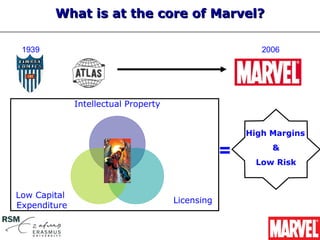

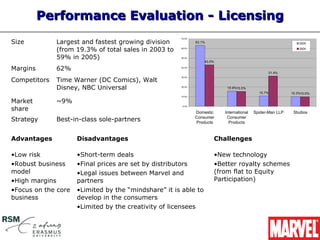

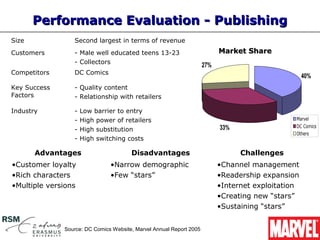

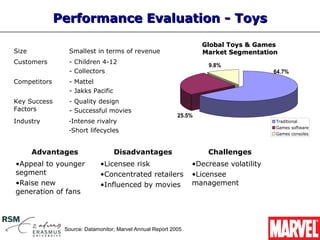

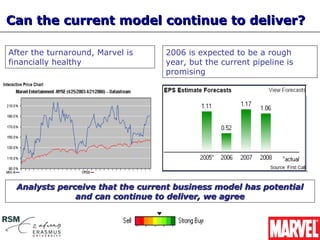

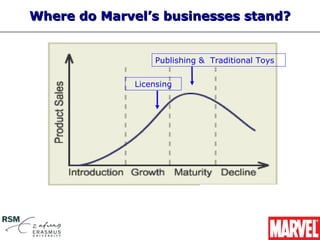

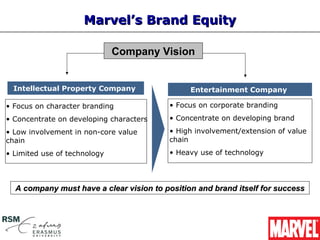

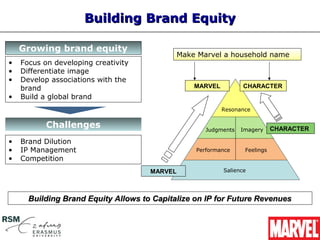

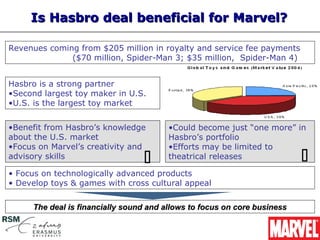

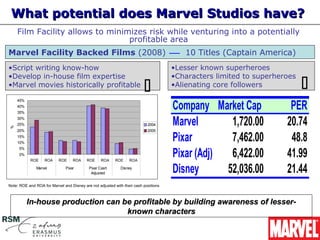

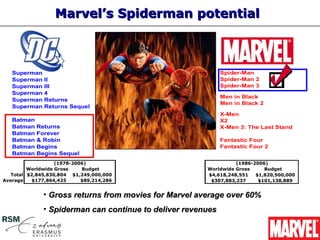

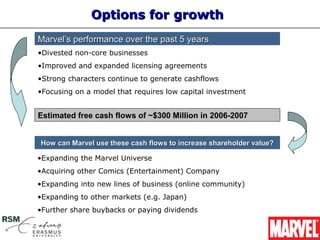

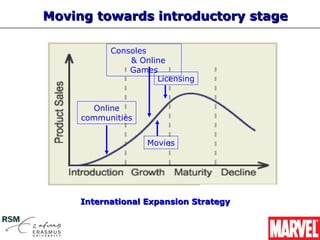

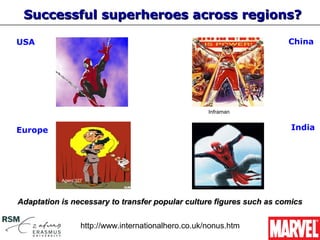

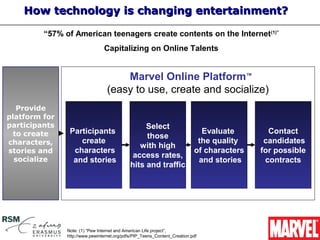

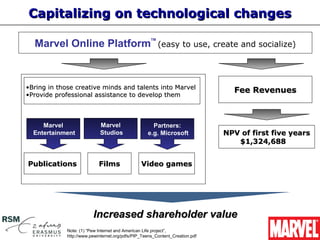

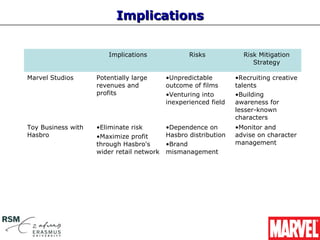

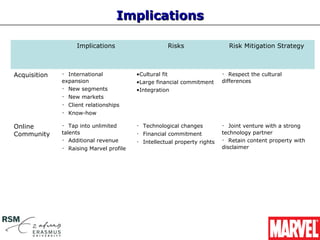

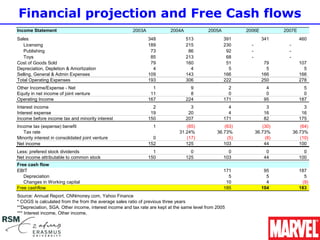

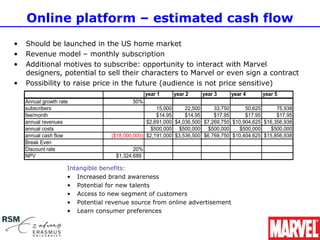

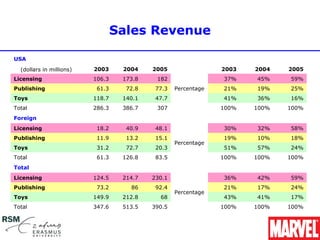

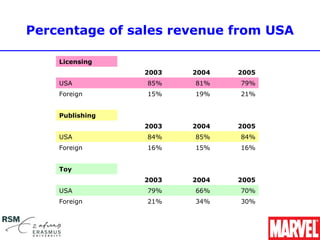

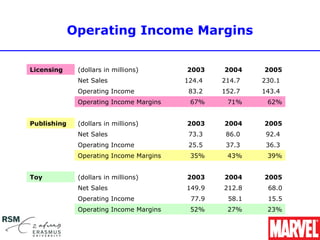

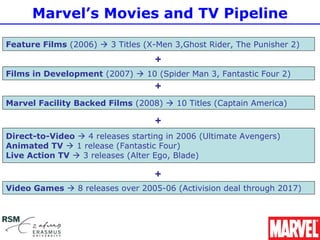

