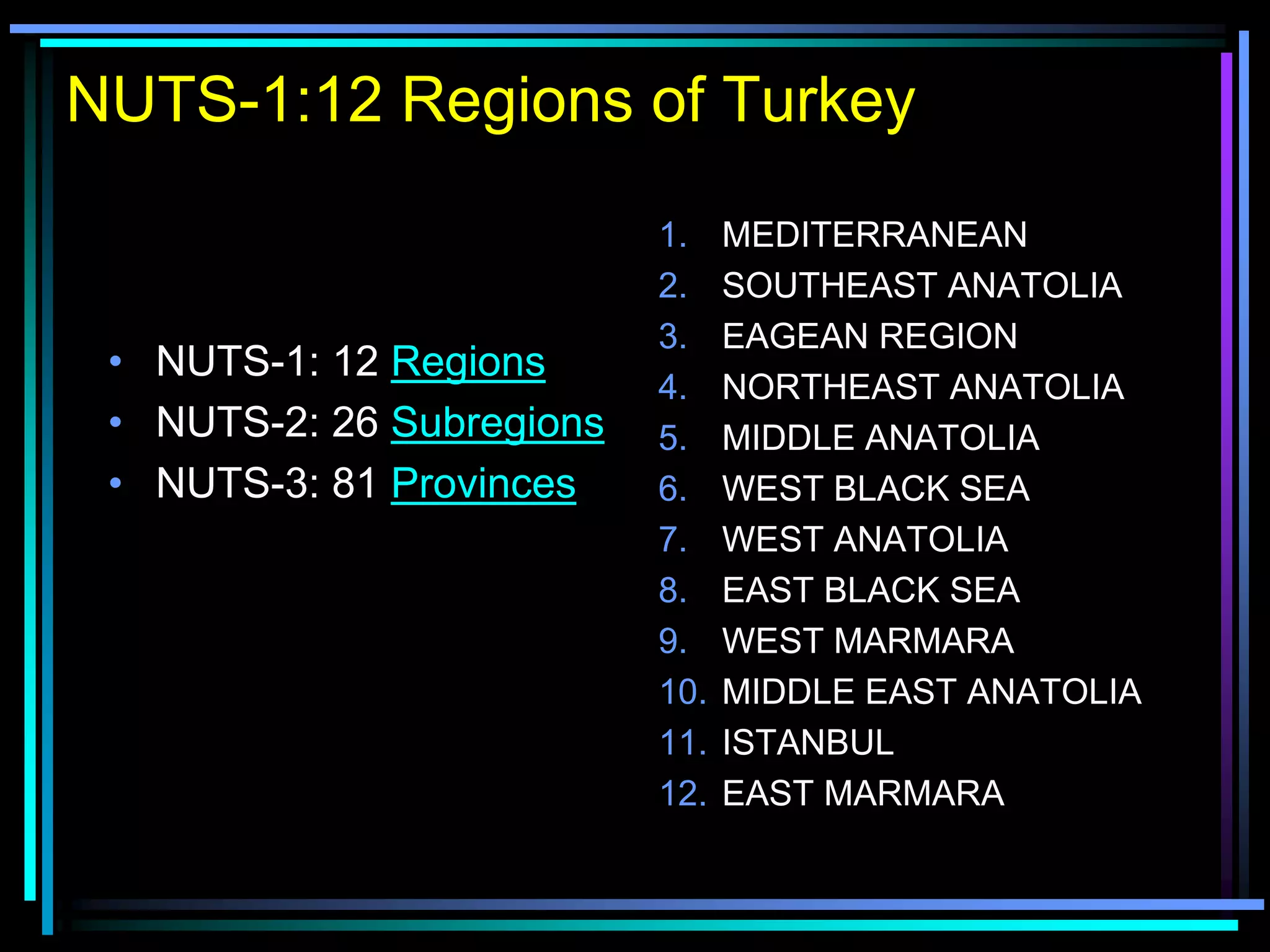

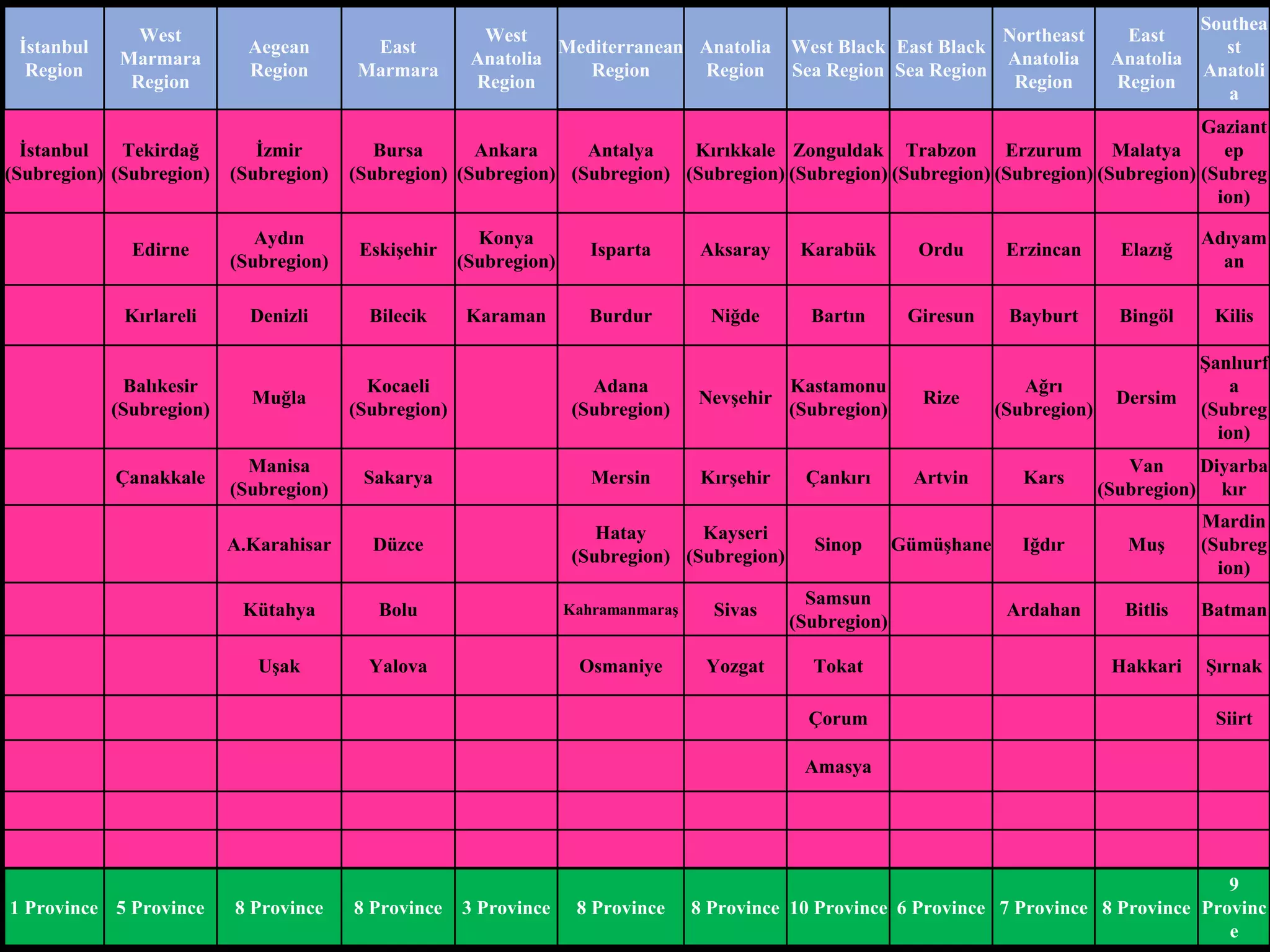

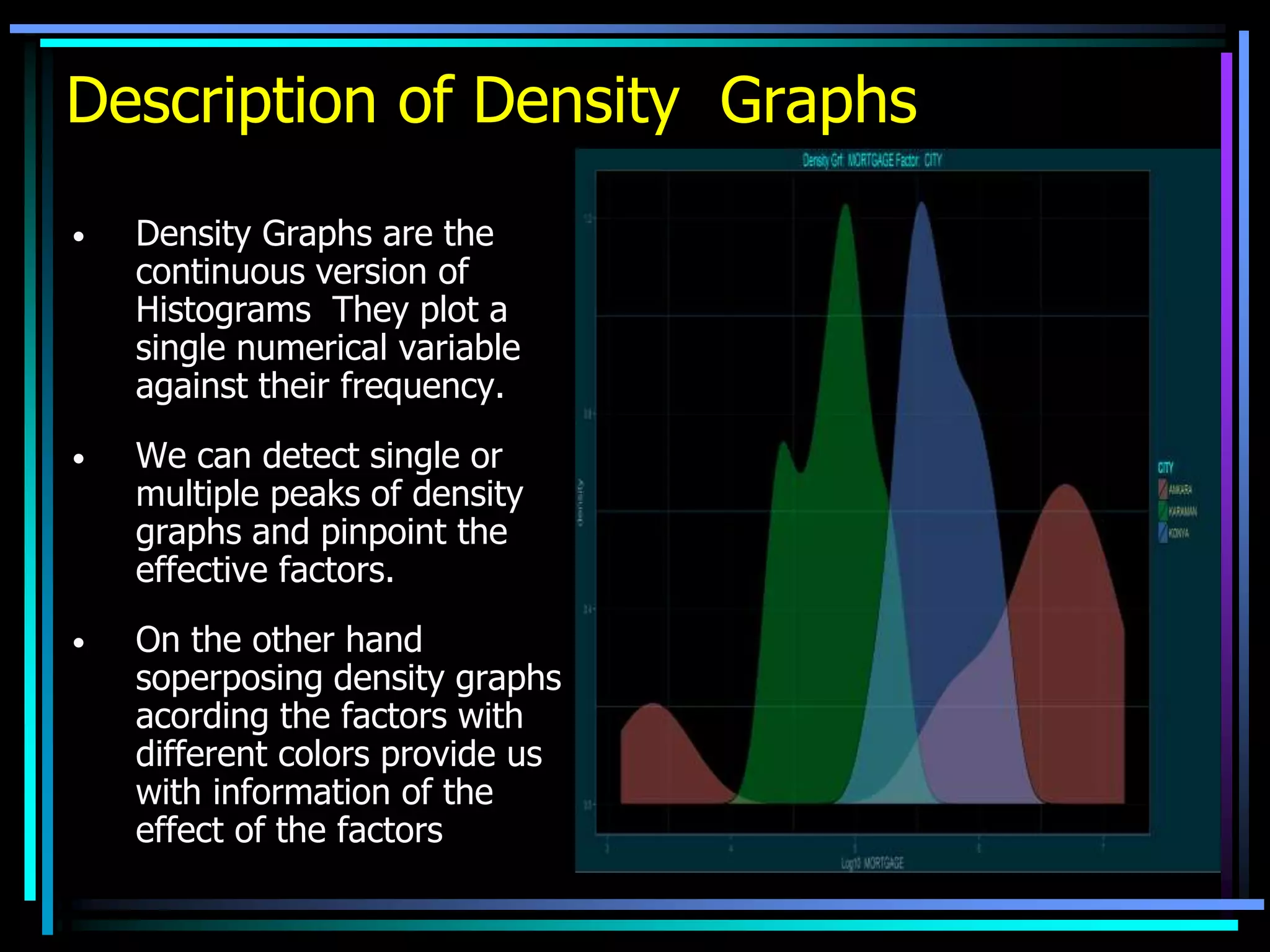

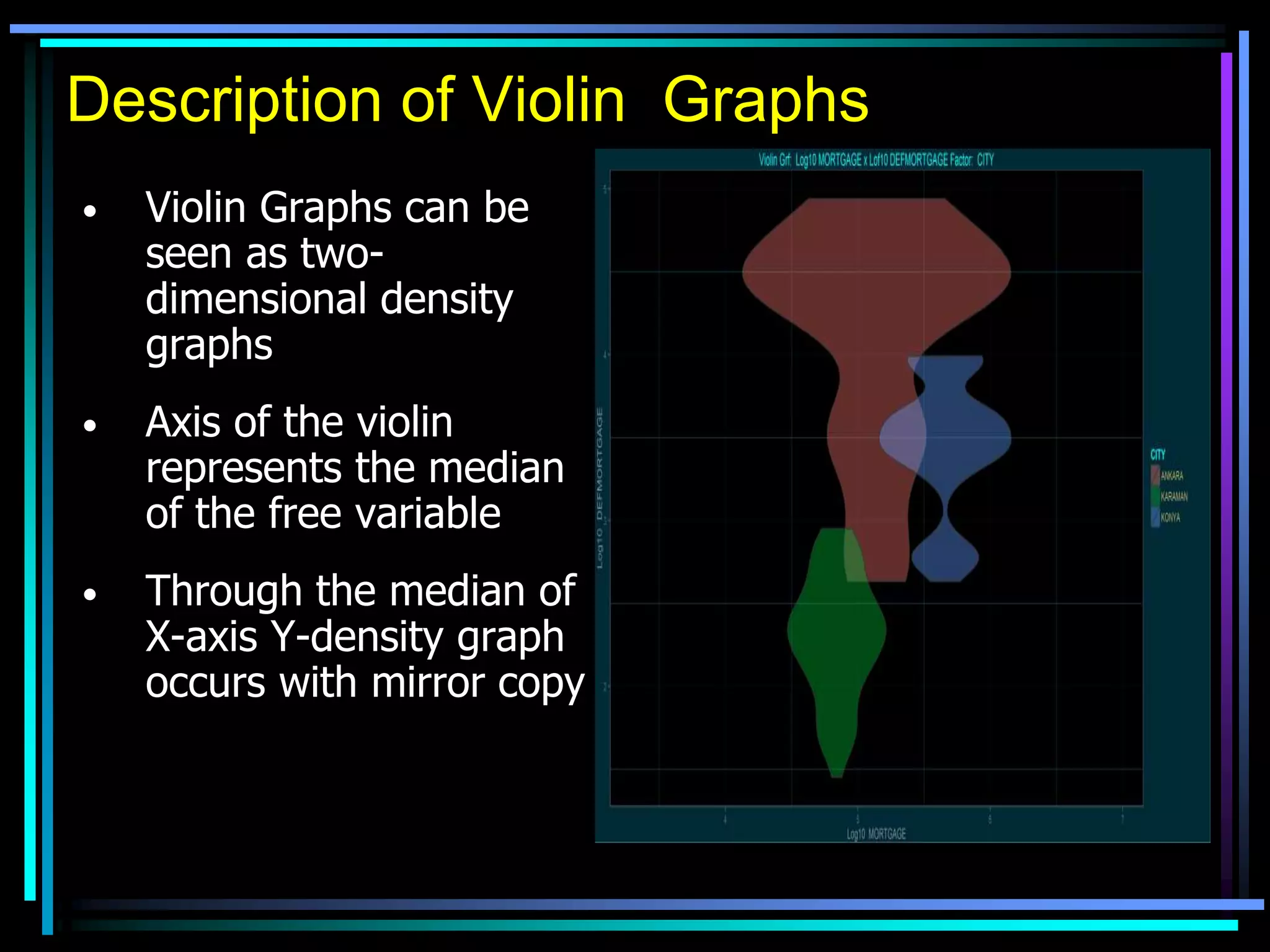

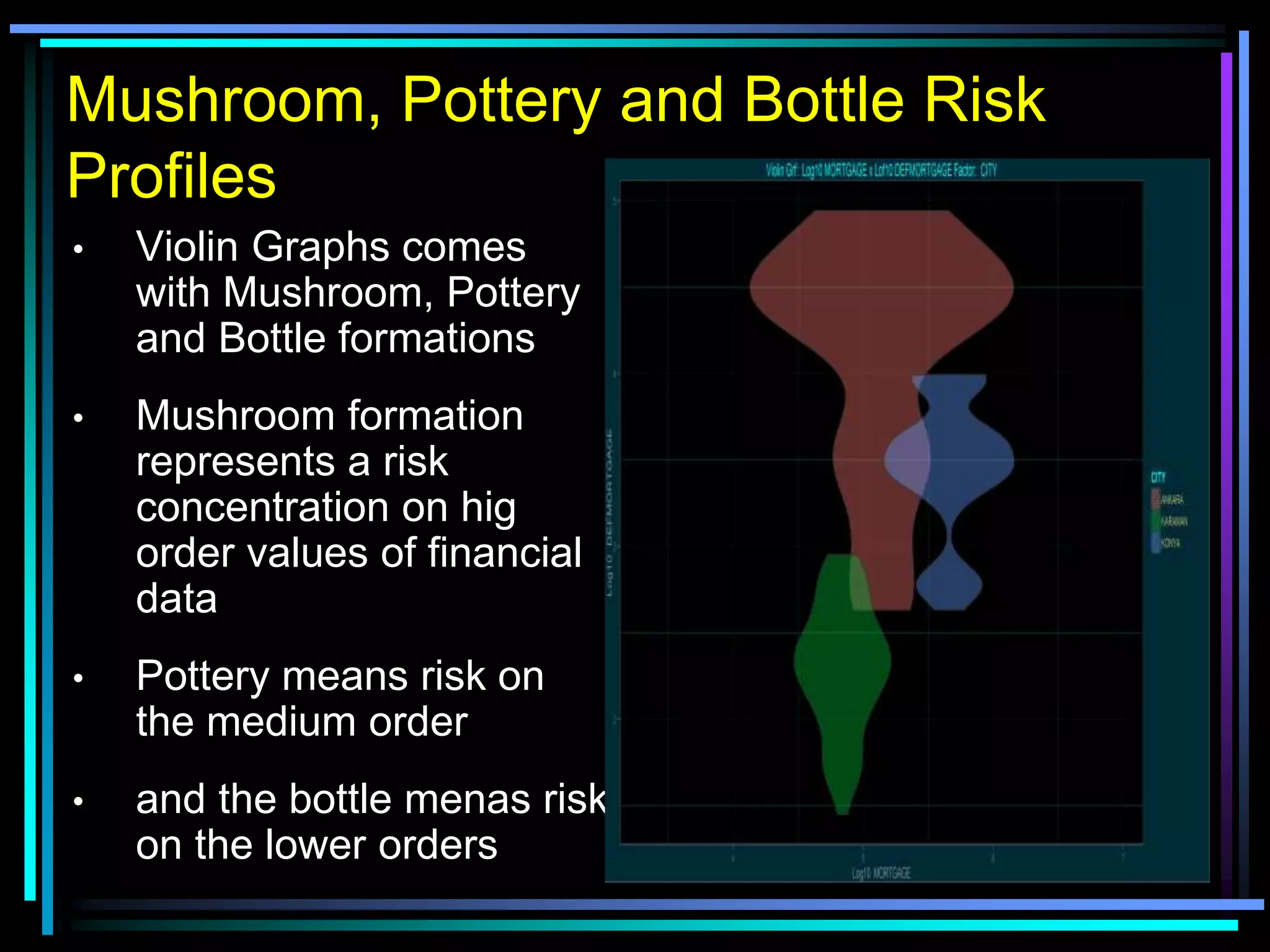

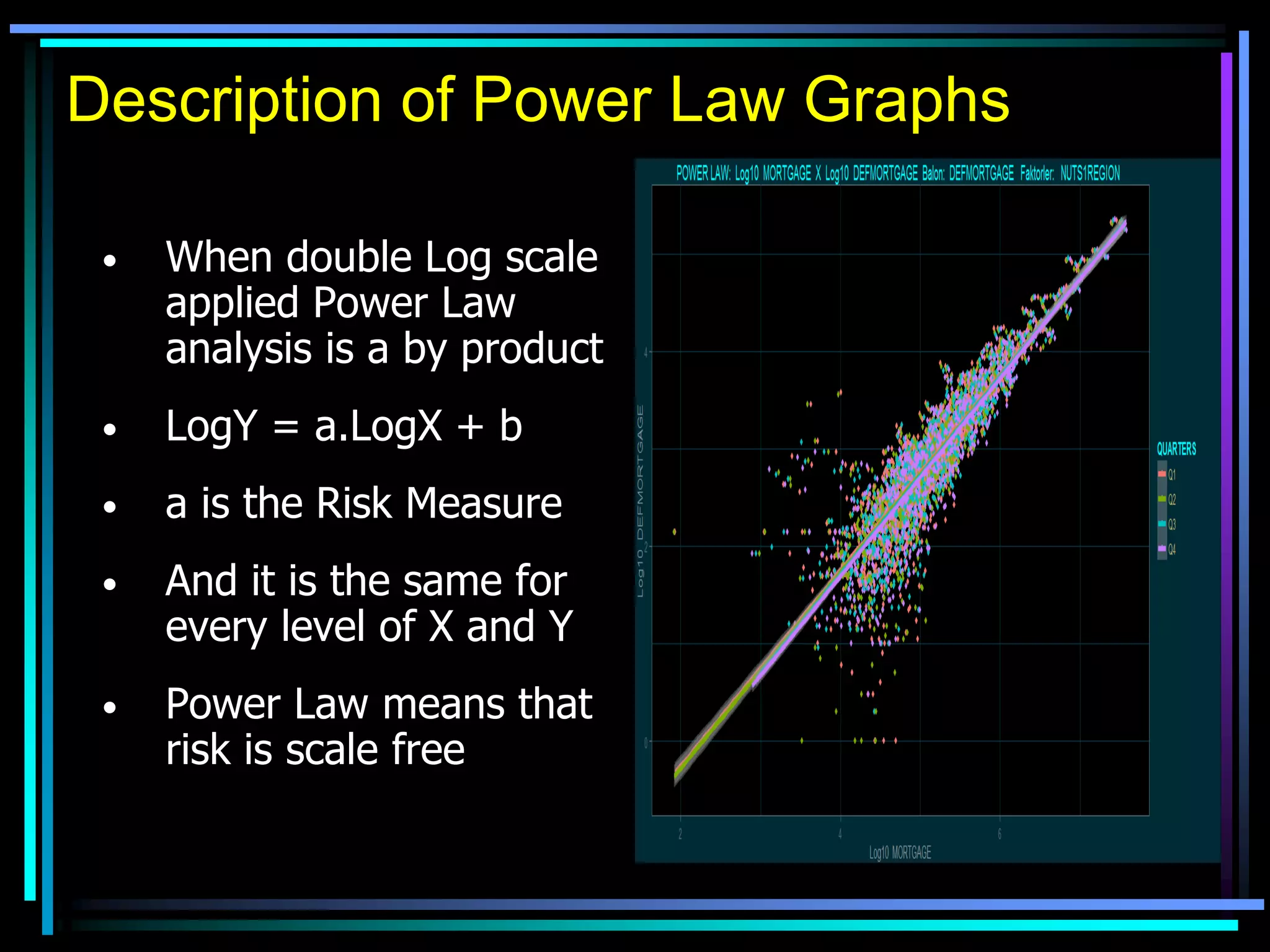

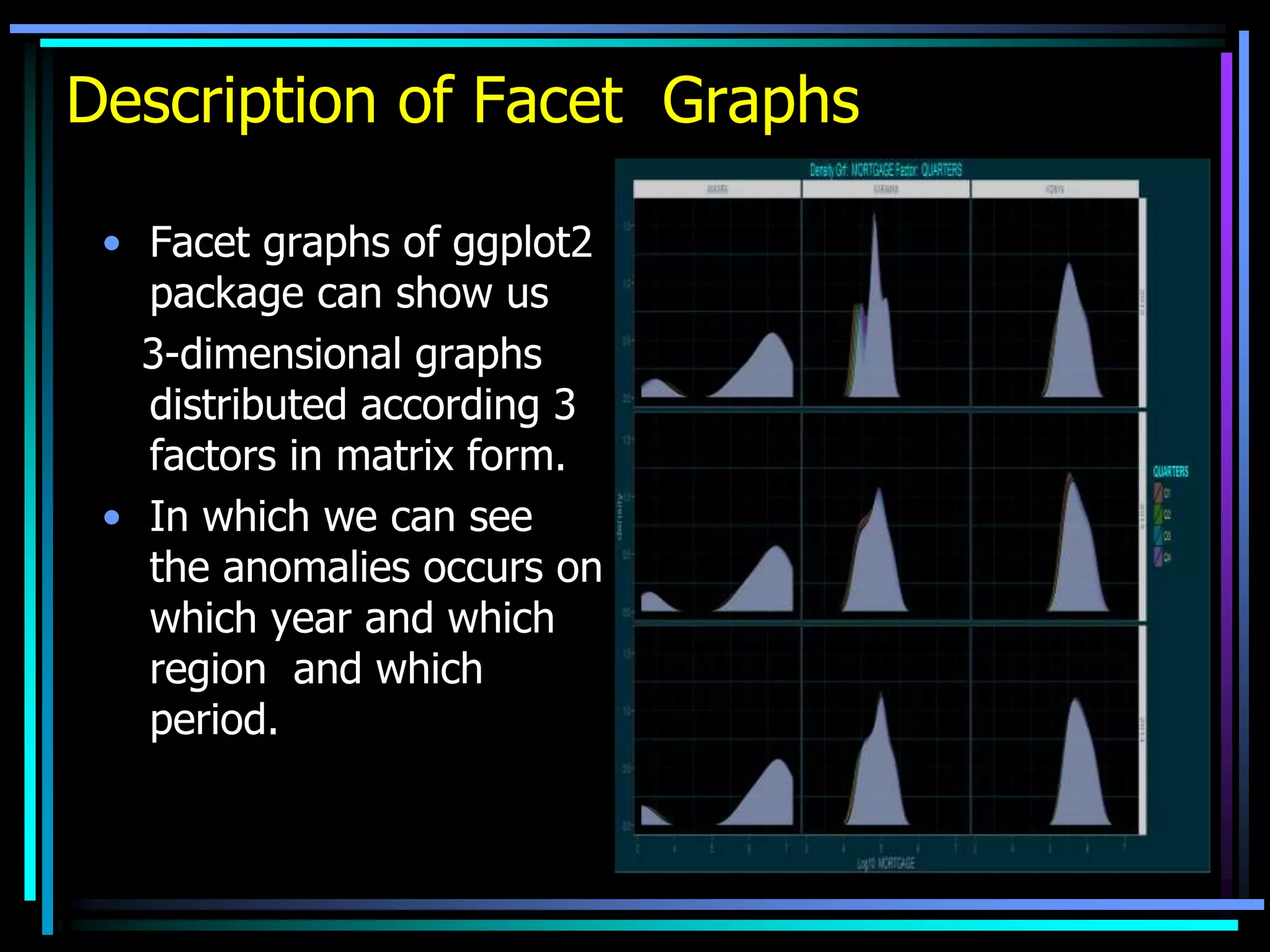

