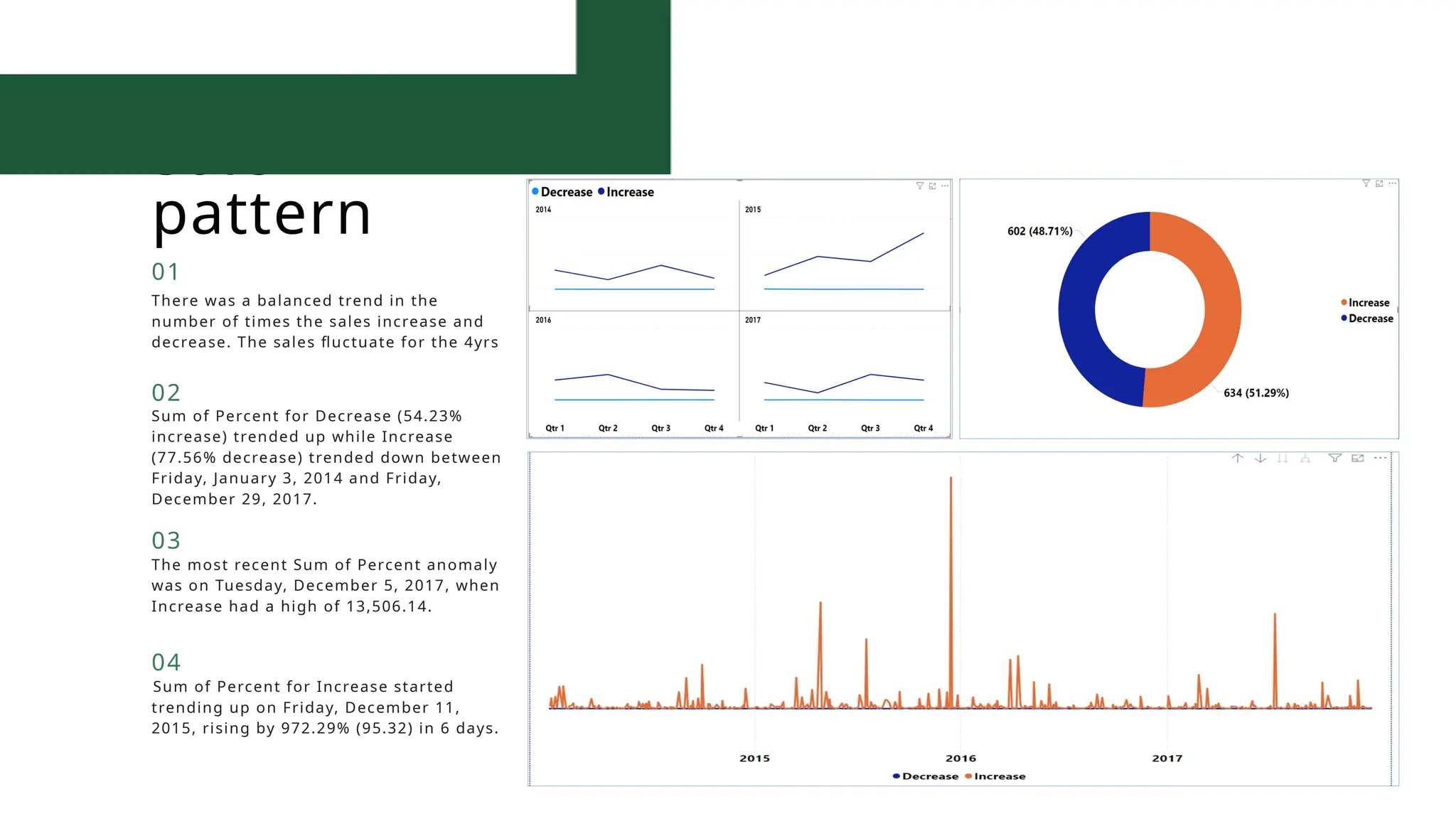

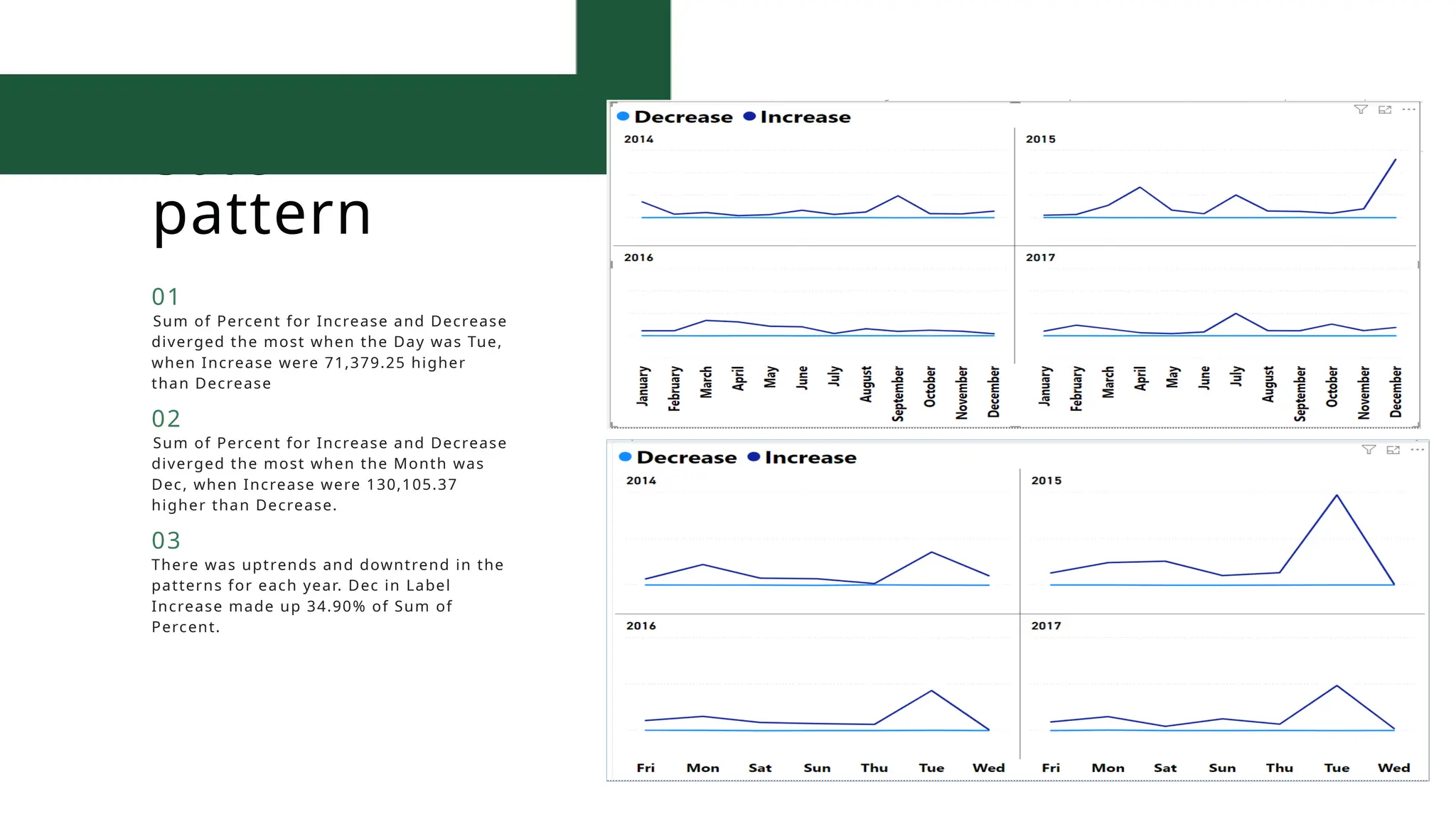

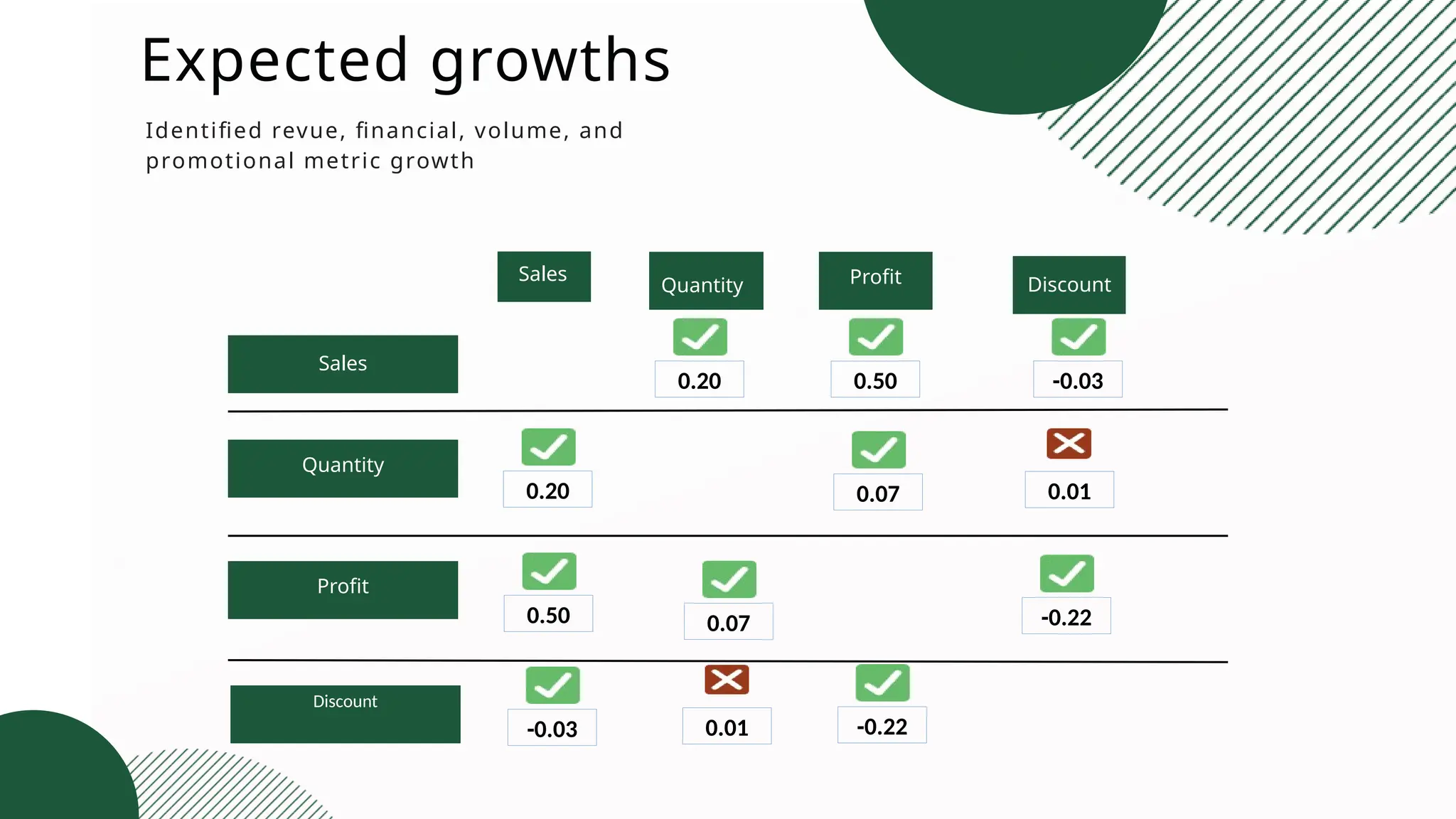

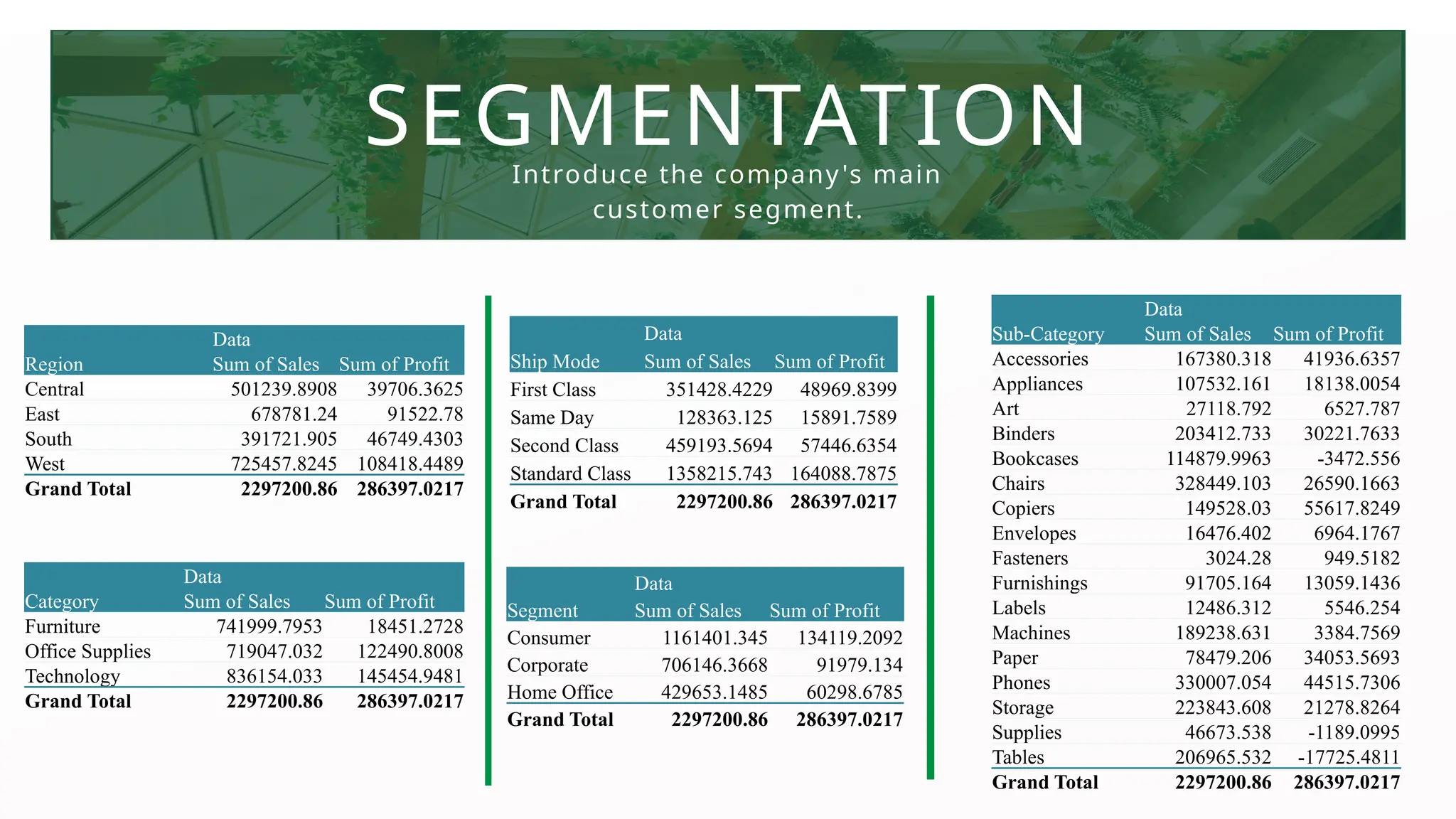

This document presents a case study aimed at optimizing retail sales and profitability through the analysis of customer segments, product performance, and sales patterns. Key objectives include identifying high-value customer segments, assessing product profitability, understanding sales trends, and developing actionable marketing strategies. Recommendations highlight the need for personalized marketing campaigns, adjusting discount rates based on sales trends, and focusing on high-margin products.