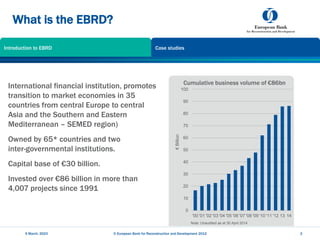

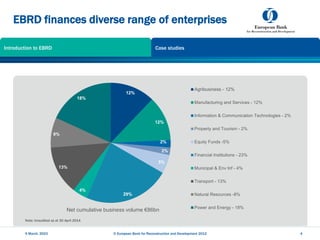

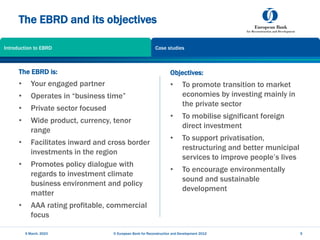

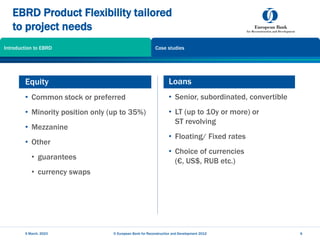

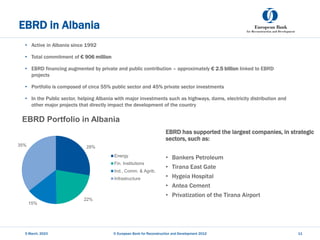

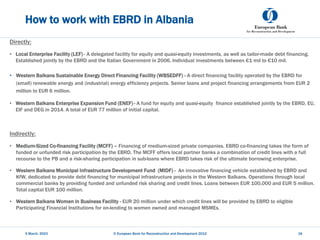

The document provides information about the European Bank for Reconstruction and Development (EBRD), including what it is, its objectives, where it invests, the types of financing it provides, and examples of projects it has supported in Albania. Specifically, the EBRD is an international financial institution that owns 65 countries and promotes transition to market economies. It has invested over €86 billion in over 4,000 projects. In Albania, examples of EBRD projects include providing a €100 million credit line to the Albanian Deposit Insurance Agency, a €17 million loan to the Tirana East Gate shopping mall project, and a €10 million loan to the Hygeia Hospital Tirana project.