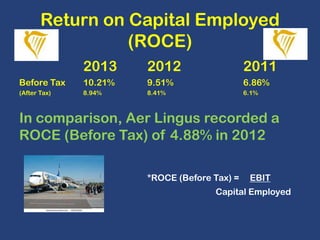

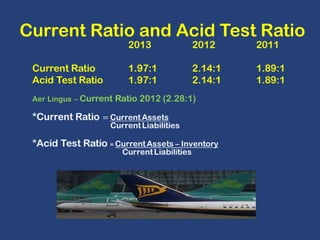

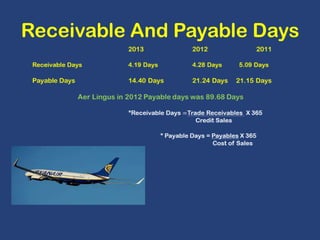

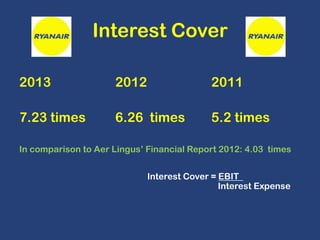

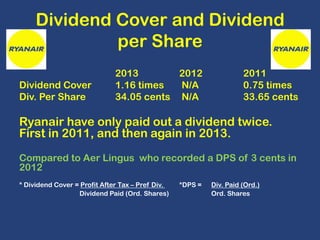

This document analyzes the financial performance and ratios of Ryanair Holdings PLC, a major European airline, for the years 2013, 2012, and 2011. It includes profitability ratios like gross profit margin and net profit margins, growth ratios, liquidity ratios, gearing ratios, and investor ratios. Key metrics for Ryanair show revenues of €4.9 billion in 2013, over 81 million passengers annually, and profit margins, return on capital employed, and earnings per share that are consistently higher than competitor Aer Lingus.