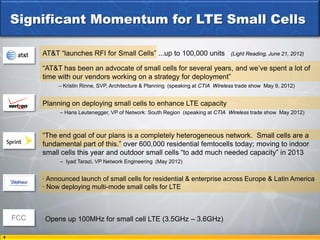

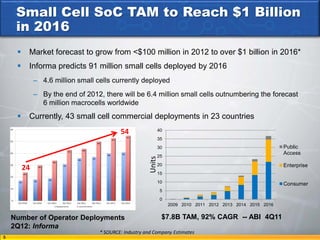

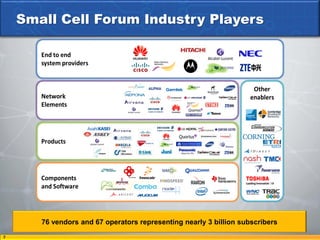

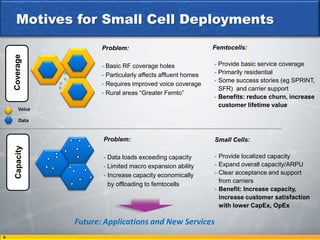

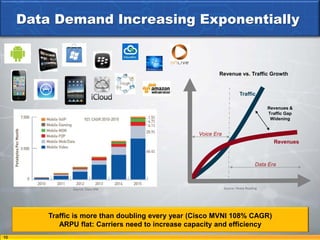

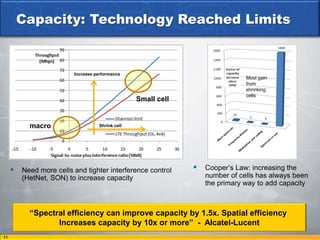

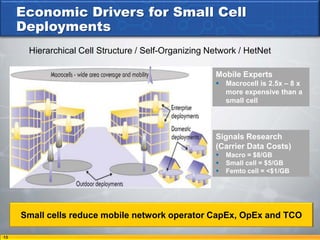

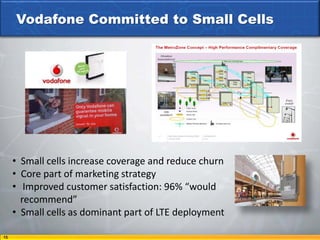

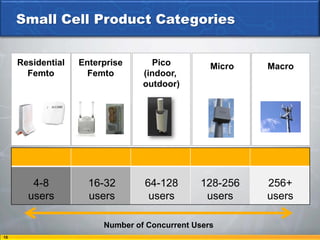

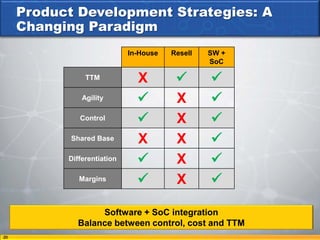

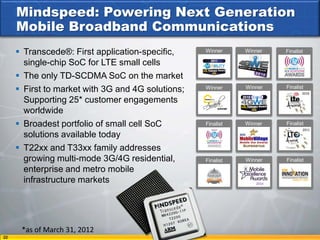

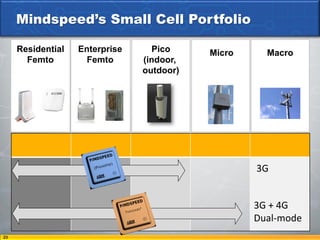

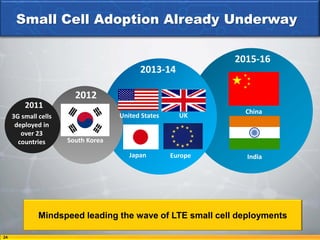

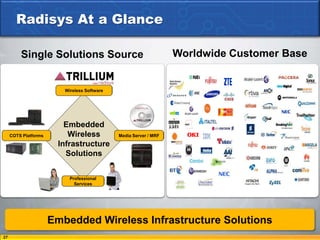

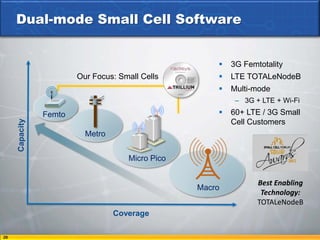

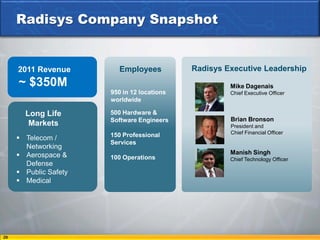

The document discusses the growing market for small cell deployments. It notes that small cells are poised for rapid growth, with the market forecast to increase from less than $100 million in 2012 to over $1 billion in 2016. Carriers are increasingly deploying small cells to enhance coverage and capacity as data demands increase exponentially. Small cells provide localized capacity and can increase overall network capacity more cost effectively than expanding macro networks alone. Mindspeed and Radisys are positioned as leaders in the small cell technology space with software and system-on-chip solutions.