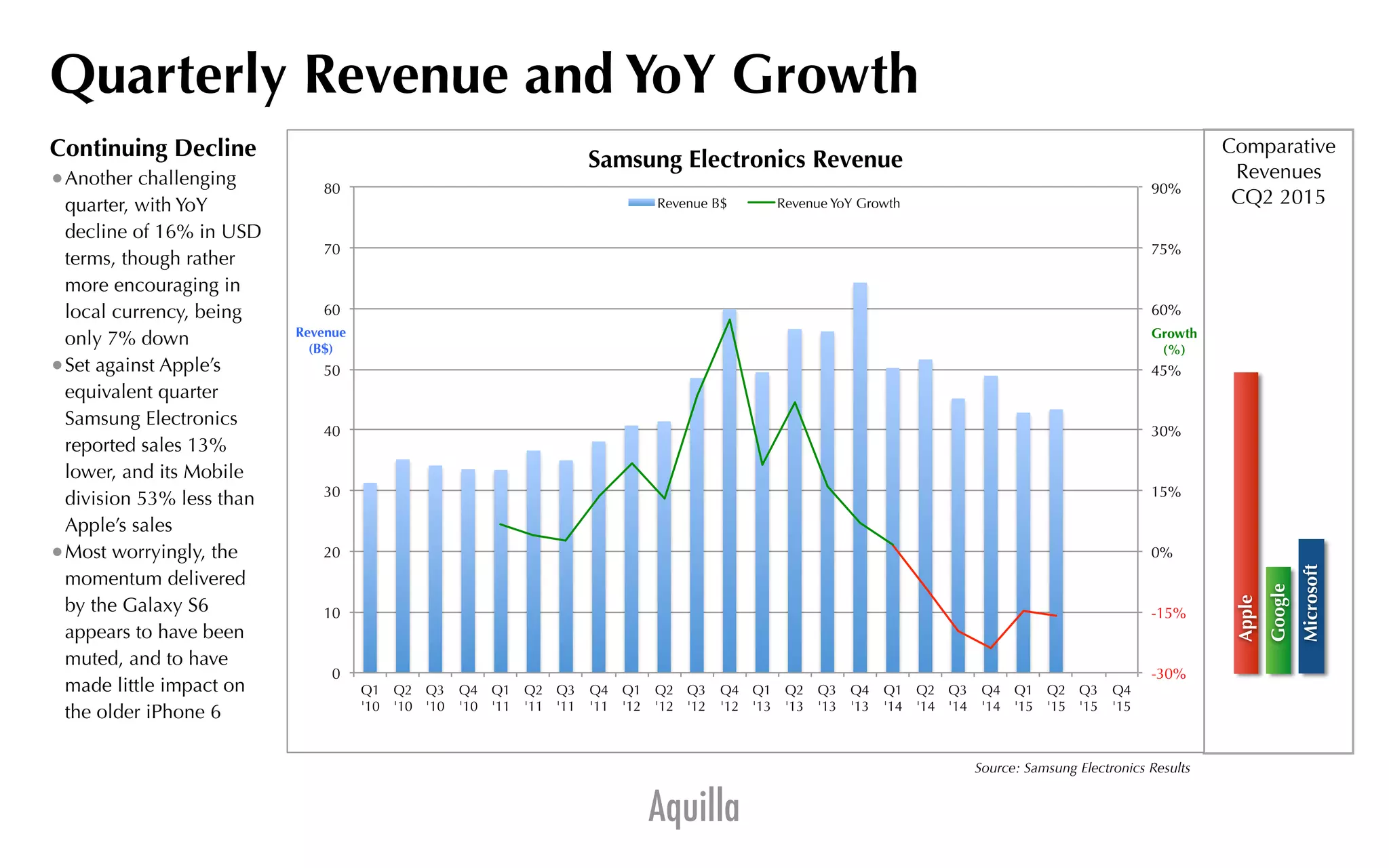

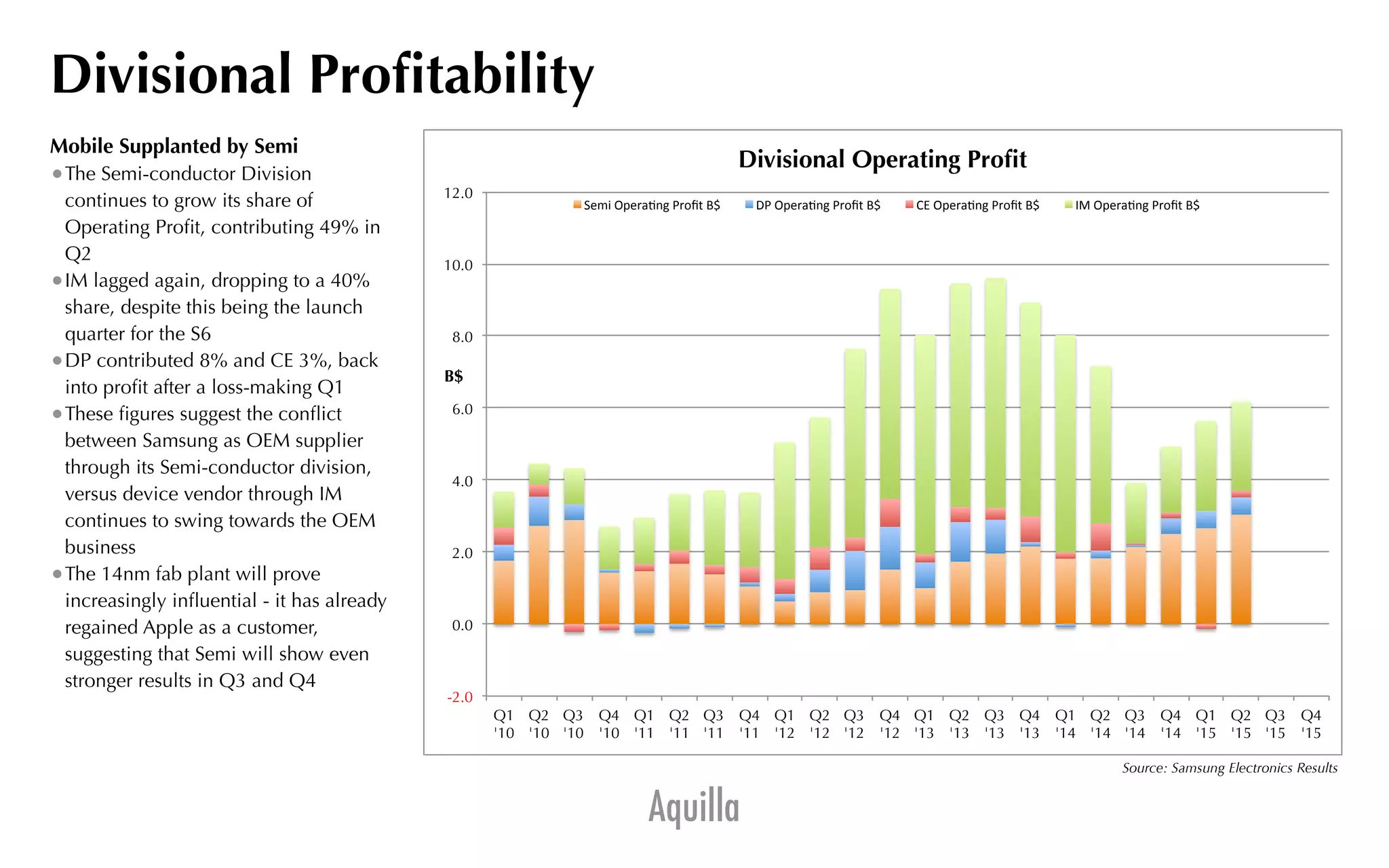

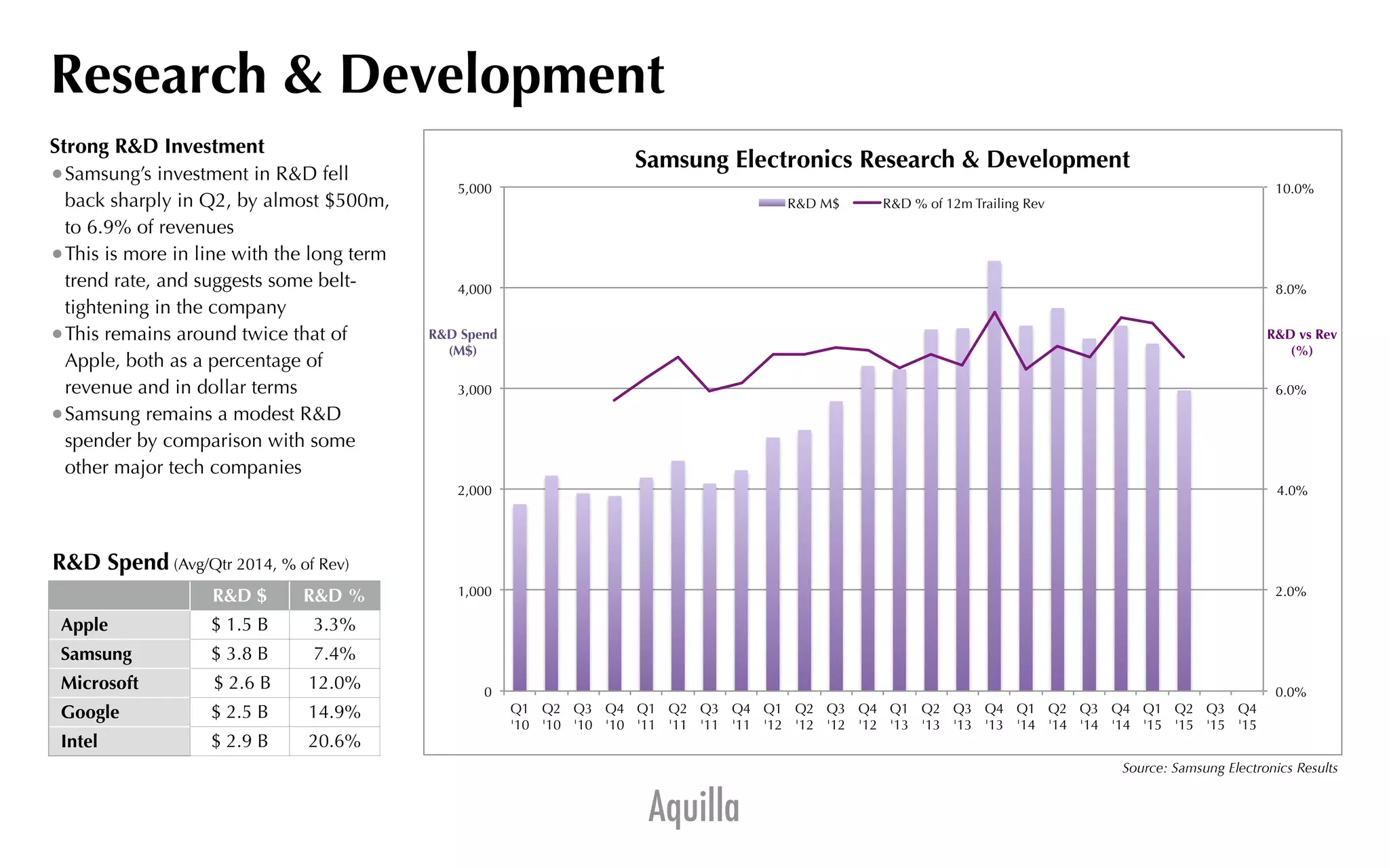

