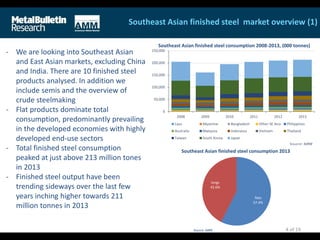

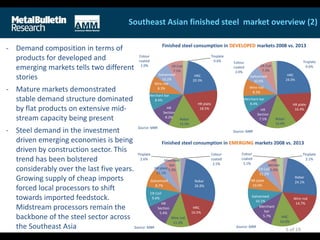

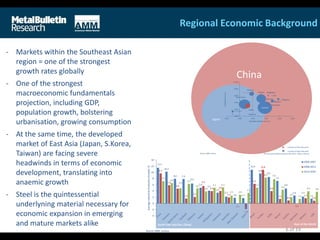

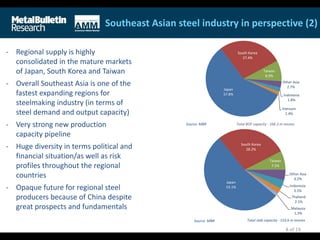

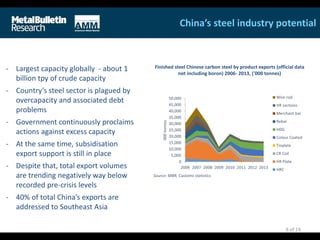

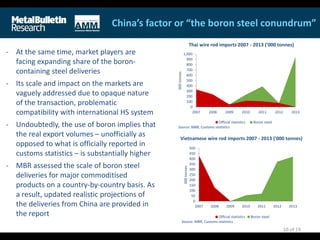

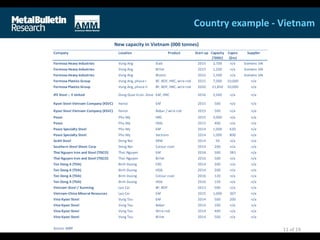

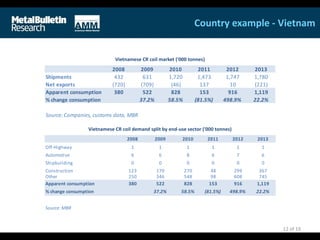

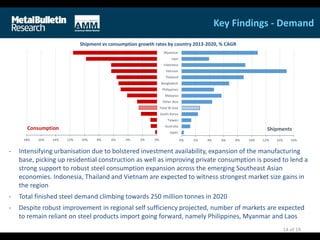

This document provides an in-depth analysis of trends in the Southeast Asian steel industry through 2020. It finds that total steel consumption in Southeast Asia peaked at over 213 million tons in 2013, with flat products dominating. China plays a major role as a supplier to the region, though its exports are opaque due to the prevalence of "boron steel" shipments. The report also examines individual country steel industries, finding Vietnam has attracted significant new mill investments that will further expand regional supply. Overall, Southeast Asian steel production is projected to grow at 2.5-3% annually to exceed 260 million tons by 2020.