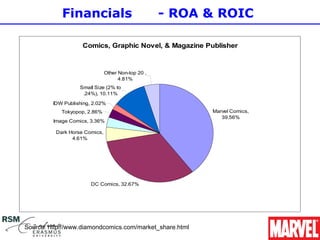

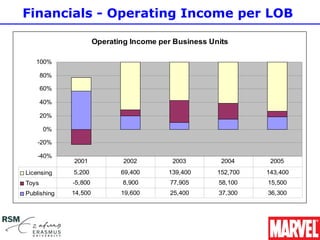

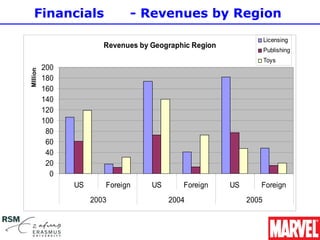

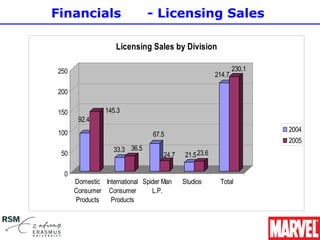

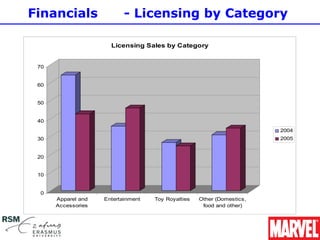

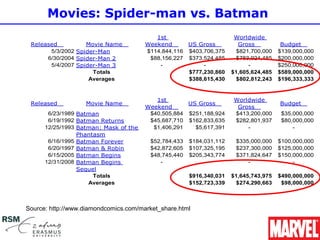

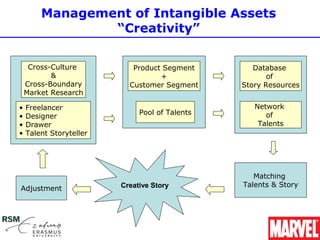

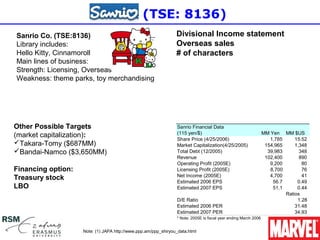

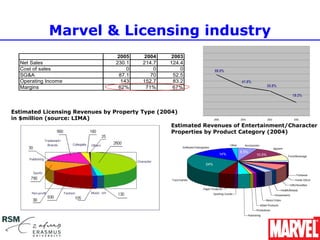

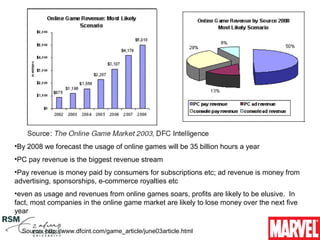

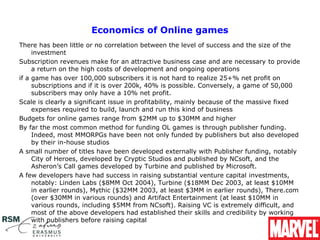

Marvel Entertainment Inc. presents on the company's current business model, lines of business, and opportunities for future growth. The core of Marvel is its intellectual property portfolio of characters. Currently, Marvel generates most of its revenue and high margins through licensing these characters. Management sees opportunities to expand internationally, through partnerships like Hasbro for toys and Marvel Studios for films, and by leveraging the online community. Marvel also has free cash flows that could be used to acquire other companies or pay dividends.