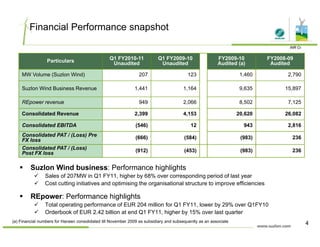

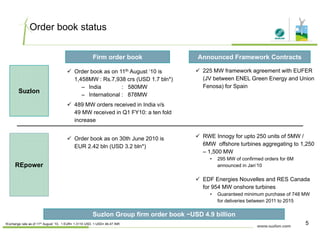

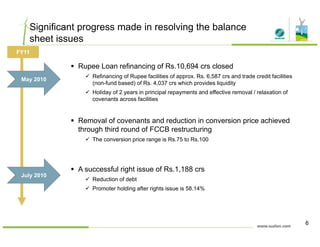

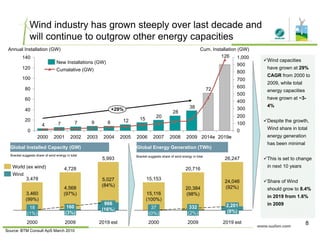

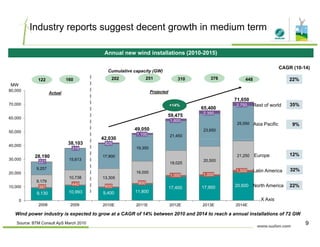

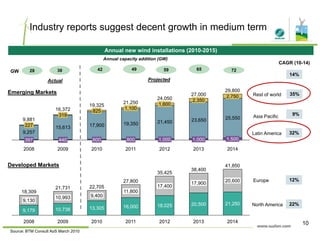

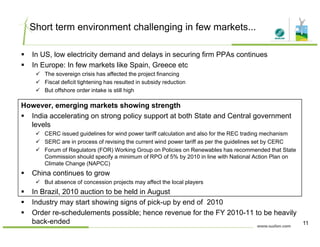

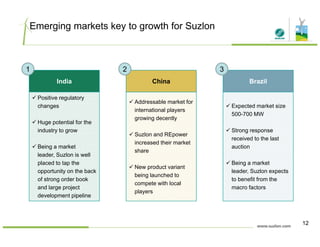

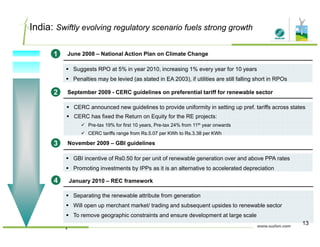

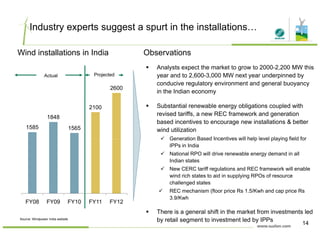

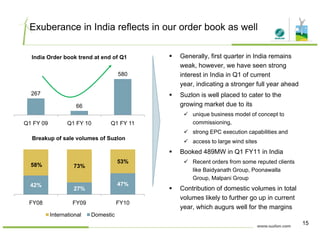

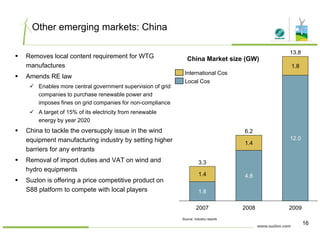

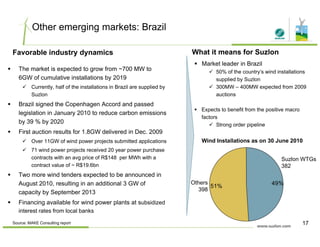

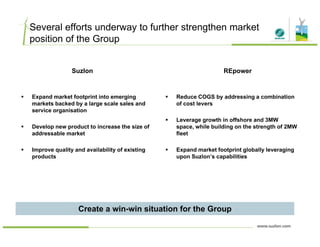

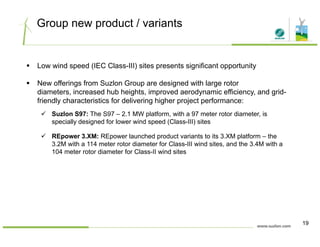

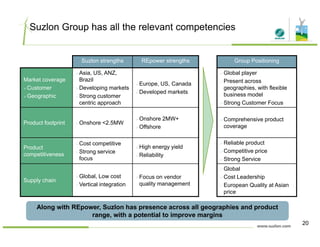

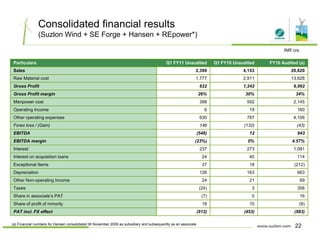

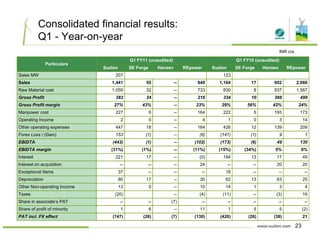

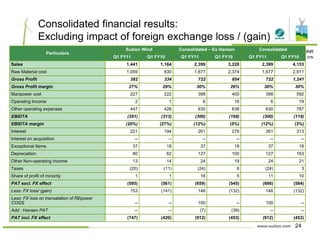

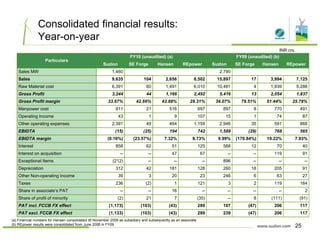

