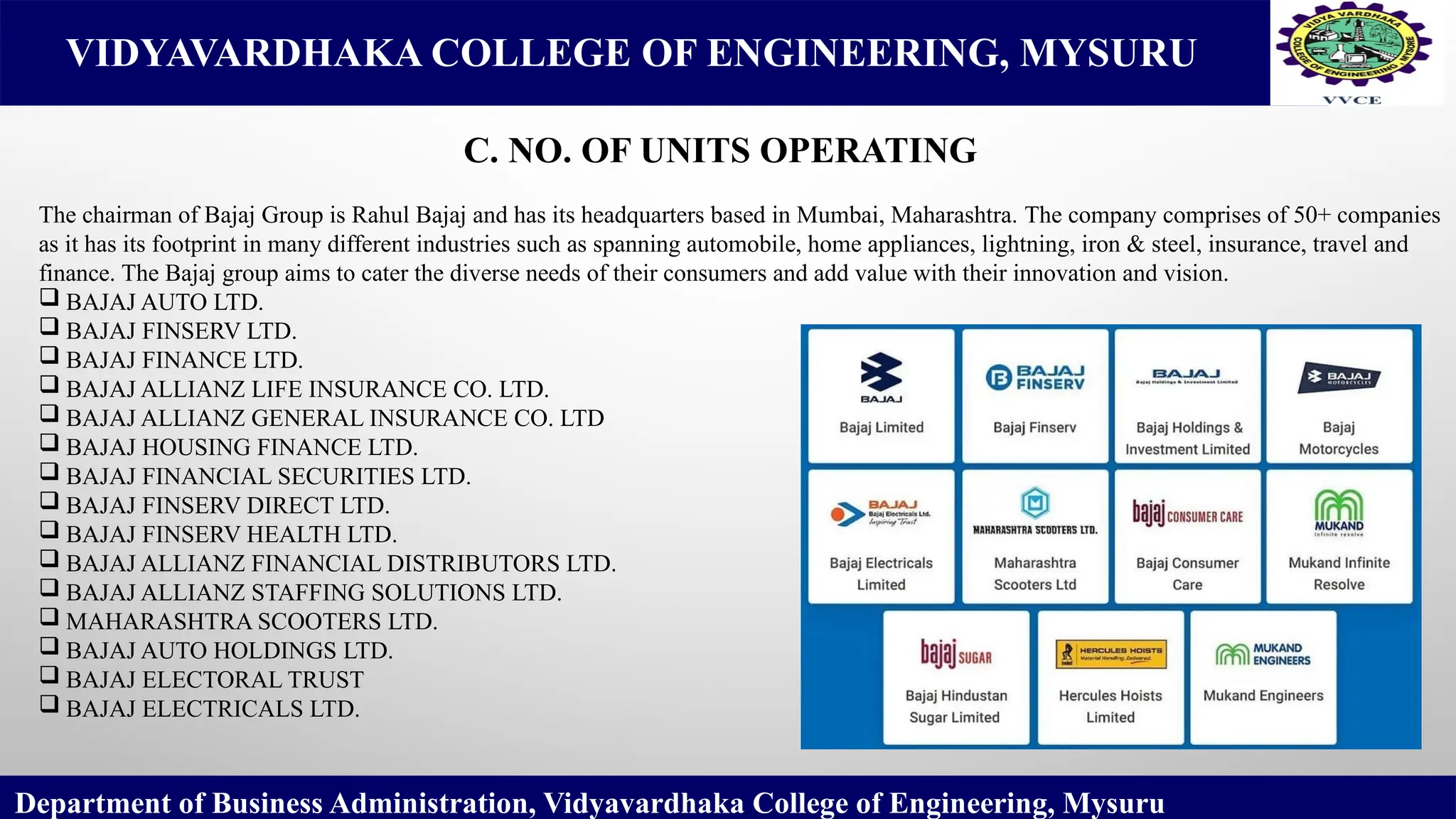

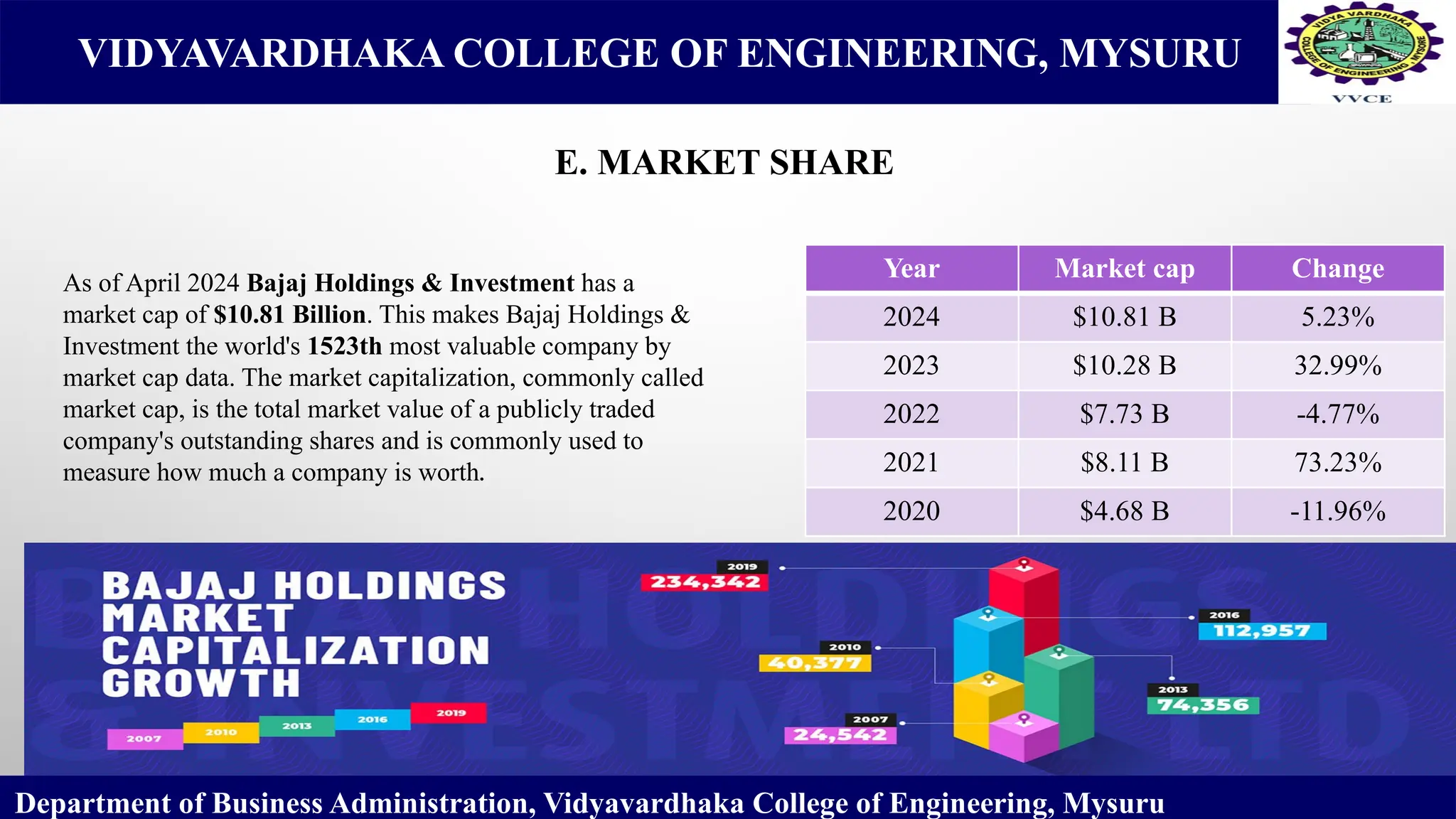

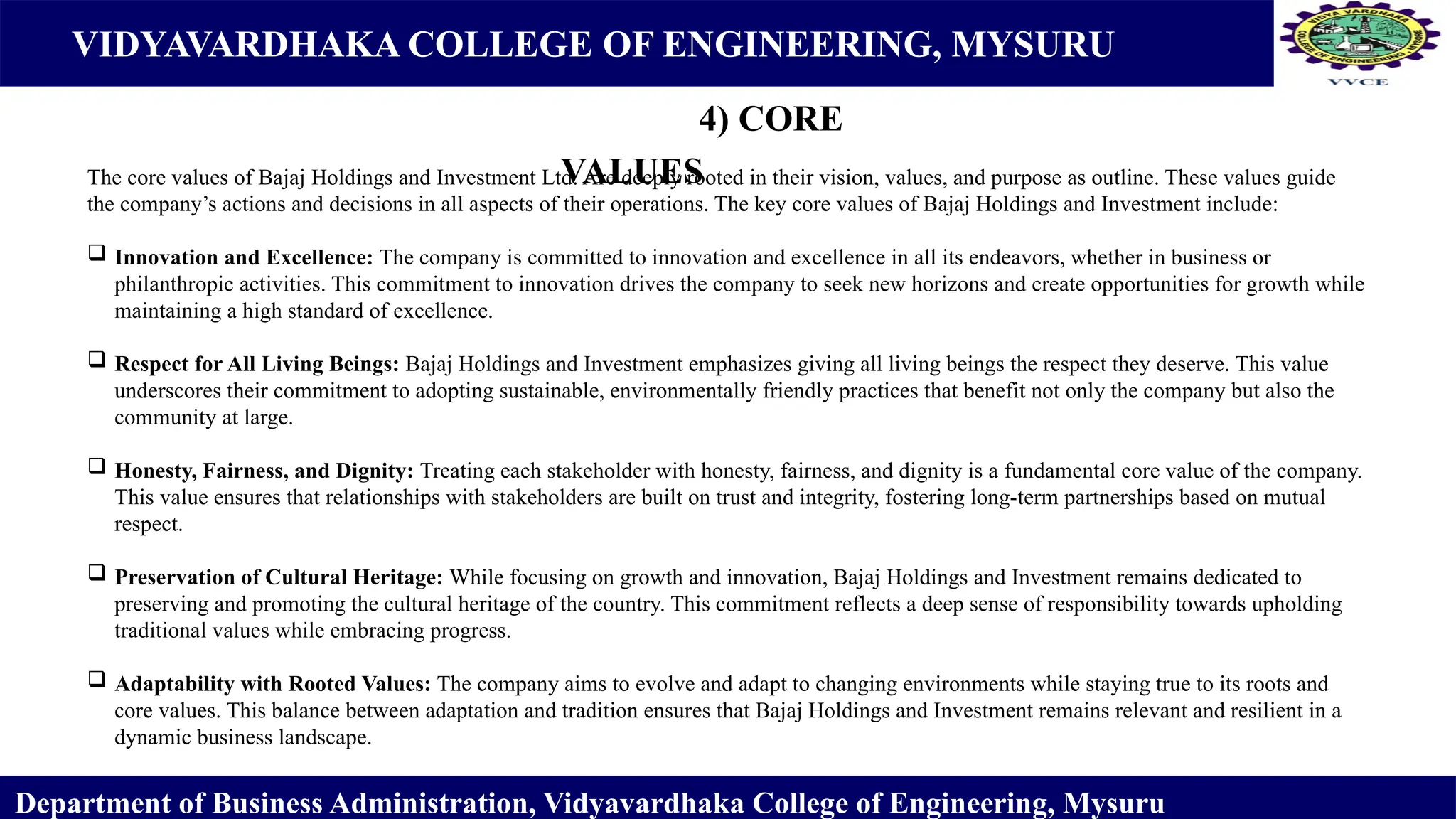

