Embed presentation

Download to read offline

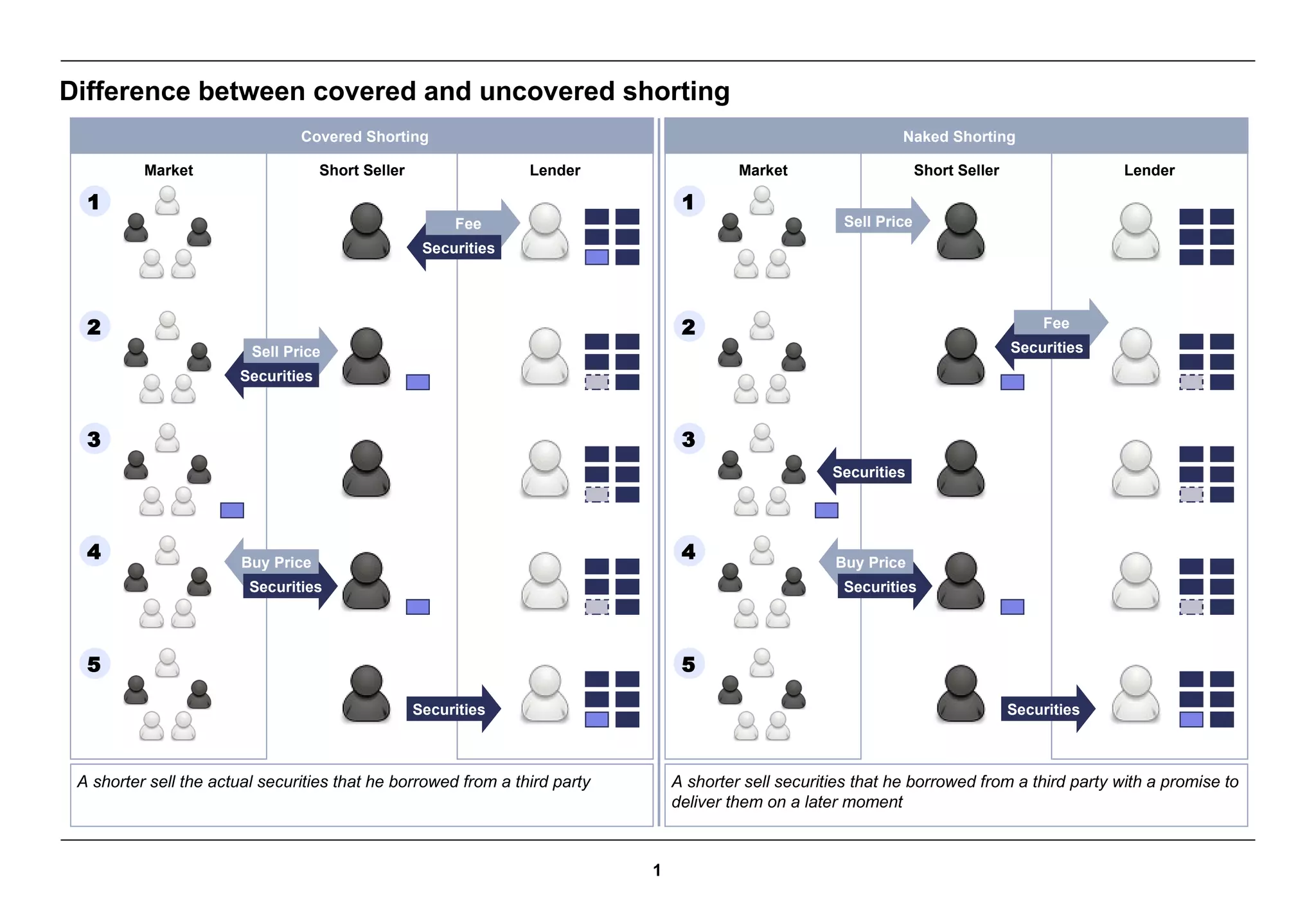

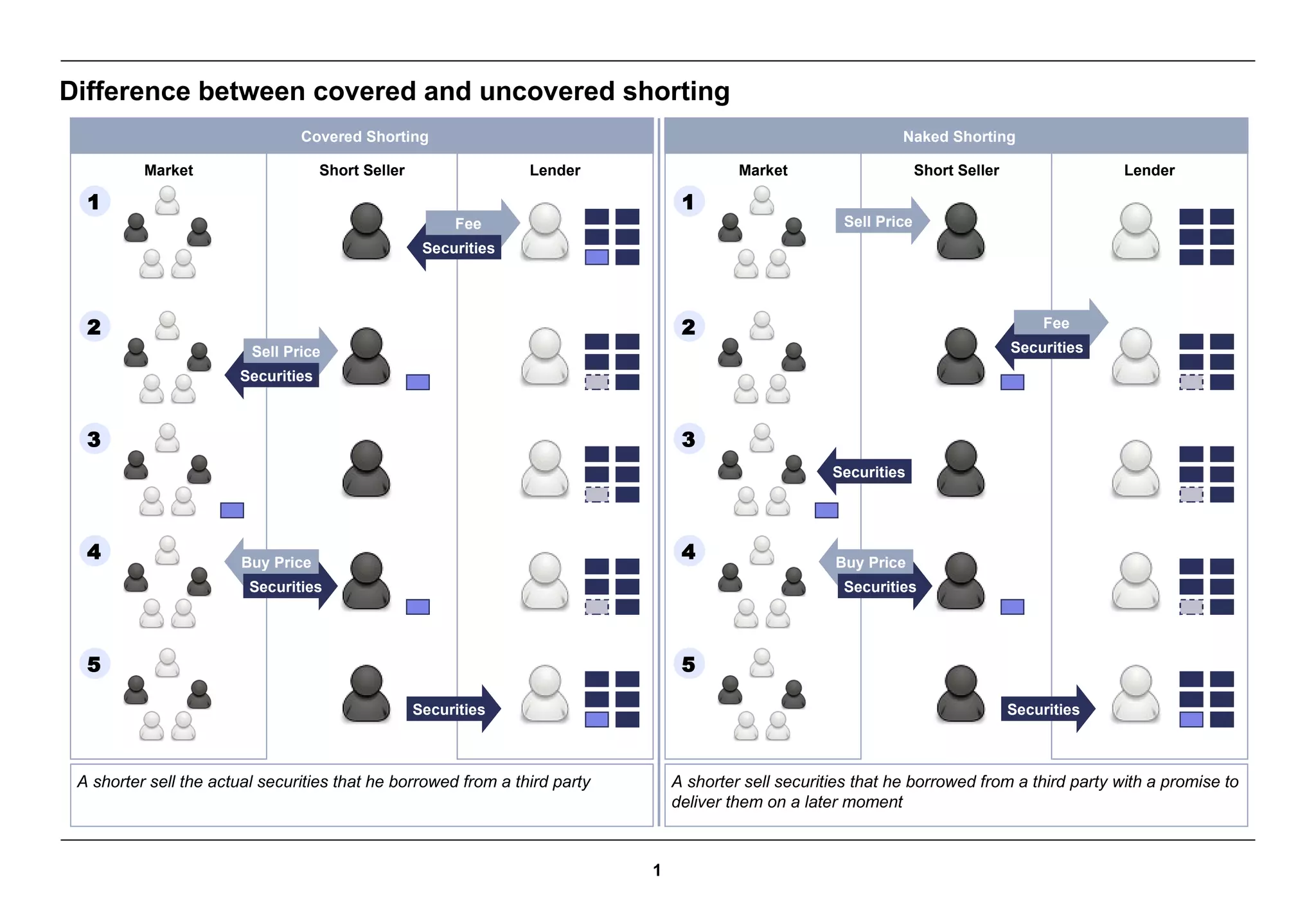

Covered shorting involves short selling securities that have been borrowed from a third party lender, while naked shorting sells securities without actually borrowing them first, essentially selling shares that do not exist with just a promise to deliver them later. The key difference is that covered shorting ensures the short seller has located the security to deliver by the future date, while naked shorting sells shares without identifying the source, taking on additional risk if the security cannot be obtained to deliver.