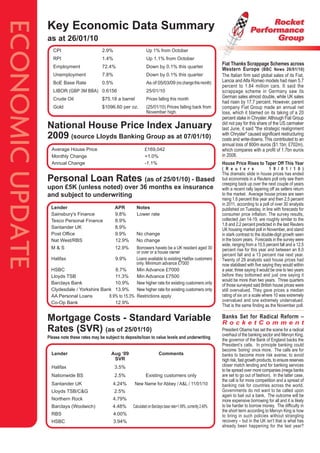

The document discusses the economic outlook as of February 1, 2010, highlighting the challenges businesses face due to recession and the importance of teamwork in overcoming these obstacles. It provides key economic data, including inflation rates, employment status, and housing market trends, while emphasizing the need for effective collaboration and nurturing high-performing teams to improve productivity. Additionally, it touches on the potential for positive economic developments and recovery signs in the UK housing market and suggests strategies for businesses to enhance team dynamics.