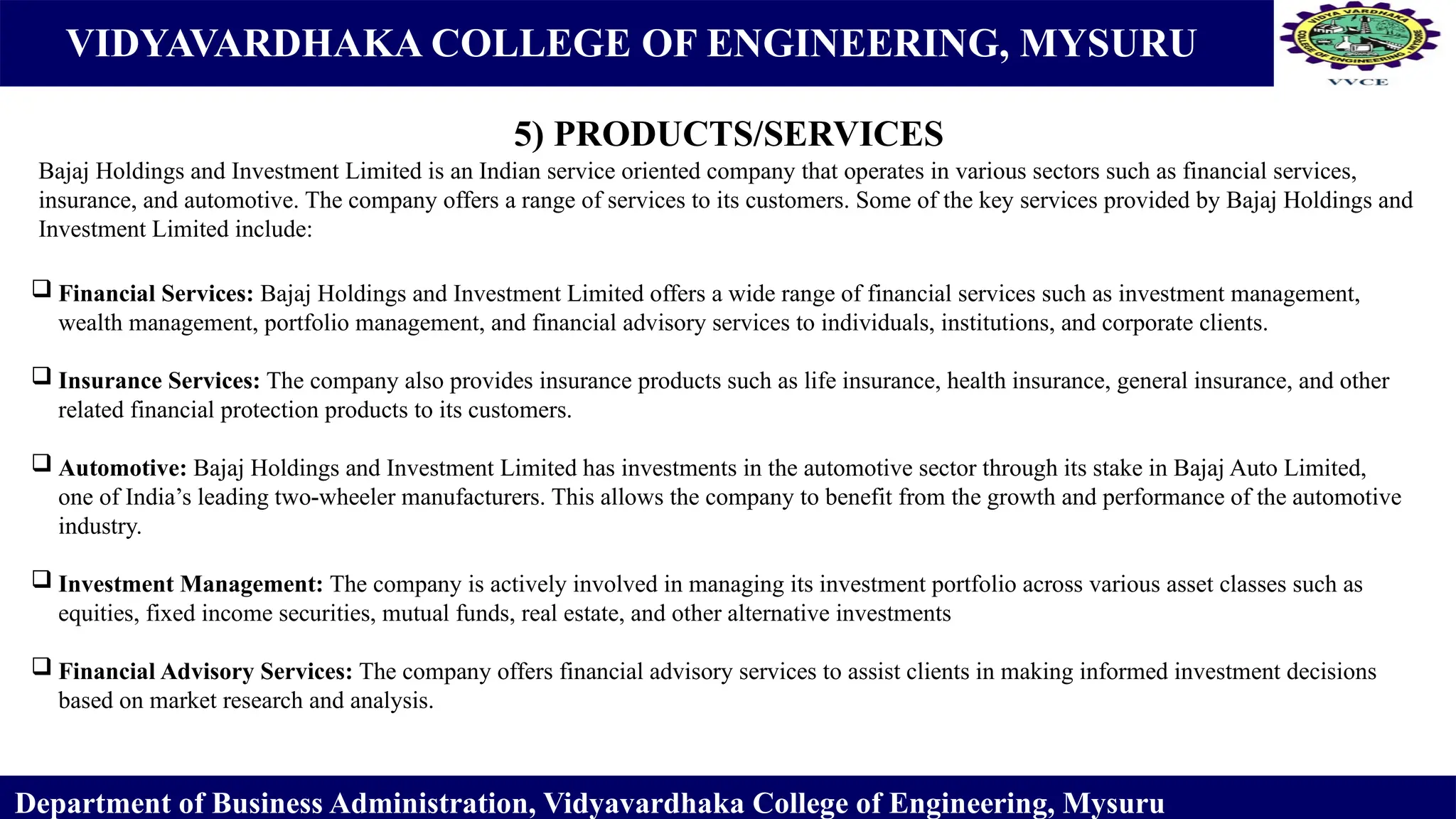

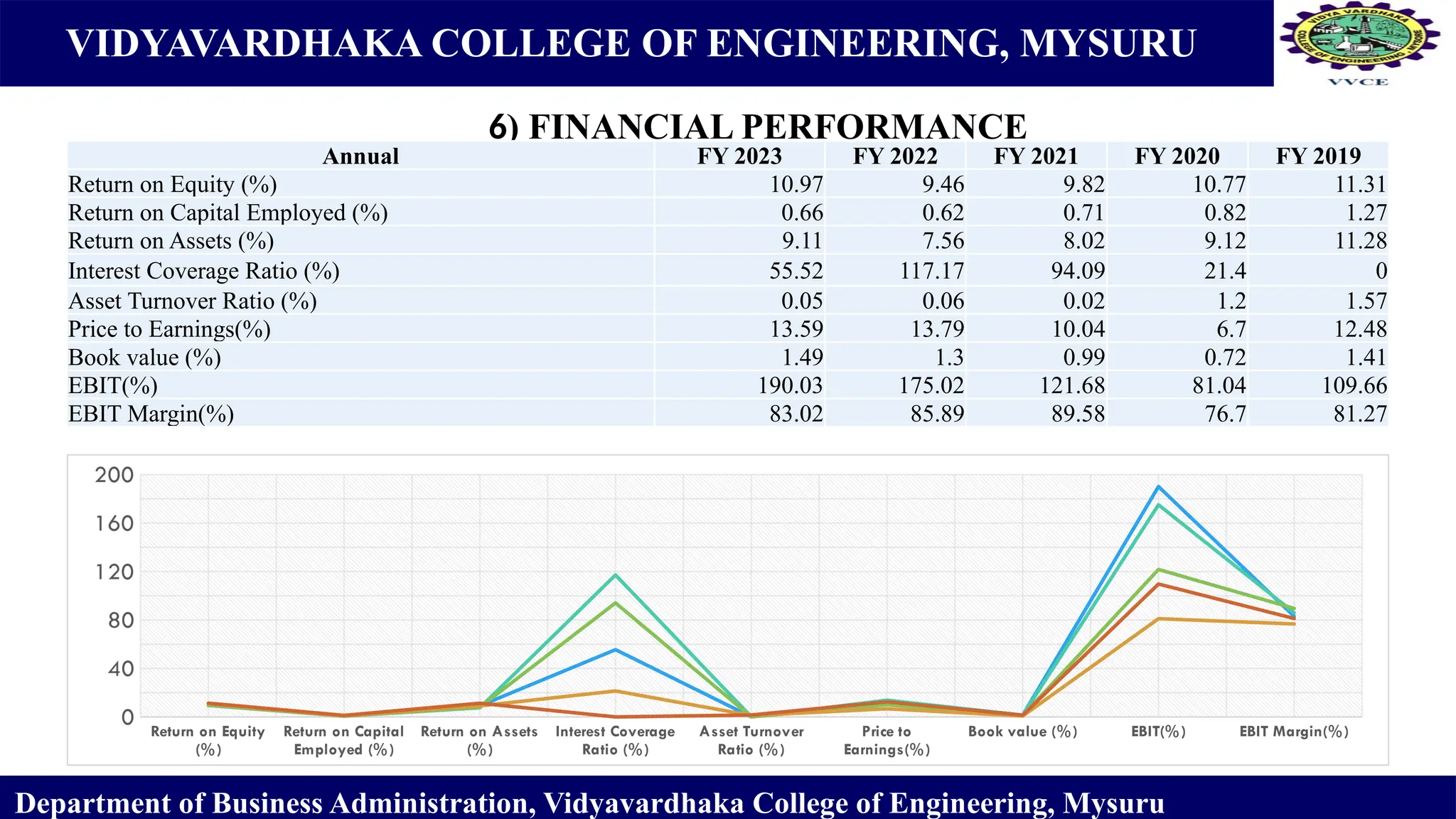

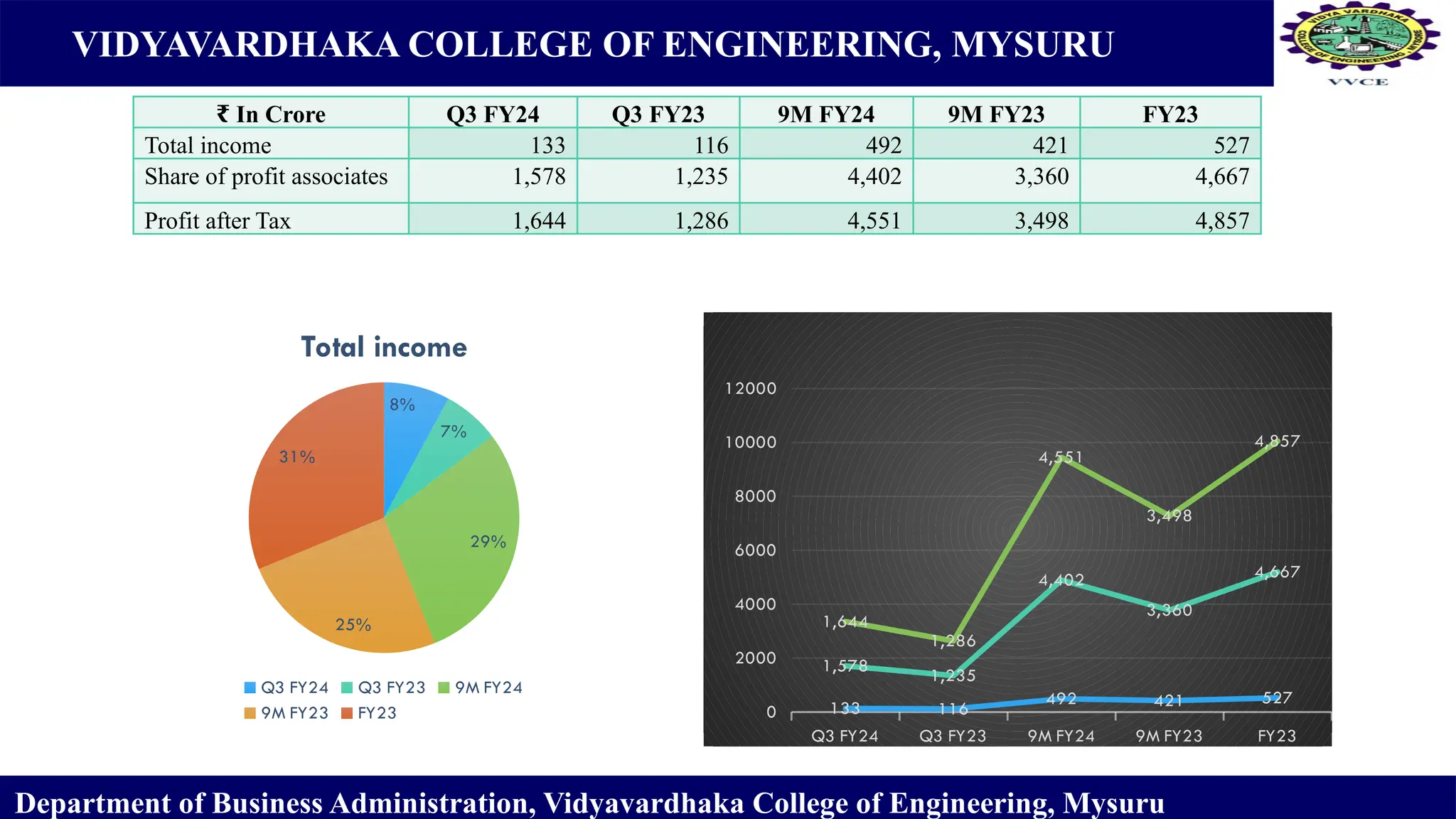

Bajaj Holdings & Investment Ltd (BHIL) is an India-based investment company with significant stakes in Bajaj Auto Ltd, Bajaj Finserv Ltd, and Maharashtra Scooters Ltd, focusing on earning returns through dividends and profits. The company's vision prioritizes innovation, community engagement, and cultural heritage preservation while operating across various sectors including financial services, automotive, and insurance. With a market cap of $10.81 billion as of April 2024, BHIL demonstrates steady financial performance and is recognized for strong corporate governance practices.