Residential Status PPT.pdf

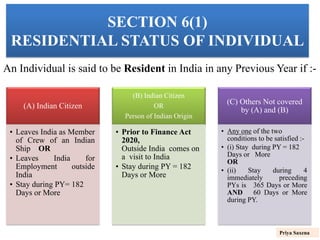

- 1. Priya Saxena SECTION 6(1) RESIDENTIAL STATUS OF INDIVIDUAL An Individual is said to be Resident in India in any Previous Year if :- (A) Indian Citizen • Leaves India as Member of Crew of an Indian Ship OR • Leaves India for Employment outside India • Stay during PY= 182 Days or More (B) Indian Citizen OR Person of Indian Origin • Prior to Finance Act 2020, Outside India comes on a visit to India • Stay during PY = 182 Days or More (C) Others Not covered by (A) and (B) • Any one of the two conditions to be satisfied :- • (i) Stay during PY = 182 Days or More OR • (ii) Stay during 4 immediately preceding PYs is 365 Days or More AND 60 Days or More during PY.

- 2. Priya Saxena Amendment by Finance Act 2020 (Explanation 1 to Section 6(1)(b) Indian Citizen OR Person of Indian Origin being Outside India comes to a visit in India in that PY AND Total Income (Other than Income from Foreign Sources) • Rs. 15 Lakhs or Less Resident if Stay during PY is 182 Days or More. • Exceeds Rs. 15 Lakhs Resident if any one of the conditions is satisfied:- (i) Stay during PY 182 Days or More (ii) Stay during 4 immediately preceding PYs is 365 Days or More AND 120 Days or More during that PY.

- 3. Priya Saxena ILLUSTRATIONS Illustration 1. Mr. John is living in Dubai since 1985. He comes to India to meet his parents on 01.06.2020 (Assume that stay in India from 01.04.2016 to 31.03.2020 is more than 365 Days) and leaves India for Dubai on: CASE I : 30th September, 2020 CASE II : 30th November, 2020 He has the following incomes:- Incomes Situation I Situation II Income arising in India 6,00,000 6,00,000 Income received abroad but deemed to accrue or arise in India as per Section 9 7,00,000 7,00,000 Income from Business outside India controlled from India 10,00,000 NIL Income in Dubai not deemed to accrue or arise in India 40,00,000 40,00,000

- 4. Priya Saxena Solution Total Income other than Income from Foreign Sources Situation 1 : 6,00,000+7,00,000+10,00,000 = 23, 00,000 Situation 2 : 6,00,000+7,00,000+NIL = 13,00,000 CASE I & SOLUTION I Income other than Income from Foreign Sources exceeds 15,00,000 Stay in India during PY 2020-21 from 01.06.20 to 30.09.20 = 122 Days Stay in India from 01.04.16 to 31.03.20 is more than 365 Days As per Amendment to FA 2020, Explanation 1 to Section 6(1)(b) Mr. John is Resident. However, since his stay in India is less than 182 Days during PY 2020-21, as per Section 6(6), he shall be Resident but not Ordinary Resident. Taxable Income in India in PY 31.03.21 = 6,00,000+7,00,000+10,00,000 = Rs.23, 00,000

- 5. Priya Saxena CASE I & SITUATION II Total Income other than Income from Foreign Sources is not exceeding Rs. 15 Lakhs Amendment to FA 2020 is Not Applicable Stay in India in PY 2020-21 is 122 Days i.e. Less than 182 Days Mr. John is a Non – Resident. Taxable Income in India PY 31.03.21 = 6,00,000+7,00,000 = Rs. 13,00,000 CASE II & SITUATION I & SITUATION II Stay in India during PY 2020-21 is 183 Days (i.e. 182 Days or More) As per Section 6(1) Mr. John is a Resident. It is irrelevant whether his Total Income other than Income from Foreign Sources exceeds Rs. 15,00,000 or Not. Mr. John shall be RNOR if he (Assumed to be RNOR in this case) (i) is Non Resident in any 9 out of 10 previous preceding PY 31.03.21 (ii) during the 7 previous years preceding the PY 31.03.21 has been in India for 729 Days or less.

