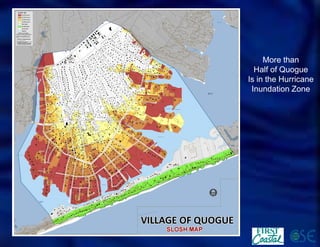

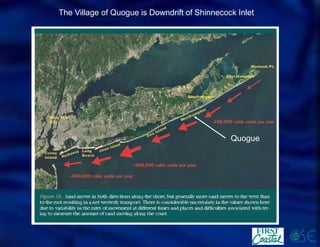

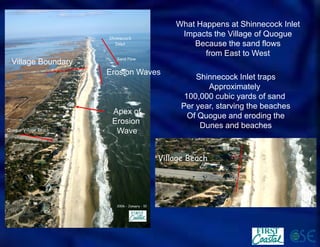

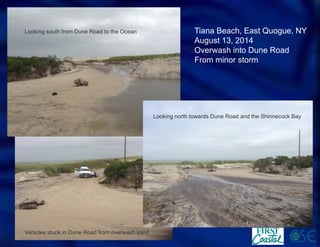

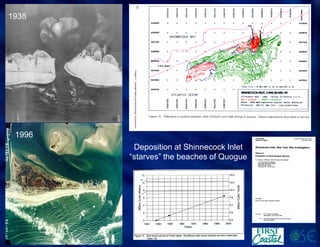

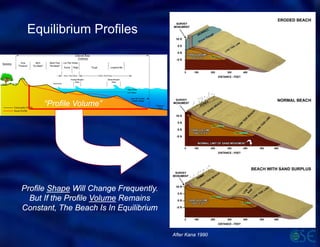

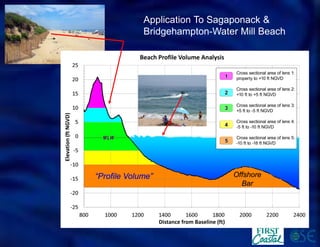

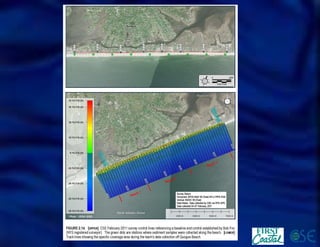

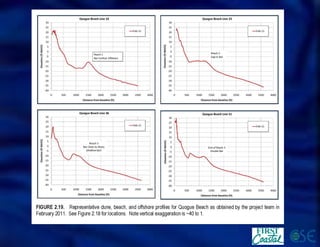

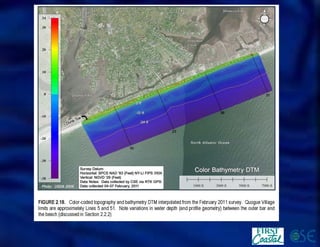

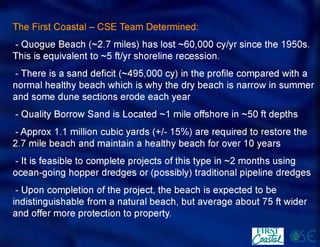

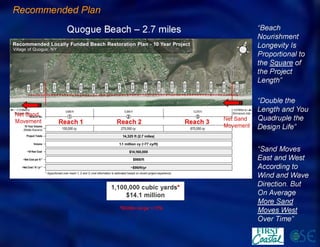

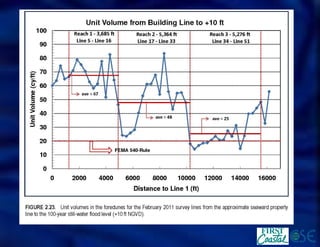

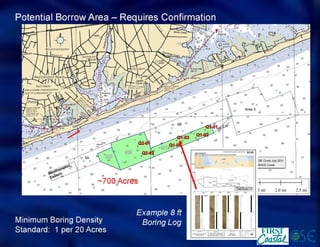

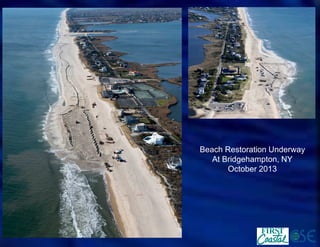

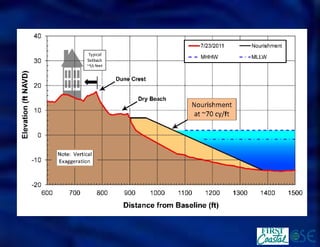

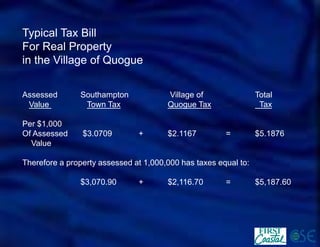

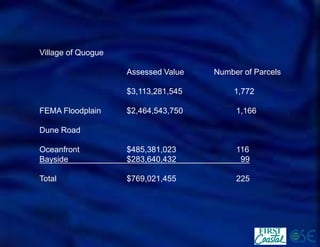

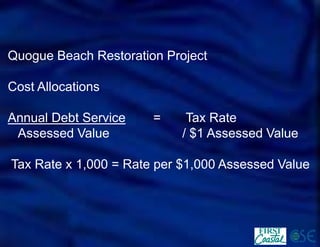

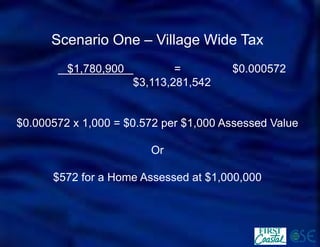

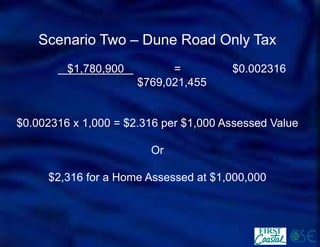

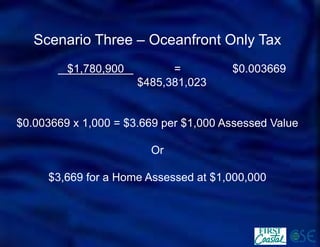

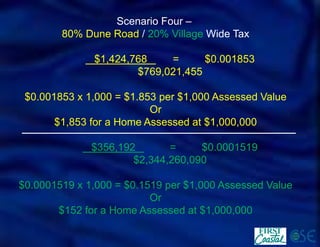

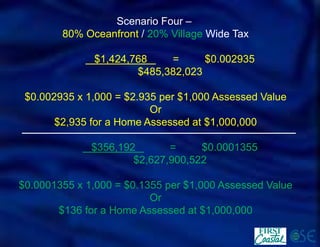

The document discusses beach erosion issues facing the Village of Quogue, New York. It notes that over half of Quogue is located in the hurricane flood zone and the village's beaches are being starved of sand from the trapping of sand at Shinnecock Inlet each year. The erosion poses risks to property and infrastructure in the village. The document proposes a $15 million beach restoration project for Quogue and analyzes different funding scenarios to pay for the project through municipal bonds and targeted tax increases.