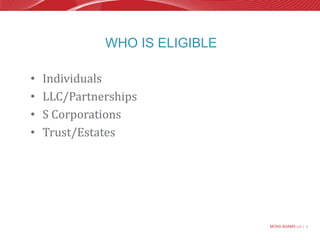

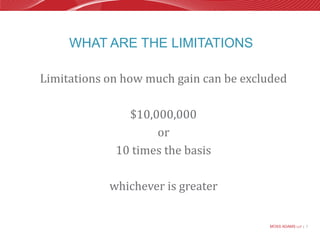

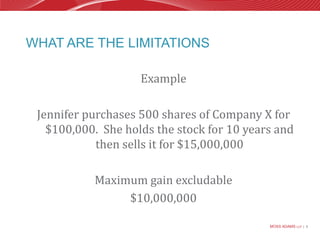

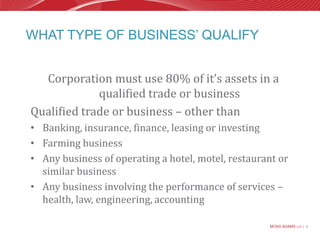

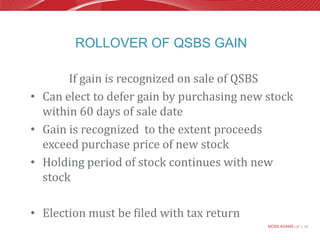

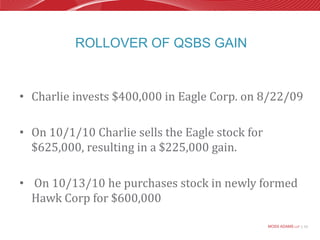

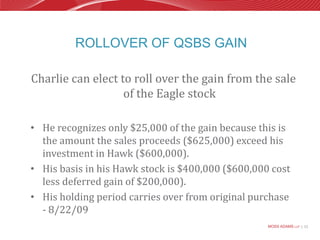

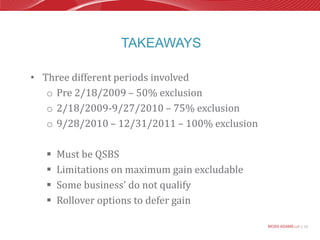

The document outlines the provisions of Code Section 1202 related to the exclusion of gains on the sale of Qualified Small Business Stock (QSBS), which allows for a 100% gain exclusion with no Alternative Minimum Tax (AMT) add back for qualifying stock acquired between specific dates. To qualify, the stock must be from a domestic C Corporation with gross assets under $50 million and held for at least five years, with an exclusion limit of $10 million or 10 times the basis. Additional details include rollover options for deferred gains, qualifications for a business to be considered a qualified trade, and associated limitations.