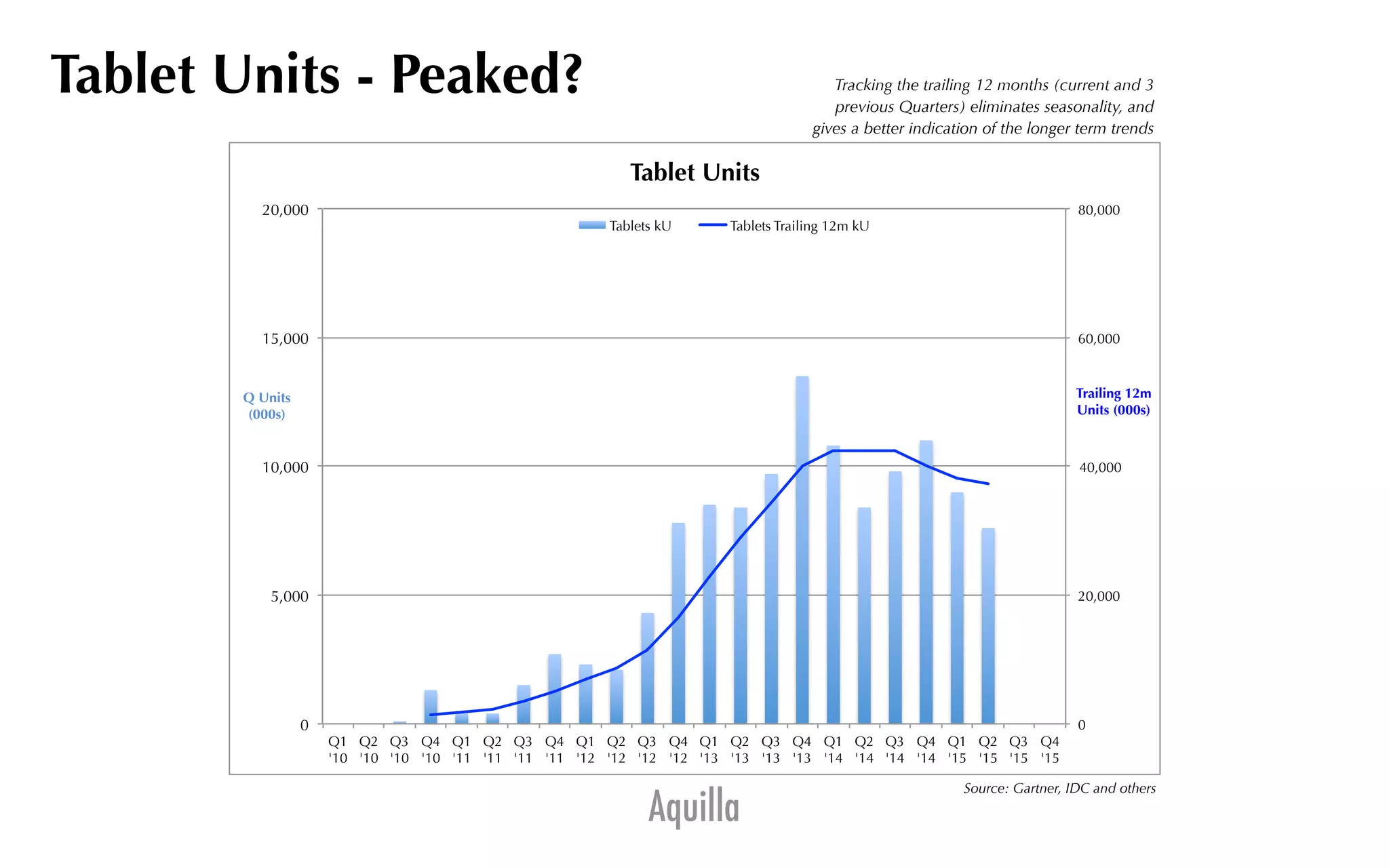

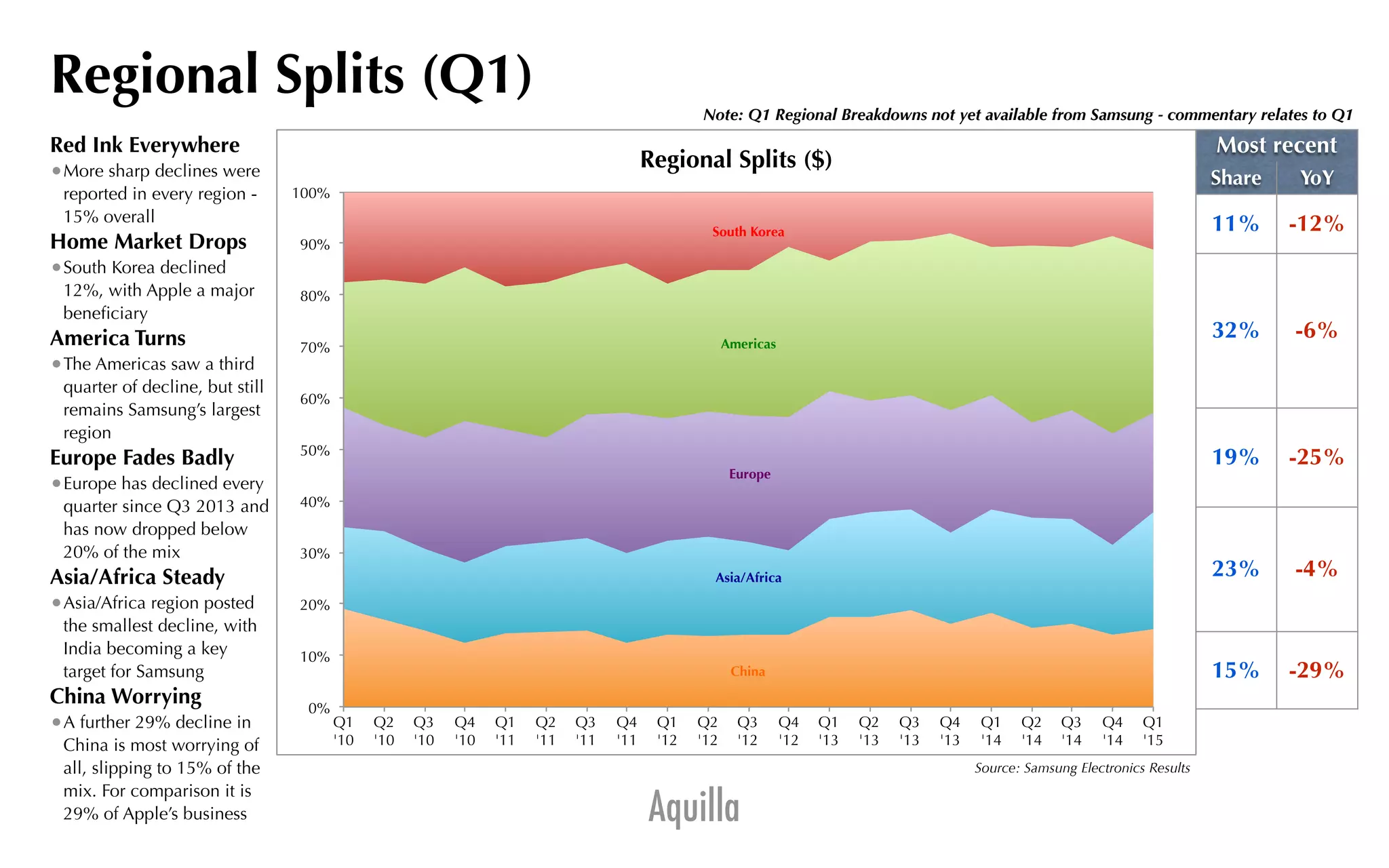

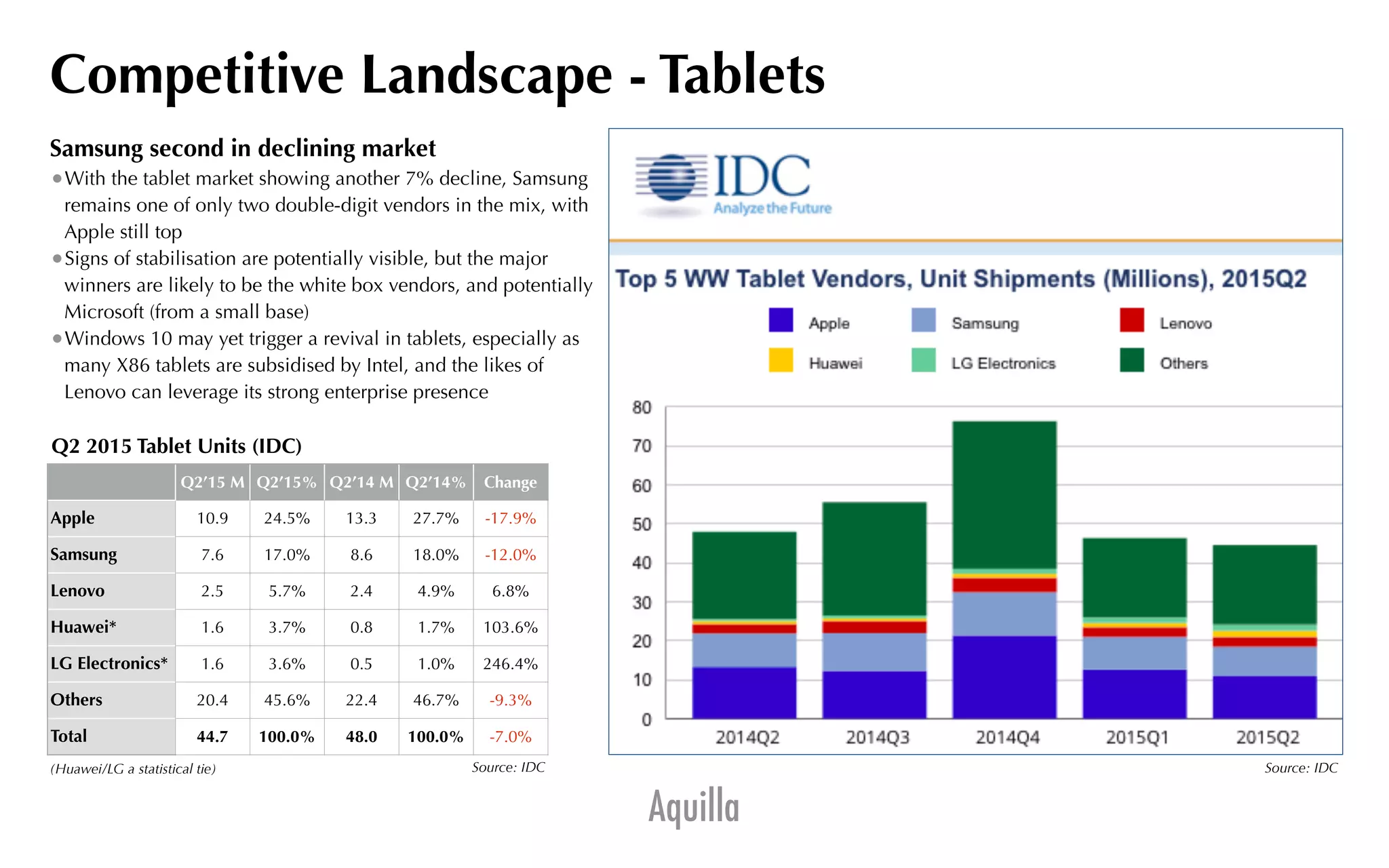

Samsung Electronics experienced a 16% year-over-year revenue decline in Q2 2015, attributed to weak performance in the mobile division despite the launch of the Galaxy S6. The semiconductor division contributed significantly to the operating profit, further suggesting a shift towards OEM supply over device sales. The company's R&D investment decreased, aligning with long-term trends, while the competitive landscape for tablets saw Samsung maintaining a second-place position amid an overall market decline.