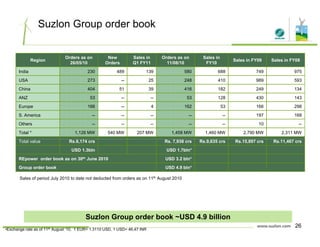

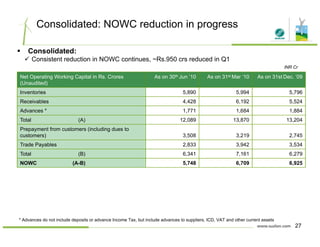

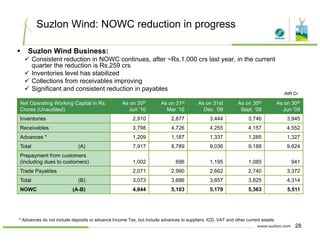

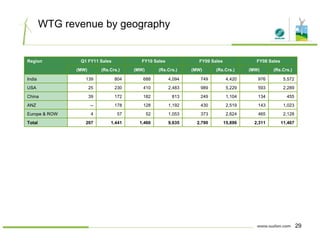

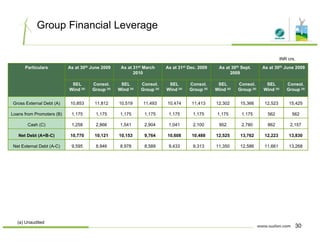

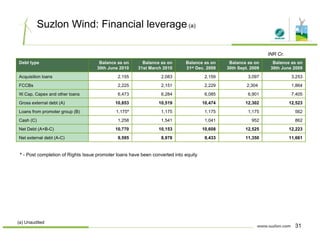

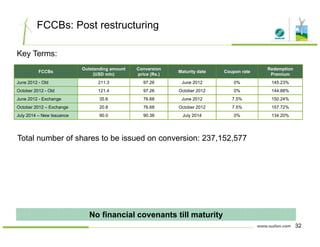

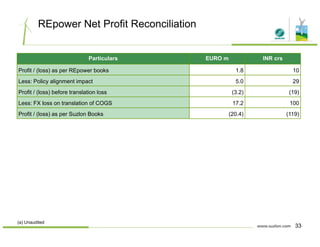

The document is Suzlon Energy Limited's presentation of its Q1 FY2011 results. Some key highlights include growth in Suzlon's wind turbine volume compared to Q1 FY2010, a significant increase in order flows in India, and the successful completion of a rights issue. The outlook suggests the wind industry will continue robust long-term growth, with the growing Indian market benefiting Suzlon. Suzlon is also working closely with REpower to strengthen their future platform.