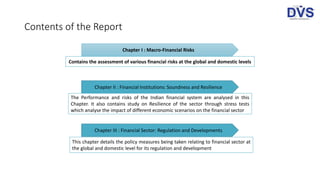

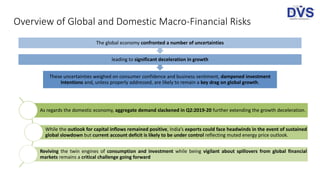

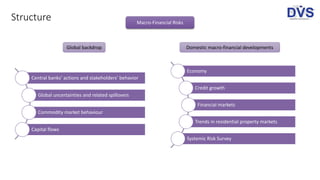

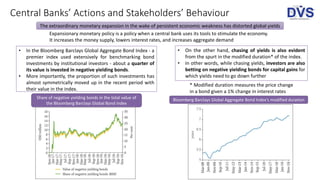

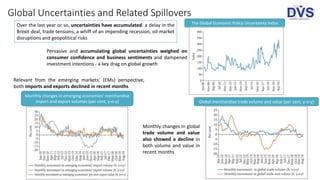

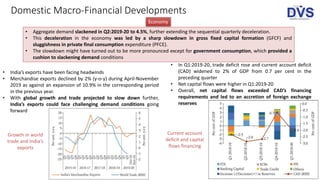

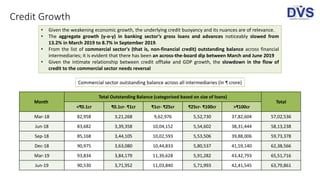

The RBI Financial Stability Report (FSR) released on December 27, 2019, provides an assessment of macro-financial risks and the resilience of the financial system in India, while highlighting the impact of global uncertainties and domestic economic challenges. It indicates a slowdown in India's growth, with a decline in exports and investment, and outlines key policy measures for the regulation and development of the financial sector. The report also reveals that risks in the banking sector are perceived to be medium, with a notable concern for domestic growth and asset quality.