- 6. Priya Saxena Taxable Income in India PY 31.03.21 (if assumed Mr. John is RNOR) Situation I : 6,00,000+7,00,000+10,00,000 = Rs. 23,00,000 Situation II : 6,00,000+7,00,000 = Rs. 13,00,000 Taxable Income in India PY 31.03.21 (if assumed Mr. John is ROR) Situation I : 6,00,000+7,00,000+40,00,000+10,00,000 = Rs.63,00,000 Situation II : 6,00,000+7,00,000+40,00,000 = Rs.53,00,000

- 7. Priya Saxena Section 6(1A) : Deemed Resident Tax Stateless Persons Applicability: Individual Indian Citizen but NOT Person of Indian Origin. Total Income (other than Income from Foreign Sources) exceeds Rs. 15 Lakhs Income is Not Liable to tax in any country(ies) or territory(ies) in which he resides (Tax Haven) Deemed Resident even if not stayed in India for a single day. If Individual is Resident as per Section 6(1), then Section 6(1A) shall not apply.

- 8. Priya Saxena SECTION 6(6) : ROR/RNOR Condition 1: Resident in any 2 years or more out of last 10 previous years preceding the relevant previous year. Condition 2: Total Stay in India in Last 7 years is 730 Days or More. If either Condition 1 or Condition 2 (i.e. any one of the above two conditions) is satisfied then Individual is said to be Resident but Not Ordinary Resident (RNOR) If Condition 1 and Condition 2, Both are Satisfied then Individual is said to be Resident and Ordinary Resident (ROR)

- 9. Amendment by Finance Act 2020 Section 6(6) Section 6(1A) : Deemed Resident RNOR Stay in India during PY >= 120 Days or more <182 Days AND 365 Days or more during 4 preceding PYs Explanation 1 to Section 6(1)(b) RNOR

- 10. Priya Saxena Illustration 2 Mr. Jhakaria is living in Cyprus (a Tax Haven). He is a citizen of India and left India in 1972. Since then, he has not returned to India for a single day. Details of his income for the PY 2020-21 are as follows:- Income Situation 1 Situation 2 Income arising in India 6,00,000 6,00,000 Income received abroad but deemed to accrue or arise in India as per Section 9 7,00,000 7,00,000 Income arising in Cyprus and not deemed to accrue or arise in India 40,00,0000 40,00,000 Income arising in Cyprus from a business controlled from India 10,00,000 NIL

- 11. Priya Saxena SOLUTION Total Income other than Income from Foreign Sources Situation 1 : 6,00,000+7,00,000+10,00,000 = 23, 00,000 Situation 2 : 6,00,000+7,00,000+NIL = 14,00,000 Situation 1 Since, Mr. Jhakaria is not taxable anywhere in the world by reason of his domicile in Cyprus, a Tax Haven, he is deemed as Resident as per Section 6(1A) as his total income excluding income from foreign sources exceeds Rs.15 Lakhs. Further, as per Section 6(6), he shall be deemed as Resident but not Ordinary Resident. Taxable Income in India during PY = 6,00,000+7,00,000+10,00,000 = 23, 00,000 Situation 2 Section 6(1A) is not applicable since his total income excluding Foreign Sources does not exceed Rs.15 Lakhs. He is a Non-Resident. Taxable Income in India during PY = 6,00,000+7,00,000=13,00,000

- 12. Priya Saxena Illustration 3 What will be the Residential Status and Taxable Income if Mr. Jhakaria was born in Cyprus and his parents were born in India? Solution: Mr. Jhakaria is a Person of Indian Origin and is not a Citizen of India. Section 6(1A) shall not be applicable. He shall be therefore, a Non-Resident in both the situations and shall be liable to pay tax on Rs.13,00,000 in both the situations.

- 13. Priya Saxena Residential Status and Scope of Total Income Source of Income ROR RNOR NR Income Received or deemed to be received in India Taxable Taxable Taxable Income accrue or arise or deemed to accrue or arise in India Taxable Taxable Taxable Income accrues or arises to him or received outside India from • A business controlled from India; or • A Profession set up in India Taxable Taxable Not Taxable Income accrues or arises or received outside India Taxable Not Taxable Not Taxable

- 14. Priya Saxena Income which accrue or arise outside India but shall not include :- Income which are deemed to accrue or arise in India by virtue of Section 9 Income derived abroad from a business controlled from India. Income derived abroad from a profession set up in India.

- 15. Priya Saxena Definitions 1. Person of Indian Origin : If He or either of his parents or any of his grandparents, was born in Undivided India. 2. Liable to Tax : There is a liability of tax on that person under the law of any country and will include a case where subsequent to imposition of such tax liability, an exemption has been provided.