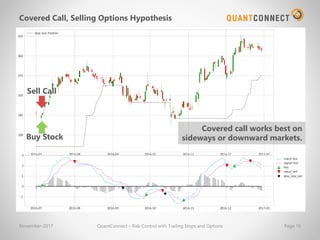

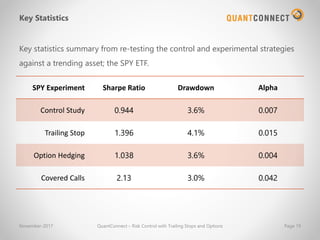

This document summarizes research into using trailing stops, option hedges, and covered calls for risk control. It describes experiments comparing the performance of a baseline long/flat MACD strategy against that same strategy enhanced with: 1) A trailing stop, 2) Put option hedging, and 3) Covered call selling. Key statistics like Sharpe ratio, drawdown, and alpha are presented for each strategy when backtested against IBM and SPY, showing that in most cases, the risk control techniques improved the strategy's risk-adjusted returns.