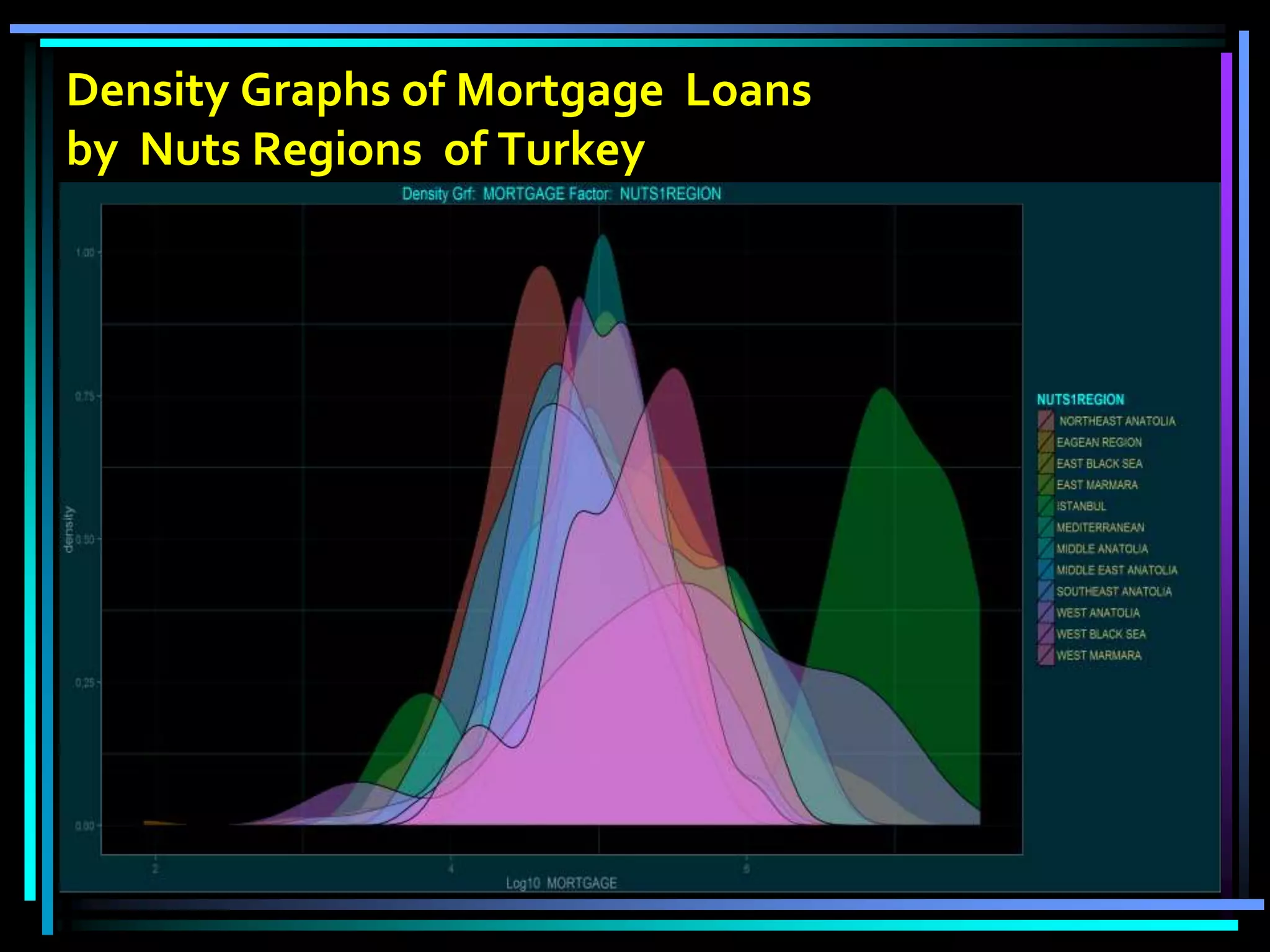

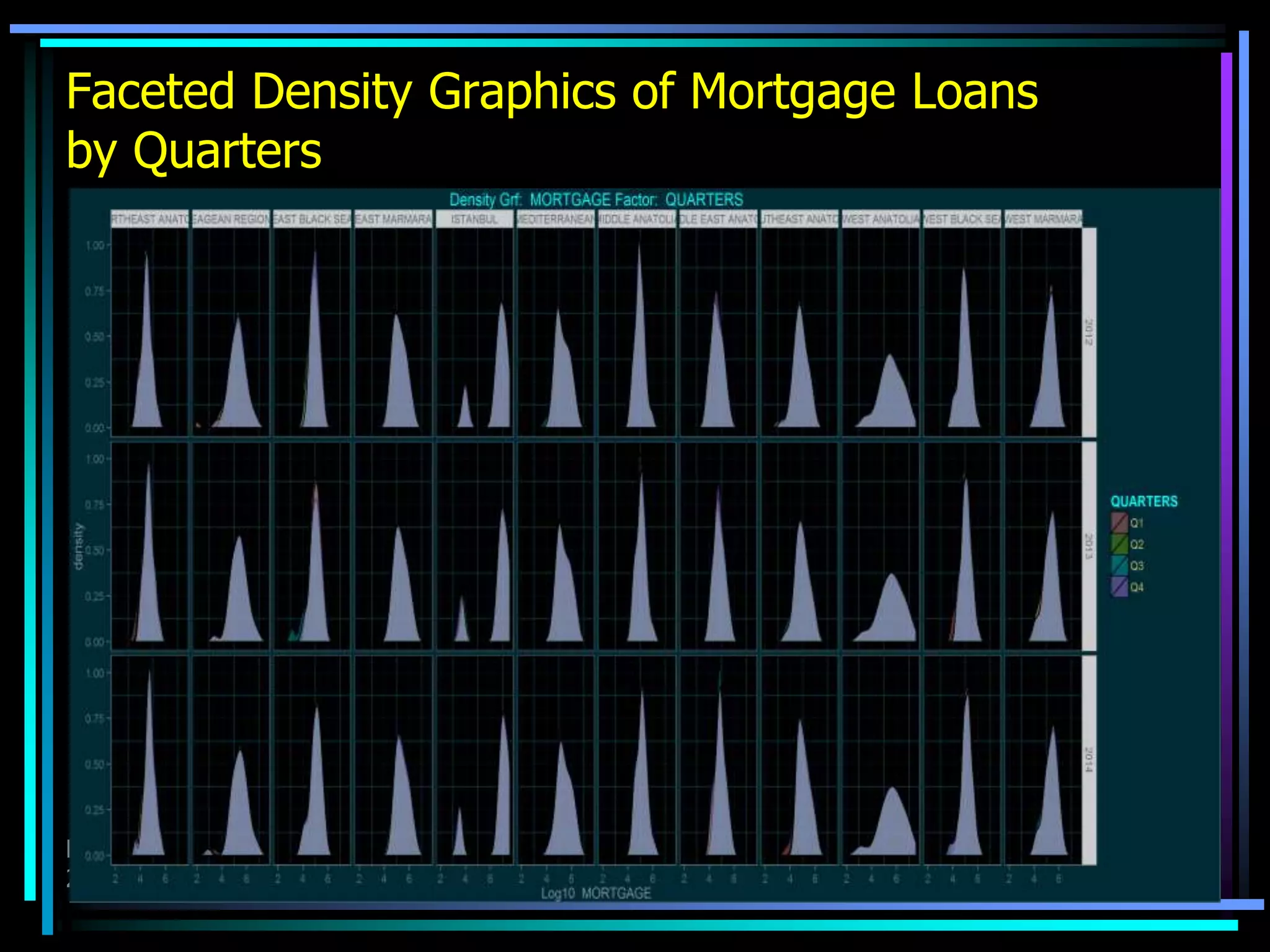

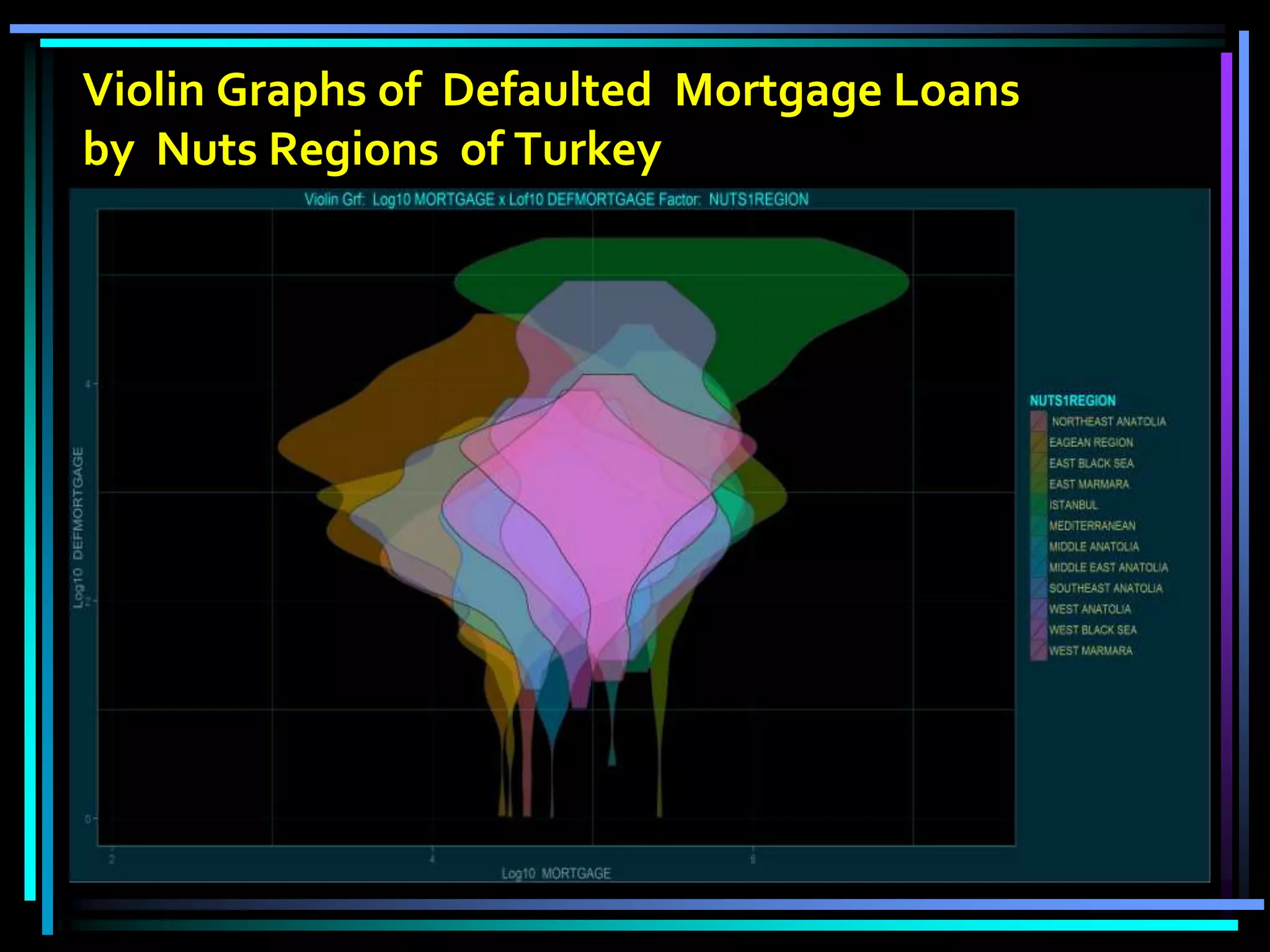

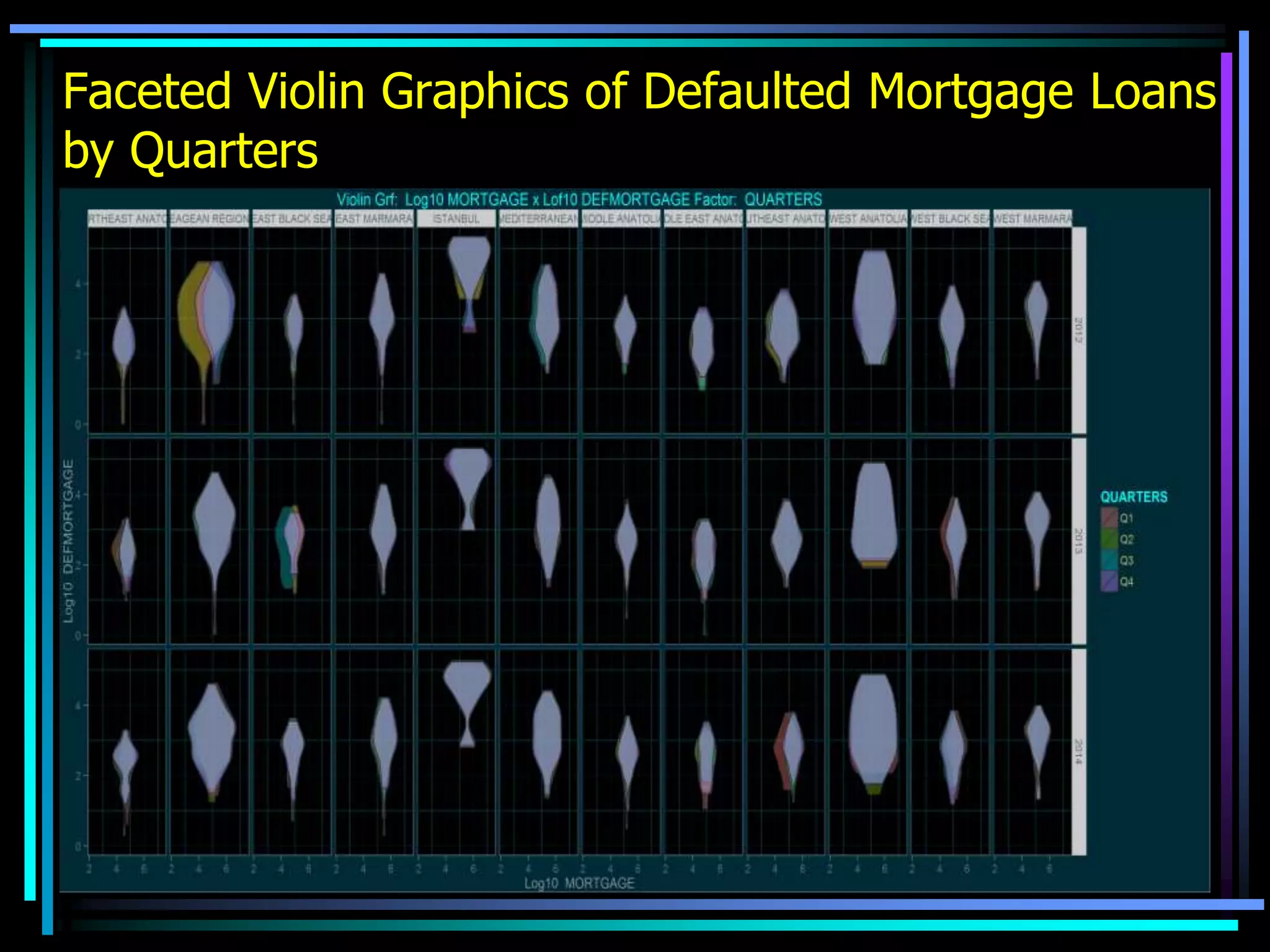

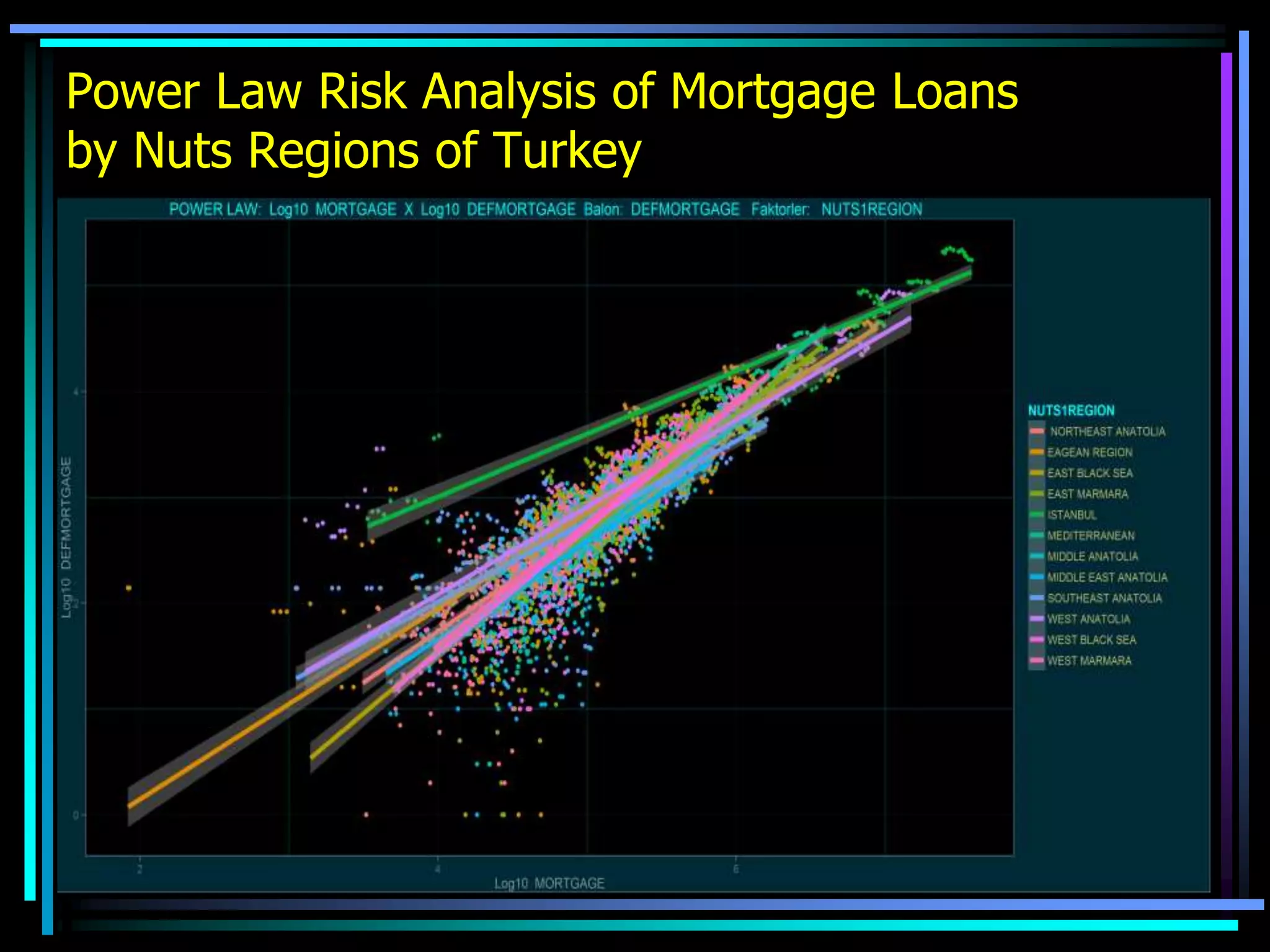

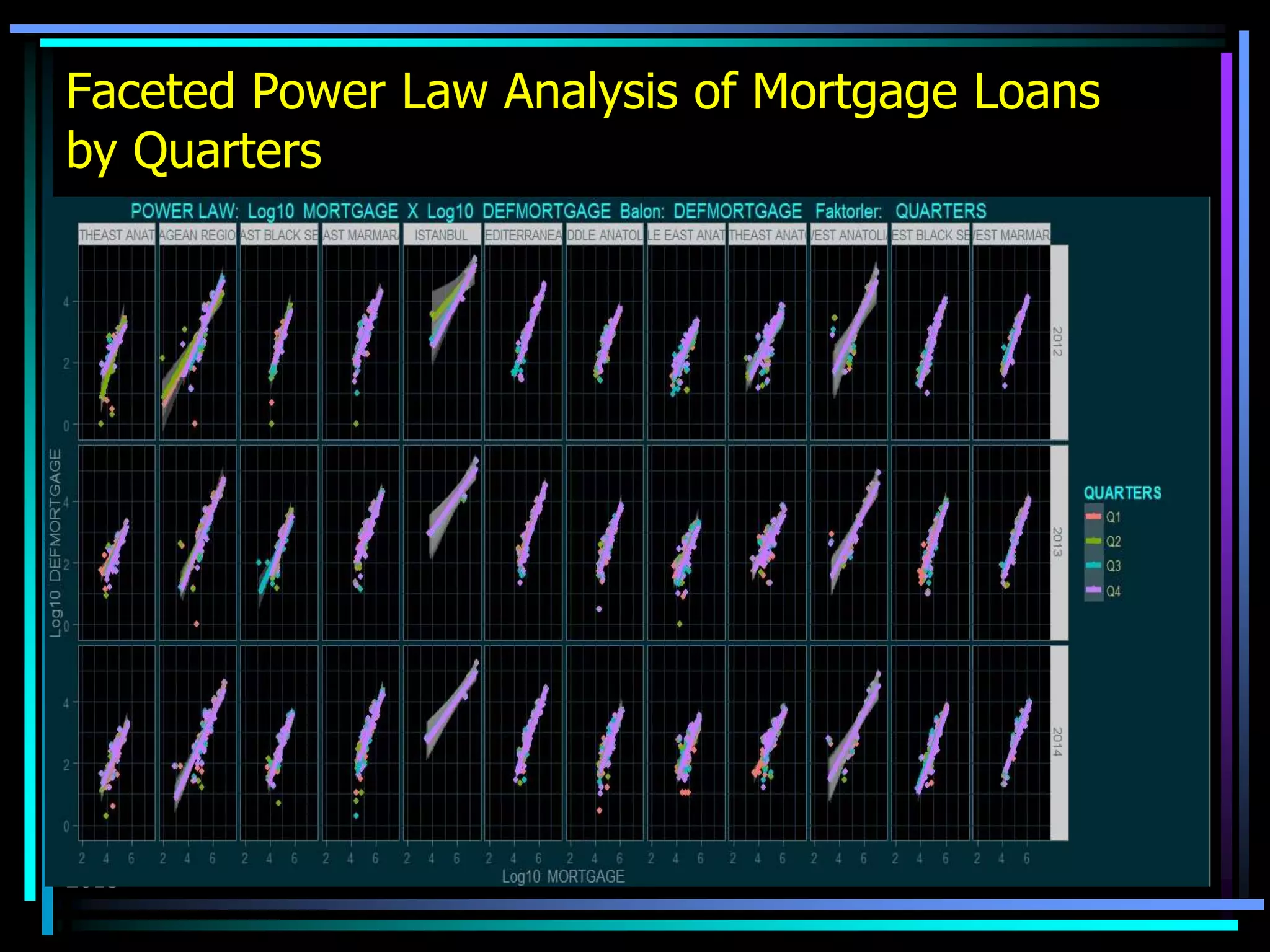

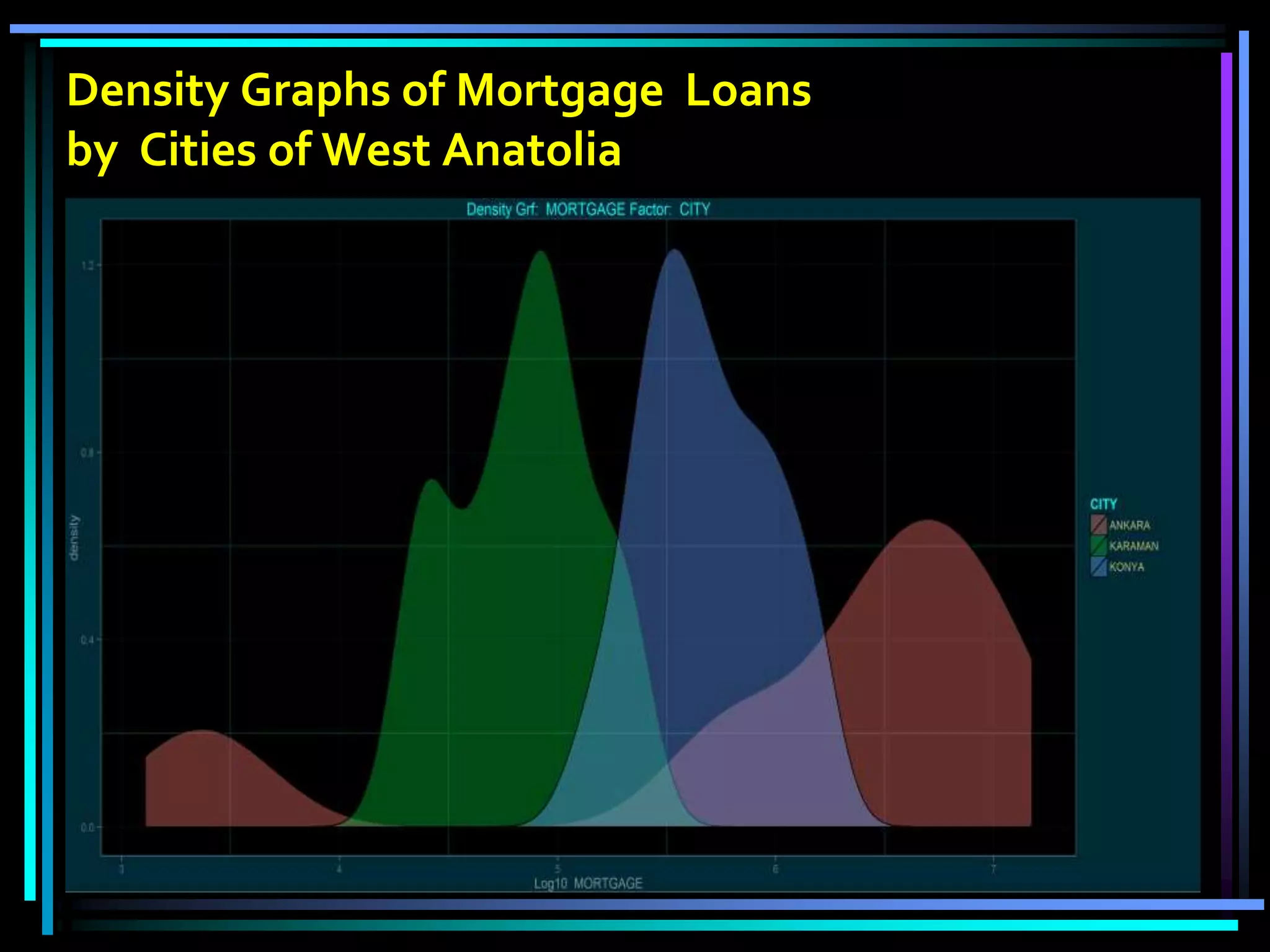

