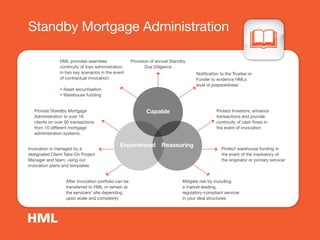

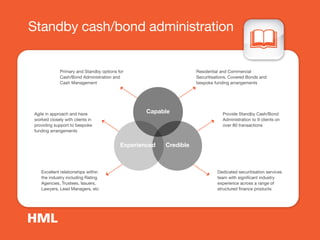

HML, a wholly-owned subsidiary of Skipton Building Society, has over 25 years of experience in managing customer accounts, servicing over 370,000 accounts, and is a leading standby servicer in the UK with a £50bn+ servicing portfolio. They provide comprehensive standby servicing solutions, ensuring business continuity during financial stress by partnering with clients for pre and post-securitisation protection. HML's reputation is bolstered by strong regulatory compliance and successful project delivery, enabling quick client onboarding and robust risk management in asset-backed financing.