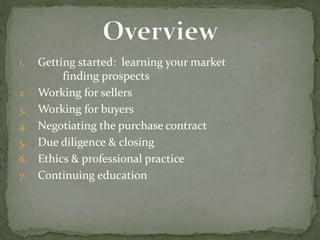

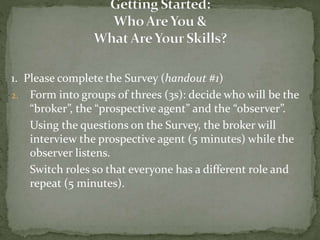

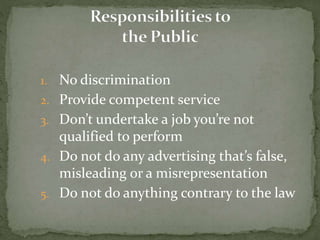

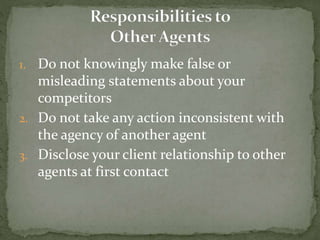

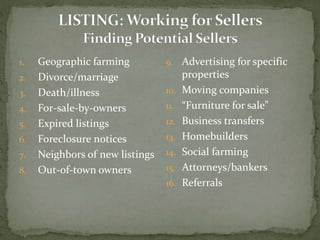

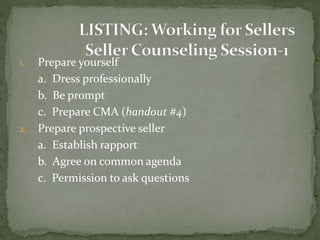

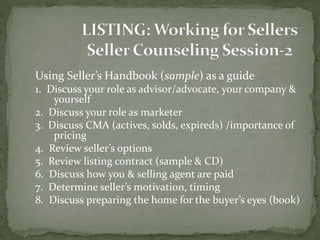

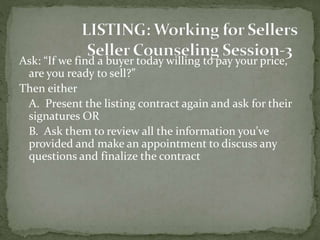

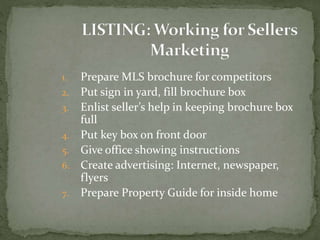

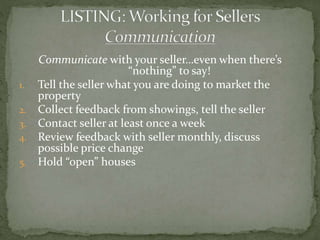

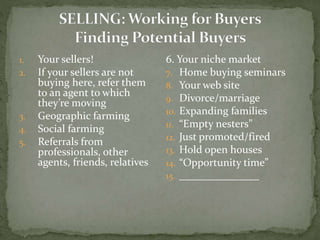

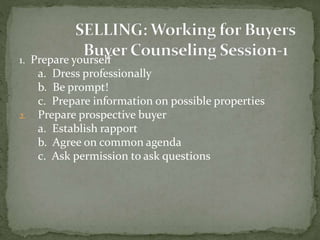

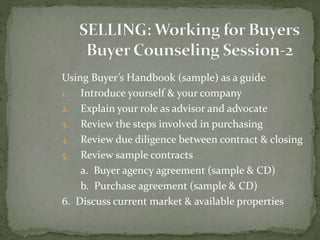

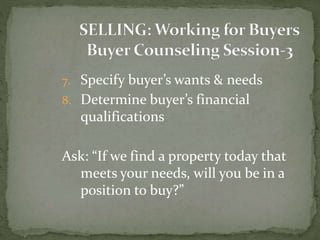

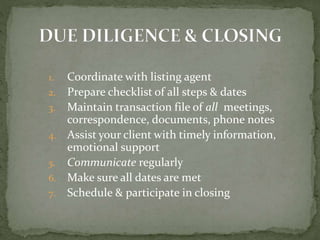

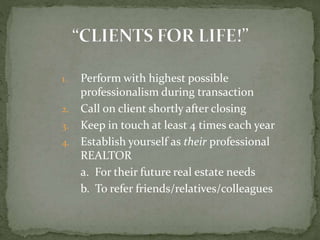

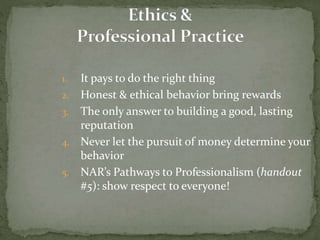

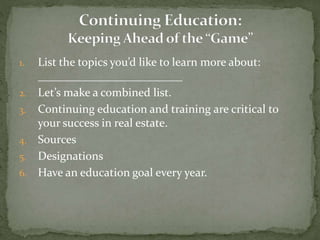

The document is a comprehensive guide prepared for real estate developers, outlining key areas including market knowledge, working with buyers and sellers, negotiations, and ethical practices in real estate transactions. It emphasizes the importance of continuing education, maintaining professional relationships, and building a database for client management. Additionally, the guide provides practical steps for successful marketing and client engagement in the competitive real estate market.