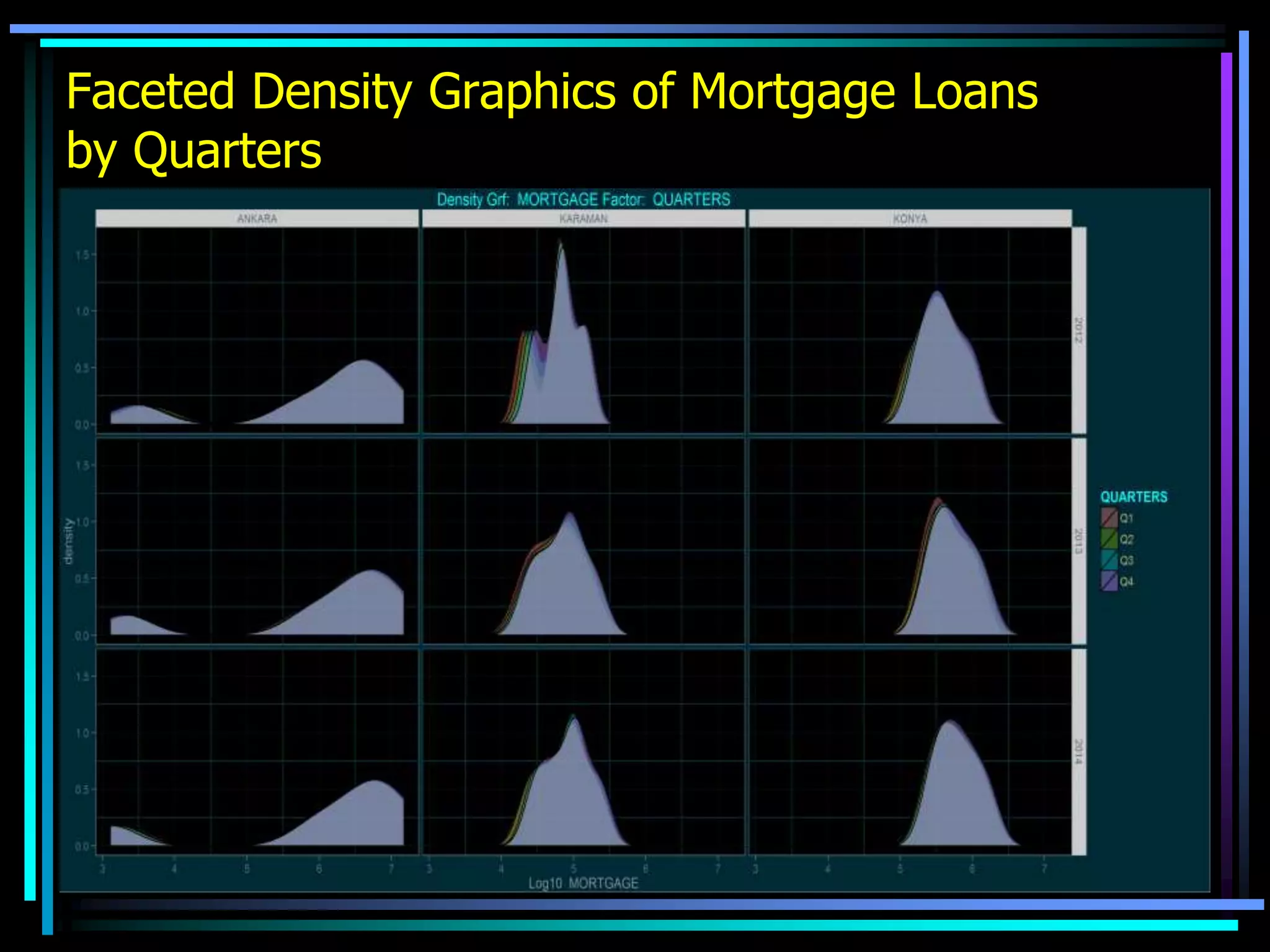

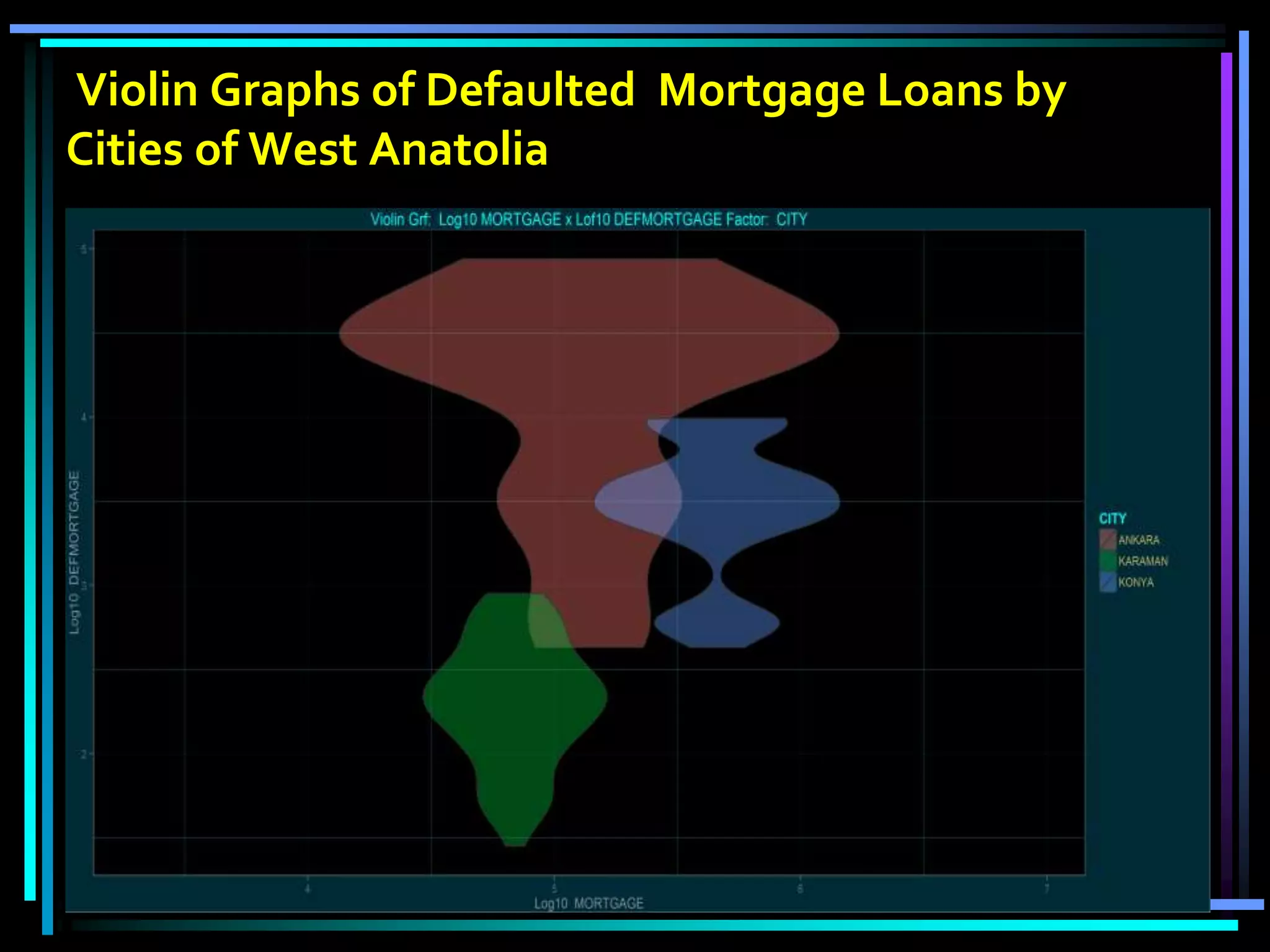

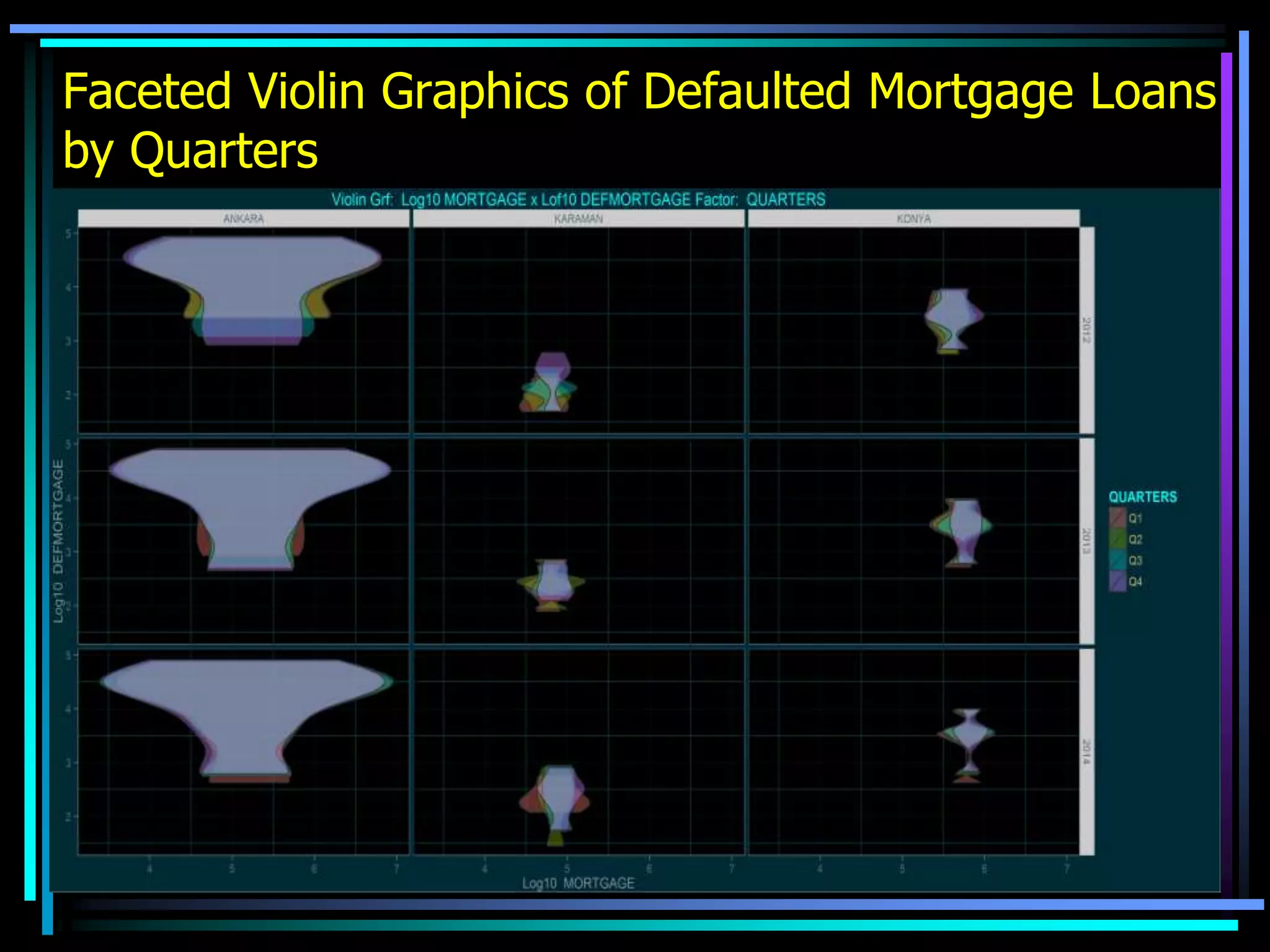

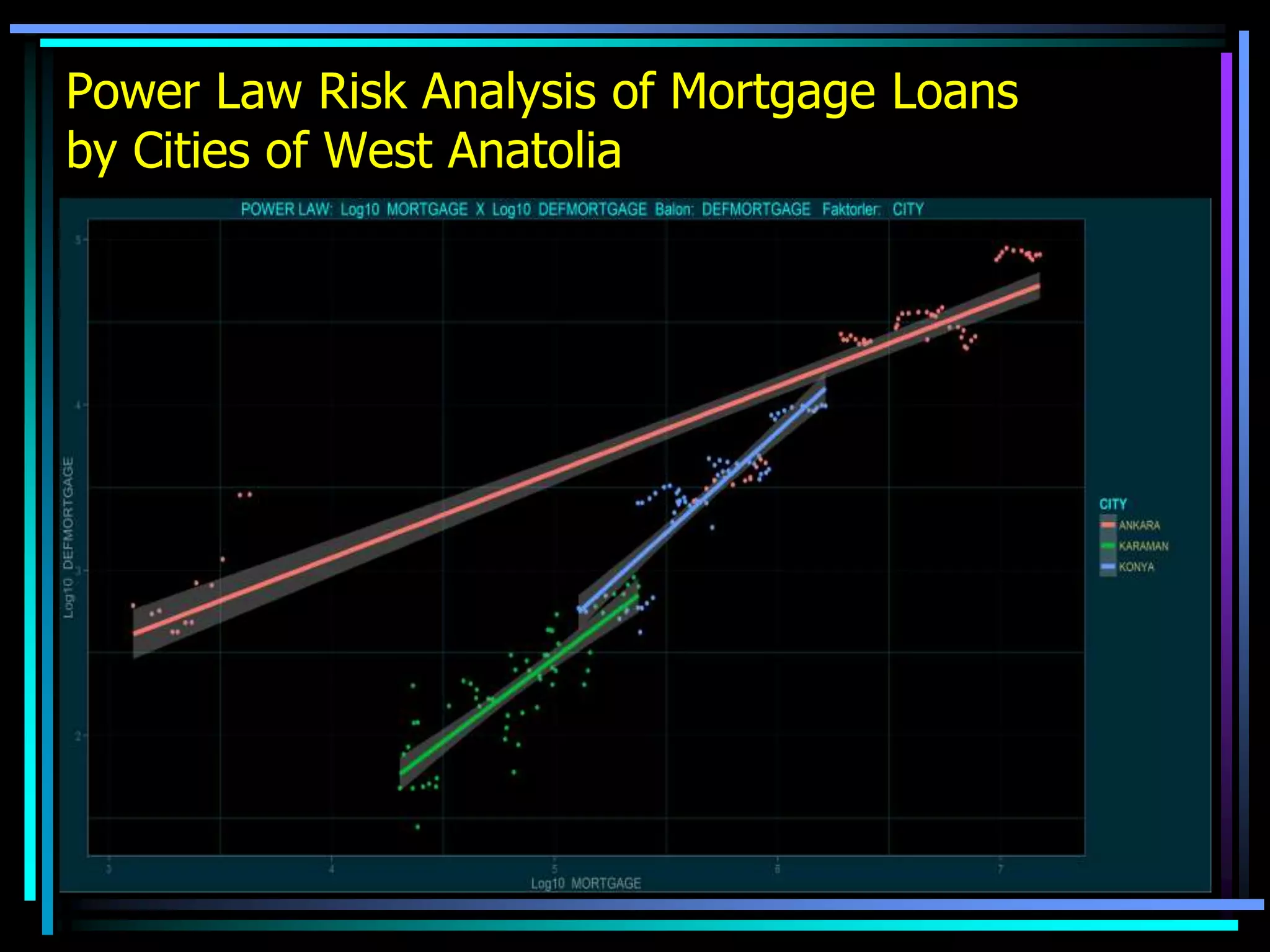

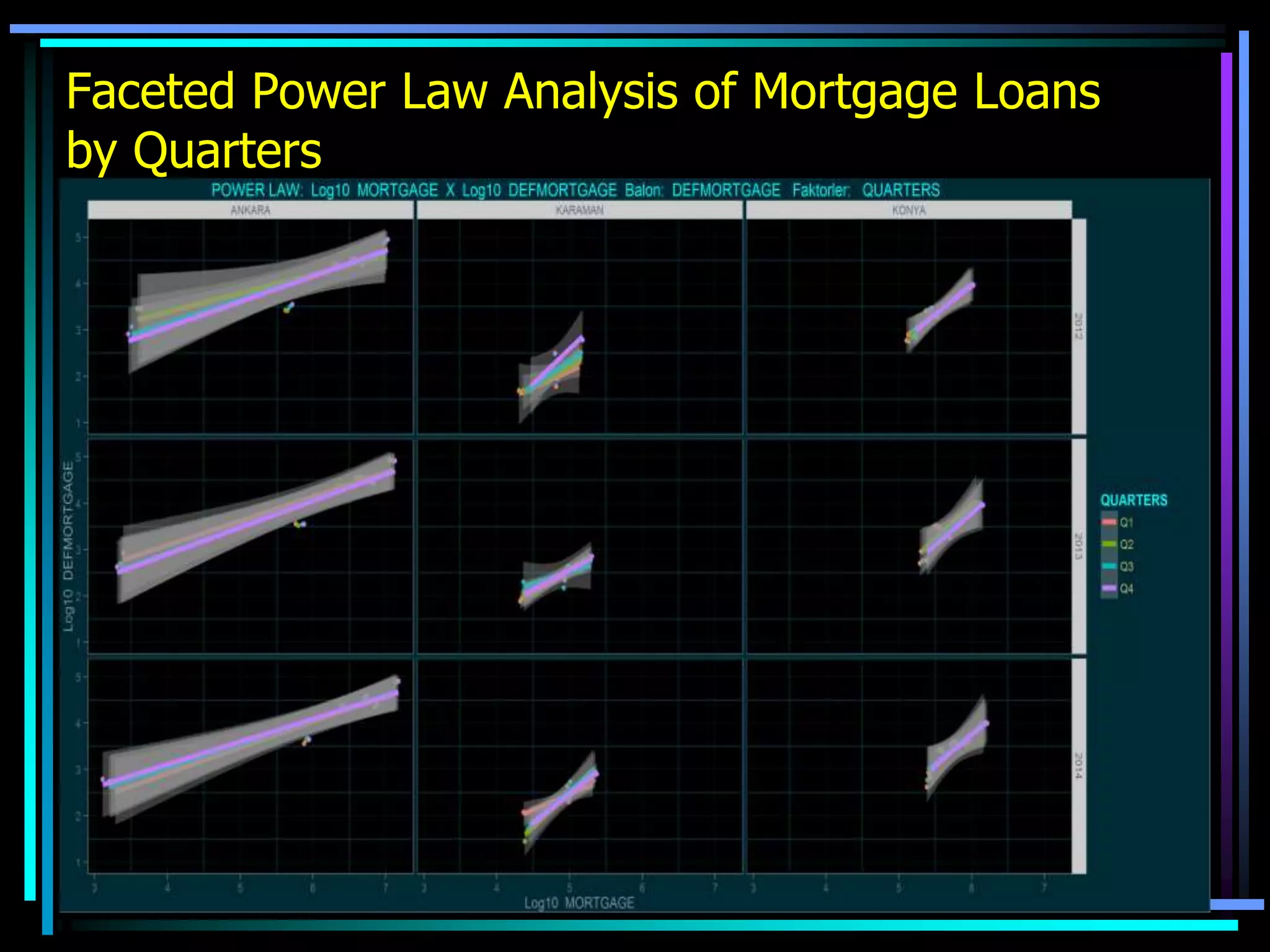

This document provides an abridged sample risk report analyzing defaulted mortgage loans in Turkey from 2012-2014. It