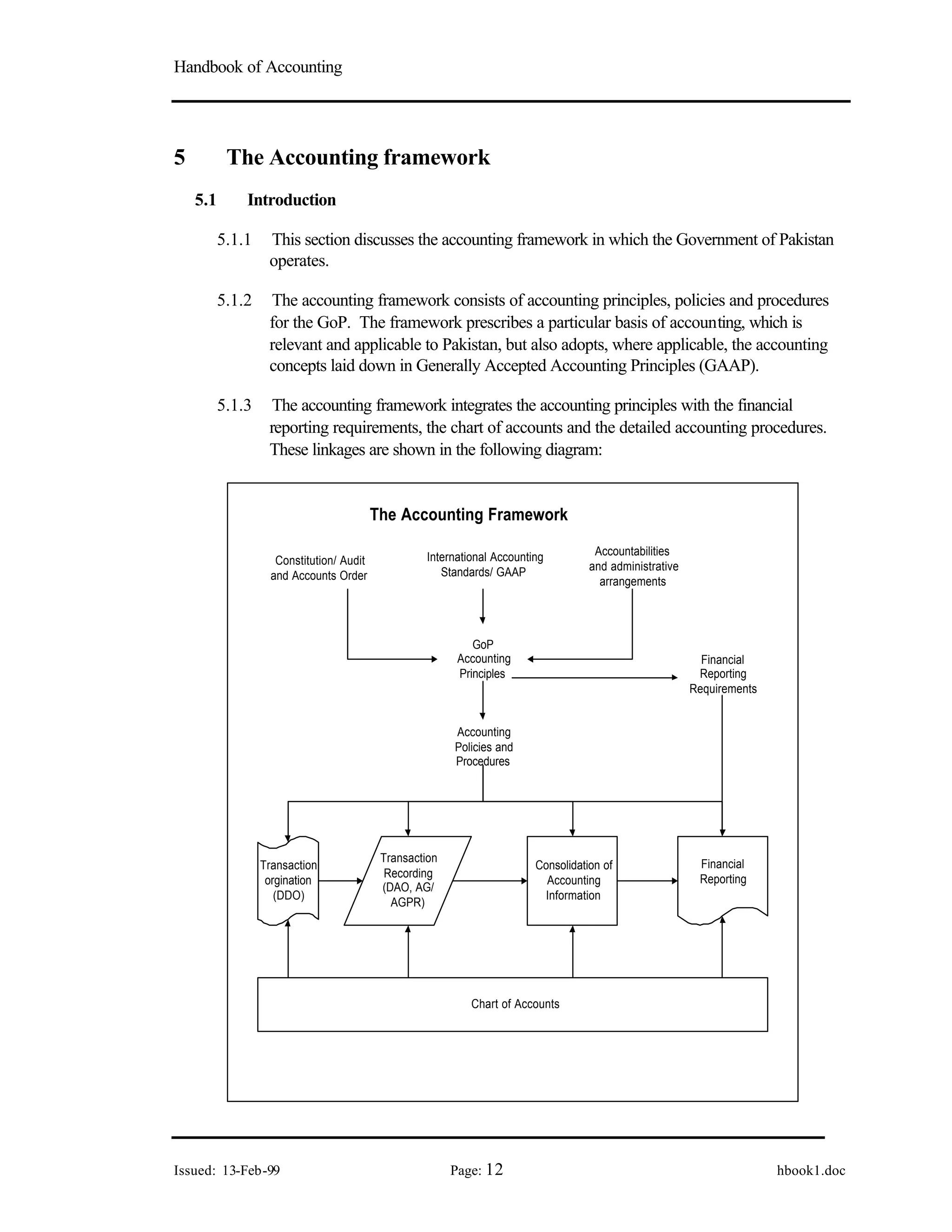

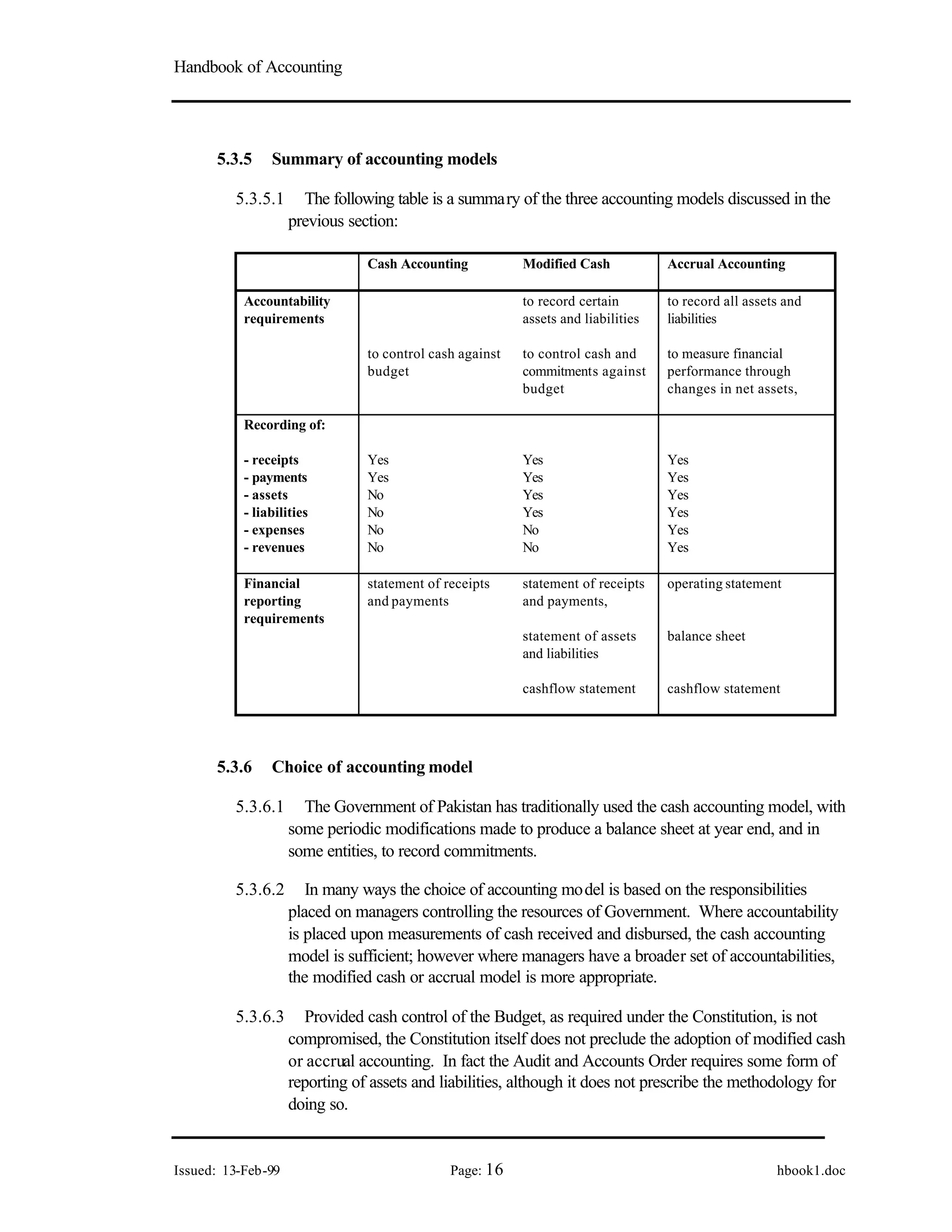

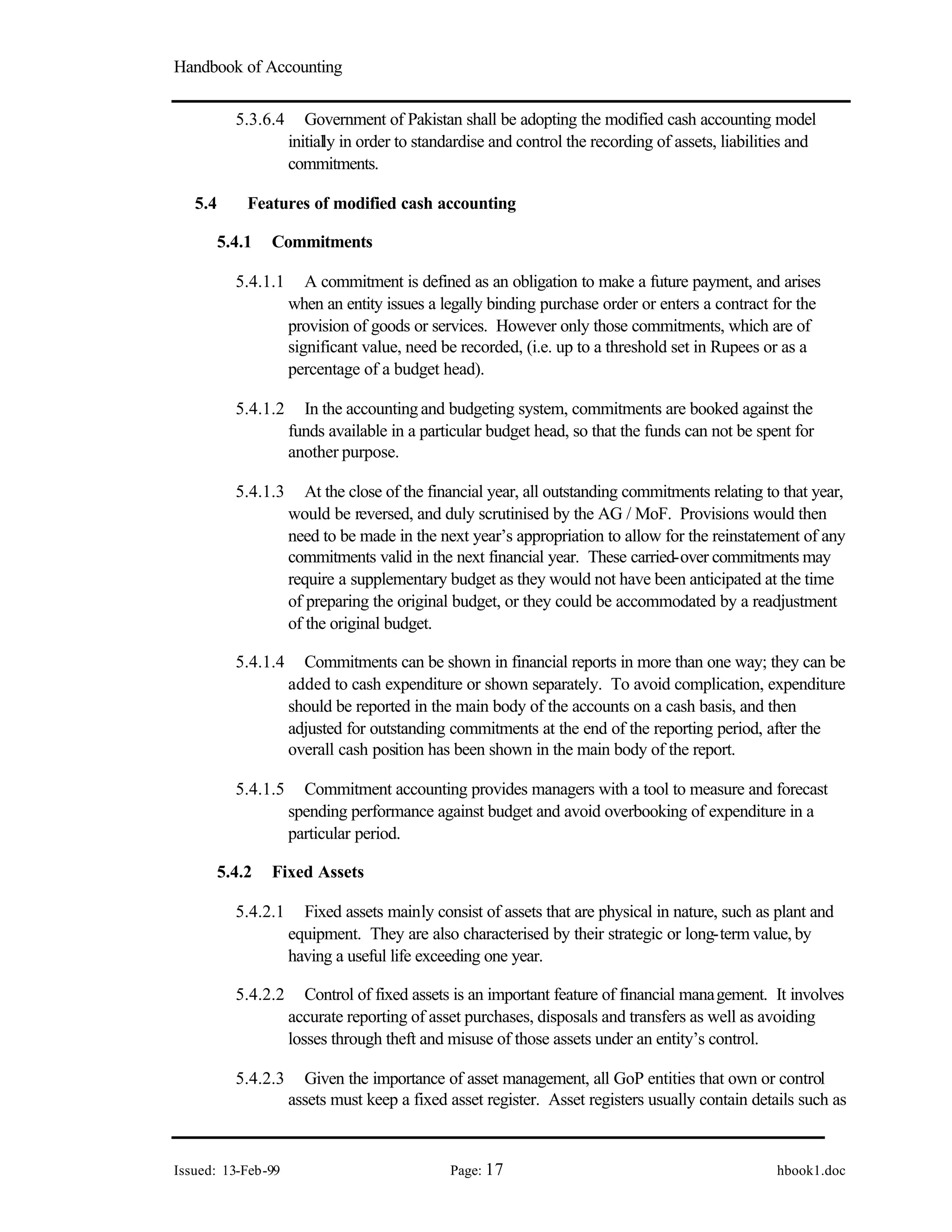

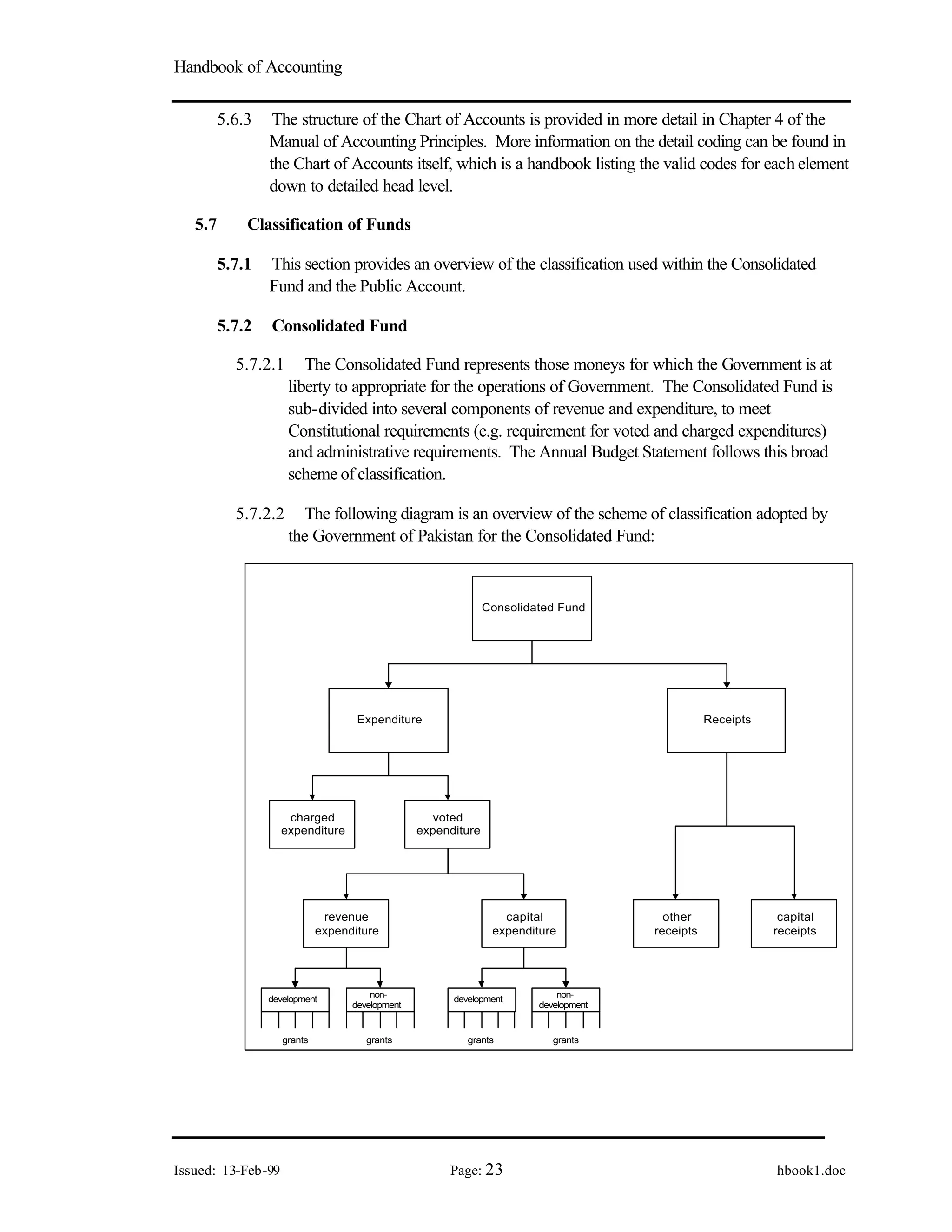

