Embed presentation

Download to read offline

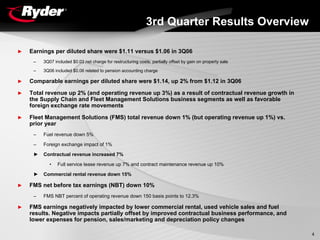

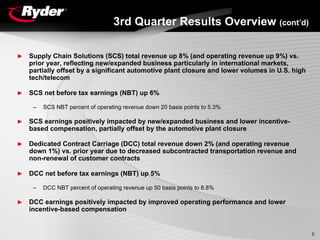

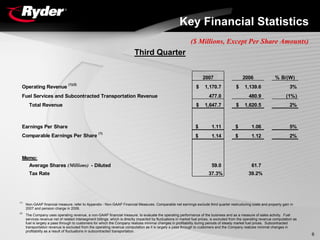

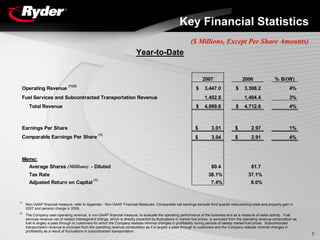

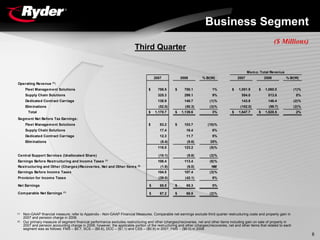

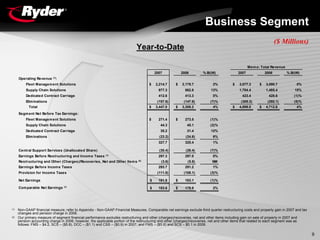

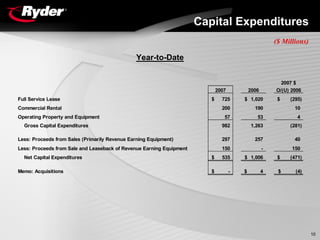

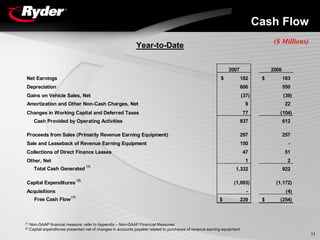

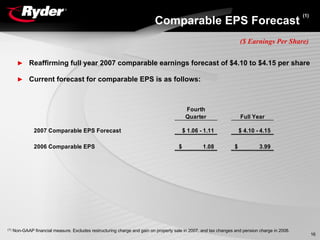

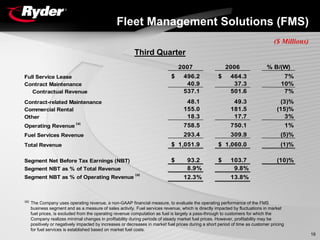

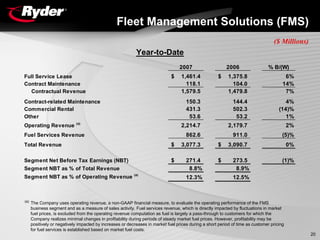

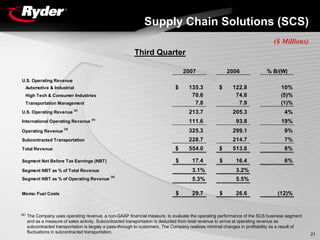

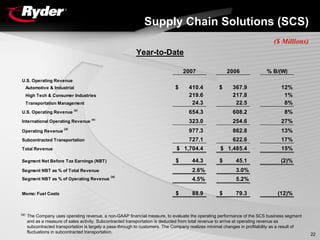

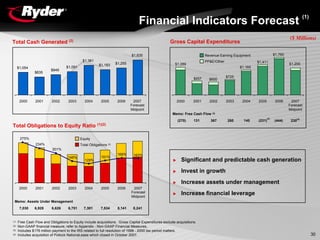

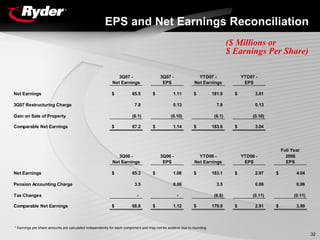

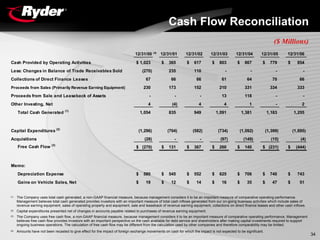

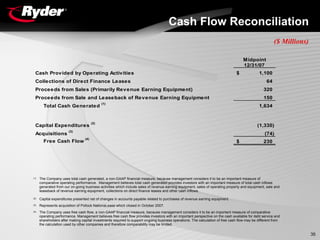

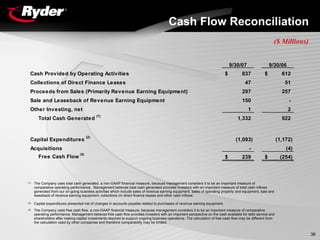

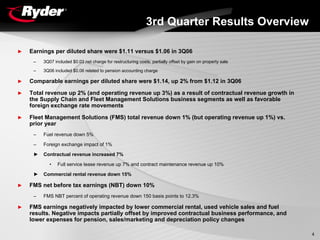

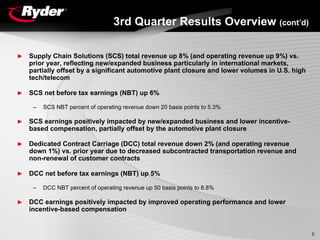

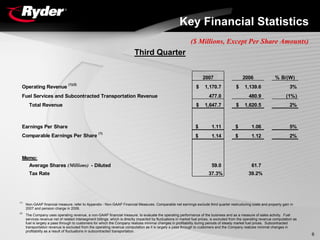

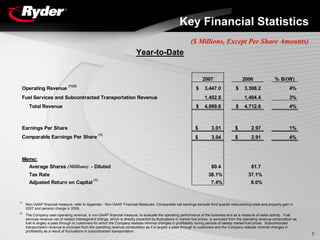

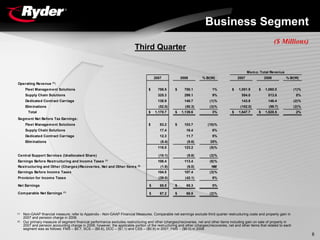

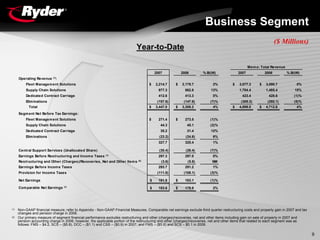

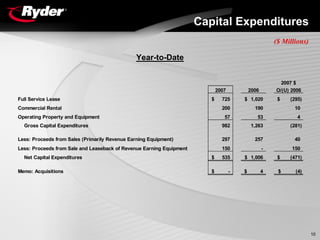

