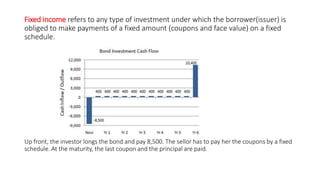

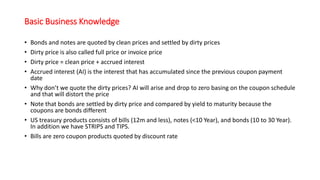

This document provides an overview of key concepts for working with fixed income products in QuantLib, including:

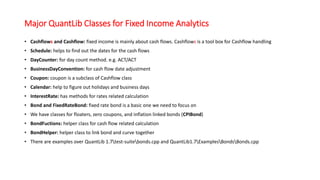

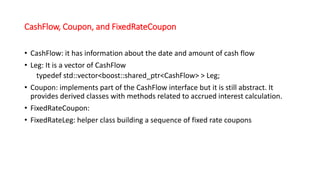

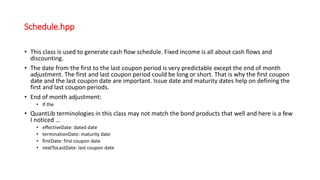

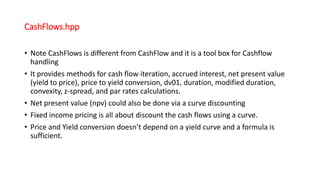

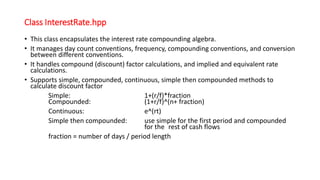

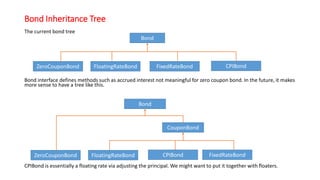

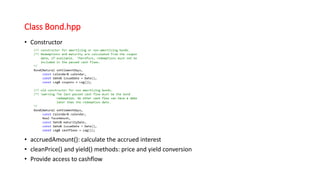

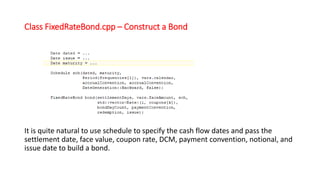

1) It describes major QuantLib classes used for fixed income analytics like CashFlow, Schedule, InterestRate, Bond, and BondFunctions.

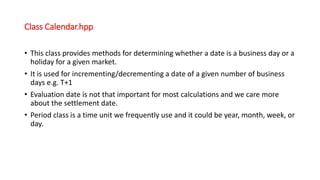

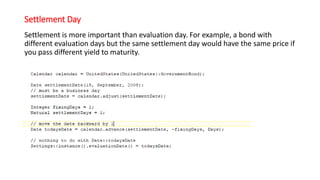

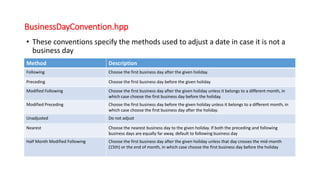

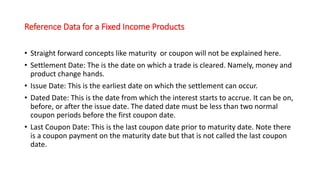

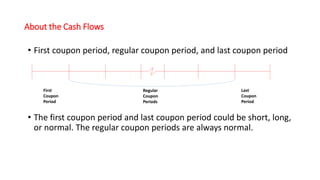

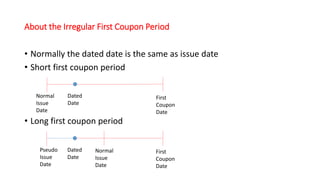

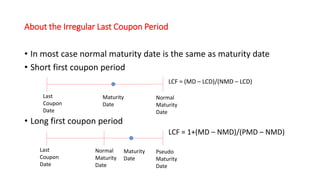

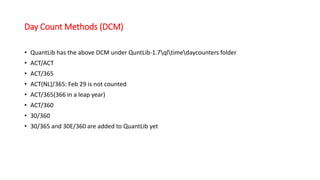

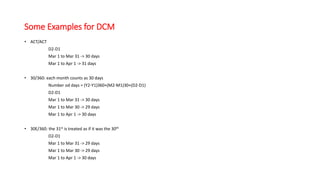

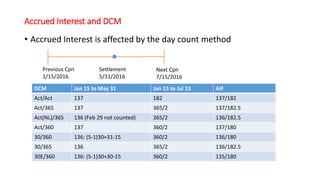

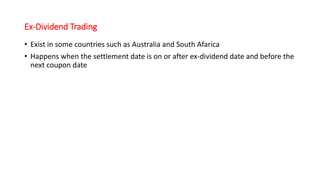

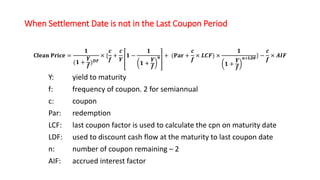

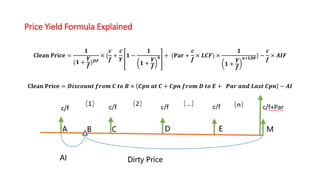

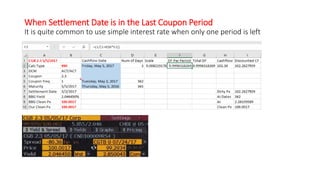

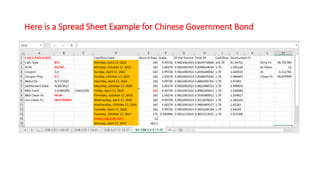

2) It explains fixed income concepts handled in QuantLib like day count conventions, cash flow schedules, and price/yield conversions.

3) It provides examples of how to construct a fixed income product like a bond in QuantLib by specifying details like settlement date and cash flow schedule.