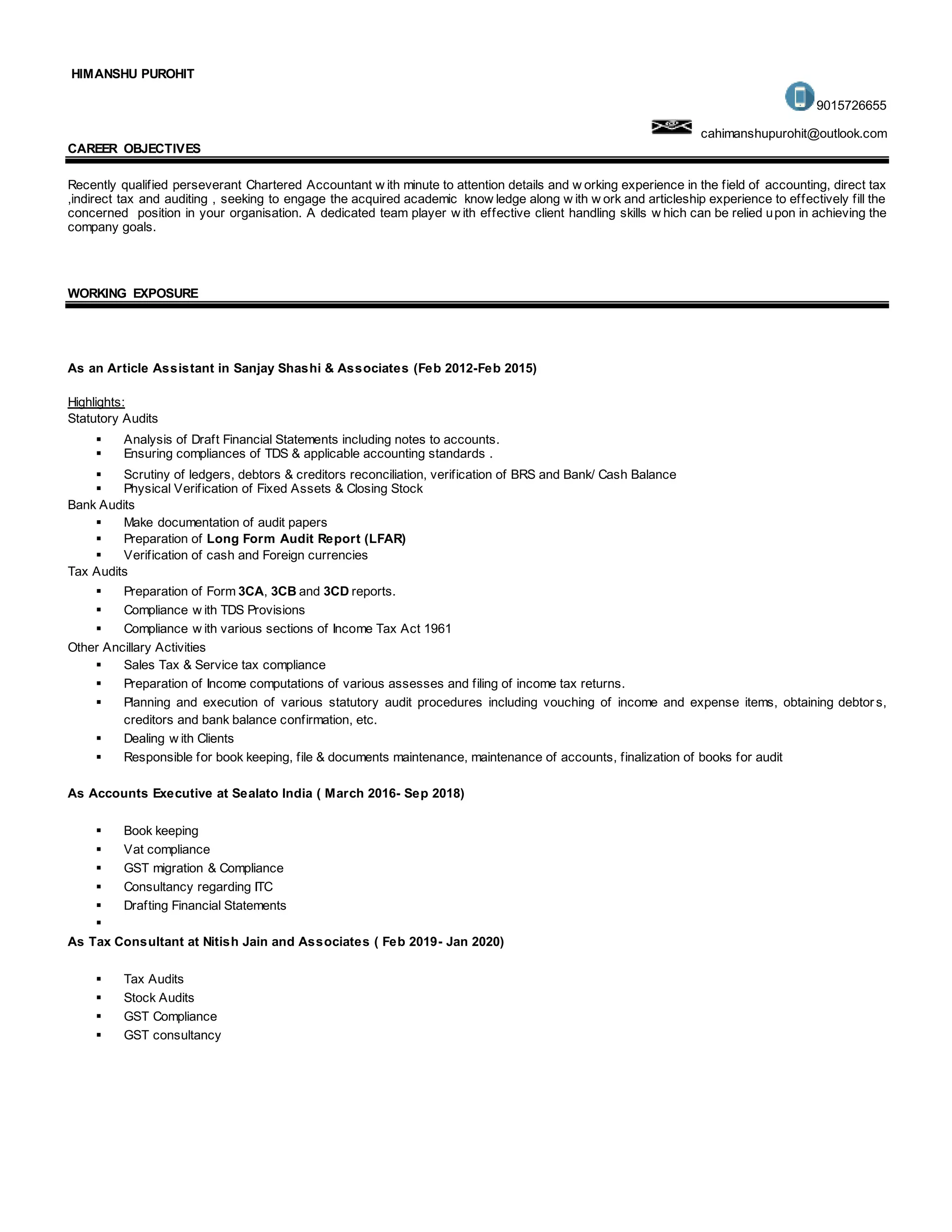

Himanshu Purohit is a Chartered Accountant seeking a position where he can utilize his academic and work experience. He has over 8 years of experience in accounting, auditing, taxation and compliance. His experience includes statutory audits, bank audits, tax audits, and GST compliance. He is proficient in accounting software and has strong client handling skills. He holds a CA, MBA, and is pursuing an MCom with specializations in finance and taxation.