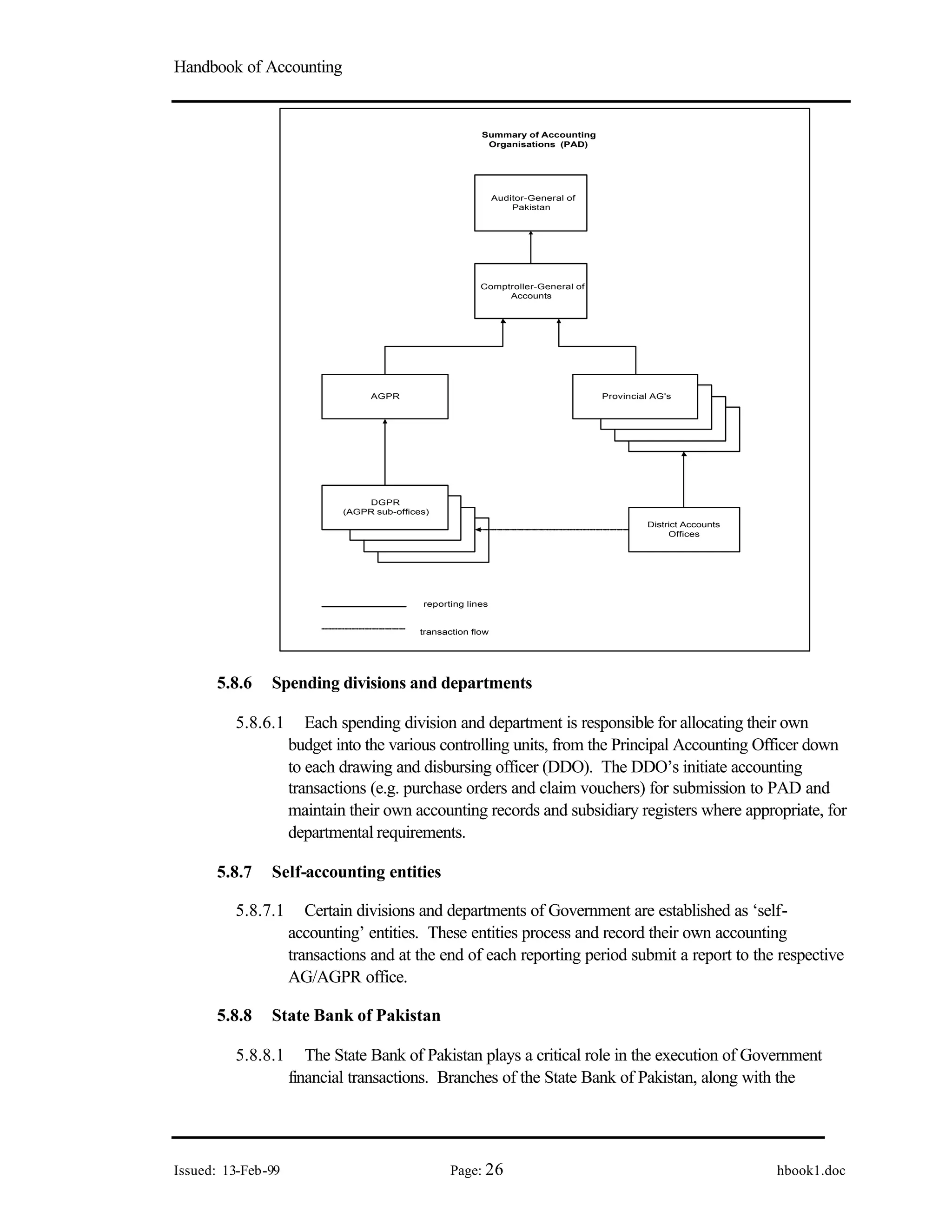

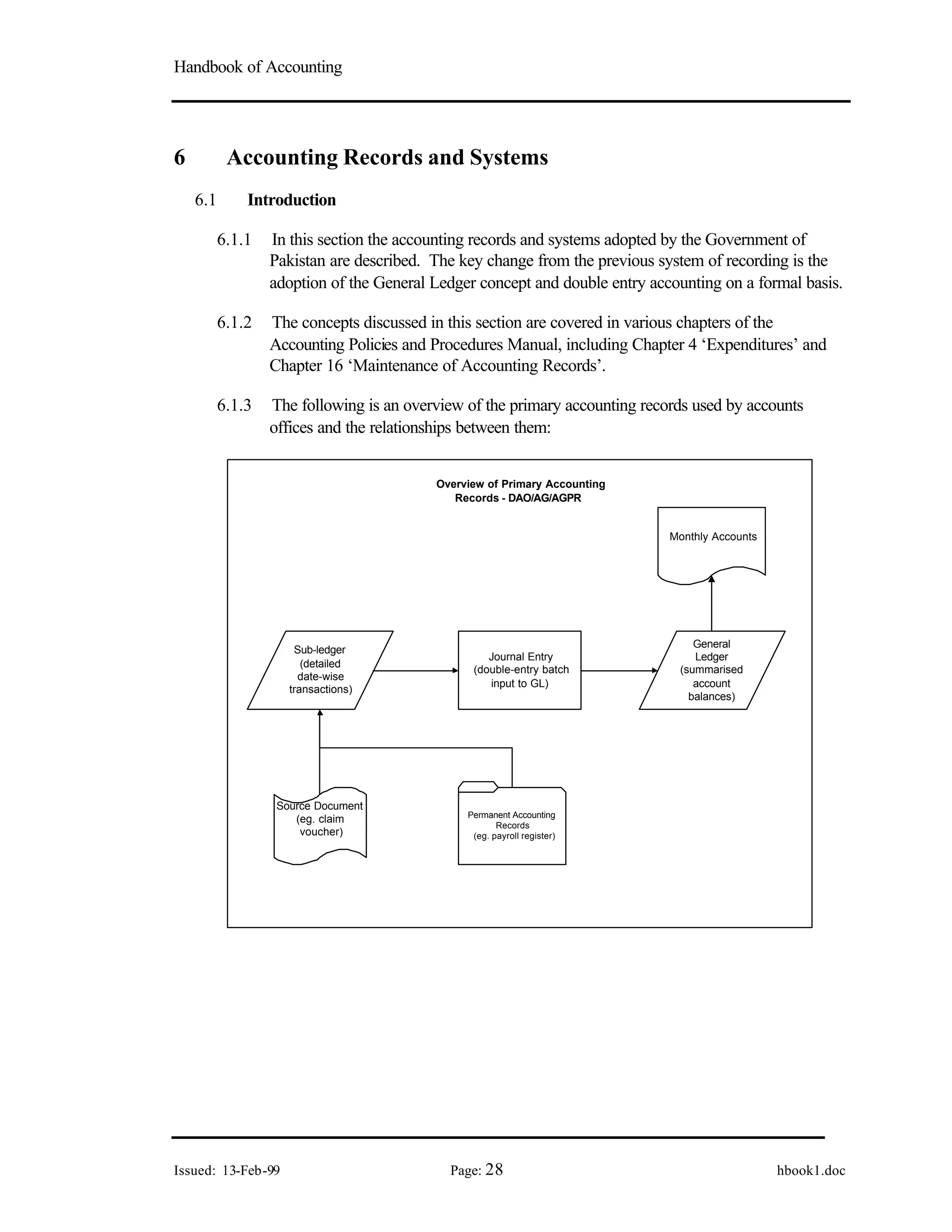

The document provides an overview of Pakistan's government accounting framework, including:

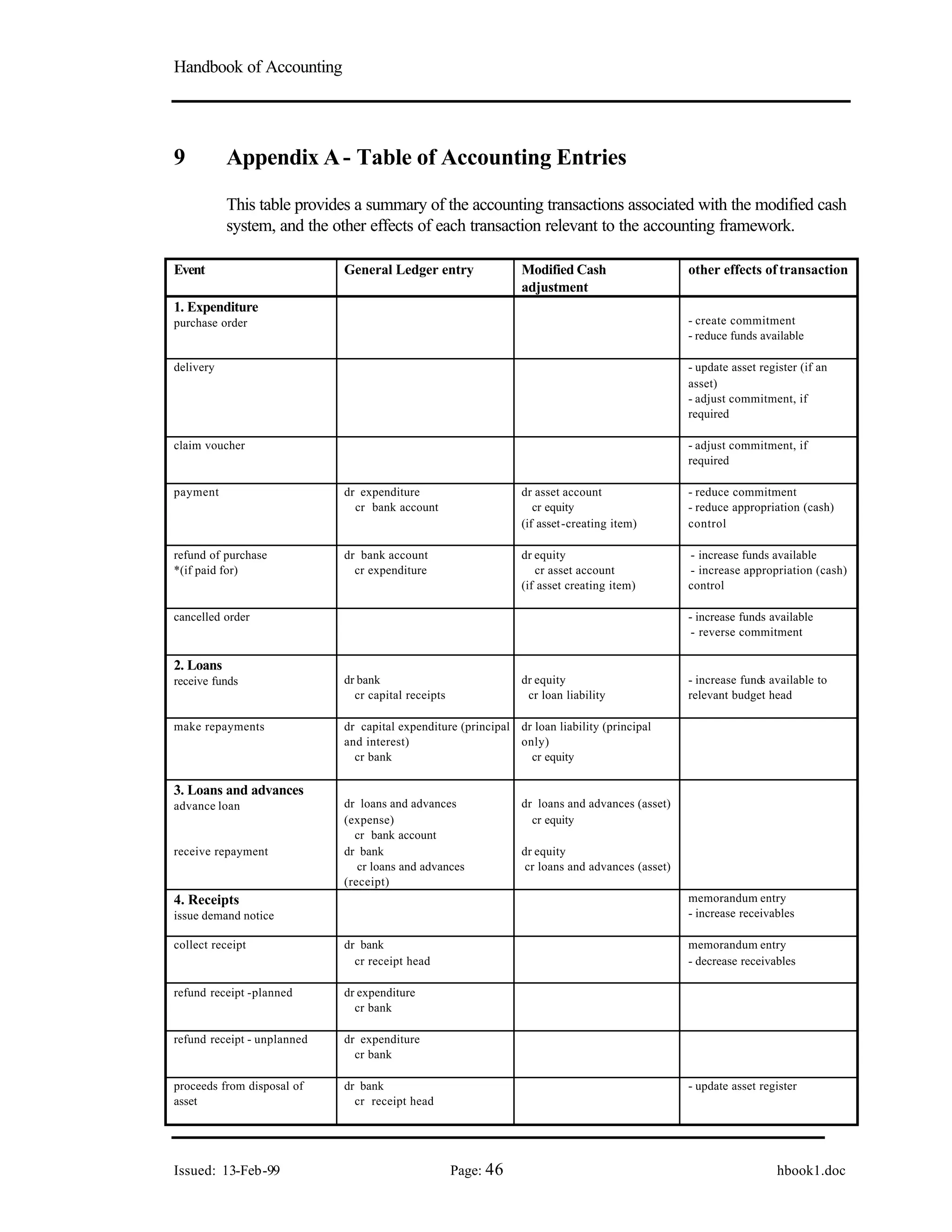

1) The accounting framework is based on a modified cash basis of accounting and incorporates Generally Accepted Accounting Principles where applicable. It integrates accounting principles, policies, procedures, financial reporting requirements and the chart of accounts.

2) The Manual of Accounting Principles defines the key concepts and sets out financial responsibilities based on the Constitution and administrative arrangements.

3) The basis of accounting is a modified cash basis, which recognizes expenditures on a cash basis but accounts for certain commitments and accruals.