uses graphical data mining techniques like density plots, violin plots, and facet plots in R to visualize loan default trends by region, city, sector, and time period. The report aims to identify financial anomalies and risk profiles according to geographic and temporal factors. It finds significant differences in risk profiles affected by these factors. Only summary information from the full report covering all Turkish regions from 2010-2015 is presented.

![Fields : names(dataset)

• names(dataset)

• [1] "NYEAR" "SYEAR" "QUARTERS"

• [4] "CITY" "CITYCODE" "NREGION"

• [7] "REGION" "NUTS3CODE" "NUTS2CODE"

• [10] "NUTS1CODE" "TRNUTS1REGION" "NUTS1REGION"

• [13] "TRGROUP" "SECTORAL" "CASHLOANS"

• [16] "NONCASHLOANS" "TOTALCASHLOANS" "AUTO"

• [19] "MORTGAGE" "OVERDRAFTACCOUNT" "CREDITCARDS"

• [22] "FOOD" "BUILDING" "MINERALS "

• [25] "FINANCIAL" "TEXTILE" "WHOSESALE "

• [28] "TOURISM" "AGRICULTURE" "ENERGY"

• [31] "MARITIME" "OTHERCONSUMER" "DEFRECEIVABLE"

• [34] "DEFCREDITCARDS" "DEFAUTO" "DEFMORTGAGE"

• [37] "DEFOTHERCONSUMER" "DEFFOOD" "DEFBUILDING"

• [40] "DEFMINERALS" "DEFFINANCIAL" "DEFTEXTILE"

• [43] "DEFWHOLESALE " "DEFTOURISM" "DEFAGRICULTURE"

• [46] "DEFENERGY" "DEFMARITIME" "NONCASHFOOD"

• [49] "NONCAHBUILDING" "NONCASHMINERALS" "NONFINANCIAL"

• [52] "NONCASHTEXTILE" "NONCASHWHOLESALE " "NONCASHTOURISM"

• [55] "NONCASHAGRICULTURE“ "NONCASHENERGY" "NONCASHMARITIME"](https://image.slidesharecdn.com/riskreport-151113141640-lva1-app6892/75/Risk-Report-abridged-6-2048.jpg)