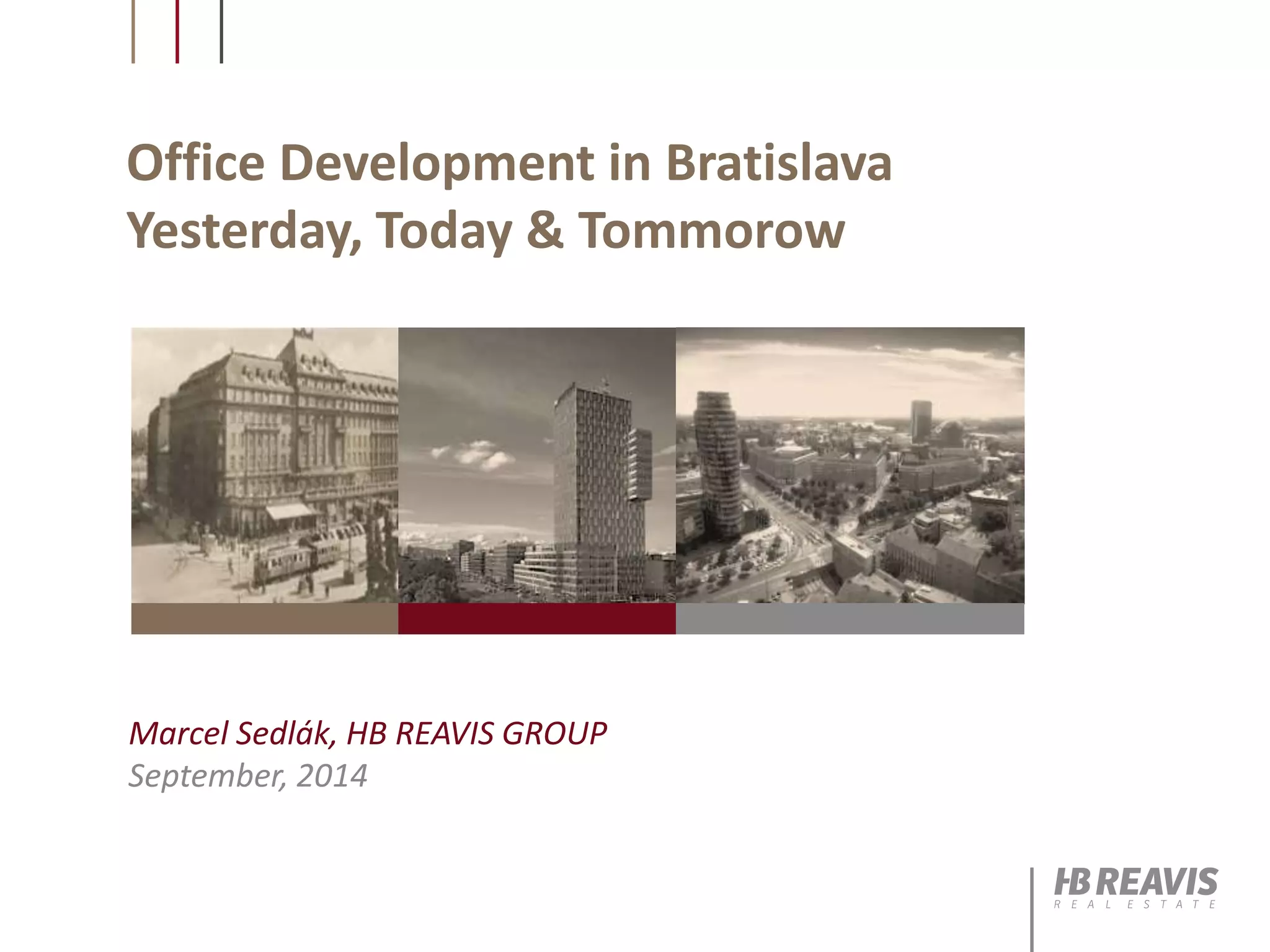

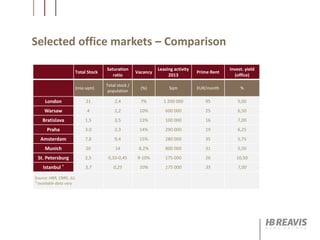

This document summarizes the development of the office market in Bratislava, Slovakia from 1989 to the present. It discusses how the market started with refurbishments and built-to-suit developments due to the lack of modern commercial space after political changes in 1989. Two pioneering speculative office projects from 1997-1999 and 2003-2006 demonstrated the potential for non-prelease development and helped establish the real estate development industry. The current Bratislava office market is analyzed in comparison to other European cities, with total stock of 1.5 million sqm and a vacancy rate of 13%. Looking ahead, the document forecasts continued development of around 80,000 sqm of new office space annually, with a stronger focus on