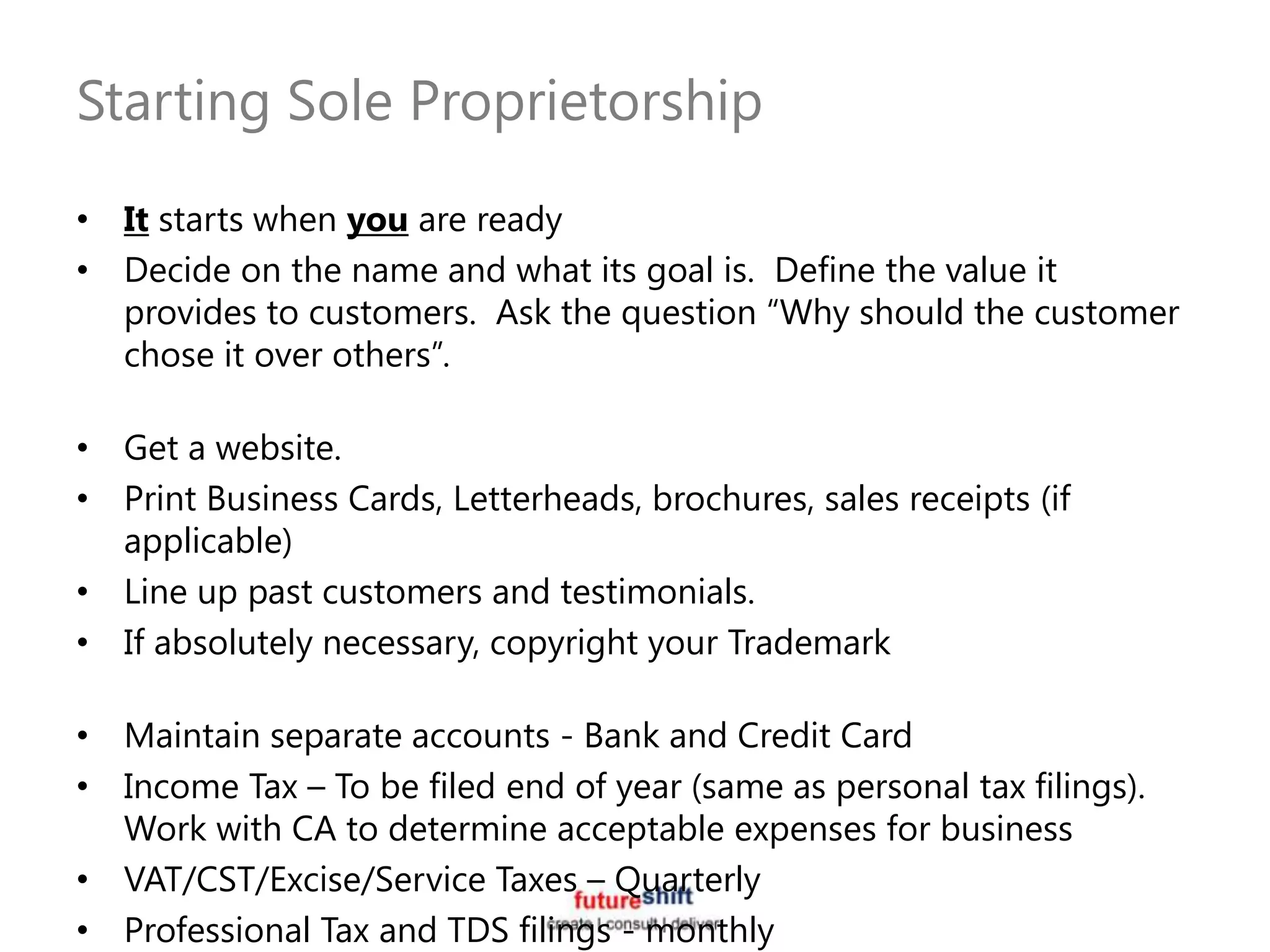

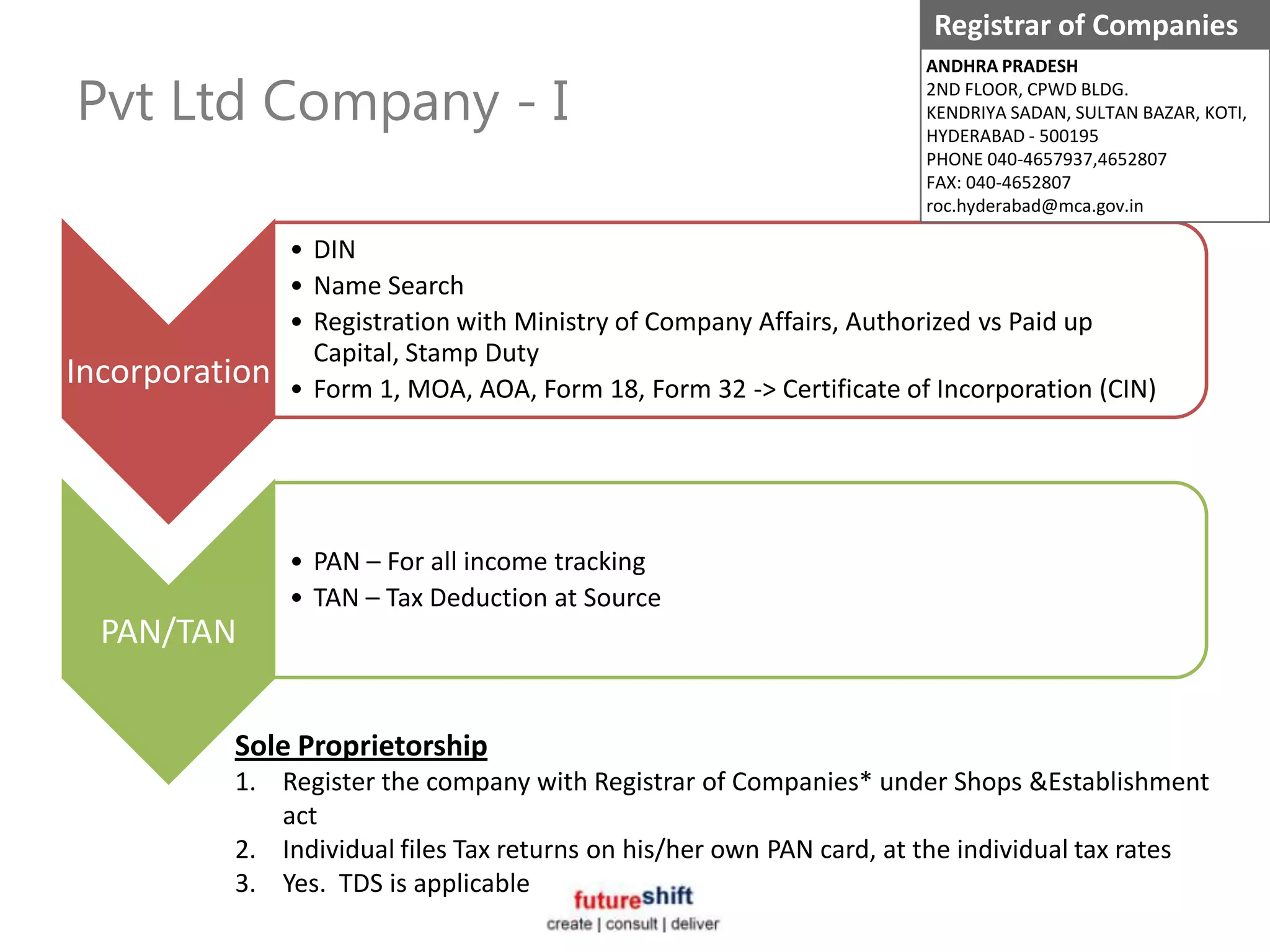

This document discusses options for setting up one's own company as either a sole proprietorship or private limited company. It provides details on the incorporation process for a private limited company, including registering with the Registrar of Companies, obtaining a PAN/TAN, initial board resolutions, opening a bank account, and necessary filings. Advantages of a private limited company over a sole proprietorship include scalability, institutionalization, limited liability, and potential tax benefits. The document emphasizes the importance of budgeting, financial management, and tax compliance.