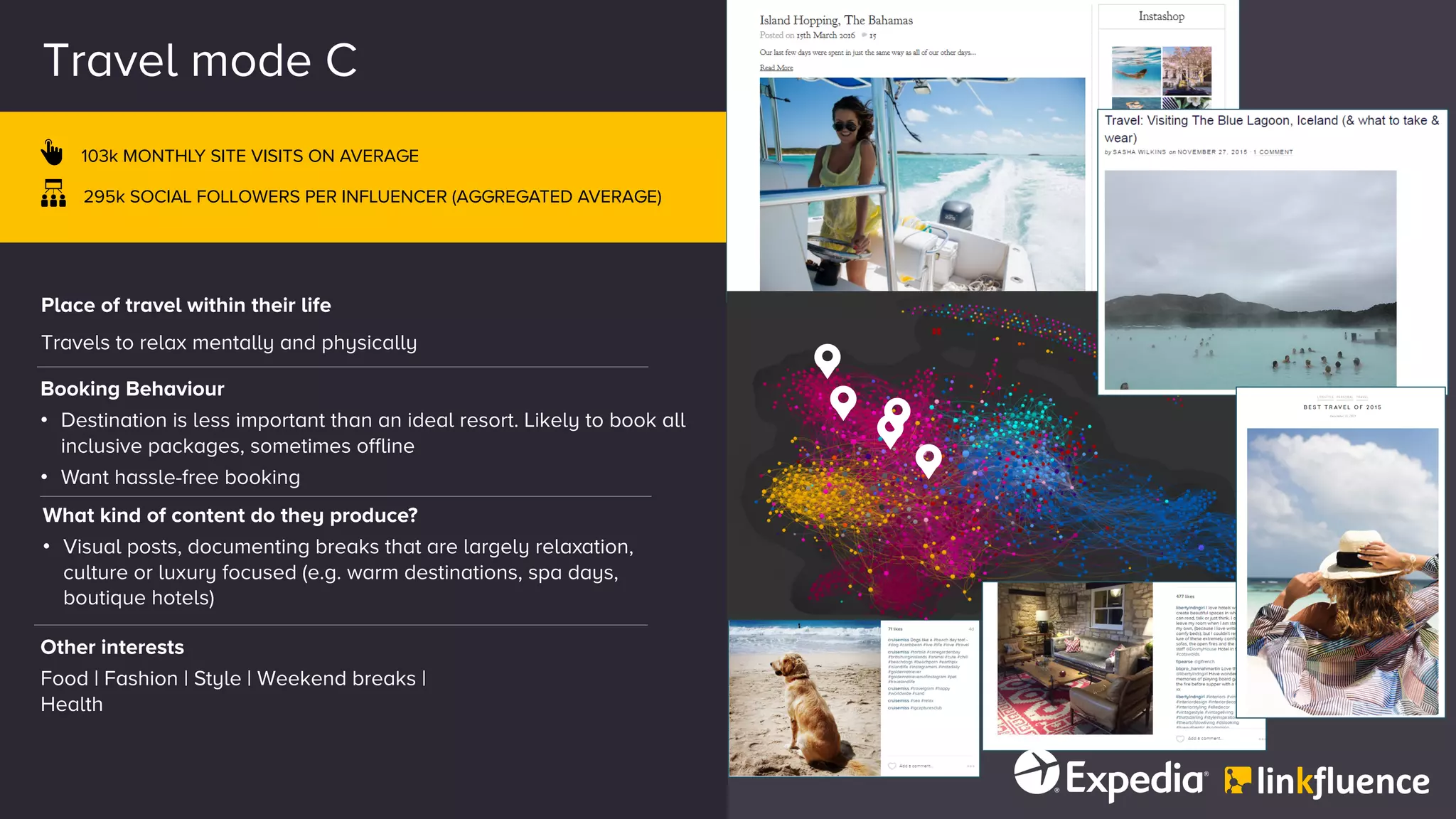

The document discusses social influence analysis in marketing, highlighting the significance of qualitative data and contextual understanding in identifying influencers and trends. It emphasizes that social influence transcends mere numbers and is rooted in relationships within online communities. Case studies from various companies illustrate how contextualized influence analysis has informed marketing strategies and enhanced engagement with target audiences.