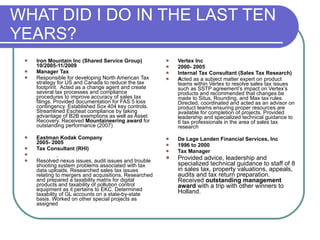

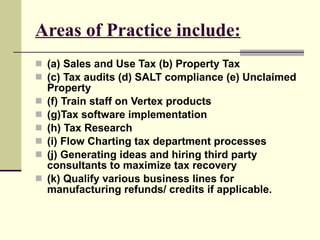

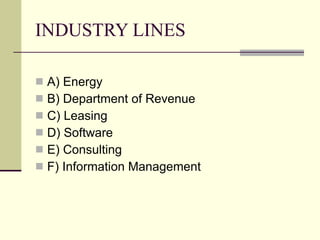

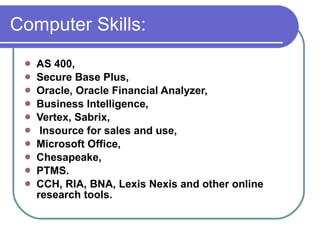

Kamal Adeni is a tax professional with over 15 years of experience in tax research, tax controversy, tax planning, and tax management. He has worked in various industries including information management, software, consulting, and energy. Some of his accomplishments include generating over $3 million in tax refunds and credits for a $3 billion data storage company, creating new tax categories for a $50 million tax software company, and reducing property tax assessments by over $1 million for a billion dollar leasing company. If hired, Kamal believes he can help reduce tax footprints, generate tax savings ideas, and take initiative on various tax issues and problems.