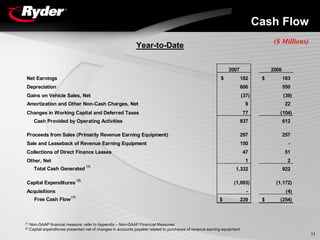

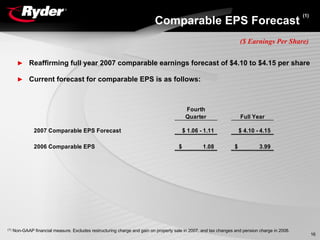

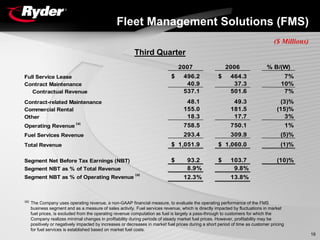

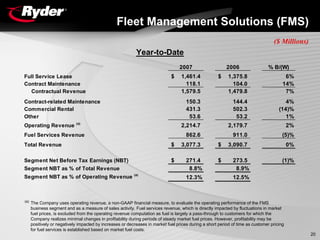

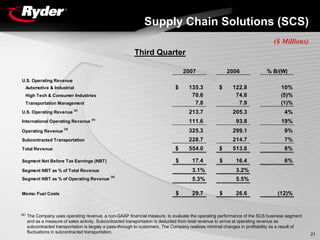

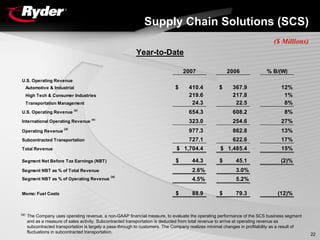

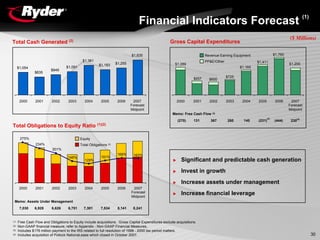

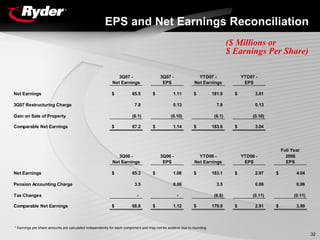

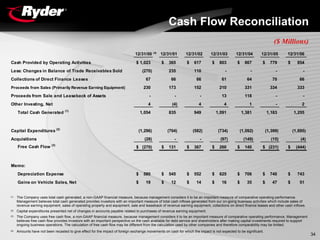

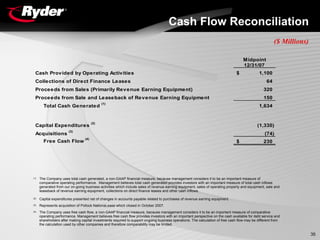

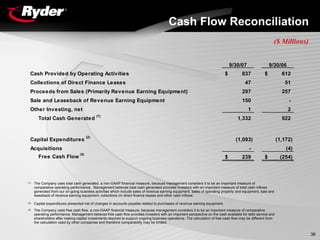

- Third quarter earnings per share were $1.11, up 5% from prior year. Comparable earnings per share were $1.14, up 2%. - Fleet Management Solutions revenue was down 1% due to lower fuel and commercial rental revenue, but contractual revenue increased. Earnings were down 10% due to commercial rental declines. - Supply Chain Solutions revenue was up 8% on new business, but earnings grew 6% due to lower incentive compensation offsetting an automotive plant closure. - Cash flow from operations was $837 million year-to-date, up from $612 million prior year. Net capital expenditures were $535 million year-to-date, down from $1.