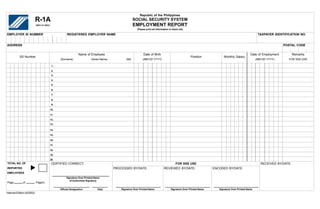

The document is an employment report form from the Social Security System of the Republic of the Philippines. It collects identifying information about employers such as their ID number, name, and address. It also collects personal details of employees like name, date of birth, position, monthly salary, and date of employment. The form includes spaces to report up to 20 employees and requires certification from the employer that the information is correct. Instructions at the bottom specify the reporting requirements, including that all employees must be reported regardless of earnings and that business owners cannot be reported as employees of their own business.